An encouraging start to 2022 – Q1 2022 M&A activity in the media and marketing services sectors

M&A activity in the media and marketing services sectors Q1 2022

Our annual round-up of 2021 reflected on what turned out to be an extremely busy year for M&A in the UK media and marketing services sectors, as the UK came out of lockdown and started to look to the future. Early signs suggest that 2022 will continue in the same vein.

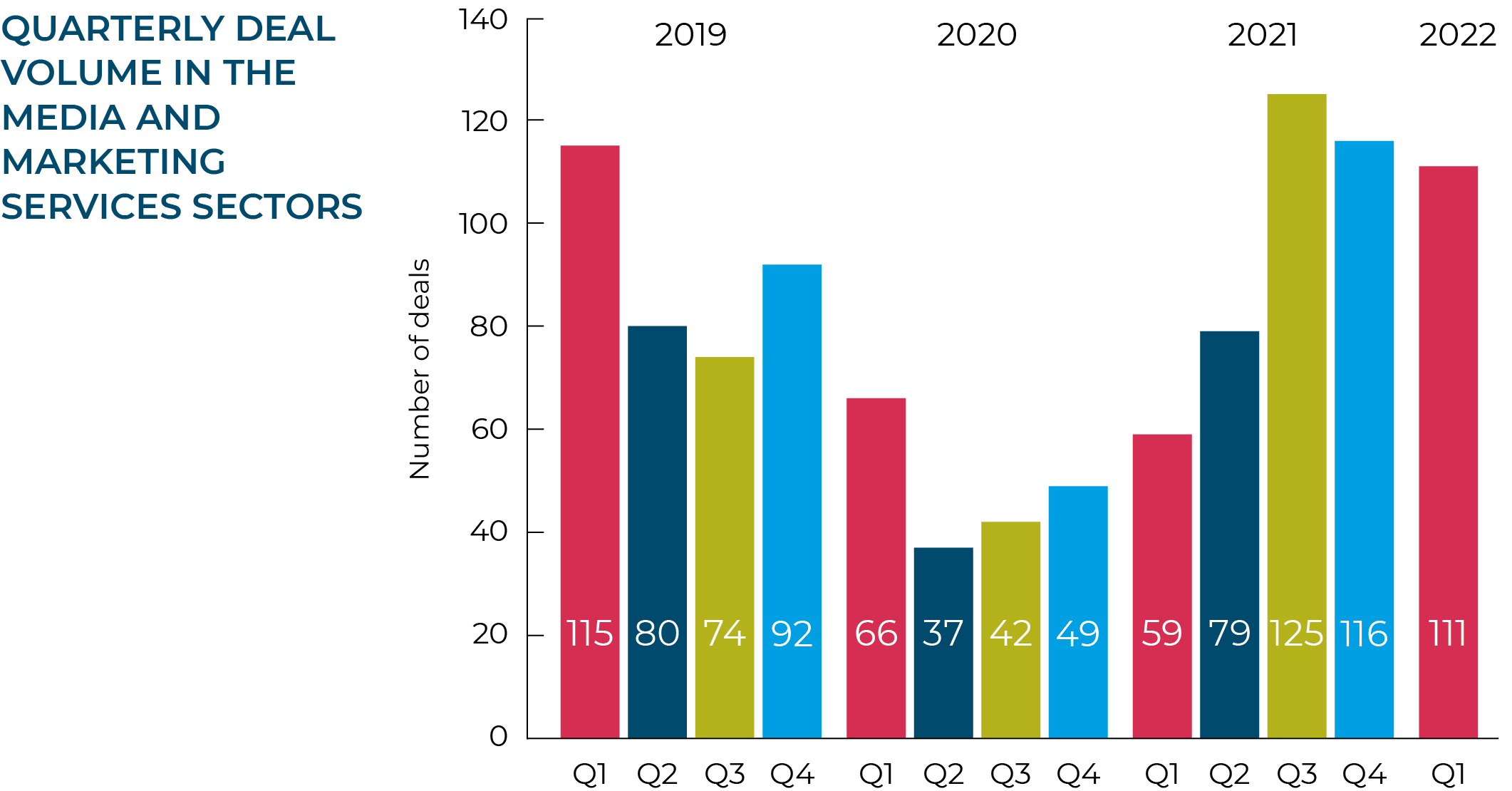

Moore Kingston Smith’s deal tracker recorded 111 UK media and marketing services deals in Q1 2022, which is just under the 116 we reported on last quarter. It is, however, still far ahead of the volumes we saw during the pandemic and is broadly on par with the same quarter in pre-pandemic 2019.

Q1’s data reflects continued seller confidence and substantial buyer appetite, driven by the easing of lockdown measures, the strength of the UK economy and its swift return to pre-pandemic levels. The pandemic led to a strategic reset for many businesses, now more focused on investing to thrive rather than simply survive. The pursuit of growth is back on the agenda, with M&A the preferred strategic option to accelerate growth.

M&A transactions have a long lead time, so Q1 deal completions were likely unaffected by Russia’s invasion of Ukraine, rising fuel prices, higher than anticipated inflation and a decline in retail sales. It remains to be seen to what extent deal-doers become more cautious throughout the remainder of this year due to these factors.

Sector activity

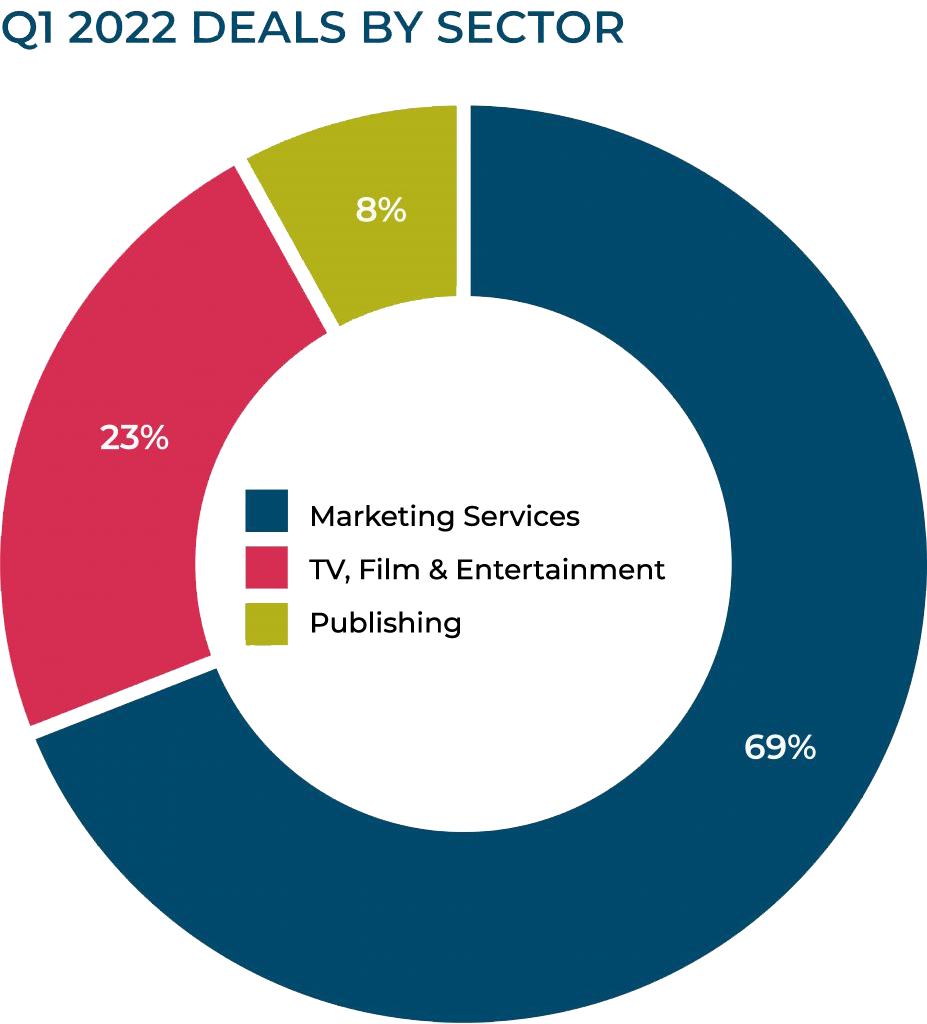

Media and marketing services cover a broad range of activities, so for the purposes of this report, we have allocated transactions to three main categories: marketing services; publishing; and TV, film and entertainment (which includes gaming and music). Almost 70% of our 111 Q1 deals fell within the marketing services sector, with a total of 77 transactions completed. TV, film and entertainment also had a busy Q1 with 25 deals announced, while we noted nine transactions in the publishing sector.

Media and marketing services cover a broad range of activities, so for the purposes of this report, we have allocated transactions to three main categories: marketing services; publishing; and TV, film and entertainment (which includes gaming and music). Almost 70% of our 111 Q1 deals fell within the marketing services sector, with a total of 77 transactions completed. TV, film and entertainment also had a busy Q1 with 25 deals announced, while we noted nine transactions in the publishing sector.

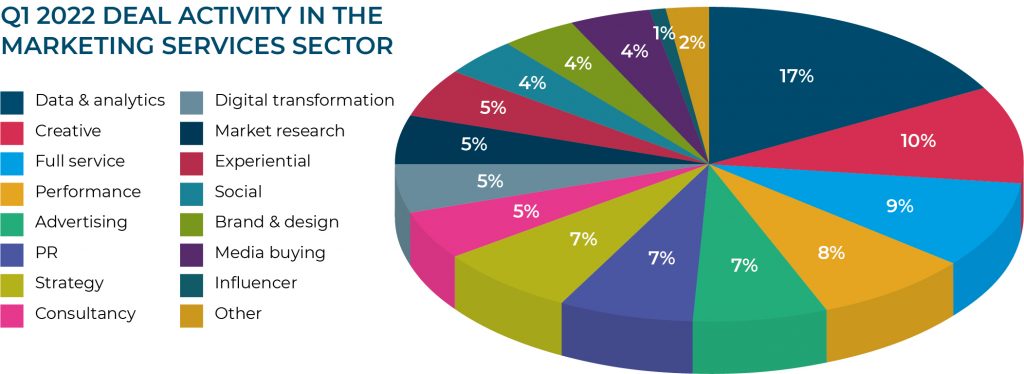

Our analysis of the 77 marketing services transactions completed last quarter enables us to determine whether the company acquired was a full-service agency or a specialist in one of the marketing services disciplines, such as PR or advertising.

In Q1 2022, agencies and companies specialising in data and analytics were most popular amongst acquirers, with creative and full-service agencies following close behind.

Following several completed transactions in the digital marketing services arena in 2021, Moore Kingston Smith’s corporate finance team announced a further digital deal on 1 February 2022. They advised Reason, a digital transformation agency, on its sale to Paragon Group. Damian Ryan, Corporate Finance Partner at Moore Kingston Smith, who led on the transaction, commented: “Digital transformation and product design is high on the requirements list for all corporates right now and we’re seeing strong interest from a diverse pool of investors.”

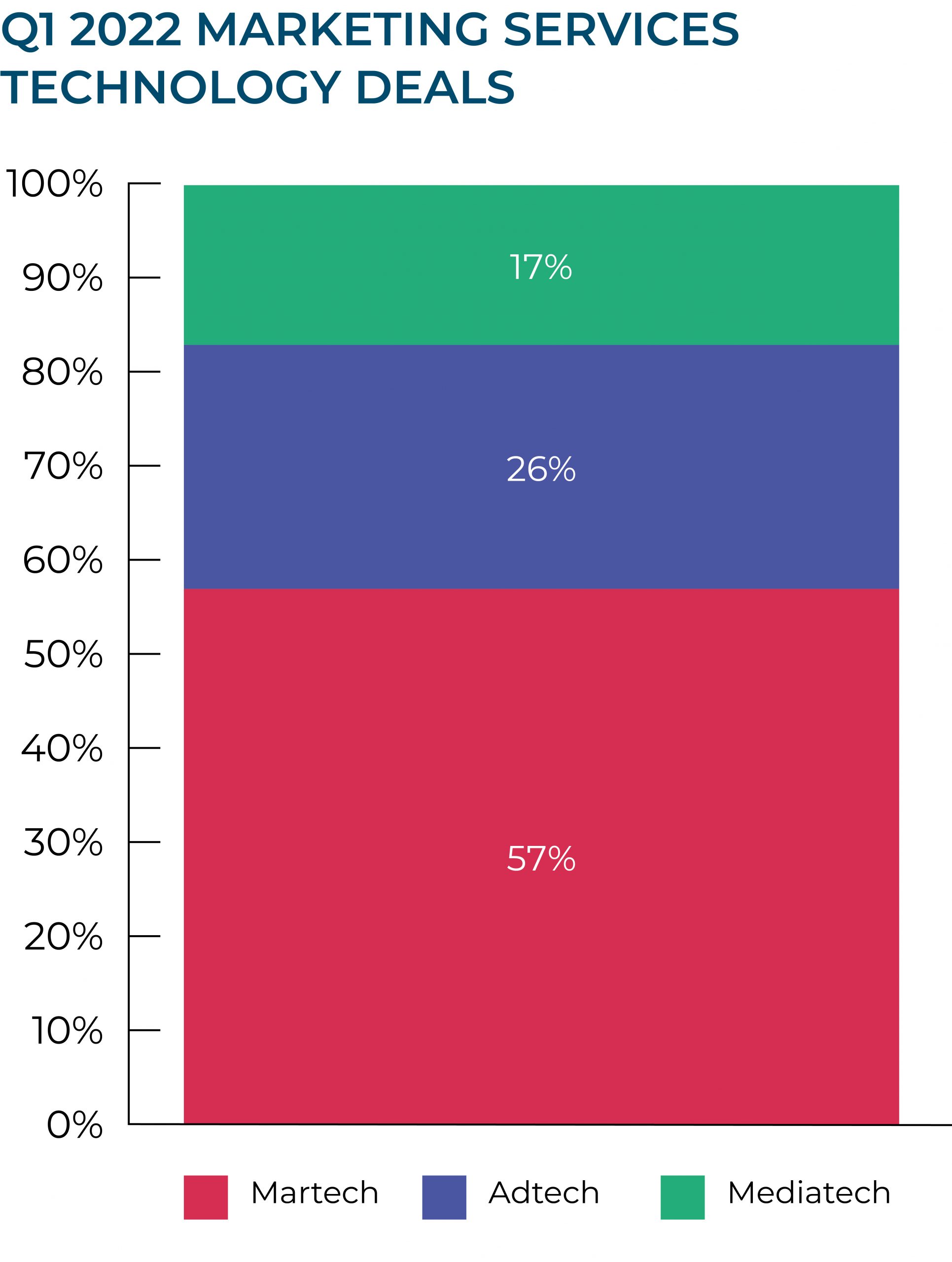

Looking more closely at the marketing services sector, we see that, while most deals involved the acquisition of traditional service-led agencies, 30% of the deals in Q1 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.Most of these marketing services technology transactions related to martech companies. These companies are developing and using technology to assist with digital marketing strategy, including such elements as lead generation, customer acquisition and retention, content and social, and data and analytics.

Looking more closely at the marketing services sector, we see that, while most deals involved the acquisition of traditional service-led agencies, 30% of the deals in Q1 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.Most of these marketing services technology transactions related to martech companies. These companies are developing and using technology to assist with digital marketing strategy, including such elements as lead generation, customer acquisition and retention, content and social, and data and analytics.

The Martech Report 2021/22 highlighted the explosive growth of martech in recent years, as marketing has transformed to meet the requirements of today’s data-driven, digitally underpinned world. Companies operating at the forefront of the martech space are attractive acquisition targets.

While martech predominated, adtech also proved popular last quarter, accounting for more than a quarter of the marketing services technology deals we recorded. Adtech usually refers to specific solutions or tools used for digital advertising, such as programmatic advertising tools, data management platforms and ad exchanges.

One notable adtech transaction was the acquisition of UK-headquartered TVSquared by US adtech company Innovid Corp for a cash and stock transaction valued at c. $160 million. TVSquared was founded in Edinburgh in 2012 and has grown to become the world’s largest measurement and attribution platform for converged TV, picking up various awards on the way, including Adtech Company of the Year at the UK Business Tech Awards. Its platform allows advertisers to ascertain whether audiences are watching in traditional linear fashion or through streaming, and to use real-time analytics to evaluate data on outcomes such as car sales or app downloads after consumers have viewed a commercial.

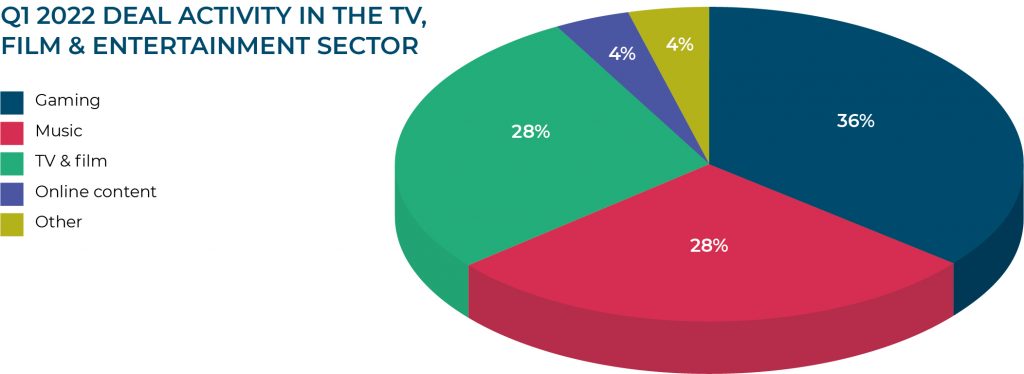

Within the TV, film and entertainment category, the gaming sector was the most active in Q1, followed by music and TV and film.

One of the most active acquirers in the gaming sector last quarter was the AIM-listed UK games developer Team17 Group. In early January, it announced the acquisition of San Francisco-based The Label, an indie publisher specialising in mobile subscription games, for an initial payment of £18 million. It followed that a couple of weeks later with the announcement of its acquisition of astragon, a developer of simulation games based in Germany, for an initial payment of £63 million. To support the astragon acquisition, Team17 raised £79 million via a new placing on AIM which was oversubscribed, indicating that gaming remains popular with investors.

Within music, Switzerland-headquartered Utopia Music found the UK a happy hunting ground. It acquired three UK-based companies in Q1: Absolute Label Services, a services provider to independent artists and record labels; distributor Proper Music Group; and music publisher Sentric Music Group.

Tech behemoth Apple also found a target company in the UK’s music industry. In early Q1, it acquired London-based AI Music, which uses artificial intelligence to generate dynamic soundtracks that change based on user interaction.

As we saw with marketing services, technology-led deals were prominent in the TV, film and entertainment sectors, accounting for just over a third of the transactions we recorded in this space. Production services accounted for a further third, with pure content plays making up just 20% of the deals recorded in Q1.

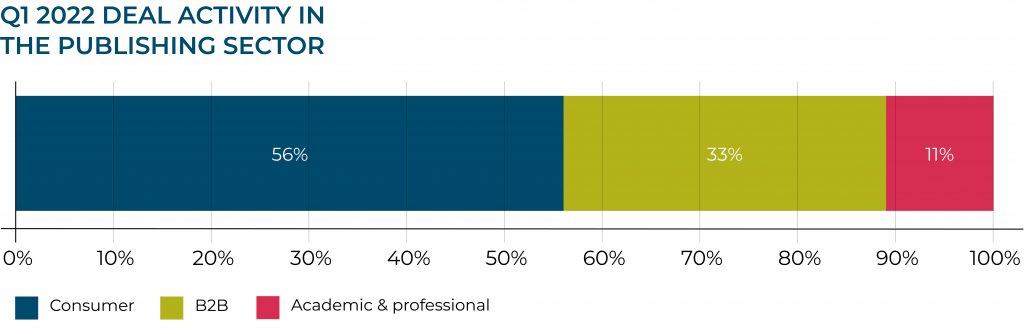

Consumer publishing saw the most deals in Q1, representing more than half the deals recorded. B2B publications were second in popularity, followed by academic and professional publishing.

Notable transactions in the publishing sector included the purchase of the UK’s fourth largest regional news and magazine publisher, Archant, by the second biggest, Newsquest. Archant owns more than 100 magazine and news brands around the UK, principally in East Anglia, and was acquired from private equity house Rcapital which bought the Coronavirus-hit business in a rescue deal in September 2020.

Marketing services networks remain active

MAJOR HOLDING COMPANIES

Havas was the most active of the major listed holding companies in Q1 2022, completing five transactions in the period. In mid-January, Havas announced that it had taken a majority investment in Tinkle, a leading PR and communications agency with a presence in Spain and Portugal. The following week, it announced the acquisition of Paris-based medical education specialist Raison de Santé.

In February, Havas announced the acquisition of Inviqa, a UK-based digital experience agency, in what it described as a “substantial, eight-figure deal”. Inviqa, with more than 150 employees across eight offices, will be integrated into Havas Creative’s dedicated customer experience network, Havas CX, and will merge with Havas’ existing digital experience agency, ekino London.

In March, Havas took a majority interest in Frontier Australia, a performance marketing agency, and also acquired the Chinese digital marketing agency Front Networks. None of the other major holding companies acquired anything in the UK in Q1.

In January, Publicis announced it had acquired Tremend, a software engineering business based in Romania. In February, WPP announced the acquisition of a US-based influencer marketing agency.

Also in February, Omnicom Health announced it had acquired Propeller, a digitally-focused omnichannel engagement marketing agency specialising in healthcare, based in the US.

In March, Omnicom followed this with the acquisition of US-based TA Digital, a digital experience consultancy.

CHALLENGER NETWORKS

Among the challenger networks, one of the most notable transactions of the quarter was the acquisition of Engine Group UK by AIM-listed Next Fifteen, which was announced in early March. Next Fifteen will pay £77.5 million to acquire Engine from US private equity house Lake Capital and will undertake a £50 million share placing on AIM to help finance the transaction.

NASDAQ-listed marketing group Stagwell acquired London-based media agency Goodstuff in January. The transaction will see the former UK’s second-largest independent media agency work alongside Stagwell’s Assembly.

Following the 12 transactions it completed in 2021, in January 2022, S4 Capital announced the “combination” between its Media. Monks business and California-based data analytics company 4 Miles Analytics. Since January, S4 Capital has been quiet on the acquisition front, no doubt distracted by the well-publicised delays in the publishing of its audited results and the decline in its share price.

The Miroma Group stepped up a gear in February when it announced it was acquiring Miroma SET, a sports entertainment and technology marketing company, in which it was already a minority investor. By acquiring Miroma SET in a share-for-share transaction, Miroma Group now finds itself with several well-known high net worth investors who had previously backed Miroma SET, including Nigel Wray, Tom Hulme from Google and Scott Belsky from Adobe. In March, Miroma Group announced it had acquired Singapore-based APAC marketing agency Maker Lab.

AIM-listed The Mission Group bought youth marketing agency Livity in March. Also in March, serial acquirer Selbey Anderson announced it had bought Digital Radish, an ABM and branding agency for high-growth technology brands and winner of B2B Marketing Agency of the Year in 2021.

Q1 2022 saw the announcement of a new UK-headquartered network in the form of the Together Group, which brings together an initial group of five founder-led agencies focused on the luxury and lifestyle sectors. The agencies involved are: Purple, a communications agency; strategy and branding agency King & Partners; Noë & Associates, a brand and design agency; creative consultancy Construct; and digital marketing specialist Hot Pot China.

Private equity still fan of media and marketing services

Since the start of 2020, private equity has substantially underpinned deal-doing in the UK’s media and marketing services sectors, with institutional investors making new investments while also backing their existing portfolio companies in their buy-and-build strategies.

Private equity-backed investments accounted for 54% of all deals completing in 2021. While the percentage dipped just below the 50% level in Q1 2022, it remains high when compared to historical norms.Key private equity-backed acquirers in the quarter included UK B2B specialist The Marketing Practice, which secured investment from Horizon Capital in April 2021. The Marketing Practice completed the acquisition of US agency 90octane in March. 90octane is The Marketing Practice’s third acquisition in six months, following the acquisitions of media, data and audience insight specialist Kingpin and digital experiences consultancy Omobono in 2021.

Gravity Global, backed by Elysian Capital since September 2021, acquired two US companies in March: B2B agency 9thWonder and creative agency Morsekode. Gravity Global has completed six acquisitions in the last two years to extend its geographical coverage and service offerings. With two more US acquisitions apparently in progress, Gravity says it is on track to double in size this year.

In January, THE (Times Higher Education), which was acquired by Inflexion Private Equity in 2019, announced that it had completed the acquisition of Inside Higher Ed, the US provider of news, analysis and solutions for universities and colleges. THE signalled that Inflexion is looking to support it through further strategic acquisitions.

“The level of private equity interest in the sector is considerable, particularly within the content, gaming and digital marketing segments,” says Paul Winterflood, Corporate Finance Partner.

Despite the macro-economic headwinds, we are confident that transaction volumes will remain strong as private equity houses continue to look to deploy capital.”

Outlook

2021 was an outstanding year for UK M&A deals in the media and marketing services sectors. So far, 2022 appears to be following suit, despite concerns about the situation in Ukraine and other macro-economic factors. We have not yet seen these wider concerns impact on deal flow and therefore remain optimistic about the outlook for 2022.

Damian Ryan adds: “Buyers are becoming more cautious because of the fast-changing economic environment and increasing tensions, as we speculated in our Q4 2021 report. Looking further ahead, we expect media assets to perform well and martech to continue winning interest from investors. We expect significant increases in private equity interest in the film content market, independent production companies and those demonstrating a successful track record of monetising content across multiple broadcast networks.”

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to consider their exit options. For more information, get in touch with the Moore Kingston Smith corporate finance team.

Contributors

Methodology: In compiling our Dealtracker, we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller (or both) and, where the target company is classified as marketing services, publishing or TV, film & entertainment, the transaction is entered into the Dealtracker. We classify marketing services into fifteen sub-categories, publishing into four sub-categories, and TV, film & entertainment into seven sub-categories. We have also used various media and marketing services companies’ press releases and investor circulars as source material for this report.

All information contained herein is correct at the time of going to print.