More give and take from the Chancellor: further extension of support schemes and Job Retention Bonus scrapped

The Chancellor has now kicked the Job Support Scheme firmly into the long grass with the Coronavirus Job Retention Scheme now extended to cover the period from 1 November 2020 to 31 March 2021.

The Job Retention Bonus, due to be paid in February 2021 at a rate of £1,000 per employee where previously furloughed employees had recommenced their employment duties, has been scrapped.

Finally, the Self-Employed Income Support Scheme has been enhanced so that the payment due to be made for the three months ended 31 January 2021 has been increased to cover 80% of profits, capped at £7,500.

Extended Coronavirus Job Retention Scheme (CJRS)

For the period from 1 November 2020 to 31 January 2021, the extension to the scheme will pay a grant to employers to enable them to pay employees 80% of their salary (capped at £2,500).

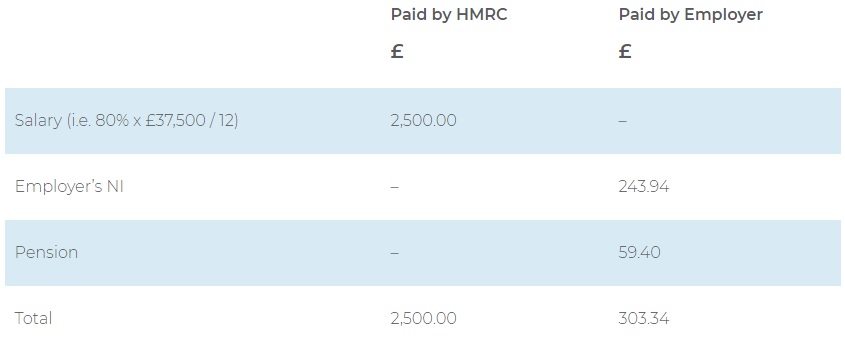

The employer will remain liable to the employer’s NI and pension costs so the split of costs for an employee on a salary of £37,500 per annum on furlough with no work done would be:

There is an unanswered question as to what the reference salary for the 80% calculation will be. Under the previous scheme this was the salary from the February 2020 payroll in most cases but this new scheme may use salary from a later month.

The government has said that they will review in January the amount payable by the employer from 1 February 2021 onwards. This seems to indicate an intention for a phased withdrawal of the scheme, with the employer making contributions in February and March 2021, as was the case in September and October 2020 where employer contributions of 10% and 20% were introduced.

As with the earlier announcement:

- There is no requirement for employers to have previously furloughed employees they now want to include in the scheme;

- Employees who were previously excluded as they were not included in a payroll RTI submission before 19 March 2020 can now be included in the scheme provided they were included in a payroll RTI submission at some point between 19 March 2020 and 30 October 2020.

In practice this should mean all employees included on a payroll in September 2020 will be eligible and, provided the RTI submission for the October payroll was made on or before 30 October, new employees who started in that month will also be eligible.

- Employees that were included in an RTI submission on or before 23 September 2020 who were made redundant or stopped working afterwards can be re-employed and claimed for.

- Employers claiming under this extended Coronavirus Job Retention Scheme will have their details published from December 2020 onwards so it will be public knowledge that they have relied on this scheme. The motivation behind HMRC doing this is likely to be to allow employees to whistle-blow on their employers where claims are being made and not being paid to employees.

- Claims can be made from 8am Wednesday 11 November (i.e. in advance of the November payroll) and claims for each month must be submitted by the 14th day of the following month. If this deadline is missed, it looks like the opportunity to make the claim for that month is lost.

Farewell to the Job Retention Bonus (JRB)

The Job Retention Bonus has been scrapped.

The JRB of £1,000 per employee was due to be paid to employers who continuously employed previously furloughed employees through to 31 January 2021, provided that a minimum salary level was paid during the three months ended 31 January 2021.

The press releases from government say, “we will redeploy a retention incentive at the appropriate time.”

The JRB was forecast to cost up to £9bn so the scrapping of it will help the Chancellor fund the cost of the extended CJRS. However, employers who were counting on this windfall in the new year will need to rework their cashflow forecasts as this may leave a hole in their finances.

Self-Employed Income Support Scheme (SEISS)

Payments under the SEISS have been increased to the level they were when it was first introduced earlier this year so, for the period from 1 November to 31 January 2021, this now will pay 80% of profits capped at £7,500.

The payment date of this grant has been accelerated so that it can now be claimed from 30 November with payment promised in good time for Christmas.

A further payment for the period from February to April 2021 is due to be available, although the level of this payment is still to be announced..

There is no indication at this stage that the earlier problems associated with SEISS will be solved so, for example, individuals commencing their self-employment after 5 April 2019 and those operating through personal service companies will still not qualify.