Update to Chancellor’s support for businesses

Less than a month has elapsed since the Chancellor delivered his winter economy plan but, as we now know, no plan survives first contact with the Coronavirus.

Each of the Job Support Scheme (JSS), the Self-Employed Income Support Scheme (SEISS) and the grants available to businesses affected by restrictions have been made more generous, and with additional generosity comes more complexity.

Job Support Scheme v2.0

From 1 November 2020 to 30 April 2021, the newly announced Job Support Scheme will still follow on from the Coronavirus Job Retention Scheme which ends on 31 October 2020.

The scheme is open to all employers with a UK bank account and a UK PAYE scheme. All small and medium-sized enterprises (SMEs) will be eligible; large businesses, defined as those with more than 250 employees, will be required to demonstrate that their business has been adversely affected by Coronavirus.

This scheme can be used for any individual in employment as of 23 September. However, this means that the employee must have been included in a Real Time Information (RTI) upload to HMRC on or before midnight on 23 September which is going to exclude almost all monthly paid employees who started a job after the August payroll was processed by the employer.

Employees being paid under this scheme must work at least 20% (formerly 33%) of their normal hours and be paid by their employer for this work.

The government and the employer will then pay two-thirds of the short fall split with the government meeting the cost of 61.67% and the employer now only paying 5%. This is a big change from the original requirement that the 66.67% was split equally between the employer and government.

The government contribution is now capped at £1,541.75 per month (formerly £697.92), which means the full benefit of the scheme will be available to employees with a gross salary of £37,500.

The level of support will be reviewed after the first three months of operation of the scheme and may change from month four onwards.

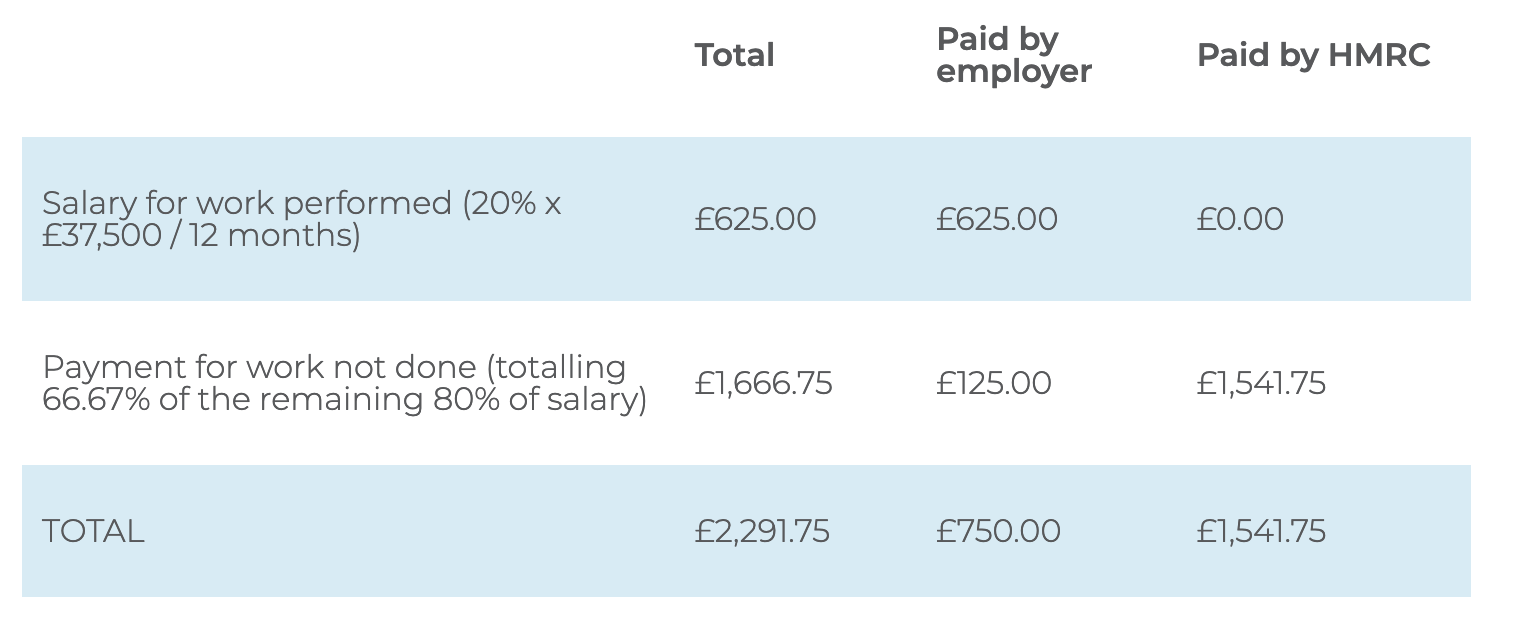

So, for an employee on a salary of £37,500 per annum who works 20% of their normal hours, they will be paid each month that the scheme operates as follows:

Under this revised scheme, the government is meeting 67% of the gross salary being paid instead of the 29% that it was originally intended would be covered.

It is still the case that the employer will have to pay employer’s NICs and pension contributions. In the above example this will amount to £293.35, so the total cost to a business of keeping this person employed would be a monthly equivalent of £1,043.35.

The first claim can be made from 8 December 2020 through a newly designed portal on Gov.uk.

The 5% contribution the employer must pay to qualify for the scheme is capped at £125. However, in a change from the original announcement, employers can now top up the employee’s salary and so pay in excess of the 5% if they wish.

Employees cannot be made redundant or put on notice of redundancy during the period within which the employer is claiming the grant. This is part of the Chancellor trying to ensure that the scheme is only used for viable jobs.

Self-Employed Income Support Scheme v.2.0

The extension to the Self-Employment Income Support Scheme announced in the winter economy plan was to have paid 20% of average profits capped at a maximum of £1,875 for each three-month period in the final six months of this scheme.

In the new version of the SEISS, this has been increased from to 40% of average profits capped at £3,750 for each three-month period. This is still significantly less than the original version of the SEISS but clearly much higher than what was originally announced.

The grant will be treated in the same way as self-employed trading profits so will be subject to income tax and NI.

All other rules have remained unchanged so to qualify, the individual must meet the following criteria:

- They must currently be eligible for the SEISS (although they do not have to have claimed the previous grants)

- They must declare that they are currently actively trading and intend to continue to trade

- They must declare that they are impacted by reduced demand due to Coronavirus in the qualifying period (which for the first grant under the extended scheme is between 1 November 2020 and the date of claim.

The first condition above means that some of the problems of the original SEISS will remain. Individuals who commenced self-employment after 5 April 2019 or those who had average profits of more than £50,000 per annum during the relevant periods will still not qualify for this new grant. There is also still no help for individuals operating through their own personal service company and paying themselves largely with dividends.

Business Grants

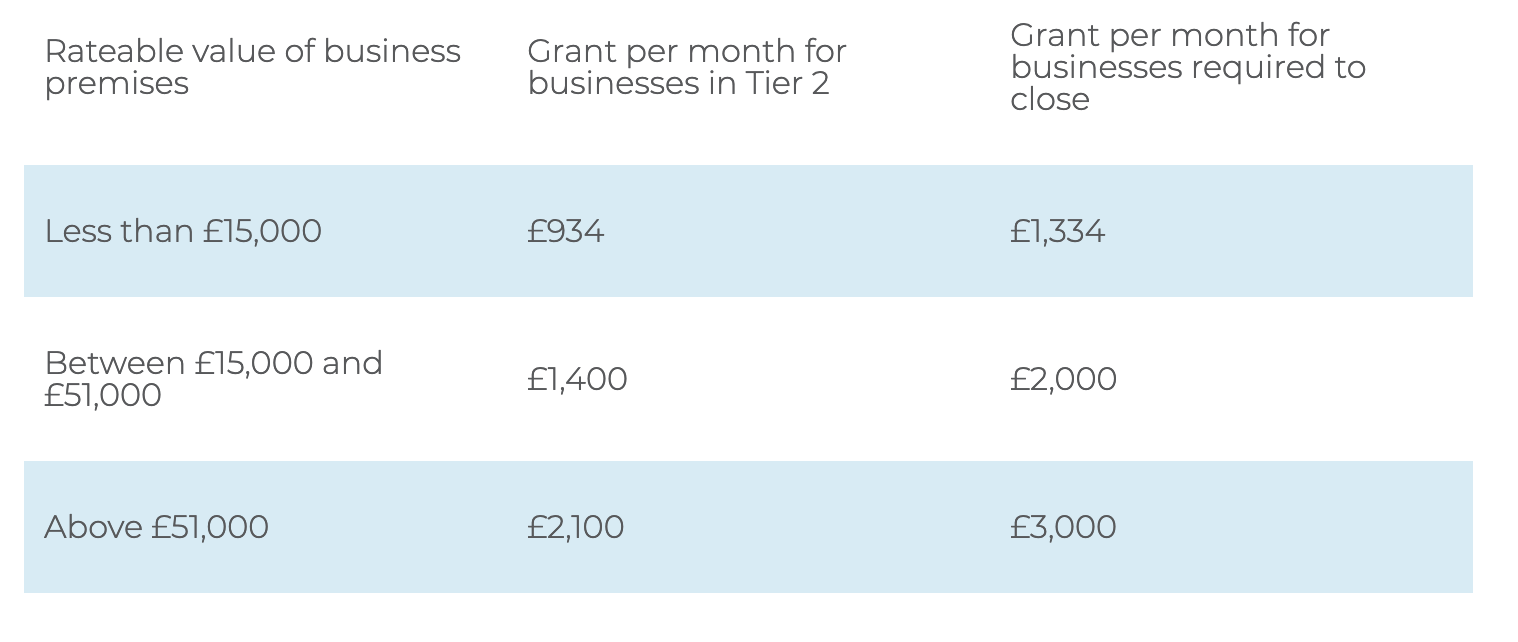

The Chancellor had already announced grants to support leisure and hospitality businesses forced to close due to local lockdown restrictions. He has now announced further funding to support hospitality, hotel, B&B and leisure businesses in Tier 2 areas, with the intention being (subject to Local Authority discretion) that these businesses will receive grants equivalent to 70% of those available to legally closed businesses, as follows:

Local Authorities will administer this system of grants with the application process and exact criteria being designed by each Local Authority, meaning there will be inevitable inconsistencies across the country as to how this system of grants is operated.