UK growth capital market still running hot – Q1 2022 growth capital update

Growth capital update – a review of Q1 2022

2021 was a phenomenal year for the UK’s growth capital market. Investment activity not only surpassed that seen in 2020 – a year obviously impacted by pandemic concerns – but also that of previous years, breaking all recent records. In our round-up of 2021, we questioned whether this level of activity would continue, given there were some economic ill winds on the horizon, but the answer is that it has continued in Q1 2022.

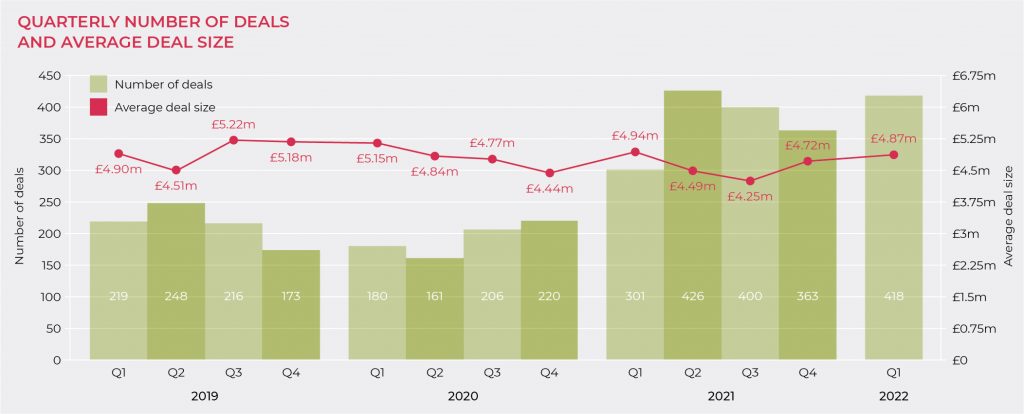

According to our latest research into UK private companies, each raising between £1 million and £20 million of growth equity capital, 418 UK businesses raised a total of £2.035 billion in the first quarter of 2022. The average deal size was £4.87 million.

A review of Q1 2022

In the final quarter of 2021, we saw 363 deals with an average deal size of £4.72 million, and £1.715 billion raised in total. Our Q1 2022 figures therefore reveal a 15% increase in the number of deals completing and a 19% increase in the overall amount of growth capital being raised.

Q1’s data reflects continued business confidence and substantial investor appetite, driven by the easing of lockdown measures, the strength of the UK economy and its swift return to pre-pandemic levels.

Growth capital transactions have long lead times, so Q1 deal completions were likely unaffected by Russia’s invasion of Ukraine, soaring fuel prices and higher than anticipated inflation figures. It remains to be seen to what extent investors become more cautious throughout the remainder of this year due to these factors.

John Cowie, Head of Growth Capital at Moore Kingston Smith, comments: “It’s great to see momentum carrying through into 2022 and that record numbers of deals are still being done. The statistics mirror our own experience, as we’ve never been busier. Despite obvious macro-economic disruption, the appetite in the growth capital investor community for seeking out exciting opportunities appears undiminished.”

Later-stage VCs were the most common types of deals in Q1 2022, with early-stage VC second. Together, early-stage and later-stage VC accounted for 60% of all deals by number and 69% by aggregate value.

“It’s great to see momentum carrying through into 2022 and that record numbers of deals are still being done,” says John Cowie, Head of Growth Capital.

Tech still trouncing

“We expect investment in tech deals to remain high, regardless of any macro-economic headwinds.

B2B tech solutions are as sought-after as ever but it was especially great to see several transactions completing in the renewable energy and related spaces: areas that will attract much investment in the coming years as the drive to net zero intensifies.”

Paul Winterflood, Corporate Finance Partner

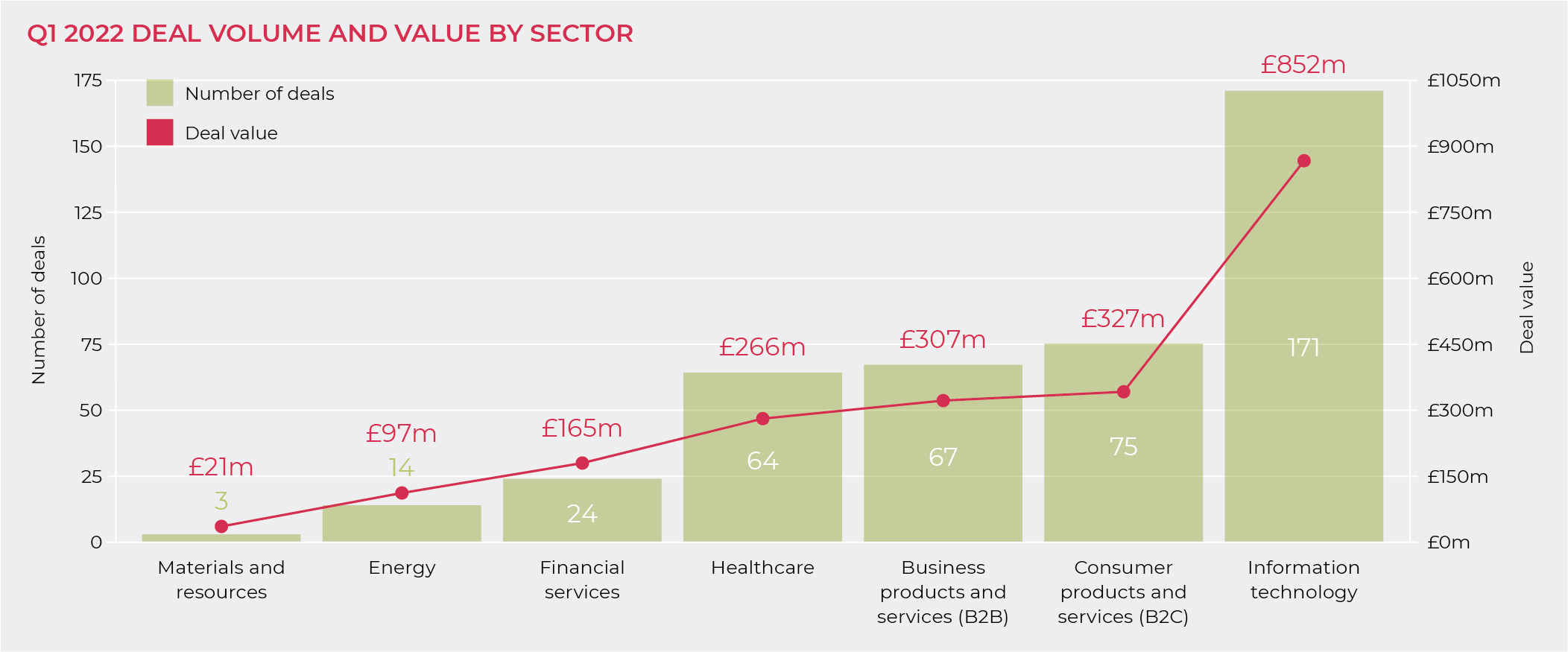

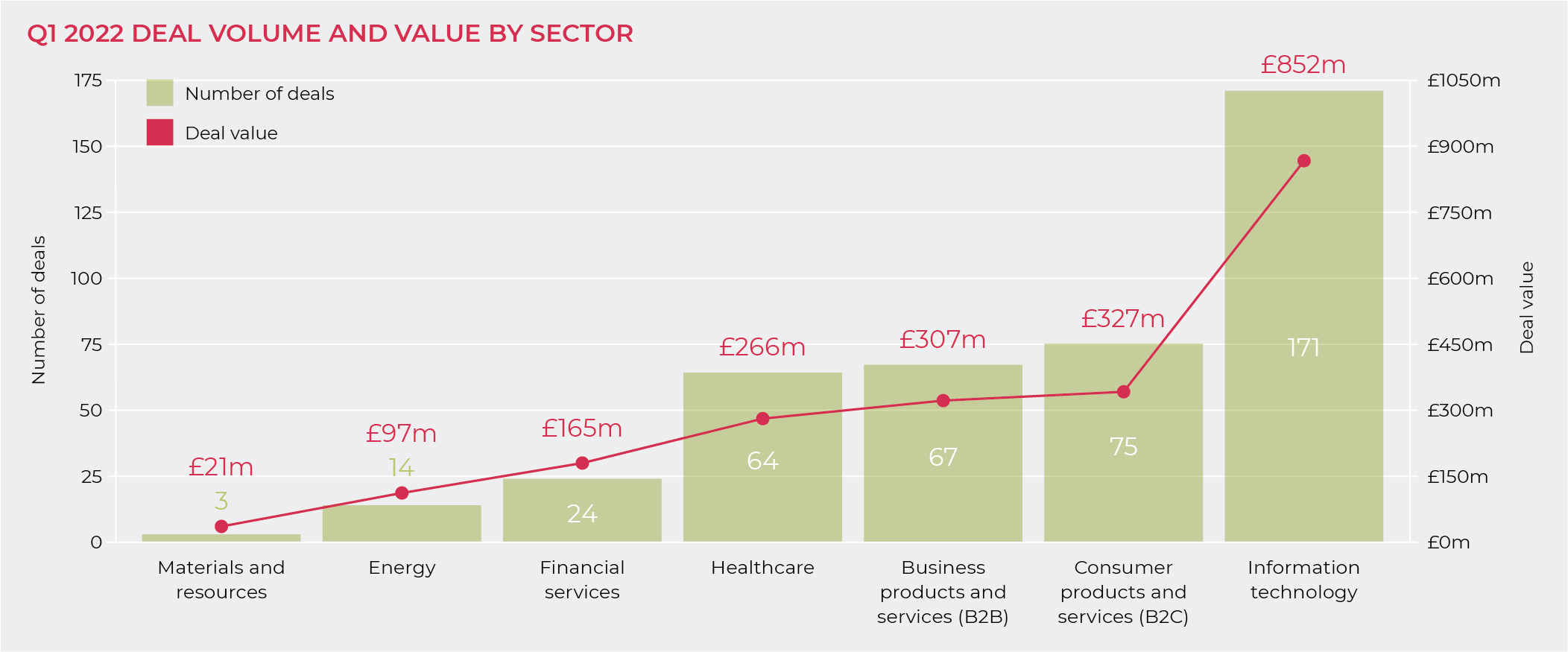

Technology was the most popular sector for investors in Q1 2022, just as it was throughout 2021, accounting for 41% of all transactions by volume and 42% by value. Investor appetite for B2C, B2B and healthcare businesses also remained strong.

Notable deals in the tech space in Q1 included the $19.9 million Series B funding secured by Bristol-based hydrographic services provider Rovco and its sister company Vaarst. The fundraising was co-led by Legal & General Capital and international energy company Equinor. Vaarst provides subsea 3D computer vision technologies supporting the offshore wind, wave and tidal, scientific, maritime security and civil engineering industries. Rovco focuses on the use of Vaarst’s technology in the energy transition space. The company uses remotely operated vehicles to conduct subsea surveys in offshore wind and oil field decommissioning. The investment in Rovco and Vaarst is part of Legal & General’s plans to expand its clean energy portfolio.

Q1 also saw the announcement by London-based Skyports that it had raised $23 million from existing and new investors to accelerate its plans to build “vertiports” for electric air taxis and expand its drone delivery services. New investors coming in on this round included Japanese conglomerate Kanematsu Corporation, ASX-listed industrial property group Goodman Group and Italian airport platform 2i Aeroporti. Skyports has previously partnered with Royal Mail to use drones to deliver parcels to islands in the Inner Hebrides, and with the NHS to carry Coronavirus test samples and other medical materials in the Argyll & Bute region. It is now partnering with French airport operator Groupe ADP to develop advanced air mobility services in time for the 2024 Paris Olympics.

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith, notes: “We expect investment in tech deals to remain high, regardless of any macro-economic headwinds. B2B tech solutions are as sought-after as ever but it was especially great to see several transactions completing in the renewable energy and related spaces: areas that will attract much investment in the coming years as the drive to net zero intensifies. This will require both capital and innovation, two things that the UK tech ecosystem has a history of delivering.”

Active investors in Q1

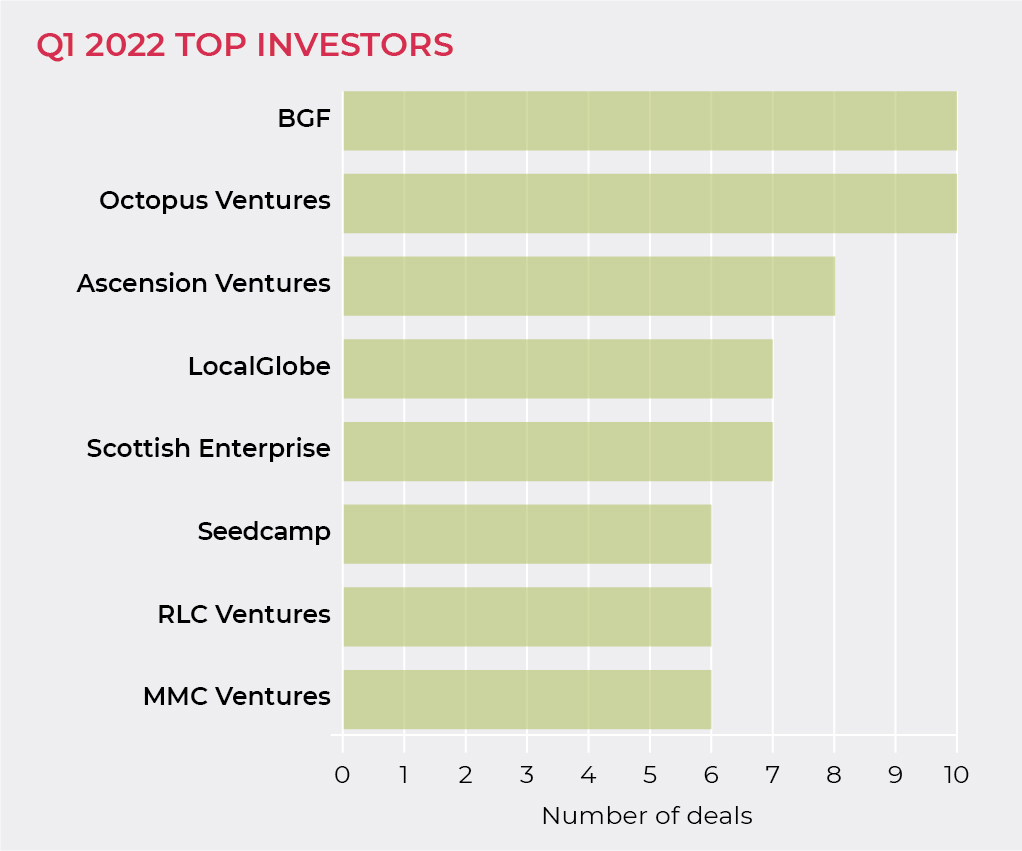

BGF and Octopus Ventures were the most active investors in Q1 2022, with ten deals completed apiece. Ascension Ventures, which topped our table in Q4 2021, came in third in Q1 2022.

BGF’s investments in Q1 included $17.2 million invested in Myzone, the global manufacturer of wearable fitness tracking technology; participation in an £8.5 million funding round co-led by Park in Pathfinder Medical, a medical device company improving outcomes for vascular procedures; and it also led a £2.5 million investment round into sustainable female underwear brand Stripe & Stare.

Octopus Ventures led an £11 million Series A funding round into LifeScore, an AI music technology company that creates music algorithmically tailored to the context and needs of the listener. It also backed Touchlab, a deep tech company based in Edinburgh that develops electronic skin for robots to enable them to develop a sense of touch, in a $4.8 million seed round.

Ascension Ventures took part in a $20 million Series A funding round into HeyGo, a London-based software start-up building a marketplace for virtual travel tours. It also backed Beem, the developer of a consumer app which allows users to livestream themselves from one device to another in real time using augmented reality, in a $4 million seed funding round.

Outlook

2021 was a record-breaking year for the UK’s growth capital market. So far, 2022 is following in the same vein, despite concerns about the war in Ukraine and other macro-economic factors, such as soaring fuel prices, rising inflation and declines in retail spending.

We have not yet seen these wider concerns impact on deal flow and therefore remain optimistic about the outlook for 2022. Investor appetite for growing UK companies – particularly tech-enabled UK companies – continues unabated.

We are in contact with an ever-growing pool of private equity investors with substantial amounts of capital to deploy, so we expect the market to prove resilient in the coming months.

Contributors

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner. Contact us to find out more about our raising finance and growth capital services.

We also assist investors, providing expert advice throughout the acquisition and investment processes. Our team helps identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology: Moore Kingston Smith’s research analyses transactions by UK-based companies that involve the issue of less than 50% of equity share capital to third parties and funds raised of between £1 million and £20 million. Accordingly, these numbers do not include senior debt and mezzanine debt fund raisings and smaller fund raisings by companies and start-up funding unless more than £1 million is raised. Start-up funding is generally significantly less than this amount.

The research aims to capture all transactions by UK companies that fall within the criteria. Inevitably there will be transactions that have not been captured. The research is based on data extracted from Pitchbook and information from the following sources: robotics247.com, proactiveinvestors.co.uk, bgf.co.uk, uktechnews.info, nordic9.com and techcrunch.com.