Furlough v3.0: Scheme extended to cover November lockdown

The November lockdown has led to the Coronavirus Job Retention Scheme being extended until 2 December 2020 instead of ending 31 October 2020 as originally planned.

This means that the Job Support Scheme due to commence on 1 November 2020 will now be deferred until December.

The payments under the furlough scheme will return to the level they were in August 2020 so the government will cover 80% of earnings up to a maximum of £2,500 per month and the employer will meet the cost of the employer’s NI and employer’s pension contributions.

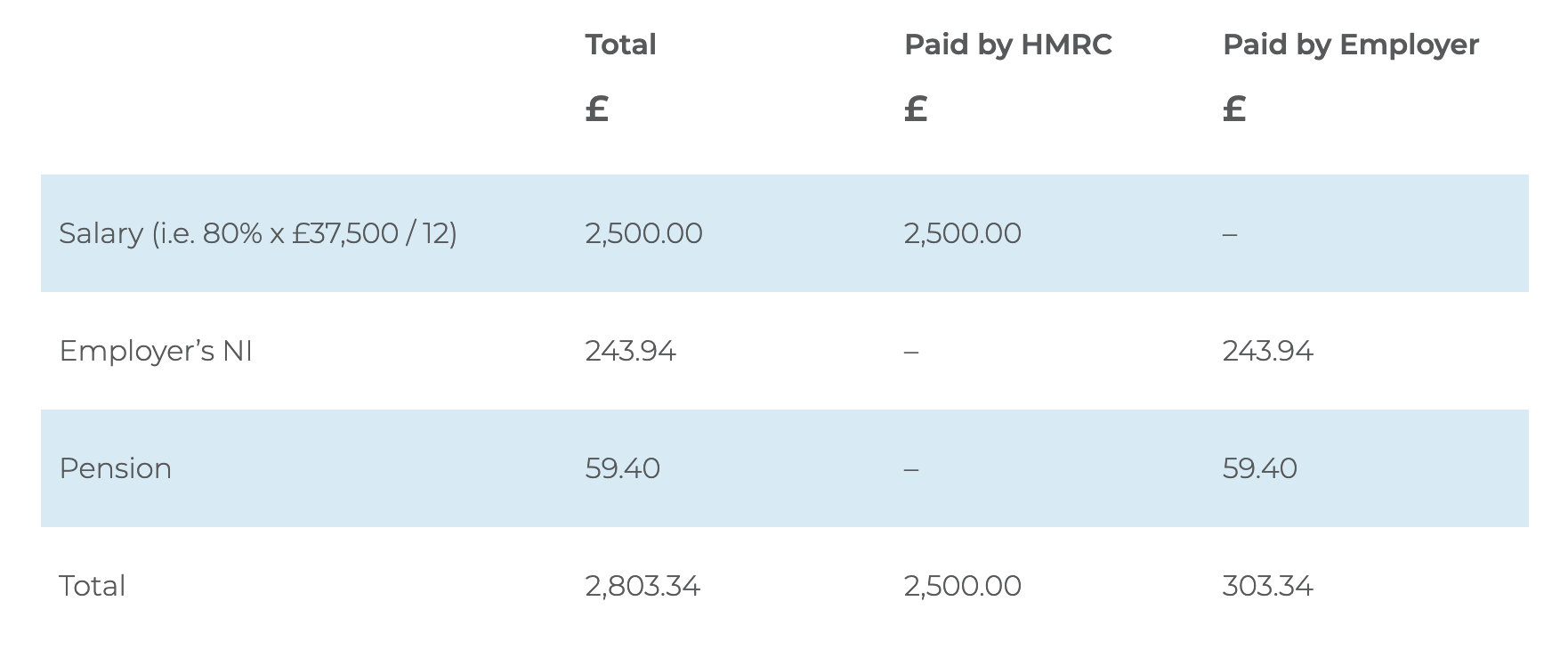

If an employee normally earns £37,500 per annum then under this scheme, the split of costs between the employer and HMRC will be as follows:

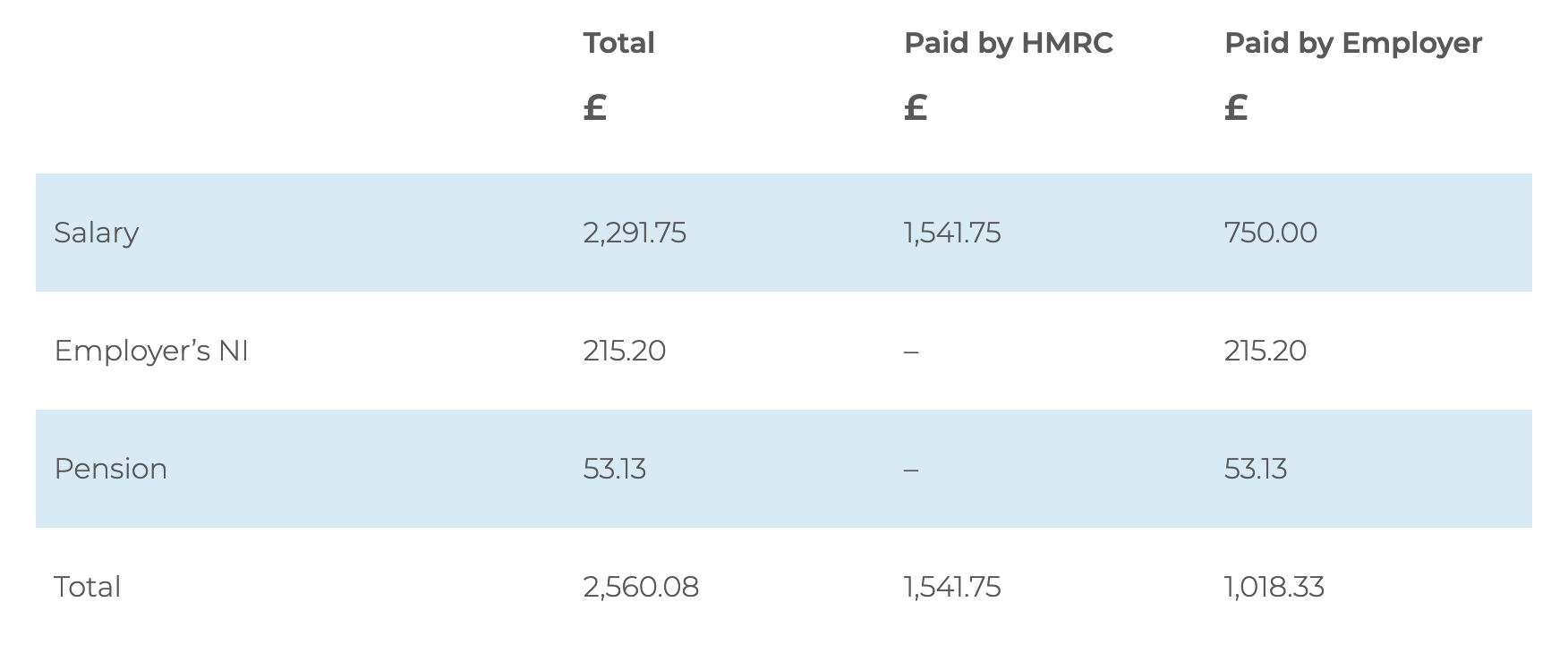

This is more generous than the Job Support Scheme where the employee is required to work for 20% of their normal hours and be paid for that time by their employer. Assuming the same level of salary as above with the employee working the minimum period of 20% of their working time to qualify, the costs under the Job Support Scheme are split as follows:

So, when compared to the Job Support Scheme, under the Coronavirus Job Retention Scheme in November, the employee can be paid a higher level of salary at a lower cost to the employer and there is no requirement that the employee continues to work.

The furlough scheme will continue to work in the same way as before but with the following key differences:

- There is no requirement for employers to have previously furloughed employees they now want to include in the scheme.

- Employees who were previously excluded, as they were not included in a payroll RTI submission before 19 March 2020, can now be included in the scheme provided they were included in a payroll RTI submission before midnight on 30th October 2020.

In practice this should mean all employees included on a payroll in September 2020 will be eligible and, provided the RTI submission for the October payroll was made on or before 30 October, new employees who started in that month will also be eligible.

If the October RTI submission was submitted on or after 31 October 2020 or has not yet been submitted by an employer, their new starters in October will not be eligible for the scheme.