Observations from the 2021 audit cycle

Following the end of the annual audit cycle in January of each year, we always highlight some benchmarking that was relevant during the submission of the Academies Accounts Return (AAR).

For this year, the major changes have been that Covid funding has been specifically reported for the first time, and the AAR was also more reflective of the detailed breakdown of income received variously from the ESFA and from other non-ESFA bodies.

Discussions with schools suggested that operations were very challenging. The priority of all schools has been the welfare of staff and pupils and to ensure all pupils were given the best level of educational support. 79% of schools felt that student welfare will be greatly impacted by Covid. Most schools commented on the fact that in-year surpluses had improved, but only as a result of lower operational costs through remote working and the lifeline given through various sources of Covid funding support.

Significant matters that came out of our analysis were as follows:

Staff costs as a % of total grant income (including Covid catch-up and excluding capital funding)

Schools have received additional grant income this year compared with previous years. As would be expected, therefore, this % figure has reduced. However, the reduction is not as great as expected because funding is also being reduced by the gradual phasing out of teacher pay and pension grant income. The figure will also be affected by the level of in-house support services such as catering, premises and cleaning, because staff numbers in those sections will have reduced disproportionately during the lockdown and furlough periods.

The following detailed elements are of interest:

- The ratio for primary schools is generally between 75% to 85%. However, schools with inherently lower levels of students have suffered (particularly, for example, rural schools) and often they are being forced to consolidate year groups to deal with staffing challenges.

- Secondary schools have seen even lower ratios than previous years due to the receipt of additional Covid testing grants which primary schools did not receive. Secondary schools averaged between 70% and 80%, lower than the benchmarks in the previous year.

- The ratios for sixth forms and post 16 education providers have not reduced as much and have exceeded the benchmark set by ESFA of 80%. This is generally due to funding constraints and smaller specialist classes absorbing higher salary costs.

Other notable key benchmarks were:

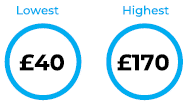

Covid funding income per pupil

The higher funding has been where schools have received further funding as a result of deficit forecasts, or for SEND/free school meals students, or for Mass Testing funds.

Technology spend per pupil

Our recent pulse survey of the education sector conducted by the Moore network highlighted that IT support for students was a particular concern. Although many schools received gifts of laptops (which schools have found extremely helpful), the results of our survey identified that 24% of students would be unable to work remotely due to lack of IT.

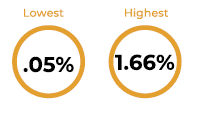

Sickness days per FTE

Some schools reported that absences were lower than anticipated because of the flexibility of remote working, while others were impacted enormously from staff illnesses, particularly in the first nine months of the academic year. This disparity may well be representative of the way that Covid infections swept through individual school populations and hit those schools’ teaching teams so intensively.

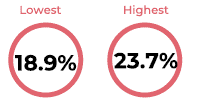

Key management staff costs as a % of staff costs

Key management staff costs in larger MATs (classed as 8 or more schools) could be as low as 1.5% of staff costs. This is because efficiencies have been made by consolidating staffing structures within Senior Leadership Teams so that decision making is more streamlined.

Costs within primary schools were higher as there appeared to be a flatter management structure and fewer efficiencies of scale.

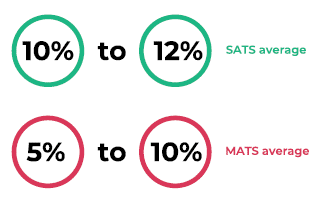

Agency costs as a % of staff costs

Agency costs have generally reduced this year, partly because of the flexibility to work remotely, but also due to the opportunity for schools to collaborate more, seeking help from other schools either within their MAT or within the collaboration of schools they have worked with, rather than using agencies to fill staff absences or shortages.

Local Government Pension Scheme Liabilities increase

We have seen a very large range of increases this year, from 14% to 60% in single academy Trusts, and between 21% and 69% in MATs. In exceptional cases, newly formed free schools have increased over 300%, and expanding smaller MATs have seen increases of between 100% and 198%. These increases will have been partly due to the liabilities transferred in.

Assumptions that have impacted on these liabilities include the performance of investments within the market, the decrease in the discount rate upon which forecast liabilities are calculated, the change in the age demographic of employees since the last triennial valuations and the increase in forecast staff salary costs. Interestingly, the life expectancy of staff has been assumed to reduce (which will decrease the liability), with one of those factors affecting the life expectancy being the impact of Covid on long term health.

Employer Pension Contribution Rates

We have also seen examples around the country of exceptional rates up to 30%.

Reserves policy

Trusts are finding this harder to maintain with increasing pension costs and foreseeable overhead increases. The preferred cover of costs is often a figure equivalent to a certain number of months of salary costs or operational costs. There are a few Trusts who are being more focussed and building up specific reserves to fund particular projects that require longer term funding, and this is reflecting a move in the wider nonprofit sector for reserves policies to be ‘smarter’ and move beyond a simple closedown calculation – but the majority retain the more basic ‘three month operating costs’ approach.

Future planning

Trusts will no doubt be very aware of the upcoming increase to national insurance rates – from 6th April 2022 there will be an increase of 1.25% for the health and social care levy. The government is expected to compensate academies for this increase, but the exact details have yet to be published.

At the time of writing, inflation is reaching higher rates then we have experienced for many years – expectations are that inflation will increase to 7% – 8% before falling later in the year. Other than staff costs, key items that Trusts are re-budgeting are building materials, fuel and energy costs and catering foods. Again, at the time of writing, these costs are seeing enormous weekly increases (with more expected to follow) as the Ukrainian conflict hits world economies hard.

Electricity costs could rise to 50% by April 2022. A lot of trusts have been tied into fixed contracts for the last few years, but these agreements are now up for renewal and tender. There is also a move towards trusts being carbon neutral by 2030 as confirmed in the latest COP26 conference and by the Department for Education’s own commitments. There will be funding available to ensure schools have the resources to achieve this, but figures have yet to be agreed.

Conclusion

Trusts have seen a lot of change over the last academic year, but the next few years will bring significantly more challenges in terms of costs and funding levels. The ESFA will be re-emphasising the importance of accurate, timely and relevant budget setting. Trustees must look to question and challenge the figures set by the Senior Leadership Team to ensure Trust finances are viable over the short to medium term as a minimum.

Read more in Academies Plus – March 2022

Contributor

Ann Mathias, Head of Education, Moore South UK