Financial planning spring bulletin 2024

As spring unfolds and the promise of summer glimmers on the horizon, we pause to reflect on critical planning areas. In this financial planning spring bulletin, we are delighted to provide valuable insights and actionable advice to navigate the complexities of the current economic landscape, empowering you to make well-informed decisions for your financial future.

We begin by emphasising the importance of health. Integrating health and wellbeing into robust financial plans is essential. While we hope for the best, it’s crucial to prepare for unforeseen circumstances to safeguard both you and your family. Our discussion encompasses medical insurance and other protective measures, ensuring not only peace of mind but also invaluable benefits in the face of challenges or unexpected circumstances.

Continuing, we review the Spring Budget and look ahead to what we can expect this year. The Budget, once again, brought a variety of changes, highlighting the uncertainty in our financial landscape, particularly in an election year. In line with this theme of uncertainty, we delve into expectations for interest rate cuts this year—a matter of keen interest for many mortgage borrowers.

In previous bulletins, we have stressed the importance of estate planning for personal affairs. In this issue, we emphasise that succession planning for business affairs is equally critical. As you focus on growing your business, it can be all too easy for succession planning and business continuity considerations to take a back seat. It is vital to have a plan in place to address potential business threats proactively.

Lastly, we turn to inflation and retirement. The increasing costs of living continue to impact everyone, with even greater significance during retirement. As expenses rise, understanding how to manage your income optimally and ensure long-term sustainability becomes paramount. For those still saving for retirement, it is essential to consider these impacts on your savings plan to ensure the creation of a sufficient future income.

Throughout this bulletin, we aim to provide practical guidance to help you plan for the future. Our dedicated team stands ready to assist you in navigating these complexities, offering tailored solutions to fortify your financial future.’

Protecting your health

Private healthcare options are on the rise as more people are looking at alternatives to the NHS through personal or workplace provision.

Protection and insurance products can provide access to some primary healthcare options, such as GP and dental services, and often contribute towards the cost.

There are significant differences between providers and products in price, coverage and exclusions, although none replicates the range of services available via the NHS. Understanding the details of each policy is key to finding the right option.

- Cash plan policies: Pay out a fixed contribution towards routine healthcare costs, such as dental and optician fees.

- Income protection: An insurance policy that pays a fixed monthly income if you are signed off work through ill health. It can ensure essential bills are paid during a period of illness.

- Critical illness: Pays a lump sum on the diagnosis of one of the serious illnesses listed on the insurance policy. The conditions will include most cancers, heart disease and stroke.

- Private medical insurance: Typically covers the cost of private diagnostic tests, consultations and hospital treatment. Emergency cover is not included, nor is treatment for existing or ongoing problems such as asthma and diabetes, nor pregnancy-related complications.

Many of these products now also offer a range of additional services, often at no extra cost. This can include virtual GP services, mindfulness apps and online counselling, plus information on lifestyle issues – for example diet, smoking or exercise.

While these products can of course be bought individually, employers are increasingly offering some form of health benefit to their staff to improve staff retention and reduce long-term sickness absence.

If you need to access health insurance at any point, or are looking to improve your health, it is worth checking what benefits may be available through your workplace, including access to healthy lifestyle services.

Top takeaways from the Spring Budget

Teasers for the 2024 Budget had been dropped across the preceding fortnight but nevertheless, Budget Day still contained a few surprises.

Chancellor Jeremy Hunt was under great political pressure to add to the tax cuts announced in his Autumn Statement 2023 and, if possible, steal a march on Labour’s tax plans. However the Office for Budget Responsibility (OBR) had made clear his scope for generosity was minimal.

Mr Hunt managed to square the circle, but only by bringing his margin of error down to just £9 billion in 2028/29, a figure which the OBR described as “a tiny fraction of the risks around any forecast”.

What’s new?

Some of the Chancellor’s Budget measures likely to affect you include:

- National insurance contributions (NICs)

The main rates of employee (class 1) and self-employed (class 4) NICs will be reduced by two percentage points to 8% and 6% respectively from 6 April 2024. The 2% rate on earnings/profits above £50,270 is unchanged. These reductions once again alter the mathematics around the wisdom of incorporation and whether to draw bonuses or dividends. - High income child benefit charge (HICBC)

The income threshold at which this charge starts to bite will rise from £50,000 to £60,000 for 2024/25. Simultaneously the rate of charge will halve, to 1% for each £200 over the threshold. Consequently, the size of the income band in which the HICBC can apply will double to £20,000 (£60,000 to £80,000). By 2026, the income threshold is expected to move from an individual to a household basis. - Residential property

The maximum capital gains tax (CGT) rate on residential property gains will be cut from 28% to 24% in 2024/25, while all other CGT rates remain unchanged. Some second homeowners will be stung, however, as the favourable tax rules for furnished holiday lets will be scrapped from April 2025. - UK ISA

The Chancellor issued a consultation paper on a ‘UK ISA’, with UK-focused investment options. This new variant will have a contribution limit of £5,000, which will be in addition to the existing overall £20,000 ISA limit (unchanged since 2017/18). - Non-domicile rules

The arcane tax rules which offer favourable tax treatment to some UK residents with a foreign domicile will be scrapped from 2025/26. The new regime will be based solely on tax residence, although transitional rules will apply for those already claiming the status.

If any of these changes could affect you or your business, or you would like further information on the Budget’s contents, please do not hesitate to contact us.

To find out about the budget in more detail, Head of Tax Tim Stovold, together with Tax Partner Nick Blundell and Tax Director Katy Shaw, analyse the announcements in the Spring Budget 2024 and offer a clear explanation of them.

Coming down: the year of interest rate cuts?

Interest rates have risen for two years straight, but the outlook indicates a change of direction in 2024.

The Bank of England raised its bank rate at fourteen consecutive meetings between December 2021 and August 2023, taking it from 0.10% to 5.25%. There is now an expectation, not disputed by the Bank’s Governor, that the next move will be downwards. The pattern of rise-and-stall has been mirrored by two other major central banks: the US Federal Reserve and the European Central Bank (ECB).

Although central bank rate have significantly increased, many banks have still not passed the full increases along to their customers. If you are not earning around 5% on your cash deposits, please speak with us to discuss your options.

Markets anticipate cuts

The yields on 10-year government bonds have fallen since last autumn in the UK, US and Europe and the knock-on effects are visible in the UK mortgage market, where new, fixed-term rates have started to drop. NS&I has also reacted, making a range of rate cuts, including 0.25% off the Premium Bond prize rate.

If you have been holding cash deposits, either directly or via money market funds, you should have benefited from the rise in rates. However, unless your deposits were earning on average within 0.7% of bank rate net, they will have lagged behind inflation. In fact, in the last 15 years it has been rare for the bank rate to be higher than the CPI inflation rate. That devaluation, combined with the likely fall in rates, means that the amount of cash you hold on deposit needs a review.

Talk to us about your options now: deposits may be less attractive once the rates begin their descent.

Mortgages

While rates coming down may not be popular among savers, it will come as a relief to those on variable mortgage rates or approaching the end of their fixed term.

Market sentiment suggests we may see the first base rate reduction towards the back end of the year and in turn, interest rates should fall accordingly.

In the meantime, there is much debate amongst lenders to the exact date and so, rates continue to fluctuate but overall on a downwards trend.

We have been securing mortgages 6 months before the product end date to lock in today’s rates. Where rates increase, the secured rate will apply. Where rates fall further, we can lock in the improved rate.

It is key to start looking far in advance of your term ending, and considering the whole of market is vital.

Whether you are looking for funding for residential, commercial or specialist purchases, we have all bases covered by our mortgages and property finance experts.

The renewed case for ISAs

Improved terms, together with the erosion of tax allowances elsewhere, are making ISAs a favourable option for the new tax year.

Since their launch, successive Chancellors have made revisions to Individual Savings Accounts (ISAs). Before his Budget proposal of an extra £5,000 for a ‘UK ISA’, the current Chancellor made arguably his biggest hitting pro-ISA changes in the Autumn Statement 2022:

- Halving the dividend allowance to £1,000 for 2023/24 and again to £500 for 2024/25.

- The capital gains tax (CGT) annual exempt amount was cut from £12,300 to £6,000 for 2023/24, then to £3,000 for 2024/25.

- Almost £25,000 was cut from the additional rate threshold leaving many more taxpayers with a zero personal savings allowance (PSA) from 2023/24.

The dramatic reductions in the dividend allowance and the CGT annual exempt amount alone mean you could be paying up to £2,450 more tax on the returns from your investments in 2024/25 than 2022/23. Even a basic rate taxpayer could be over £1,050 worse off.

ISAs offer a way to sidestep these tax increases. As a reminder:

- Dividend income within an ISA is free of UK income tax, although withholding tax may apply to foreign dividends.

- Interest from deposits or fixed interest securities is also free of UK income tax.

- Gains on investments held within ISAs are free of CGT.

- There is nothing to report regarding ISAs on your tax return.

As we move into a new tax year, now is the time to consider your ISA contributions for 2024/25 and review the investments holdings in existing ISAs to maximise those potential tax savings.

Succession: have you got a plan?

It is not only fictional multinational media empires that need to consider future ownership and control.

In 2023, the question of how to transfer control of a large, high profile family organisation gripped attention. First the Sky Atlantic series, Succession, drew us in, followed by its inspiration, the transfer of the Fox and News Corporation reins by Rupert Murdoch to his son, Lachlan.

What happens when ownership changes is not only a concern for the likes of multinational empires, real or otherwise. If you are a private company shareholder/director or a partner in a partnership, business succession is something that should matter to you. For example, what would happen if one of the fellow shareholders in your company or partners in your partnership suddenly died or suffered a disabling accident?

The way to deal with such potential business threats is to have a plan in place before disaster strikes and, equally important, to ensure the money is there to execute it; one without the other can be a minefield. Take the example of a suddenly disabled partner. Your agreement may require the partner to retire in such a situation, but unless the remaining partners have the resources to buy out their colleague, a new partner may need to be found or the business might even have to be sold. What you and your business associates need to protect against such situations are:

- appropriate, tax-efficient agreements to deal with the sale of interests on death and serious illness; and

- life and health insurance cover to fund the purchase costs those remaining in the business will face.

For advice on both aspects, talk to us today – as Succession showed – you never know what tomorrow might bring.

Tax charge trap for pension withdrawals

Pension freedom rules have given people earlier and more flexible access to their retirement savings. However, many are paying too much tax when they first make a withdrawal, due to the way HMRC’s computer systems operate.

Latest HMRC data shows it processed 12,000 reclaim forms in the last three months of 2023 relating specifically to this issue. In total it paid back nearly £39m to savers who have been overtaxed on pension withdrawals, making the average rebate £3,216.

The problem occurs when savers first make a withdrawal from a drawdown plan (rather than just taking their tax-free lump sum) payment). HMRC software assumes that this payment will be a regular monthly withdrawal, and taxes it accordingly, via an emergency tax code.

Tax rebate

In many cases, however, people aren’t taking a regular payment but are using the pension freedom rules to make one or more ad-hoc withdrawals – perhaps to pay for a holiday, home improvements or reduce debts – and so end up with a smaller sum due to this taxation issue.

If you’ve been overtaxed, you can claim this money back via an HMRC form. Complete either a P55, P53Z or P50Z depending on your circumstances. Those who don’t complete a form should have this tax readjusted in the following year, via the self-assessment process.

Staged payments

If you are planning to make a flexible withdrawal from your pension plan in the near future, there are steps you can take to try to avoid this problem. The best way is to make a very small initial withdrawal. The temporary tax code is then imposed on this smaller sum, and will be reapplied to the second, larger withdrawal. There may still be some adjustments to make but it is unlikely to result in such a large overpayment.

Costs of living in retirement increase

Savers need to build up more funds if they want to secure a decent standard of living in retirement.

An independent pensions body has updated its calculations on how much money people need to fund a basic, moderate or comfortable lifestyle in retirement. Rising food and energy costs, plus the fact more people want to socialise with family and friends post pandemic, has pushed up the cost of a ‘moderate’ retirement by £8,000, to £31,300 a year – with couples looking at a combined cost of £43,100 a year. For more, income required will be significantly higher.

As the name suggests, this is not funding a life of luxury. The Pensions and Lifetime Savings Association (PLSA) says this covers one week-long holiday in Europe each year, running a small car and modest amounts for socialising, alongside essential bills.

Moderate retirement costs increase most

The costs of ‘minimum’ and ‘comfortable’ lifestyles have also increased – although not by as much in percentage terms. The PLSA estimates an individual needs £14,400 a year to fund a basic lifestyle and £43,100 for a more ‘comfortable’ retirement.

These are ballpark figures, and individuals’ spending requirements will vary. But the numbers can be useful as part of a wider pension planning process. Remember, not all this cost needs to be met by private pensions, as from April this year those qualifying for the full state pension will get £11,502 a year, although that alone is not enough to meet basic living requirements according to these calculations.

It is never to early or late to start planning for retirement. Contact us for more information.

Don’t discount inflation

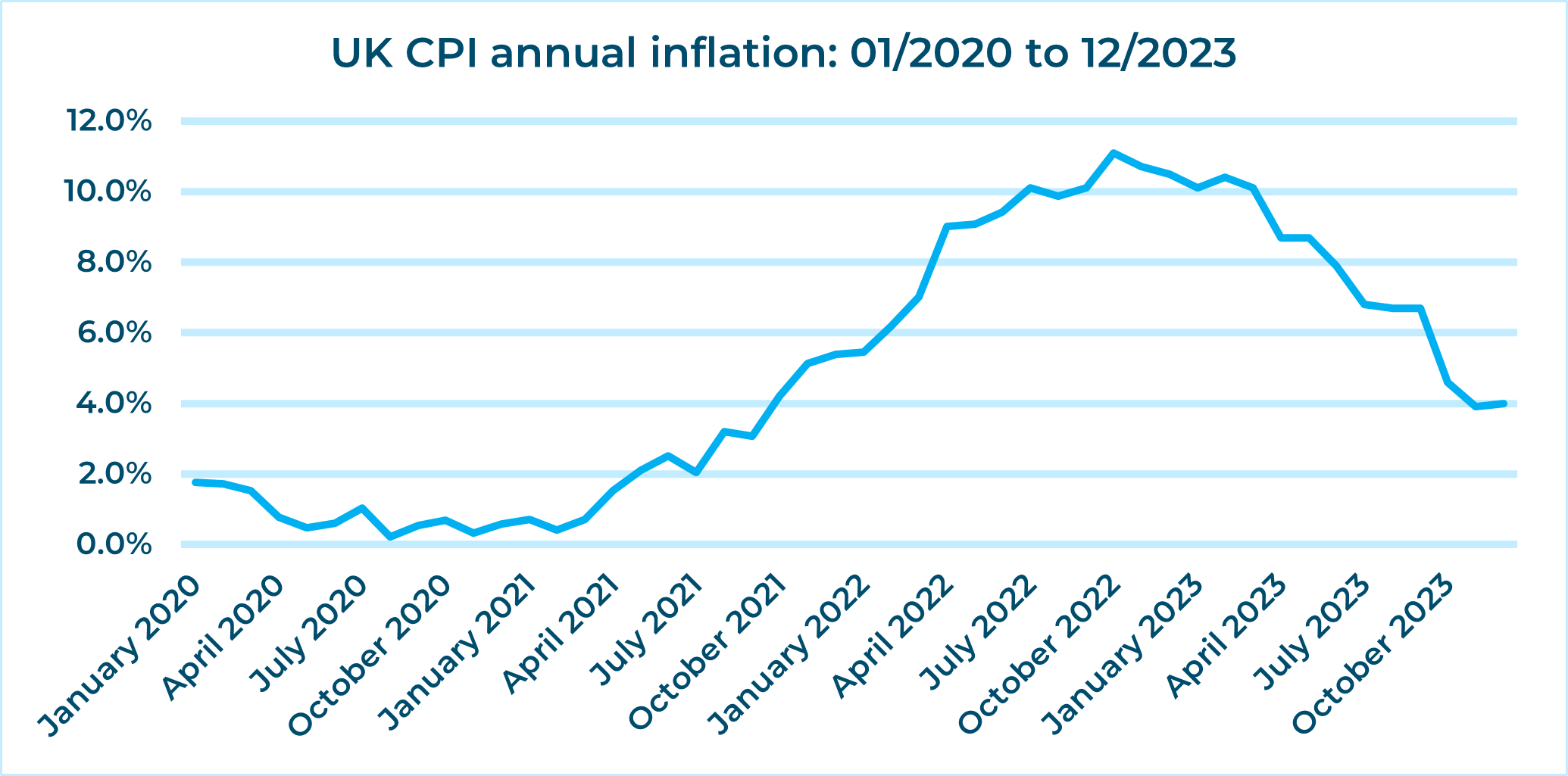

Despite slowing down considerably, inflation has not gone away yet.

Source: ONS

The fact that annual price rises have dropped to under half their October 2022 11.1% peak does not mean you can now ignore inflation’s impact. As some of those who grew up in the 2010 –2020 era of low inflation are now realising, a falling inflation rate (disinflation) is not the same as a general falling in prices (deflation). Prices are still rising, albeit at a slower rate.

In the three years since the start of 2021, inflation added over a fifth to average prices, only 2.2% less than the increase across the entire decade from 2010. You could now need to review your financial plans if they are more than a couple of years old. The level of life and health cover that looked more than adequate in 2020 may no longer be enough. Similarly, the pension pot that looked sufficient for a comfortable retirement may now be at the just-getting-by level.

News round up

New online trading data sharing rules

If you sell things online using sites such as Ebay or Vinted, or rent out your home via Airbnb or similar sites, those platforms will now automatically share data with HMRC. The rules are designed to ensure that those earning via digital platforms are fully declaring their correct income and tax. There is an ‘occasional seller’ exclusion for those making less than 30 sales under the value of around £1,700. The rules came in from 1 January 2024, but the relevant platforms will start reporting data from 1 January 2025, so there’s time to understand if you could be affected. Our Tax Dispute Resolution Partner John Hood, discusses the recent HMRC announcement regarding online traders and platforms and clarifies who this announcement is primarily aimed at, click here for more.

Student loans hit by marginal tax rates

Last December’s Scottish Budget introduced a new ‘advanced’ 45% income tax rate covering taxable income between £62,430 and £125,140. One unfortunate consequence of the change was to create a potential marginal ‘tax’ rate of 78.5% on earnings between £100,000 and £125,140 for graduates still repaying their student loans (67.5% effective income tax rate + 9% graduate repayment + 2% national insurance). If you think you have escaped this by living outside Scotland, be warned – the equivalent elsewhere in the UK is 71%.

Entitled to a bigger State pension?

HMRC is contacting thousands of people by post, mainly women, to highlight that they may be eligible for a higher State pension than they realise. An error in national insurance records has meant those eligible may have missed out on a provision called ‘home responsibilities protection’ between 1978 and 2010. The letters are going out in phases and explain how to check for eligibility and then claim, potentially adding thousands of pounds to State pension entitlement. It’s not a scam, but you can check and confirm with HMRC if you receive a letter.

Contact us

Contact us if you have any questions regrading the issues raised in our Spring Bulletin.