M&A activity holds firm in Q3 despite turbulent times

M&A in the UK IT services sector – Q3 2022

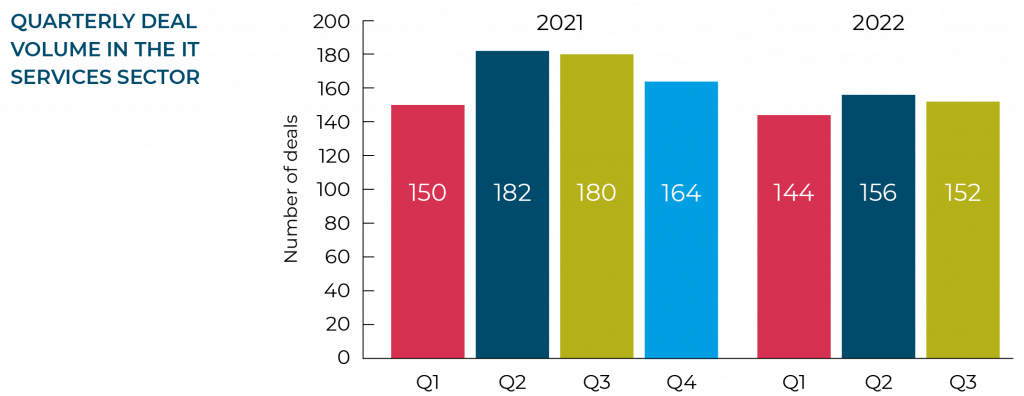

Moore Kingston Smith’s deal tracker recorded a total of 152 UK IT services deals in Q3 2022, which is marginally down on the 156 deals in Q2. Activity is still high when viewed in the wider historical context. However, it seems unlikely that 2022 will break 2021’s records unless a glut of deals complete before year end.

The difficulties in the UK and global economies are doubtless causing corporate and private equity investors to be more cautious than last year. However, appetite for the IT services sector remains strong, with activity merely flattening rather than showing any obvious signs of decline.

Analysis by service

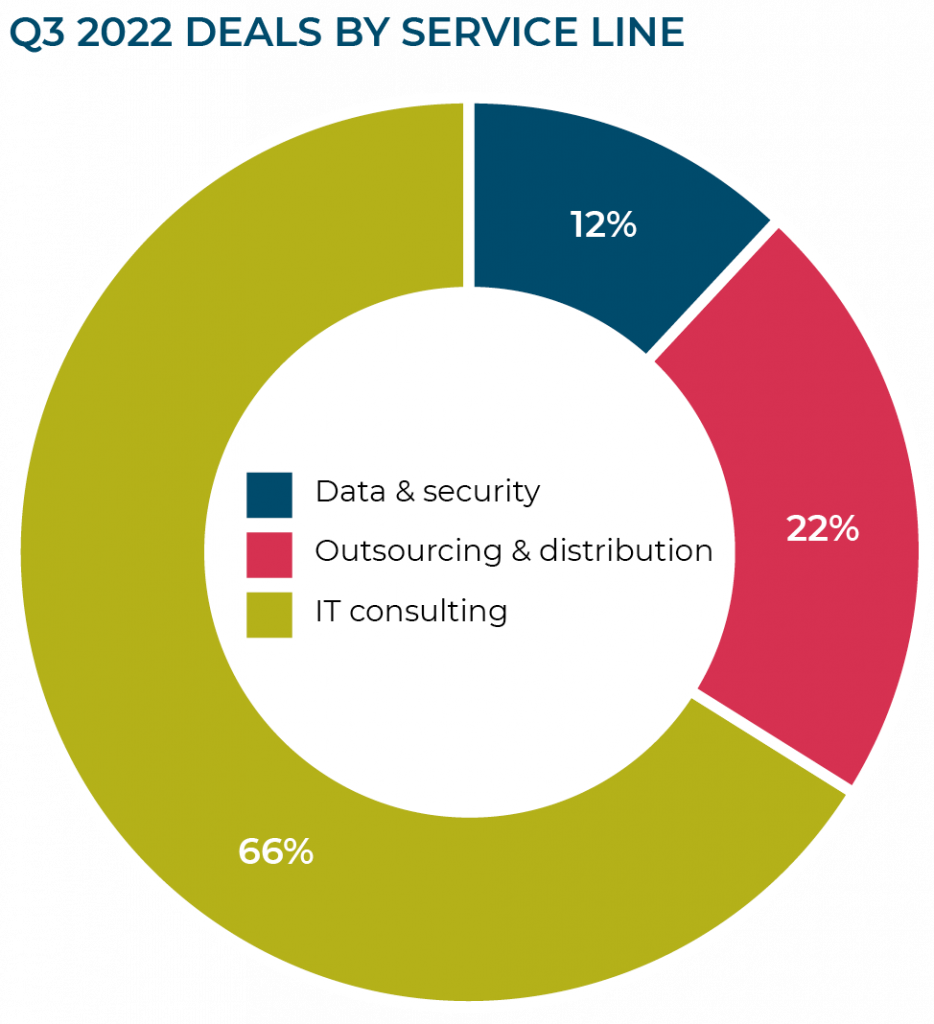

IT services covers a broad range of activities so, for the purposes of this report, we have allocated transactions to three main categories: IT consulting; outsourcing and distribution; and data and security.

66% of our 152 Q3 deals fell within IT consulting, with a total of 100 transactions completed. This is a significant increase on the 57% we recorded in Q2. Outsourcing and distribution also had a busy Q3, with 33 deals announced, while we noted 19 transactions in data and security.

Hot IT consulting disciplines

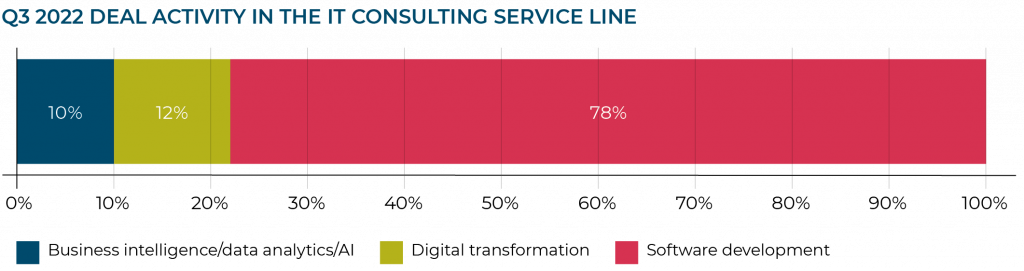

Our analysis of the 100 IT consulting transactions completed last quarter enables us to determine whether the company acquired was primarily focused on software development, business intelligence (including data analytics and AI) or digital transformation consulting.

In Q3 2022, over three quarters of IT consulting companies acquired were engaged in software development. Business intelligence deals fell from 24% in Q2 to just 12% of deals in Q3, while digital transformation deals accounted for 10% of transactions in Q3, having represented just 4% in Q2.

41% of all the IT services deals we analysed had a cross-border element, and UK software development companies proved particularly popular with overseas acquirers in Q3. In July, French group Flowbird announced it had acquired UK-based YourParkingSpace in a transaction that was reported to be worth c. £120 million. YourParkingSpace was founded in 2013 and specialises in parking technology solutions for off-street parking. Its 85,000 space providers range from individual driveway owners to household names such as Premier Inn, Tesco and Morrisons.

In August, Swedish company Hygglo announced that it had acquired UK digital renting platform Fat Llama for $41.4 million. Founded in London in 2016, Fat Llama has developed a peer-to-peer consumer products rental platform. Since the end of the pandemic, Fat Llama has gone from strength to strength. Demand has been high for its party-related items, including cameras, speakers and DJ decks, helping it to achieve profitability last year. The deal will see Hygglo acquire Fat Llama’s team, operations, software and branding. Fat Llama will retain its name in the UK, US and any new markets in mainland Europe. Fat Llama raised around $13 million in funding before the Hygglo acquisition, having received investment from Atomico, Y Combinator and Blossom Capital.

Outsourcing and distribution

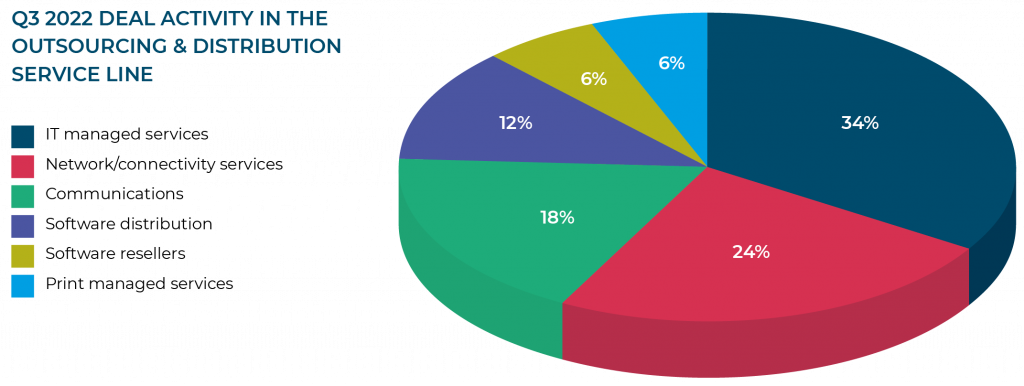

Within the outsourcing and distribution category, the IT managed services segment was the most active in Q3 (as it was in Q2), followed by network/connectivity services and communications.

“IT managed services transactions continue to represent the most popular acquisition targets in the outsourcing & distribution segment,” says Matt McRae, Senior Manager in the Moore Kingston Smith Corporate Finance team. “This is no surprise as IT managed services companies represent ideal platforms for acquirers to launch buy-and-build strategies incorporating other outsourcing services, due to the cross-selling opportunities available.”

We saw two Manchester-based deals within the IT managed services space in Q3. In July, Managed IT Services Group (MITSG) acquired Everything Tech. The acquisition will see Everything Tech become the flagship brand in the group, with Manchester becoming its national headquarters. This is the latest acquisition for MITSG, taking its total to four since May 2021. The group is backed by Boost & Co for acquisition funding.

In August, IT services company Lucid Networks, which was based at Manchester Science Park, was acquired by Salford-based WeDo Digital. The acquisition of Lucid brings to the group a range of IT services, from complex infrastructure projects and cyber security to back-up hosting solutions and day-to-day IT strategy delivery. Tech entrepreneur Luke Pilfold-Thomas, who co-founded WeDo Digital, comments: “We were looking to increase our digital offering to include more traditional IT managed services and wanted to acquire a north-west business with a strong record of customer retention. Lucid has developed and maintained an excellent business and client base over the years, with many of its customer relationships spanning more than a decade, so it fitted the bill perfectly.”

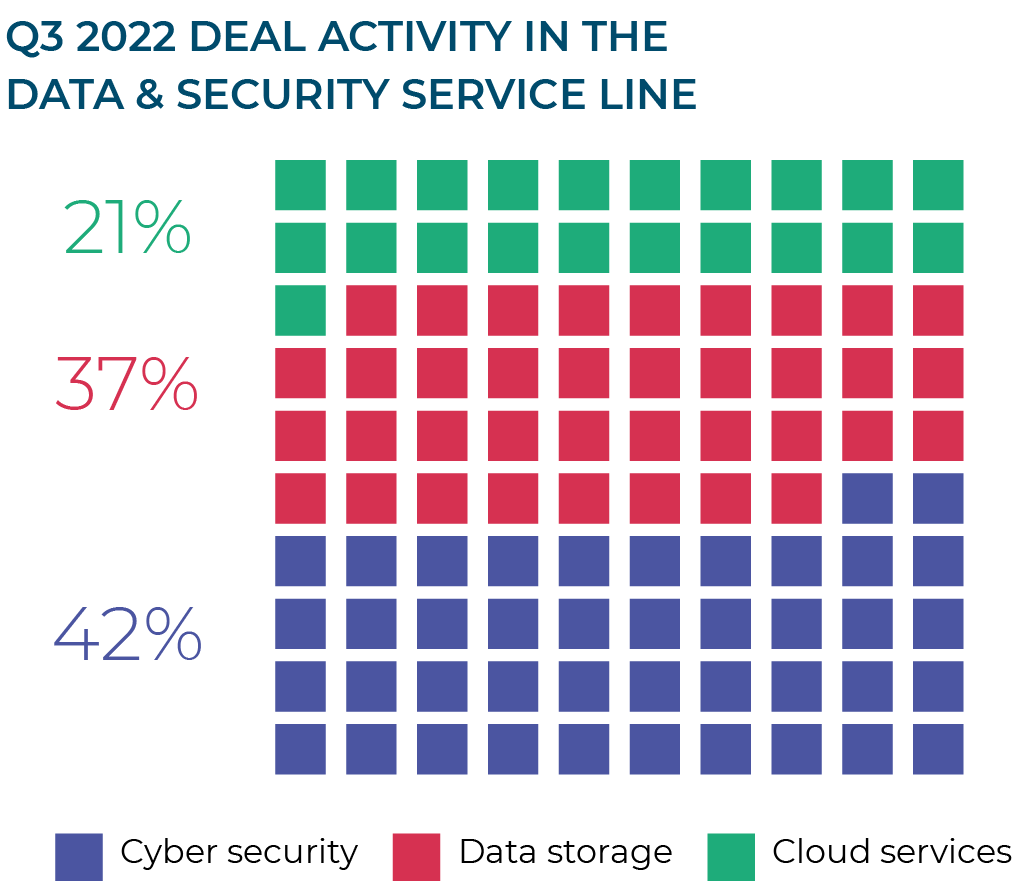

Data and security

Cyber security saw the most deals in Q3, representing 42% of the deals recorded. Data storage was second in popularity, followed by cloud services.

In July, US-based enterprise software provider SymphonyAI announced it was acquiring NetReveal, a provider of fraud detection platforms for the finance industry, from the UK’s BAE Systems. NetReveal offers a suite of tools to protect financial institutions against financial crime, managing all aspects of AML detection, fraud investigation and reporting, regulatory compliance and risk management. It is already used by around 200 institutions. It was acquired by BAE Systems in 2008 as part of a £500 million deal for parent company Detica. BAE Systems announced its intention to sell NetReveal earlier this year. SymphonyAI said the acquisition “marks a significant step” in its expansion within the financial vertical.

Private equity is the driving force behind IT services M&A

Moore Kingston Smith has been publishing a quarterly report on the UK growth capital market for several years. IT and technology have consistently been the most popular areas for private equity investment in the UK market.

Within IT services, private equity is substantially underpinning deal-doing in this space in the UK. Institutional investors are making new stand-alone investments and also backing their existing portfolio companies in their buy-and-build strategies.

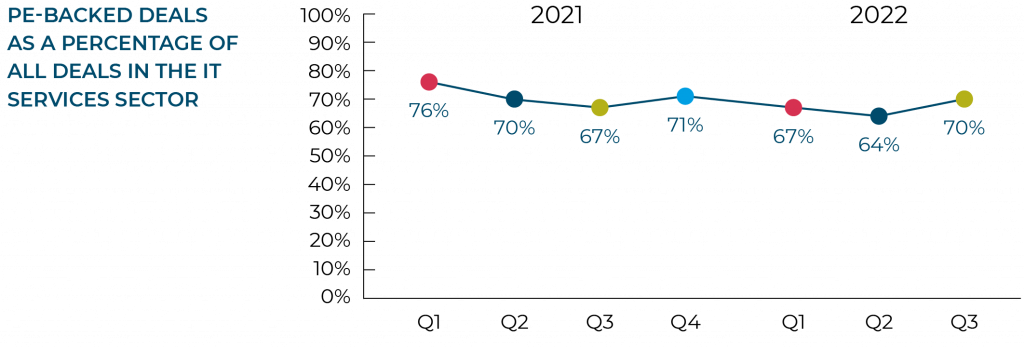

Private equity-backed investments accounted for 70% of all IT services deals completing in Q3 2022, which is a significant increase on the previous quarter and more reflective of the levels seen in the prior year. This suggests that trade buyers may be more affected by the current adverse economic headwinds than PE-backed entities.

The most prolific PE-backed acquirer in Q3 was Babble – the cloud communications, contact centre and cyber solutions provider. It completed no fewer than four transactions in the quarter. In July, the firm acquired Wakefield-based technology provider Yorkshire Telecom/Biscuit IT, as well as Basildon-based mobile services provider ADSI. In September, Babble announced it had bought Salisbury-based Berry Telecom and Cavendish Communications, which operates out of Newhaven. Babble has been a darling of the private equity community for some years. Formerly backed by LDC, it was sold in a £90 million secondary buyout to Graphite Capital at the end of 2020 and has wasted little time in putting its new investor’s funds to work. It completed nine acquisitions in 2021 and has announced six so far in 2022.

PE-backed ClearCourse, a London-headquartered group of technology brands providing software solutions and an integrated payments platform, announced three acquisitions in Q3. In August, it acquired Norwich-based Pursuit Software, a provider of integrated back office, sales and stock management software to jewellery businesses. In early September, it bought Manchester-based Club Systems International, a sports clubs management software provider. Later that same month, it announced the acquisition of Belfast-based healthcare clinic management software provider Blue Zinc. ClearCourse is backed by New York PE house Aquiline Capital Partners.

Katharine Stone, Corporate Finance Director, notes: “As the economy moves into difficult times, PE houses often adjust their investing strategies, looking for businesses with strong income security, high cash ratios and adaptability to uncertainty. This is why IT services are so attractive for PE houses who are looking to maintain their ROI, a trend we expect to continue see over the next 12-24 months.”

Valuations

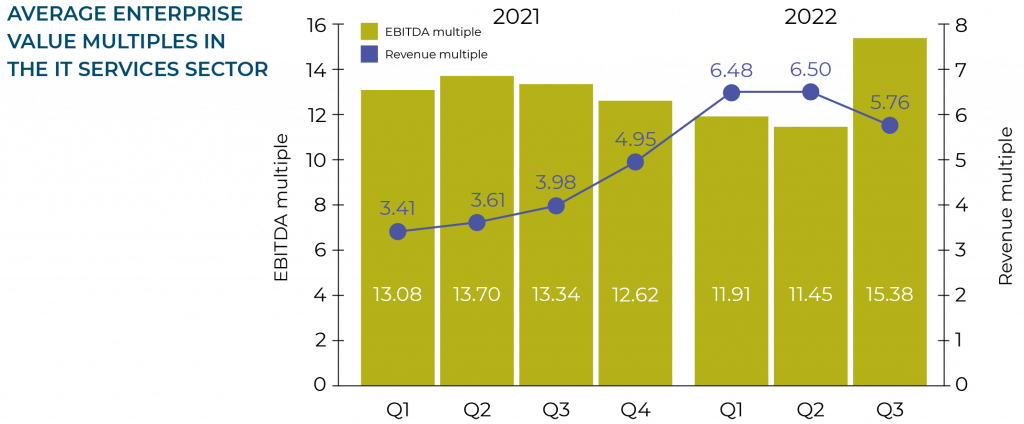

Our analysis of Q3 deals where pricing details can be determined (most state “terms were not disclosed”) reveals that those companies were sold on an average revenue multiple of 5.76x and an average EBITDA multiple of 15.38x.

Revenue multiples have softened from the previous two quarters’ highs. However, EBITDA multiples have increased significantly this quarter. This suggests that the companies being sold in Q3 have started to see their operating margins decline, perhaps in response to 2022’s economic turbulence.

Insight

Rising cost of debt is expected to have an impact on UK M&A activity, since so many transactions require leverage, particularly for PE buyers. However, as lenders become more particular about who they lend to, the recurring revenues of companies in the IT services sector may make them more attractive.

IT services industry stock performance

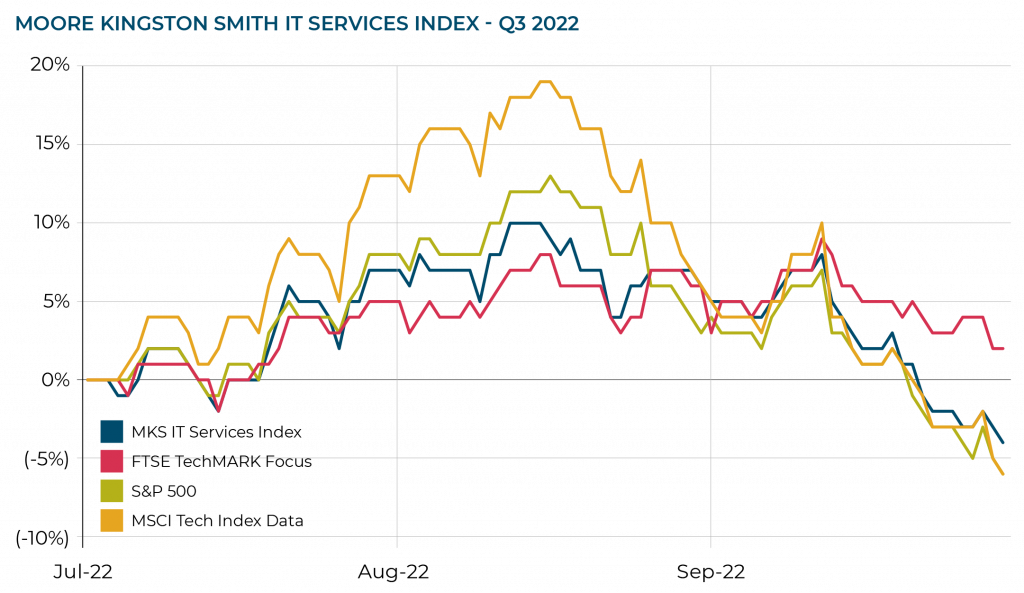

In our Moore Kingston Smith IT Services Index, we have plotted the share price performance of 21 listed IT services groups. The index tracks how they have fared in the last quarter compared with the S&P 500, the MSCI World Information Technology and FTSE TechMARK Focus indices.

Q3 2022 saw stock markets, and tech stocks in particular, rally somewhat in August. However, they went into decline in September, following poor economic data and concerns about a global recession, to end the quarter down overall. The S&P 500 declined by 6% across the period. The Moore Kingston Smith IT Services Index also fell in the quarter, although it did slightly outperform the market with a 4% decline in value. This was also slightly ahead of one of our technology-specific indices, the MSCI World Information Technology index, which matched the market with a 6% fall. Only the FTSE TechMark Focus index (which focuses on companies with market capitalisations under £4 billion) ended the quarter in positive territory, up 2%.

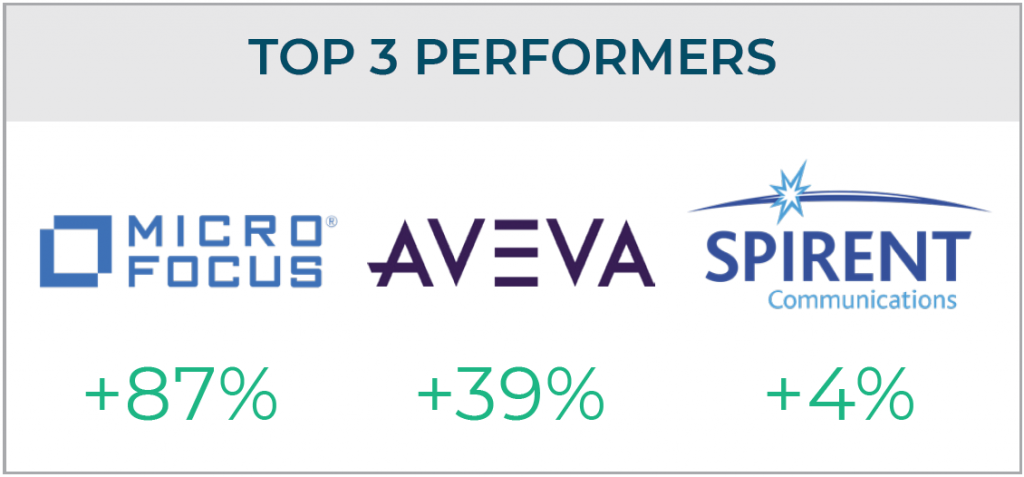

Of the 21 companies that make up the Moore Kingston Smith index, just four ended the quarter with share price increases; the vast majority ended in negative territory. The star performer this quarter was Micro Focus, one of the few remaining British technology firms to be listed in London. At the end of August, it announced that it was set to be acquired for c. £5 billion by Canadian software provider OpenText in a deal expected to complete in the first quarter of 2023. The news saw Micro Focus’s share price surge by more than 90% in a single day, and it ended the quarter up 87% overall.

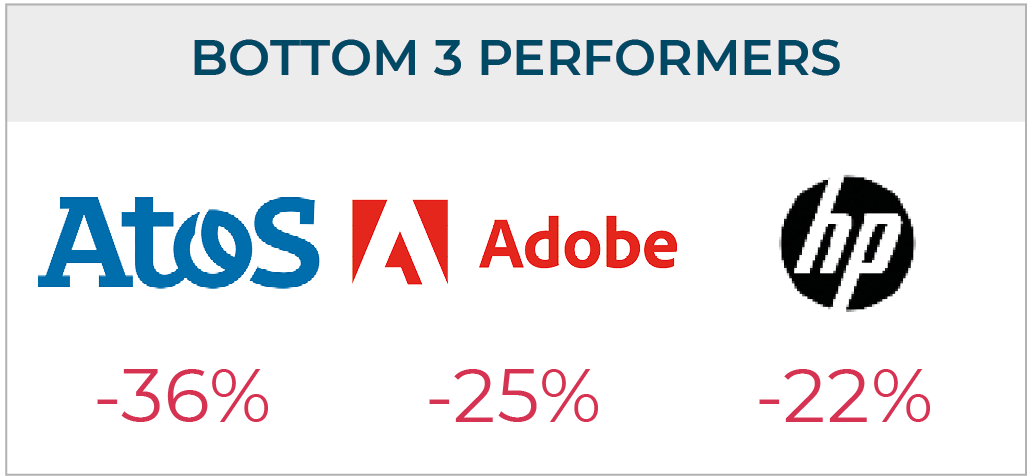

Conversely, the worst performer in Q3 was struggling French IT company Atos, which saw its share price fall by 36%. It was also our worst performer in Q2, when its share price dropped by 49%. Atos’s shares are now trading at near 30-year lows and there have been calls from institutional shareholders for the chair of the company and long-standing board members to resign amid scepticism about their restructuring plan. The share price fell by 15% in just one day in September, following Goldman Sachs cutting its rating to sell, arguing that the company’s weak financial profile and low visibility of earnings foretold a long way to recovery.

Outlook

The results for Q3 2022 show no dramatic softening in UK M&A in the IT services sector. While activity is essentially flat, transaction volume does not appear to have been significantly affected by macroeconomic and geopolitical factors – the situation in Ukraine, commodity shortages and price rises, concerns about global warming, increasing inflation and declining retail sales.

Apart from global challenges, the UK is dealing with domestic issues, as the financial markets react to the UK government’s fiscal plans. A key factor for M&A is the cost of debt, since many transactions require leverage. As the rate for UK government borrowing increases, so do the rates for personal and corporate borrowing, and that could act as a brake on M&A activity. However, to balance that, we have the fact that a decline in the value of sterling can make UK-based assets look “cheap” to overseas acquirers, particularly from the US, which could provide a fillip to the market.

Notwithstanding the turbulence in the wider economy, there remain many positive micro-economic drivers of M&A activity within this sector – the IT services market is expanding and companies are looking to provide an integrated offering to their clients. There are also numerous private equity houses looking to back consolidators in the sector.

The UK M&A market continues to be busy and the Moore Kingston Smith corporate finance team continues working on transactions in the IT services sector. We remain optimistic about the outlook for the remainder of the year, despite the market volatility.

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in IT services companies to consider their exit options.

For more information, get in touch with the Moore Kingston Smith corporate finance team.