M&A activity in the IT services sector – Q2 2022

This is the first in a series of quarterly reports on M&A activity in the UK IT services sector, where Moore Kingston Smith has advised many clients in recent years.

Analysts’ estimates of the global size of the IT services industry vary. Statista’s 2021 report* estimates it to be worth more than $1 trillion annually, while others such as Gartner** suggest numbers closer to $1.3 trillion. All analysts agree the market is growing at considerable pace, with double-digit growth rates expected annually over the next five to ten years.

The IT services industry has grown as its clients’ IT infrastructure needs have become increasingly complex in response to drivers such as big data, the move to cloud-based systems, the adoption of block-chain technology and the internet of things. Moreover, the growing volume of enterprise data and increased automation of business processes across industries like retail, manufacturing and healthcare are driving the growth of the business software market.

More recently, the global pandemic has led to a rapid acceleration in the adoption of systems to facilitate remote working. This has posed new challenges for companies and further opportunities for IT service providers. As more people work from home and there is a shift from data being held on premises to the cloud, security concerns come to the fore. The IT services market has benefited from this change, as providers can advise on securing business IT infrastructures and supply security services, such as continuous monitoring, identity and access management.

M&A activity

The IT services market is dominated by some major players, such as IBM, Fujitsu, Atos, Cisco and Infosys. These organisations typically service the requirements of large multinational clients. However, there is also a healthy and diverse ecosystem of smaller niche players catering for the IT needs of SMEs.Many of these smaller IT services businesses operate within a single geography or particular specialism, focusing on just one part of the technology estate. Client companies are increasingly looking to engage with integrated service providers and this has led to specialists merging or being acquired to become part of a more integrated group.

For the purposes of this report, we are particularly interested in looking at M&A within the UK. We have therefore researched deals where at least one of the counterparties – buyer or seller – is UK-based or has a significant UK trading presence.

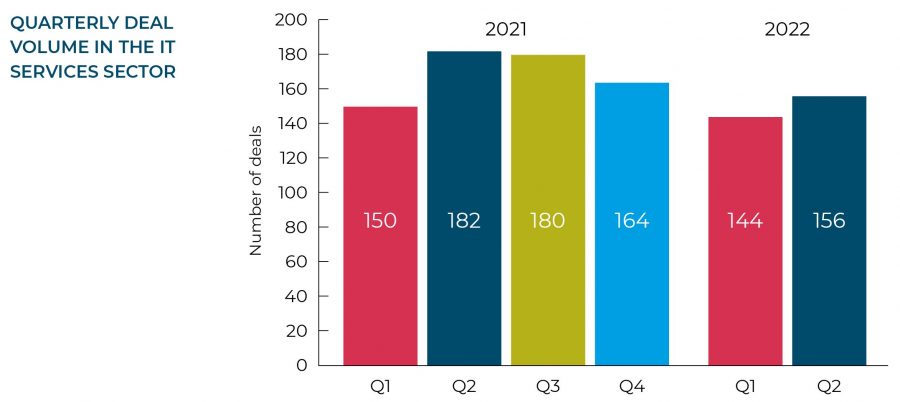

The number of deals completed in Q2 is c.8% up on the 144 transactions recorded in the previous quarter.

Moore Kingston Smith’s deal tracker recorded a total of 156 UK IT services deals in Q2 2022. While this is our first IT services M&A report, for comparison purposes, we ran the data from the beginning of 2021. This shows that the number of deals completed in Q2 is c.8% up on the 144 transactions recorded in the previous quarter, albeit down on the same quarter in the previous year.2021 was a bumper year for M&A across several industries. Successful businesses that had weathered the Coronavirus storm started investing to thrive rather than to simply survive. The pursuit of growth was very much on the agenda in 2021, and M&A was, for many, the preferred strategic option to accelerate growth. Within the IT services space, 2022 seems to be holding up relatively well so far. However, there are clearly some macroeconomic and geopolitical factors that might be dampening enthusiasm to a degree.

Analysis by service

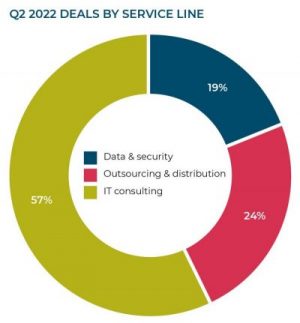

IT services cover an extremely broad range of activities. For the purposes of this report, we have allocated transactions to three main categories: IT consulting, outsourcing and distribution, and data and security.

57% of our 156 Q2 deals fell within IT consulting, with a total of 89 transactions completed.

Outsourcing and distribution also had a busy Q2, with 37 deals announced, while we noted 30 transactions in data and security.

Hot IT consulting disciplines

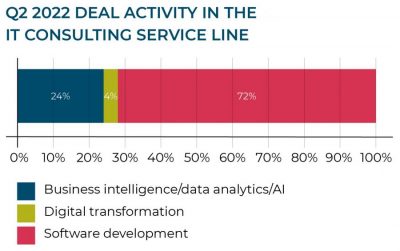

Our analysis of the 89 IT consulting transactions completed last quarter enables us to determine whether the company acquired was primarily focused on software development, software testing, business intelligence (including data analytics and AI) or digital transformation. In Q2 2022, nearly three quarters of IT consulting companies acquired were engaged in software development. We recorded no software testing transactions in the quarter.

Our analysis of the 89 IT consulting transactions completed last quarter enables us to determine whether the company acquired was primarily focused on software development, software testing, business intelligence (including data analytics and AI) or digital transformation. In Q2 2022, nearly three quarters of IT consulting companies acquired were engaged in software development. We recorded no software testing transactions in the quarter.

There were also cross-border deals in the software development space in Q2.

In April, Canadian company Vitalhub announced it had acquired Surrey-based Hicom Technology for £8.7 million. Hicom develops software that automates a wide range of healthcare-centred processes, including patient and clinical care, clinical research, learning and development, and compliance management. In May, another Canadian company, Dialogue Health Technologies, announced it had acquired UK healthcare SaaS business TicTrac, in a deal valued at up to Can$56 million.

Outsourcing and distribution

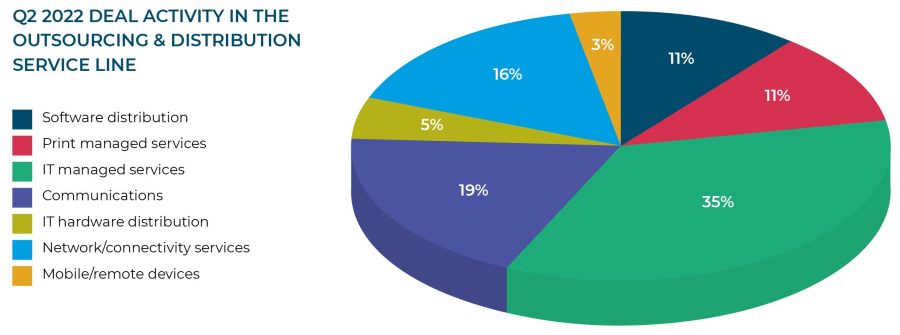

Within the outsourcing and distribution category, the IT managed services segment was the most active in Q2, followed by communications and network/ connectivity services. The IT managed services sector has grown significantly over recent years. Companies have realised that, by outsourcing to a third party, they can manage recurring in-house IT expenditure, reduce the requirement to employ their own highly-skilled IT staff, and gain specialist input into how to optimise for efficiency and better achieve their business objectives.

Moore Kingston Smith’s corporate finance team announced two deals in the outsourcing and distribution arena in Q2. In June, they advised Mode Solutions, a leading managed print and communications business backed by PE house Connection Capital, on its acquisition of IT managed services company, eacs. They also advised IT, telecoms and cyber security specialist Communicate Technology on its acquisition of Zencom Telecommunications, a supplier of inbound and outbound call services to SMEs and home-working solutions.

Nick Thompson, Corporate Finance Partner at Moore Kingston Smith, who advised both Mode Solutions and Communicate Technology, commented: “Consolidation in the market continues to be a growing trend, allowing IT service businesses to become a one-stop shop for SMEs and their evolving technology requirements. We expect to see further transactions of this nature in the coming year.”

Data and security

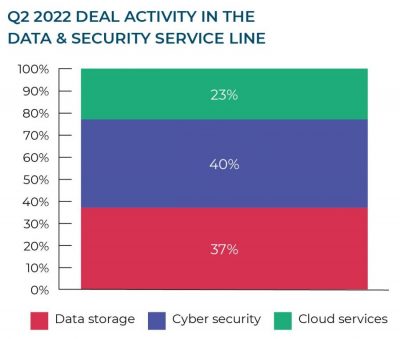

Cyber security saw the most deals in Q2, representing 40% of all deals recorded. Data storage was second in popularity, followed by cloud services.

Statista valued the global cyber security market at $125 billion* in 2020 and expects this to grow by 40% to $175 billion by 2024.

In early April, Liverpool-headquartered, AIM-listed SysGroup announced that it had acquired Truststream Security Solutions, a leading Edinburgh-based provider of managed cyber security services, for a purchase price of up to £8 million. SysGroup may be one to watch in coming months; it announced a second purchase at the end of April – the acquisition of Bristol-based IT consulting firm Orchard Computers – and has said it is actively focusing on its M&A strategy.

Private equity the driving force behind IT services M&A

Moore Kingston Smith has been publishing a quarterly report on the UK growth capital market for several years. IT and technology have consistently been the most popular areas for private equity investment in this market.

“Post-Coronavirus, software, digital transformation and cyber security remain top of the list for private equity firms, who are willing to pay premium multiples for these businesses.”

When we focus in on IT services, it is not surprising to find that private equity is substantially underpinning deal-doing in this space in the UK. Institutional investors are making new stand-alone investments and backing their existing portfolio companies in their buy-and-build strategies.

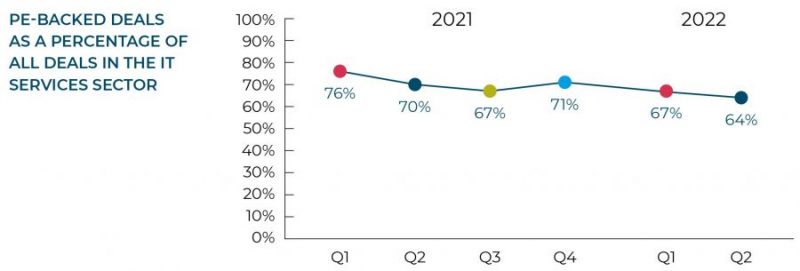

Private equity-backed investments accounted for 64% of all deals completing in Q2 2022, which is down slightly on the previous quarter and the past year. This indicates that trade buyers are returning to the fray to compete with PE-backed entities.

Katharine Stone, Corporate Finance Director at Moore Kingston Smith, notes: “Post-Coronavirus, software, digital transformation and cyber security remain top of the list for private equity firms, who are willing to pay premium multiples for these businesses. This reflects belief that growth is still in the early stages in many parts of the IT services market but is expected to accelerate in the coming years.”

The largest PE-backed transaction to complete in Q2 was Permira’s $5.8 billion all-cash purchase of Mimecast. Mimecast is a Jersey-domiciled, UK-headquartered company specialising in cloud-based email management and cyber security. It had been listed on NASDAQ since 2015 but returned to private ownership when the deal completed in May.

Q2 also saw One Equity Partners complete the purchase of Trustmarque, a UK-based integrated IT managed services provider, from Capita for £118 million.

Valuations

As well as understanding which sectors and services are most popular with buyers, as well as who is buying, we always want to know what prices are being paid and whether valuations are holding up. This is much harder to confirm, since most deals are announced with the line “terms were not disclosed”. However, in the case of larger transactions, particularly those involving listed entities which have to meet certain shareholder reporting requirements, we can glean details of the price paid. This allows us to determine certain valuation metrics, such as revenue or EBITDA multiples.

“As well as who is buying, we always want to know what prices are being paid and whether valuations are holding up.”

The following is based on a small subset of our 156 transactions and is inherently skewed by the inclusion of only larger – in some cases, very large – transactions. Caveats aside, our analysis of Q2’s deals where pricing details can be determined, reveal that those companies were sold on an average revenue multiple of 6.5x and an average EBITDA multiple of 11.45x.

If we look back to the start of 2021, we see that revenue multiples appear to have risen considerably over the period, while EBITDA multiples have declined. Our sample may be too small to draw definitive conclusions, but that would suggest the companies being sold in Q2 2022 were achieving much higher operating margins than those selling at the start of 2021 – perhaps not surprising given that those companies would have been in the thick of the pandemic at that point.

IT services industry stock performance

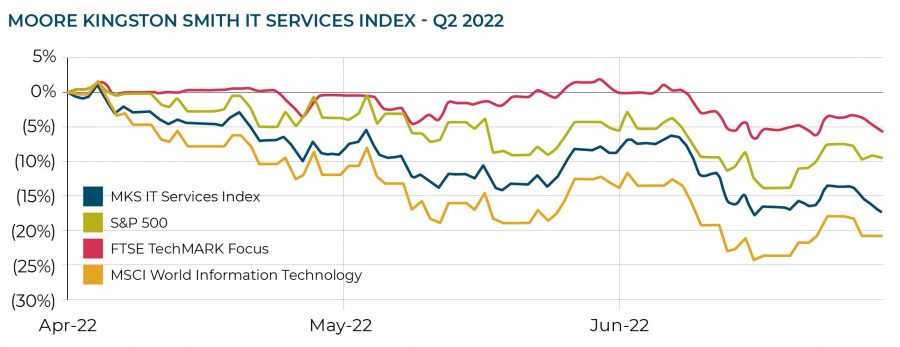

In our Moore Kingston Smith IT Services Index, we have plotted the share price performance of 21 listed IT services groups. The index tracks how they have fared in the last quarter in comparison with the S&P 500, the MSCI World Information Technology and FTSE TechMARK Focus indices.

Q2 2022 was not a great quarter for stock markets generally, with the S&P 500 declining by 9% across the period. However, the Moore Kingston Smith IT Services Index underperformed the market, showing a 17% fall in value. The MSCI World Information Technology index fared even worse with a 21% decline but the FTSE TechMark Focus index (which focuses on companies with market capitalisations under £4 billion) ended the quarter only 6% down.

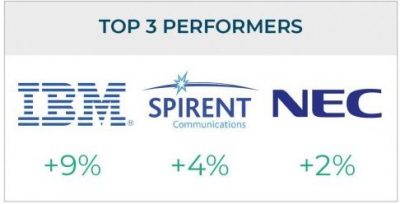

Of the 21 companies that make up the Moore Kingston Smith index, only three ended the quarter in positive territory, with the vast majority seeing their share prices fall.

Outlook

2021 was an outstanding year for UK M&A activity. While the IT services sector appears to be holding up well thus far, it looks like 2022 will not be breaking 2021’s records unless there is an uptick in activity in the latter half of the year.

There are many positive drivers of M&A activity within this sector – the market is expanding rapidly and there is an imperative for specialist companies to come together to provide a more integrated offer to clients. There are also vast pools of private equity waiting to be tapped.

However, there are some macroeconomic and geopolitical factors that could act as a drag on transactions. The situation in Ukraine, commodity shortages and price rises, concerns about global warming, increasing inflation and declining retail sales all serve to inject a note of caution into any forecast for the rest of the year.

Moore Kingston Smith knows the sector well, has advised on a good number of IT services transactions to date, and continues to advise shareholders considering the sale of their business as well as active acquirers seeking help with their M&A strategy. We remain optimistic about the outlook for 2022 and beyond and expect to see strong demand for well-run, profitable IT services businesses.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

Contributors

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner. Contact us to find out more about our raising finance and growth capital services.

We also assist investors, providing expert advice throughout the acquisition and investment processes. Our team helps identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology

In compiling our deal tracker we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller or both. Where the target company is classified as IT consulting, outsourcing and distribution, or data and security, the transaction is entered into the deal tracker. We classify IT consulting into four sub-categories, outsourcing and distribution into eight sub-categories, and data and security into three sub-categories.

We have referred to market data from *Statista: IT Services – Market Data Analysis & Forecast, 2021 and **Gartner: Global IT services market to grow 7.9%. In addition to the data extracted from Pitchbook we have used information from the following sources: vitalhub.com, investors.dialogue.co, sysgroup.com, permira.com, trustmarque.com.

Any assumptions, opinions and estimates expressed in the information contained in this content constitute the judgment of Moore Kingston Smith LLP and/or its associated businesses as of the date thereof and are subject to change without notice. This information does not constitute advice and professional advice should be taken before acting on any information herein. No liability for any direct, consequential, or other loss arising from reliance on the Information is accepted by Moore Kingston Smith LLP, or any of its associated businesses.