Our terms and conditions

Moore Kingston Smith LLP is a multi-disciplinary practice regulated by the Institute of Chartered Accountants in England and Wales (ICAEW) and, in relation to certain legal services, by the Solicitors Regulation Authority (SRA) as a licensed body under the Legal Services Act 2007 (LSA). Our registered address is 9 Appold Street, London, EC2A 2AP.

Moore Kingston Smith LLP is a multi-disciplinary practice regulated by the Institute of Chartered Accountants in England and Wales (ICAEW) and, in relation to certain legal services, by the Solicitors Regulation Authority (SRA) as a licensed body under the Legal Services Act 2007 (LSA). Our registered address is 9 Appold Street, London, EC2A 2AP.

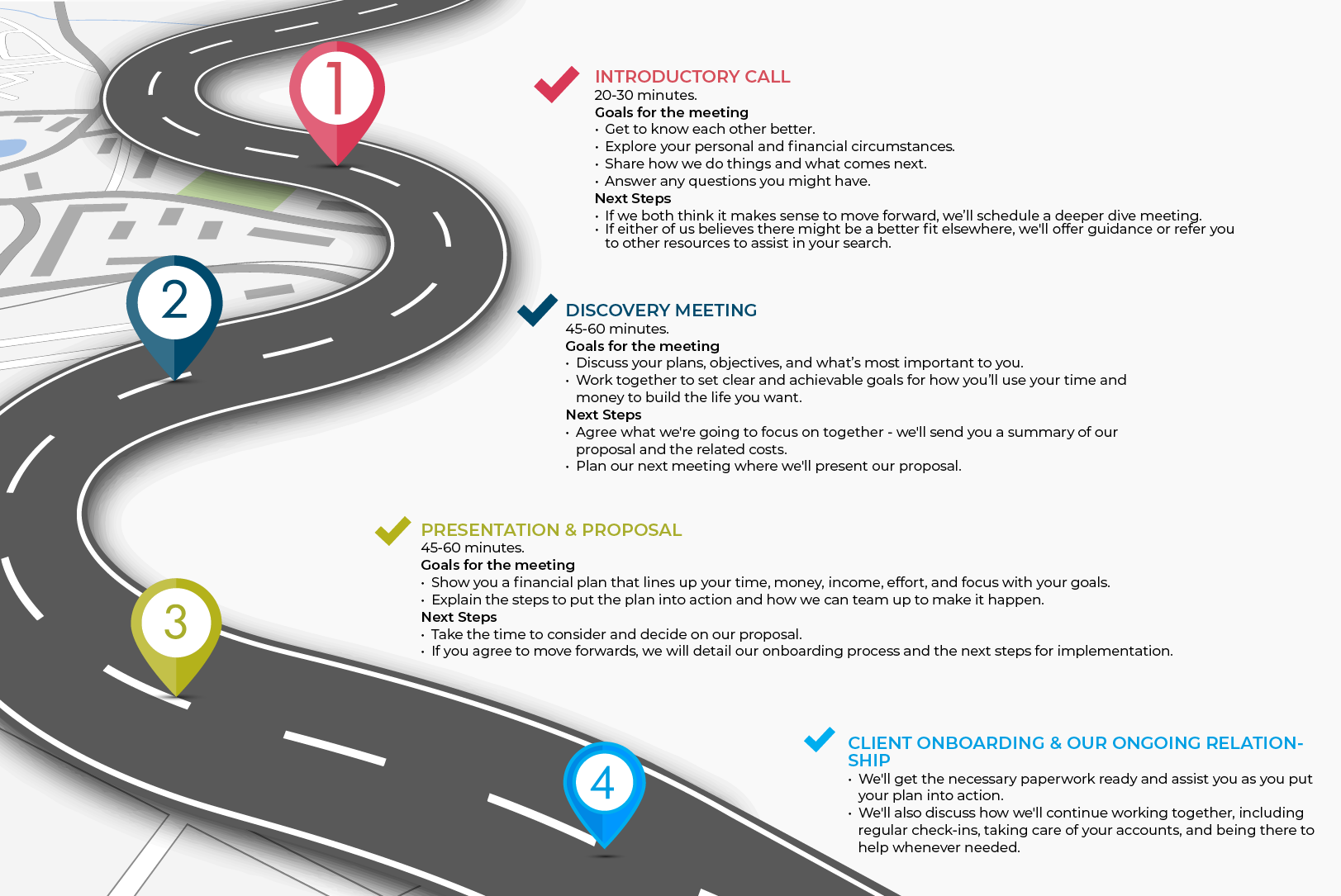

Regulated financial advice is provided by Moore Kingston Smith Financial Advisers Limited an appointed representative of Best Practice IFA Group Limited which is authorised and regulated by the Financial Conduct Authority (FCA). Our FCA number is 558116. Moore Mortgages UK is a trading name of Moore Kingston Smith Financial Advisers Limited, a wholly owned subsidiary of Moore Kingston Smith LLP.

The information contained in this publication represents our understanding of the current law and HM Revenue & Customs practice which may be subject to change.

Moore Kingston Smith LLP is not responsible for the accuracy of the information contained within the linked sites.

This information does not constitute personalised advice and you should seek professional advice before acting or making any decisions based on the contents. Investments can fall as well as rise in value and past performance should not be considered a guide to future performance. Your home may be repossessed if you do not keep up repayments on any mortgage secured on it. Not all products are regulated. The FCA does not regulate tax advice. @ Copyright 2023. All rights reserved.

Click here for our terms and conditions.