Advisory

Environmental, social and governance (ESG)

Environmental, social and governance (ESG) support for businesses

Your aim is to ensure there’s increasing focus on ESG in your corporate strategy, but fulfilling the requirements and meeting standards can be complex. You are balancing the short-term cost of ESG compliance with long-term benefits of operational efficiency and increased business value.

We provide clarity and assurance, wherever you’re at in your ESG journey:

- Our ESG baseline assessment helps you understand your business’s current position and prioritise actions. If your focus has been on managing risks that have a material financial risk to the business and you’re currently undertaking very few ESG actions, this is a great place to start.

- If you have implemented initial policies and processes to address risks and identify opportunities, our advice on ESG strategic development can ensure your business is fit for the future.

- If you need help navigating the intricate landscape of climate action, our climate transition advisory services can help.

- Clear communication of your organisation’s strategy is essential, our guidance on regulatory and sustainability reporting can ensure you are compliant.

- If you have clear and defined processes that incorporate ESG and you are communicating your impact to stakeholders, you might now require tailored and risk-based assurance of your sustainability report.

- If mergers, acquisitions, investments, or partnerships are part of your plans, our ESG due diligence services provide evaluation of the risks in these events.

If you would like to discuss how we can help you incorporate ESG into your business strategy or if you need assistance with your ESG reporting, please contact us.

Related links

Employee Ownership Trusts (EOT)

Employee Ownership Trusts (EOTs) continue to grow in popularity as a way of engaging with employees while providing an alternative exit strategy for business owners who do not want to pursue a third-party sale.

How do EOTs work?

Business owners transfer a majority stake to a trust benefiting employees, who then also enjoy a tax-free bonus of up to £3,600 each year.

Owners can receive full market value for their shares – generally via a mixture of up-front consideration from existing cash reserves and deferred consideration funded from future profits of the business.

A significant upside is that owners can sell to the EOT without incurring a capital gains tax (CGT) liability. This feature of EOTs will continue to make them popular given the reduction in the lifetime allowance for Business Asset Disposal Relief in 2020 (formerly known as Entrepreneurs’ Relief) and the much-anticipated increase to the rate of capital gains tax in 2022.

EOTs are particularly relevant to businesses where people are the key drivers of the company. They provide the opportunity to increase employee engagement and improve recruitment and retention rates and are also suitable for corporate social responsibility profiles.

When implemented carefully, there are many advantages of EOTs for shareholders, companies and their employees.

How can Moore Kingston Smith help?

As champions of EOTs, we are proud members of the Employee Ownership Association.

We offer a holistic business advisory service around EOTs encompassing tax, legal, corporate finance, HR and accounting services. Having implemented many EOTs already, we are well placed to advise you throughout the whole process: from the initial discussions to determine if it’s right for you, to supporting you with the communication of the completed transaction to your employees and the outside world.

Importantly we use the benefit of our experience to ensure a final EOT structure tailored to your specific needs. We do this via a structured consultative process with you over several meetings before legal drafting begins.

Our full range of services include the following:

- Preliminary restructuring advice where required, e.g. including the incorporation of partnerships or general group restructuring.

- Tax advice on whether the qualifying conditions are met and seeking clearance in advance from HMRC.

- Provision of professional share valuation.

- Financial modelling to give a view of how the consideration will be settled.

- Corporate finance advice on possible part-funding by third-party debt financing.

- Structured consultative process to tailor the EOT to your specific requirements.

- Advice on the identity of the trustees and their appointment.

- Advice on the establishment of an employee council.

- Advice on whether new contracts of employment are required for owners.

- Legal drafting of the EOT trust deed, sale and purchase agreement and ancillary documents.

- Recommendations on shareholder and keyman protection policies, so they remain relevant and valid.

- Assisting with structuring employee bonus model.

- Assisting with communications to employees.

- Post-transaction support, including accounting for EOT transactions and ongoing filing requirements.

Get in touch

Please get in touch with our team if you would like an initial discussion to explore whether an EOT might be right for you.

Related links

Case studies

Moore Kingston Smith is delighted to have advised White Label on its transformation into an employee-owned company, through its sale to an Employee Ownership Trust (“EOT”).

White Label is a highly successful recruitment marketing agency that works with employers to enhance talent attraction and employee communications. White Label uses tracking and data to measure results, analyse effectiveness and build high performing marketing solutions for its clients. It has worked with a range of well-known employers, such as GlaxoSmithKline, EY and Amazon.

The company was founded in 2013 by Claire Herriott, who was its sole director and, together with other family members, owned 100% of the business. As the business grew it attracted a loyal pool of talented employees, and by 2020 Claire was keen to consider how to put in place longer-term plans to secure the future of the business. She was interested in realising the value of her ownership of the business, but was most keen to ensure the company’s culture and independence was preserved and her colleagues and employees could have a share in White Label’s future. White Label is fundamentally a people business, and the recruitment and retention of talent is key to its success.

Claire was introduced to Nicola Horton, Corporate Finance Principal, and Mike Hayes, Tax Partner at Moore Kingston Smith, who advised that sale to an EOT could meet all of Claire’s objectives. It would allow Claire to sell her stake in the business, but rather than sell to a third-party acquirer, who might have wanted to take the business in a different direction, a trust would be established to hold the shares for the benefit of all current and future employees.

Claire would no longer own the business, and going forward she would share management responsibilities with members of staff appointed to the White Label board by a newly-formed Employee Council. As an employee-owned company, White Label would be governed and operated in the employees’ best interests and would reward employees for the development and growth of the business.

Having agreed that sale to an EOT was the company’s best option, Moore Kingston Smith assembled a team of advisers to help White Label make the transition, introducing various parts of the firm at key points to keep the process moving. Our Corporate Finance team, led by Nicola Horton and Calvin Bond, advised the company on valuation and financial issues, while our Tax team, led by Mike Hayes and Shima Kelly, advised on tax clearances and how to structure the transaction effectively in order to benefit from the various tax advantages that sale to an EOT confer. Moore Kingston Smith’s legal services team, led by Partner Andrew Bloom and Vida McShane, prepared all the legal documentation governing the sale and establishing the EOT, including the sale & purchase agreement, trust deed and new articles, while our HR team drew up new director service agreements and incentive scheme rules.

The sale to the EOT completed in early January 2021 and has been welcomed by White Label’s staff who see it as a positive reflection on their contribution to the business and a great incentive to help the company grow still further. Claire believes being able to tell potential new hires that the business is employee-owned will be a significant factor in White Label’s future success.

Reflecting on her experience of working with Moore Kingston Smith, Claire Herriott said: “From my first conversation with Moore Kingston Smith it was immediately clear that I was surrounded by impressive professionals. Each member of the assembled team played an important part, and quickly became trusted advisors in the truest sense. It has been a privilege to work with them on this important evolution for my business and with the successful establishment of the EOT we have undoubtedly benefited from their combined expertise.”

Digital transformation

Our digital transformation team helps businesses realise their full potential. We’ll equip you with everything you need to thrive in the digital age and meet the ever-changing needs of your customers.

What is digital transformation?

Digital transformation is about more than embracing new technology. It’s about re-imagining the status-quo and pushing the boundaries of possibility.

We’ll help you leverage technology across all areas of your business and culture to meet changing market requirements.

It’ll revolutionise how you interact with your customers, how you engage your employees and how your business operates.

Our digital transformation services include:

- Business process optimisation

- Artificial intelligence and automation

- Customer experience design

- Product innovation and development

- Pre-built digital solutions

- Accounting and business software solutions

- Cybersecurity

- Business intelligence

Our team

Our digital transformation team is a diverse group of change experts. With backgrounds ranging from accountants, auditors, engineers, UX and UI designers, automation and AI specialists, IT architects, developers and cybersecurity advisors, we all work collaboratively to help transform your business and generate lasting value.

Our approach

We’ll take the time to understand your objectives and challenges and identify your opportunities. Then we’ll create a bespoke plan for your digital transformation.

We’ll take care of the change management side of things, communicating with all teams to ensure a seamless transition, as well as providing additional support.

When it comes to delivery, our approach is collaborative. We’ll incorporate your feedback iteratively at every stage. For maximum benefit, we leverage the partnerships we’ve developed with software and hardware providers, along with one of the world’s leading outsourcing companies.

A bespoke service

We’ll tailor our service to your specific needs. We take on all kinds of digital transformation projects, big and small.

We pride ourselves on our ability to achieve quick wins and can work fast to optimise your existing platforms. But we’re equally adept at developing entire digital strategies with brand new operating systems and transformative new technologies. Contact us to see how we can help you.

Related links

Research and development (R&D)

The UK has one of the most attractive research and development (R&D) tax credit regimes in the world. It is designed to reward business innovation and boost intellectual property across the country. However, many small and medium-sized businesses are unaware of the schemes and thus missing out on a vital source of funding.

How our R&D experts can help

Our specialist team of scientists, engineers and tax advisers are here to help. From identifying surprising activities that qualify as research and development to considering additional tax implications, we take care of everything, leaving you to concentrate on running your business.

Areas that qualify as research and development include

- Software development

- Outsourced innovation

- Research costs

- Product development

- Working in collaboration on a project

- Trialling-related costs and prototypes

- Process development (or improvements to manufacturing processes)

As a member of Moore Global Network, a global accountancy and consultancy network in some 112 countries around the world, we are also well placed to meet your international business needs.

Corporate finance

Truly expert corporate finance advice

Getting the right outcome from any corporate finance deal is critical, whether you’re selling, borrowing, merging, expanding or buying. And having the trust and confidence that you’re making the right decision is priceless.

At Moore Kingston Smith we draw on the full expertise from across the firm, as well as our global reach, to help you achieve your goals and to build value. We do this by expertly finding you the partner that gives you the right strategic fit and on the terms that suit you best. And we make sure you get exactly what you’re expecting.

We provide corporate finance services across all sectors, specialising in media and technology, education, manufacturing and business services.

Business owners or financial institutions

We work with owners selling or seeking corporate finance options for their business, as well as a vast global network of buyers, investors and financial institutions.

End to end support

Our expertise and reach means we’re on hand with practical advice and support whenever and wherever you need us, working with colleagues across the firm to give you fully integrated advice. We help some clients throughout the whole lifecycle of their business. With others it’s to guide them through a transaction.

What remains the same is our dedication to helping those we work with to thrive. Both now and in the future. Contact us to find out how we can help you with your corporate finance.

Payroll

Outsourced payroll in the UK: save money, time and

ensure compliance

Outsourcing payroll is a smart move for SMEs, and here’s why:

- Cost savings: reduce payroll costs significantly.

- Time efficiency: free up valuable time for growing your business.

- Guaranteed compliance: stay on top of changing tax and payroll regulations.

- Secure and flexible payments: reliable, on-time payments to your staff and HMRC.

Why should you choose us for your payroll services?

With 300+ years of payroll expertise within our team, we simplify payroll and protect your business. Experience the difference with our seasoned team of payroll experts.

We handle:

- Accurate calculations and timely submissions

- Full compliance with the latest regulations

- Stress-free HMRC query management

We are shaping the future of payroll through our relentless focus on our people, our clients and intelligent innovation, fostering collaboration for sustainable success.

Your payroll services provider

Benefits you can expect:

- Year-round expert support

- Compliance with tax, deduction and pension laws

- Flexible employee payment options

- Automated payments for any schedule

- BACS-approved bureau

- HMRC and The Pensions Regulator query handling

- Payroll legislation updates

- Customisable, easy-to-use reporting

- Secure data, GDPR-compliant, ISO-certified employer and employee portal

- Transparent fees and service level agreements.

Ready to simplify your payroll and focus on growth?

Let’s discuss how our payroll services can transform your UK business. Contact us today for a free, no-obligation quote and consultation.

Some shocking facts about in-house payroll:

- Savings: A £35,000 in-house payroll employee can incur total costs of around £45,000 with overheads, while an outsourced equivalent might be around £3,500 annually (for a 20-employee payroll) – a potential saving of up to 95%.

- Compliance: Payroll regulations are complex and constantly changing. Of our recent new clients, a staggering 44% had non-compliant pension schemes.

- Penalties: Some companies are fined £100,000 in PAYE penalties due to RTI submission errors.

Interested in learning more about payroll outsourcing? Click here for answers to your questions.

Business recovery and insolvency

Insolvency practitioners who offer empathetic business recovery services

With decades of experience, our business recovery and insolvency team is here to support you and your business through the tough times, offering relevant and empathetic advice. We focus on creating positive outcomes from difficult situations. If you’re a director in need of urgent support, head to our directors’ hub.

If you’re facing challenges – such as performance dips, mounting debt or reduced cash flow – we can help. The Coronavirus pandemic has brought some unique challenges we can help you navigate.

Frequently requested services

- Advising on directors’ duties

- Solvent liquidation/members’ voluntary liquidation (MVL)

- Advising landlords and tenants

- Advising the retail and hospitality industry

- Advising directors on Bounce Back Loans and Furlough Payments

Financial planning

Set and achieve clear goals with our independent financial planning services

Financial planning will help you set and prioritise your goals and map out clear strategies for achieving them. Our independent financial advisers will support you along the way.

Getting to know you is central to everything we do, as understanding your individual circumstances, aspirations and preferences allows us to construct a personalised and holistic financial plan.

We understand there may be other non-financial considerations, for example a focus on socially responsible investing. We consider environmental, social and governance (ESG) factors across our financial planning and can provide specific advice on Ethical Investments to meet your individual preferences.

A good plan should be adaptable to deal with the unexpected when it occurs, so your planning will be reviewed regularly to monitor progress towards your short, medium and long-term goals.

Where appropriate, we will construct a detailed cash flow model to help you make decisions and act as the foundation on which to build future planning.

Powerful and flexible cash-flow modelling software

- Assess your current financial situation.

- Understand what action may be taken now to meet your future goals.

- Highlight shortfalls and risks to your financial security.

- Present complex information in a visual and easy to understand format.

Client portal

Our client portal brings all aspects of your wealth onto a secure dashboard, taking the stress out of keeping on top of your planning. The portal includes a number of useful features, such as:

- A snapshot of your current assets and liabilities.

- Portfolio valuations with live price feeds where available.

- A secure way to upload and download documents containing sensitive information.

- A central place to upload and store your important documents.

- A ‘Go Green’ option allowing you to switch to paperless communication.

Chartered Independent Financial Planners

We are Chartered Independent Financial Planners, as awarded by the Chartered Insurance Institute (CII) the leading professional body for financial planners. Chartered status is the industry’s ‘gold standard’ of financial planning. Discover what chartered status means.

As Chartered Financial Planners, we are publicly committed to a customer-first approach and values that align with a professional Code of Ethics. We’ll provide solutions relevant to your needs, maintaining our knowledge through qualifications and ongoing professional development. Contact us to see how we can help you.

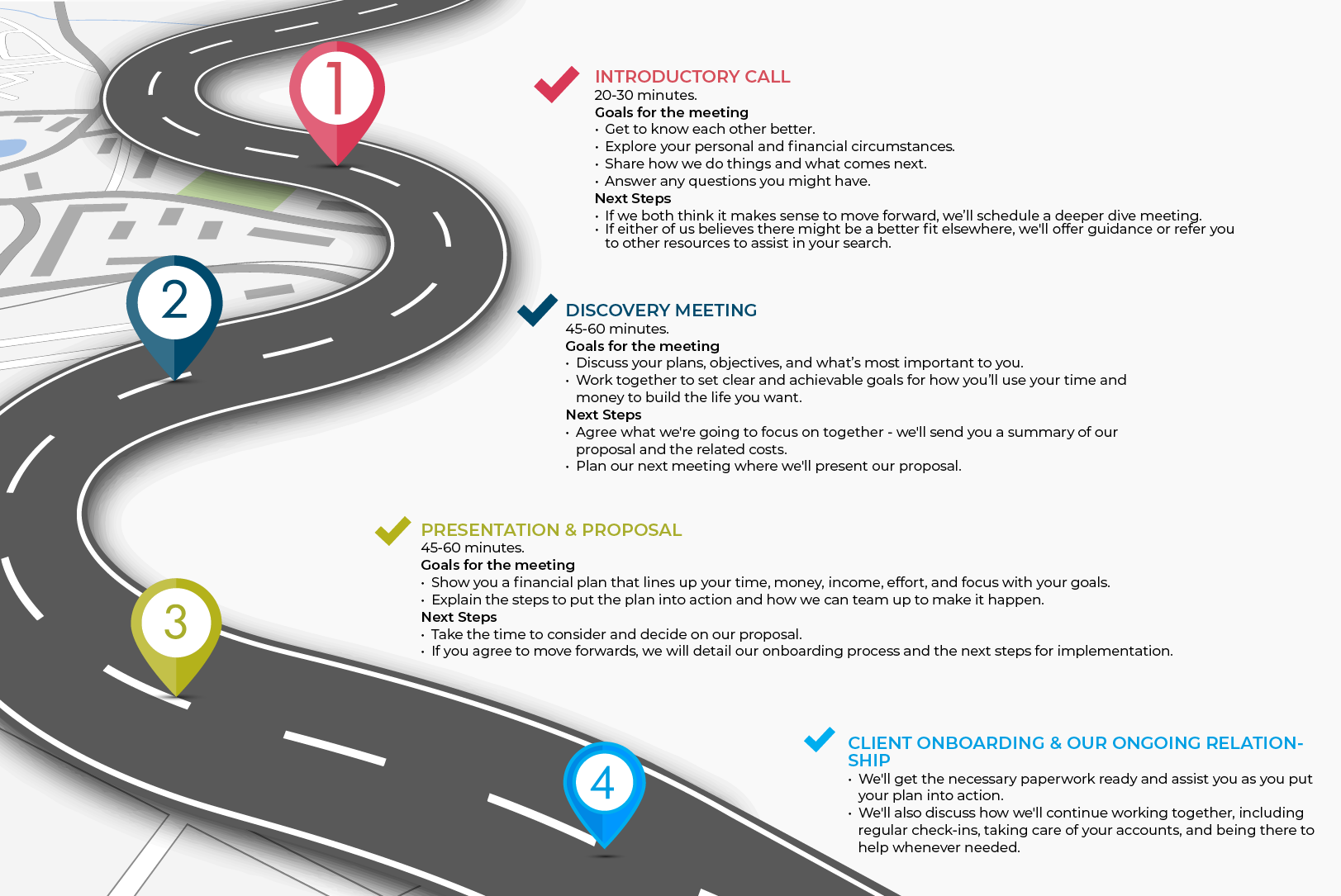

Our onboarding process

Click image to view bigger version.

Related links

Forensic accounting

Expert forensic accounting and advice

Moore Kingston Smith’s highly respected forensic accounting team has decades of experience to call upon, in complex cases ranging from listed companies to privately owned businesses and individuals. We provide expert witness, advisory and investigation services and have given evidence in the High Court, Family Court, Crown Court and the Upper Tribunal (Lands Chamber), as well as in arbitral and disciplinary tribunals. We also have extensive experience of acting in alternative dispute resolution forums, such as mediations and expert determinations.

Feedback from our clients is that we write clear and comprehensive reports, which are measured and credible. Where we are providing advisory services, we ensure our advice is pragmatic and focused, so as to enable our clients to achieve the best possible outcome. Our forensic accounting services include forensic investigations, professional negligence cases and fraud investigations.

Contact us to discuss how we can help you.

Nonprofit Advisory

Thrive with our nonprofit advisory services

Charities and nonprofits come to us when they need advice and support to help them thrive. With our tool-box of experts in impact management, fundraising strategy, financial effectiveness and sustainability and strategic planning, we can help you forge a better path into the future.

Our team of Nonprofit Associates have all formerly worked in the nonprofit sector. Together we have helped nonprofits like yours to influence funders by evaluating your social return on investment, to improve efficiency by rearranging finance processes, to get your organisation more money through improved cost recovery, to identify non-compliance against the Code of Fundraising Practice or re-imagine new business models to respond to what stakeholders need now, rather than what they needed a decade ago. If you need advice about the best way to run your nonprofit, we will try to help you find a solution.

Talk to us. We offer a free, entirely no-obligation consultancy session to explore how we can help to improve your organisation using our breadth of experience and depth of expertise – so get in touch today.

Restructuring advisory

Helping you find the best restructuring solutions in

challenging times

When you start to experience financial difficulties, acting swiftly and engaging restructuring advisory experts early can maximise your chances of a solvent recovery.

Our specialist team of business, HR and insolvency consultants will work with you and your advisers, stakeholders and funders to quickly assess your situation. We can identify the immediate challenges to your business and present and recommend the best possible solutions.

Our restructuring advisory team can help you to

- Develop effective plans for recovery, prioritising your resources and identifying your key workstreams and milestones to keep them on track.

- Manage any redundancy processes or changes in employment terms and conditions.

- Work out your cash requirements using financial modelling and improve your cash flow management processes.

- Review your business development processes to identify any gaps (such as improvements to your value proposition) that could help with your recovery.

- Secure alternative sources of funding.

- Realise value and find new ownership for your business at speed.

- Formally review options for value realisation and report on these.

- Help make sure you are harnessing the full power of your employees as well as properly considering your obligations.

If solvent solutions are not possible, we will work with our business recovery and insolvency team to help you navigate your responsibilities and options to create the best outcome. Contact us to discover more about our restructuring advisory services.

Related links

Case studies

A consumer PR agency approached us, in considerable distress, for advice on the future of their business and whether they should apply for a CBILS loan. The managing partners feared their only viable option was to close down.

However, we managed to create a sustainable business structure to keep the company afloat throughout 2021, without needing the loan after all. Now, the managing partners are confident their agency is fit to face the future.

We started by having an in-depth conversation with the managing partners, where they catalogued their predicament. They were incurring significant monthly losses, had lost major clients, their H2 revenue forecast showed income dropping by over 50%, they had deferred paying VAT, implemented salary cuts and furloughed staff. Yet still their cash was due to run out in six months’ time.

Next, we went through the agency’s cash flow, balance sheet, profit and loss, budget and trading forecast, and identified missed opportunities and substantial flaws in their management information. We uncovered a major fundamental error in their cash flow modelling, which is what had made the managing partners believe that insolvency was looming.

Conversely, our cash flow modelling demonstrated that they did in fact have the reserves to execute a successful strategy. We also reviewed their overhead base, pinpointed appropriate cost reductions and our HR consultancy arm subsequently handled their staffing restructuring needs.

The agency said: “Thank you to the team at Moore Kingston Smith. We feel assured that the business is set up for the foreseeable, and the decisions we are making are based on sound reasoning.”

Moore Kingston Smith supported a family owned food manufacturer with severe liquidity problems and losses. The team stabilized liquidity following a comprehensive situation analysis, identifying opportunities to generate cash quickly from inventory and restructured the staff base. The team negotiated with funders for a grace period and then identified strategic assets and buyers before ultimately selling the business to one of these strategic buyers realising shareholder value and refinancing the debt.

The Moore Kingston Smith team advised a struggling marketing services business that had become loss making following the termination of major client contracts resulting in a return to profitability within five months. Following a detailed options review and modelling exercise the team guided the business through a process of reducing headcount to eliminate excess capacity, a premises renegotiation with their landlord and a comprehensive cost cutting exercise based upon a zero based budgeting approach.

Moore Kingston Smith supported a medium sized manufacturing business with severe losses and cash flow issues. The team performed a comprehensive situation analysis, prepared an integrated financial model and identified opportunities to renegotiate supplier terms to provide financial headroom before ultimately arranging for a sale to a key supplier realising shareholder value and safeguarding the business.

Moore Kingston Smith supported a wholesaling business which had seen their revenues cease as a result of lockdown obtain a £1.5 million CBILS loan from their bank to provide liquidity during the Coronavirus crisis. The team performed a review of the options available to the business, including government support, reviewed and advised them on their business plans and forecasts and supported them through the loan application process.

Global mobility

Optimise your people strategy for international success with our cross-border tax and people advisory services.

Managing people across multiple countries has never been more challenging. Remote working and new geopolitical risks have added to the already complex task of managing cross-border employees who are subject to differing tax and legal regulations. All of this while trying to retain talent and prioritising employee wellbeing.

Our global mobility team, providing expert tax advisory services, takes into account all these factors when providing advice to incorporate into or enhance your global people strategy. We ensure you have the right plans and procedures to stay on top of your cross-border people arrangements. Whether planning for your first international employee, scaling your international growth when reorganising, diversifying or downsizing your existing operation, we will adopt the best approach to:

- Developing your cross-border tax and people strategy

- Evaluating and minimising potential risks

- Assessing the practicality of new projects or policy changes

- Contingency-planning for future disruptions

Our team works alongside our payroll and People Advisory practices to provide you with a seamless service to manage your international workforce. And as a member of the Moore Global Network, we can tap you into the knowledge and expertise of over 30,000 experts across more than 110 countries, providing you with the same transactional and advisory support worldwide.

As the world moves towards more flexible ways of working, it is vital to continuously review your global mobility strategy to ensure it is dynamic and adaptable for an uncertain future.

Contact our team for a free no-obligation consultation.

Data privacy and cyber security

Moore ClearComm is part of Moore Kingston Smith. Our services include data privacy, cyber security, business continuity and information security to organisations worldwide.

As trusted advisers to businesses and nonprofit organisations, we are passionate about helping our clients achieve data privacy compliance and cyber secure environments. Our highly experienced people have the strategic insight, drive and dedication to deliver results.

We are part of the Moore Global Network, present in 110 countries with over 30,000 employees. We have the global reach to provide you with rapid access to the right people in the right places to deliver international solutions.

As part of the network, we have the resources to enable us to be accessible, responsive and facilitate staff continuity, which our clients highly value.

People Advisory

HR consultancy and outsourced HR support – creating sustainable success through people

Moore Kingston Smith People Advisory are a leading HR consultancy of people and reward specialists who make it simple for businesses and teams to flourish by enabling them to attract, retain and reward their people.

We strengthen and support the growth of founder-led businesses, SMEs, larger and international corporates, and in-house HR teams by creating sustainable people strategies that are simple to implement.

How can we help?

- HR consultancy and outsourced HR support

- Employee compensation and benefits consultancy and support

- Incentivisation with bonus schemes and Long-Term Incentive Plans (LTIP)

- Organisational design and development consultancy and support

- People and leadership development

- Team building and employee engagement

- Employee wellbeing consultancy and support

- Creating great places to work and your business as an employer of choice

- Contracts of employment, employee handbooks, HR polices and HR advice and HR administration

- Employment law and settlement agreement drafting

How we can work together

Setting the gold standard in HR consultancy and outsourced HR support, we distinguish ourselves as the leading HR consultancy offering unrivalled on-site HR support. We ensure a tailored approach that elevates the success of your business. Book a free consultation.

What our clients say about our HR services