Effective succession planning for German property has significant impact on tax burden

Recent insights from Germany show a trend in investors seeing the benefits of effective succession planning for their property after new guidance on how to lower their tax burden. This new approach also applies to non-Germany residents with property in Germany.

Our fellow Moore Global member firm Moore Treuhand Kurpfalz discusses the legal valuation regulations for property valuation in their recent article. It highlights how the timing of property transfers can determine the value of the property transfer, which can indicate the expected tax burden. The active monitoring and consideration of valuation parameters can have a significant impact on the total value.

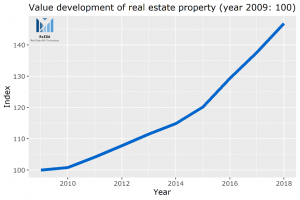

In recent years, property prices in Germany have risen considerably, although the level of value appreciation varies regionally. On average, Germany has seen an increase in value of over 40% since 2009.

Source: German Statistical Office, own calculations

Generally, the transfer of property as a gift is taxable in Germany and falls within the scope of the gift and inheritance tax. There are differing allowances depending on the personal relationship, which have remained the same since 2009. The combined effect of increasing property prices and unindexed allowances means that the allowance is often used up much faster.

It is possible to use the allowances every ten years, so early consideration of the property owner’s personal situation can be useful. Additionally, the rules in the property owner’s country of residence and Germany might require close coordination.

Exemplary Allowances for German Gift Tax Purposes

An early transfer of property can be particularly interesting under a so called beneficial interest. ‘Breaks’ in the value development of the properties should be identified using valuation regulations for tax law purposes. Similarly, close coordination with the rules of the home country is required.

Regarding the valuation of the beneficial interest, an annual value has to be multiplied by the statistical life expectancy, which makes it even more beneficial to think about an early transfer of property.

The new approach requires a close alignment of the rules between the property owner’s country of residence and Germany.

If you would like to receive a complete translation of the article or speak to our German Group about how you can ensure you are in the best tax position in both the UK and Germany, please contact us here.