M&A activity in the UK IT services sector – a review of 2022

Steady as she goes

2022 has been a difficult year for many businesses. The domestic and global economies have been affected by such factors as commodity shortages, increasing inflation, higher borrowing costs and industrial disputes, not to mention the situation in Ukraine. However, political and economic uncertainty has created numerous opportunities for dealmakers, and M&A activity within the UK IT services sectors has remained relatively strong.

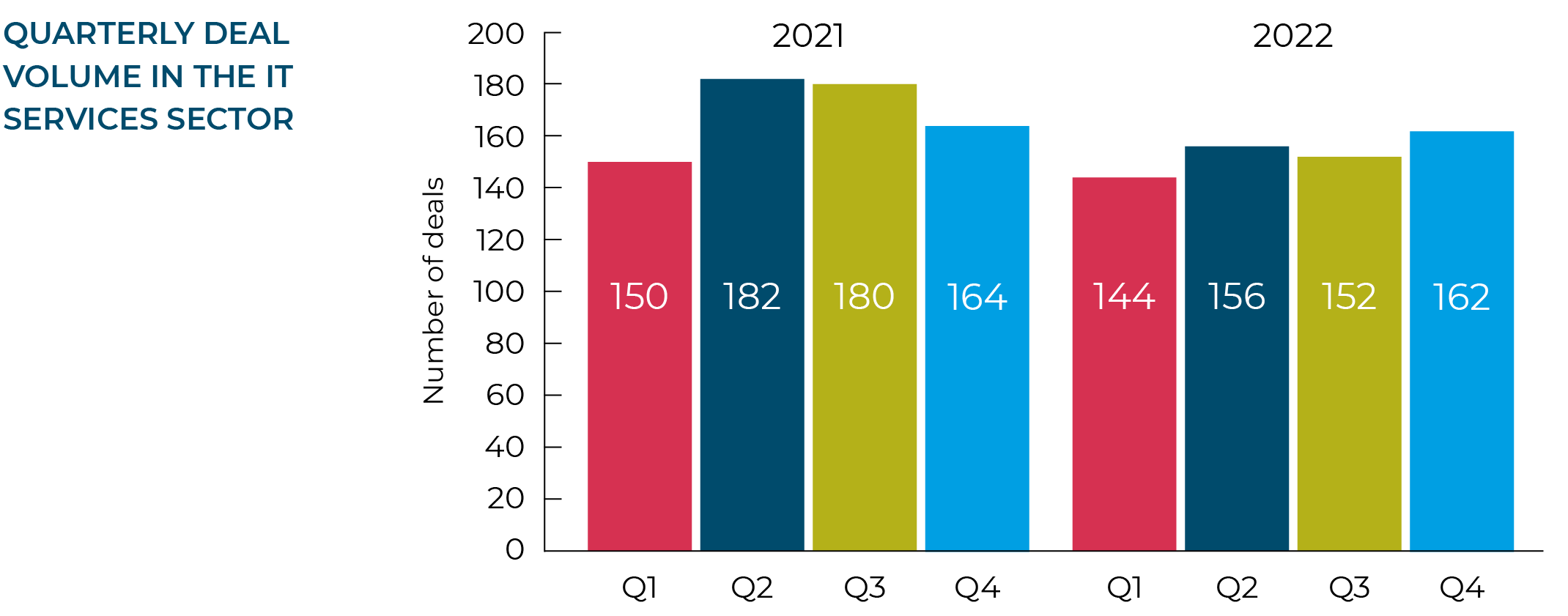

We predicted in our Q3 report that 2022 would be unlikely to break 2021’s records, and the data shows that it didn’t. However, an uptick in activity in the final quarter of the year means this has still been a very good year overall for M&A in the sector.

According to our research, 2022 produced a total of 614 UK deals, which is 9% down on the 676 we recorded in 2021, itself a bumper year for M&A.

When we look at the quarterly data, we see that there has been a consistently high level of activity throughout the entire year. Moore Kingston Smith’s deal tracker recorded a total of 162 UK IT services deals in Q4 2022, which is 7% up on the 152 deals we reported in Q3, and makes Q4 the best-performing quarter of last year.

The difficulties in the UK and global economies are doubtless causing corporate and private equity investors to be slightly more cautious than last year. However, appetite for the IT services sector remains strong, with activity remaining relatively consistent quarter on quarter. Pent-up demand and corporate M&A plans put on ice during the pandemic are underpinning this activity, along with continued enthusiasm from the private equity sector for IT services assets, although we are anticipating a slightly quieter market in the first half of 2023.

Outlook

2021 was a record year for UK M&A activity. While the IT services sector in 2022 has not quite managed to match the activity of the previous year, interest in the sector remains very strong. Any fears that macroeconomic and geopolitical concerns would affect the market have yet to be realised in any meaningful sense.

The recent improvement in the share prices of many of the large global listed IT services companies is likely to increase their appetite for acquisitions, since they will find it easier and cheaper to use their paper as currency.

Private equity interest in the sector is holding up, although it is possible that activity here may wane in the first half of 2023, reflecting concerns about rising interest rates and the affordability of transactions. Many M&A transactions require leverage – and private equity transactions require substantial leverage more often than not. As borrowing costs increase, we may see private equity finding it harder to compete with corporate acquirers investing from their own balance sheets.

The UK M&A market continues to be busy and the Moore Kingston Smith corporate finance team is working on a number of live deals in the IT services sector. While we are expecting a quieter market in the first half of 2023, we expect valuations to remain at high levels due to continued strong demand for quality assets in the sector.

“Any fears that macroeconomic and geopolitical concerns would affect the market have yet to be realised in any meaningful sense.”

Private equity remains the driving force behind IT services M&A

Private equity is substantially underpinning dealdoing within the UK IT services sector. Institutional investors are making new standalone investments and backing their existing portfolio companies in their buy-and-build strategies.

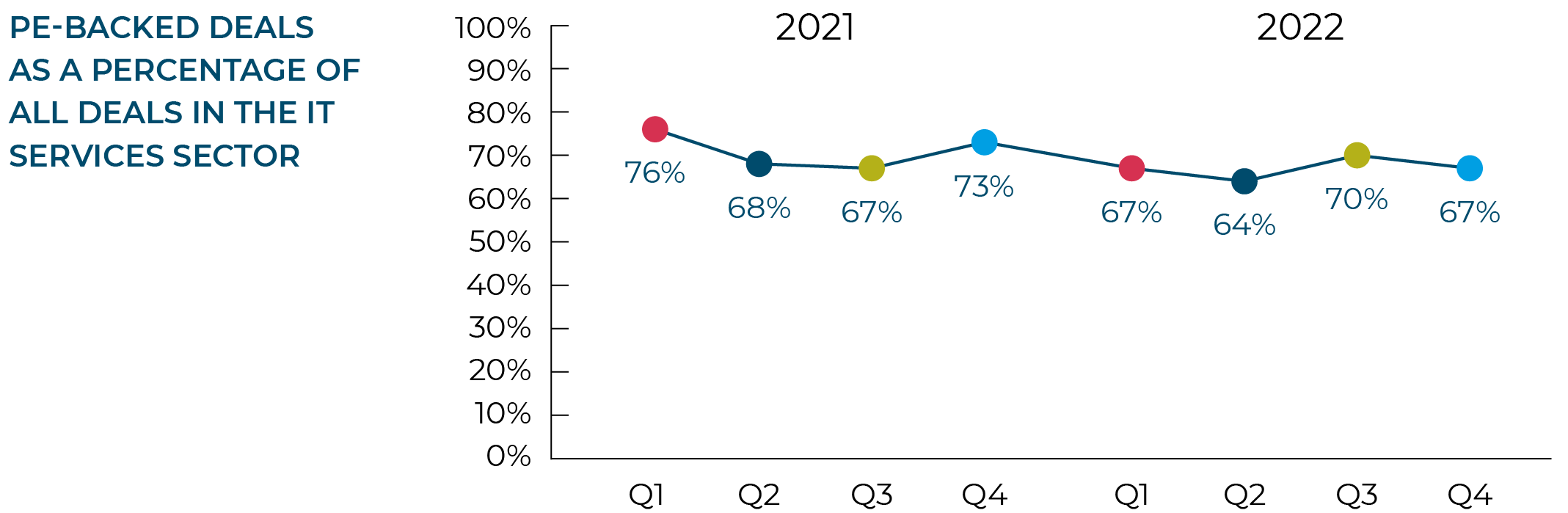

Private equity-backed investments accounted for 67% of all IT services deals completing in Q4 2022, which is largely consistent with the levels that we have seen all year, albeit slightly down on Q3.

When we look at the year as a whole, we find that private equity-backed investments accounted for the vast majority of deals done in 2022. Of the 614 deals we recorded, 413, or 67%, involved private equity investment either directly or via an existing portfolio company. This compares with the 71% that we saw in 2021.

We featured Graphite Capital-backed acquirer Babble, a cloud communications, contact centre and cyber solutions provider, in our Q3 report, and it has continued its prolific M&A activity in Q4. In October, it acquired Buckinghamshire-based cyber security specialist activereach. Then in November, it announced its largest acquisition to date – that of Chester-based mobile services reseller Vivio. This latest acquisition brings its total for 2022 to nine deals, the same number as it completed in 2021.

In November, The Access Group announced that it had acquired Reading-based Paycircle, a cloud-based collaborative payroll platform for payroll bureaux. Private equity house Hg Capital has been invested in The Access Group since 2018 and, in June 2022, made a further investment in the group alongside TA Associates.

As well as backing its portfolio company The Access Group, in October, Hg Capital made a direct investment in the sector by acquiring a majority stake in TrustQuay from Silverfleet Capital. TrustQuay is a technology provider to the global trust, corporate and fund services industry. We expect to see more of these secondary transactions – the sale of portfolio companies from one private equity backer to another – in 2023.

“Despite a turbulent economy, PE has been highly active in the IT services sector due to the continued need for companies to embrace digital transformation underpinning sector growth. We expect businesses who operate with a strong recurring revenue model, positive net customer churn and high cash generation will continue to make ideal platform investments for PE funds.”

Katharine Stone, Corporate Finance Director at Moore Kingston Smith

Analysis by service

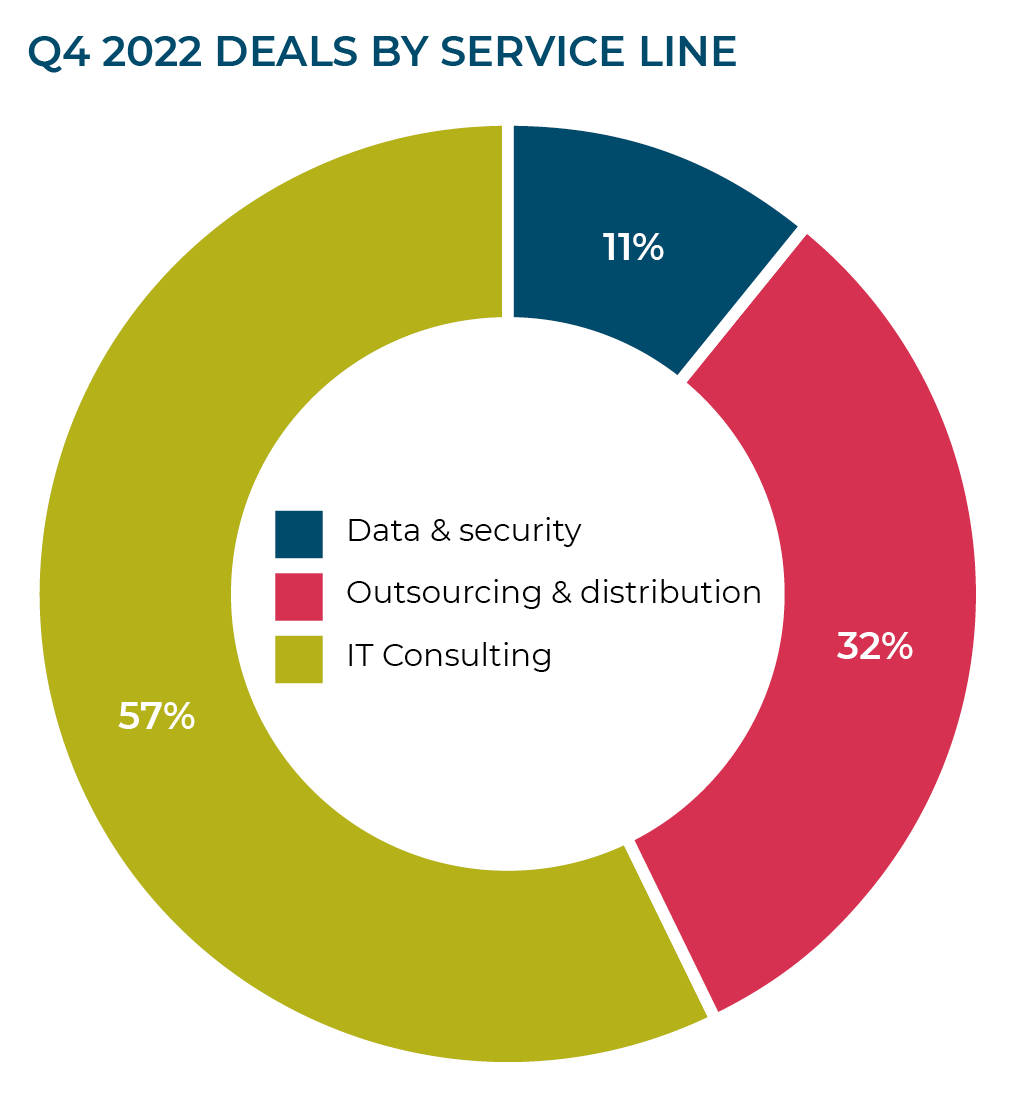

IT services covers a broad range of activities so, for the purposes of this report, we have allocated transactions to three main categories: IT consulting; outsourcing and distribution; and data and security.

“57% of our 162 Q4 deals fell within IT consulting, with a total of 92 transactions completed. Outsourcing and distribution also had a busy Q4, with 52 deals announced, while we noted 18 transactions in data and security.”

Hot IT consulting disciplines

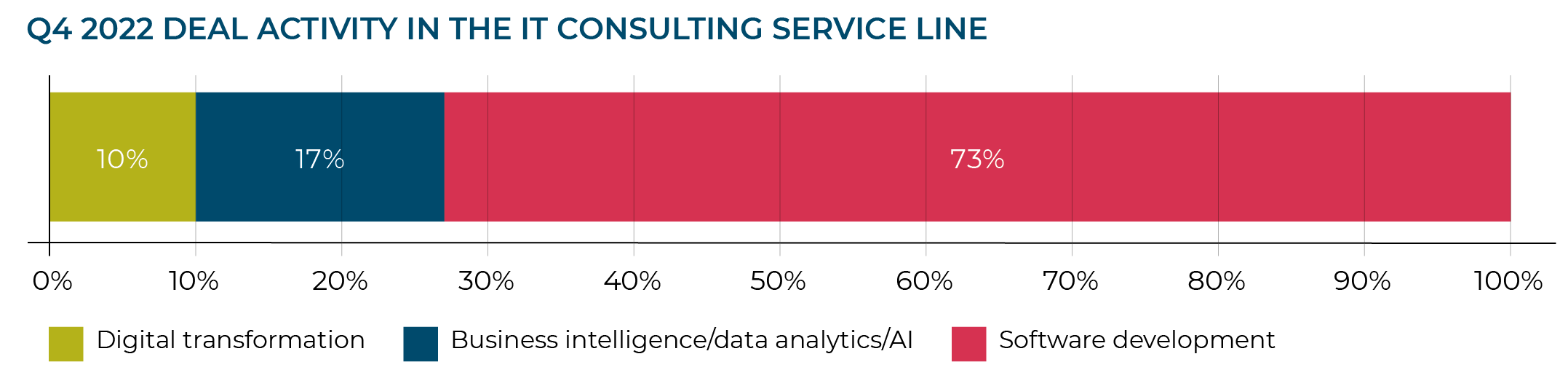

Our analysis of the 92 IT consulting transactions completed last quarter enables us to determine whether the company acquired was primarily focused on software development, business intelligence (including data analytics and AI) or digital transformation consulting.

In Q4 2022, almost three quarters of IT consulting companies acquired were engaged in software development. Business intelligence deals increased from 12% in Q3 to 17% of deals in Q4, while digital transformation deals accounted for 10% of transactions in Q4, the same level as we recorded in Q3.

The majority of the IT services deals we analysed in Q4 were domestic – i.e. involving a UK acquirer and a UK target, with fewer cross-border deals than we saw earlier in the year.

Domestic software development deals included the October announcement by AIM-listed Idox, a supplier of specialist information management software to the public sector, that it was acquiring LandHawk Software Services, a land mapping software and geospatial information services business. The initial cash consideration for the acquisition was reported to be £1.1 million from Idox’s existing resources, with a further £0.4 million of deferred equity consideration to be issued 18 months post transaction.

Also in October, accounting and payroll software company Sage, which is listed on London’s Main Market, announced that it had acquired Bristol-based Spherics, a carbon accounting solution to help businesses easily understand and reduce their environmental impact.

Spherics automates the process of calculating emissions by ingesting data from a customer’s accounting software and matching transactions to emission factors to create an initial estimate of their carbon footprint. The software then guides the customer to refine this estimate by submitting further data for a more accurate calculation – supporting businesses on their journey to net zero.

Outsourcing and distribution

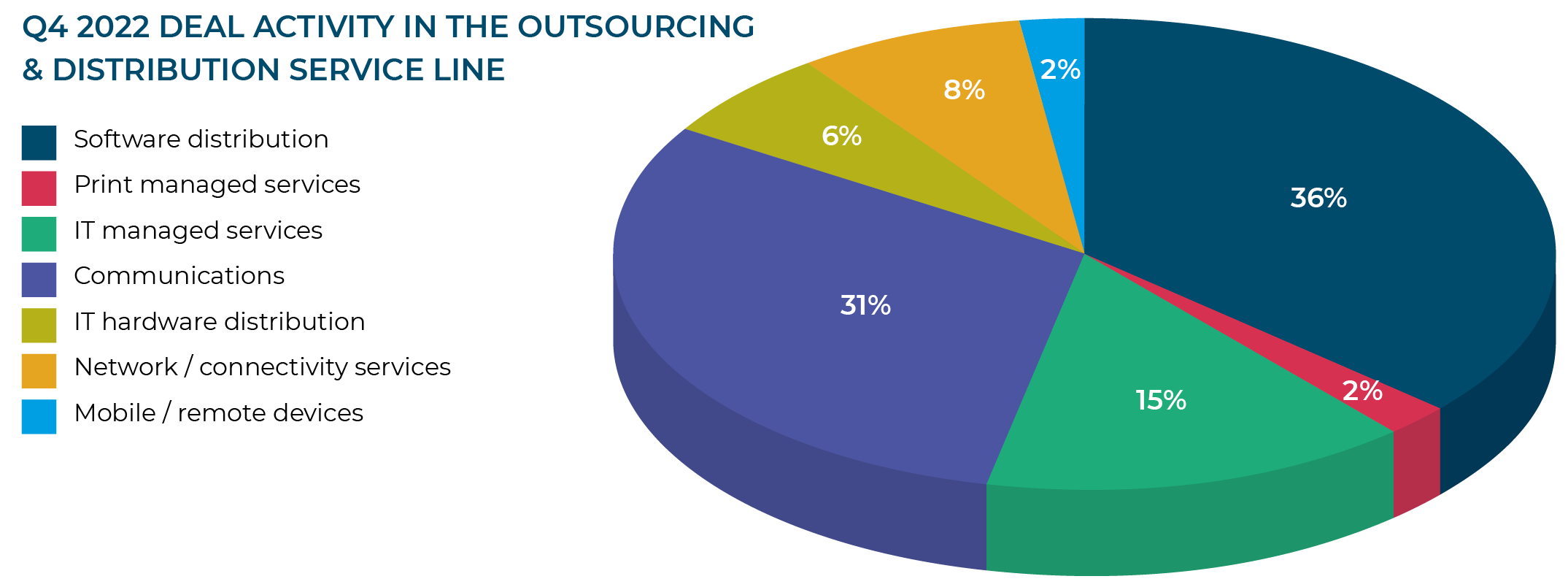

Within the outsourcing and distribution category, the software distribution segment was the most active in Q4, followed by communications. IT managed services, which was the most active in Q3 and Q2, fell to third place in Q4.

Highly acquisitive UK-based software distributor Pinnacle made four acquisitions in 2022, including two in Q4. In October, it announced that it had snapped up Cardiff-based Sage 200 business partner Prosys Computing. The acquisition, for an undisclosed sum, strengthens Pinnacle’s presence in Wales and the South West of England, adding more than 100 Sage customers to Pinnacle’s existing base of 1,900. Then in November, it revealed that it had acquired Belfast and Warrington-based Flint Studios, a web solutions and digital transformation software business.

One Q4 cross-border deal we spotted in the software distribution space was the acquisition of UK-based Salesforce specialist Oegen by Canadian digital transformation services business OSF Digital in November. OSF Digital had a busy 2022 on the M&A front, having made five acquisitions before the Oegen announcement. With over 1,000 global clients, OSF Digital has served several businesses with offices in the UK including Gatwick Airport, Marks and Spencer, Schuh, Babyliss and others.

Data and security

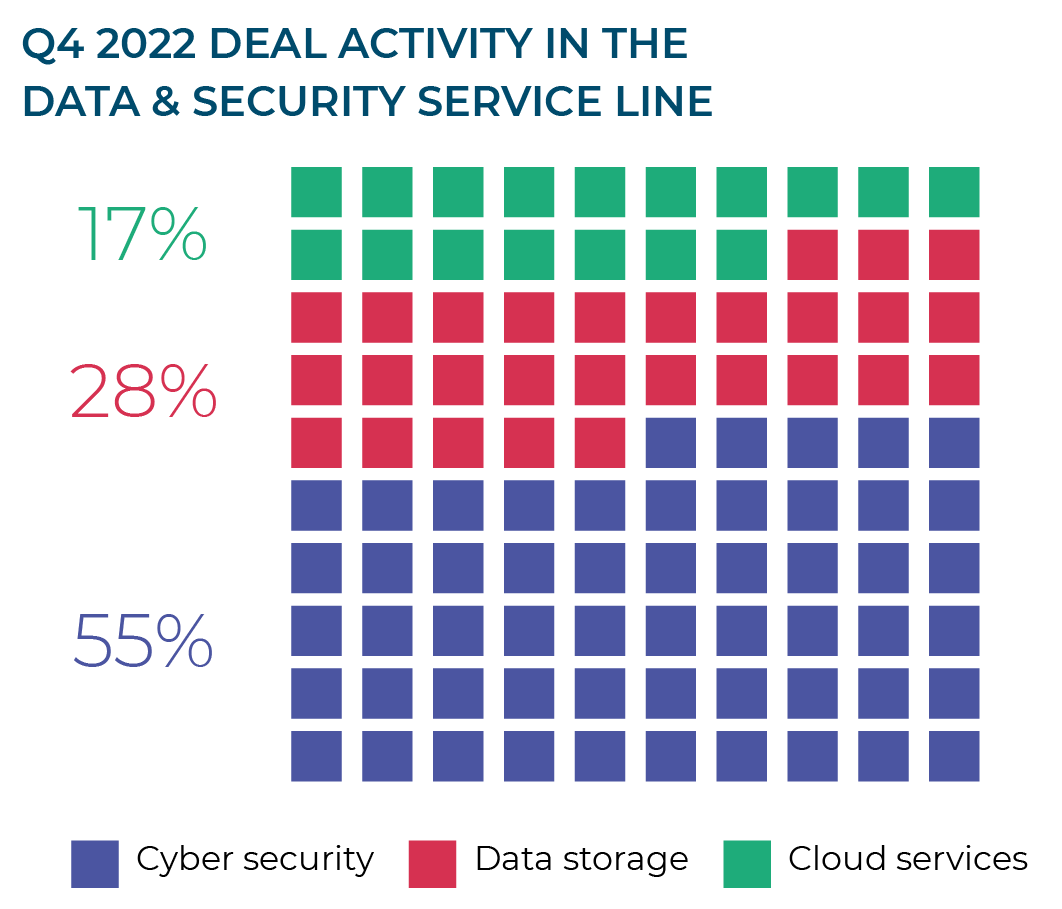

Cyber security saw the most deals in Q4 2022, representing 55% of the deals recorded. Data storage was second in popularity, followed by cloud services.

Within the cyber security space, we noted the October announcement by AIM-listed Intercede Group, supplier of public key infrastructure credential management software, that it was acquiring Authlogics, a multi-factor authentication and password security management software vendor. The initial consideration for the transaction was £2.5 million plus a further deferred conditional and staged earnout payment of up to £3 million.

“The acquisition of Authlogics enables us to deliver on the strategic vision that we have shared with investors of addressing the entire authentication pyramid. We believe that the addition of the Authlogics products will allow us to support our customers and prospects wherever they are in their authentication journey, and to embrace a wider set of use cases.”

Klaas van der Leest, CEO of Intercede Group

Valuations

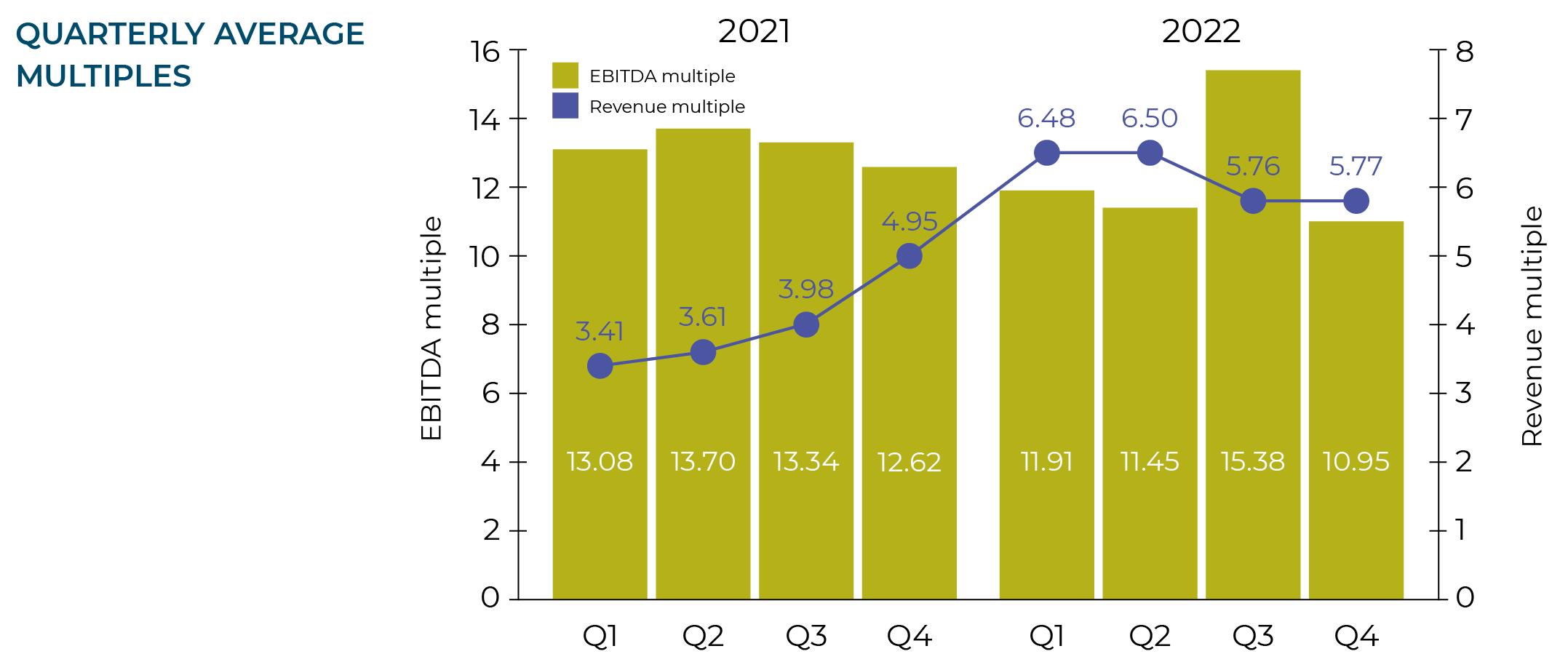

Our analysis of Q4 deals where pricing details can be determined (most state “terms were not disclosed”) reveals that those companies were sold on an average revenue multiple of 5.77x (almost identical to Q3’s 5.76x) and an average EBITDA multiple of 10.95x, which represents a significant softening from Q3’s 15.38x multiple.

If revenue multiples are remaining constant but EBITDA multiples are declining (2022: 12.11x vs 2021: 13.16x), that suggests that companies needed to be significantly more profitable in Q4 than they did in Q3 to be an attractive acquisition target. However, given the relative paucity of the data, we should probably not read too much into any single quarter’s results in isolation.

Despite this, average revenue multiples in 2022 at 6.17x were substantially higher than 2021 (4.28x) which points to buyers placing an increasing value on driving revenue growth through M&A.

IT services industry stock performance

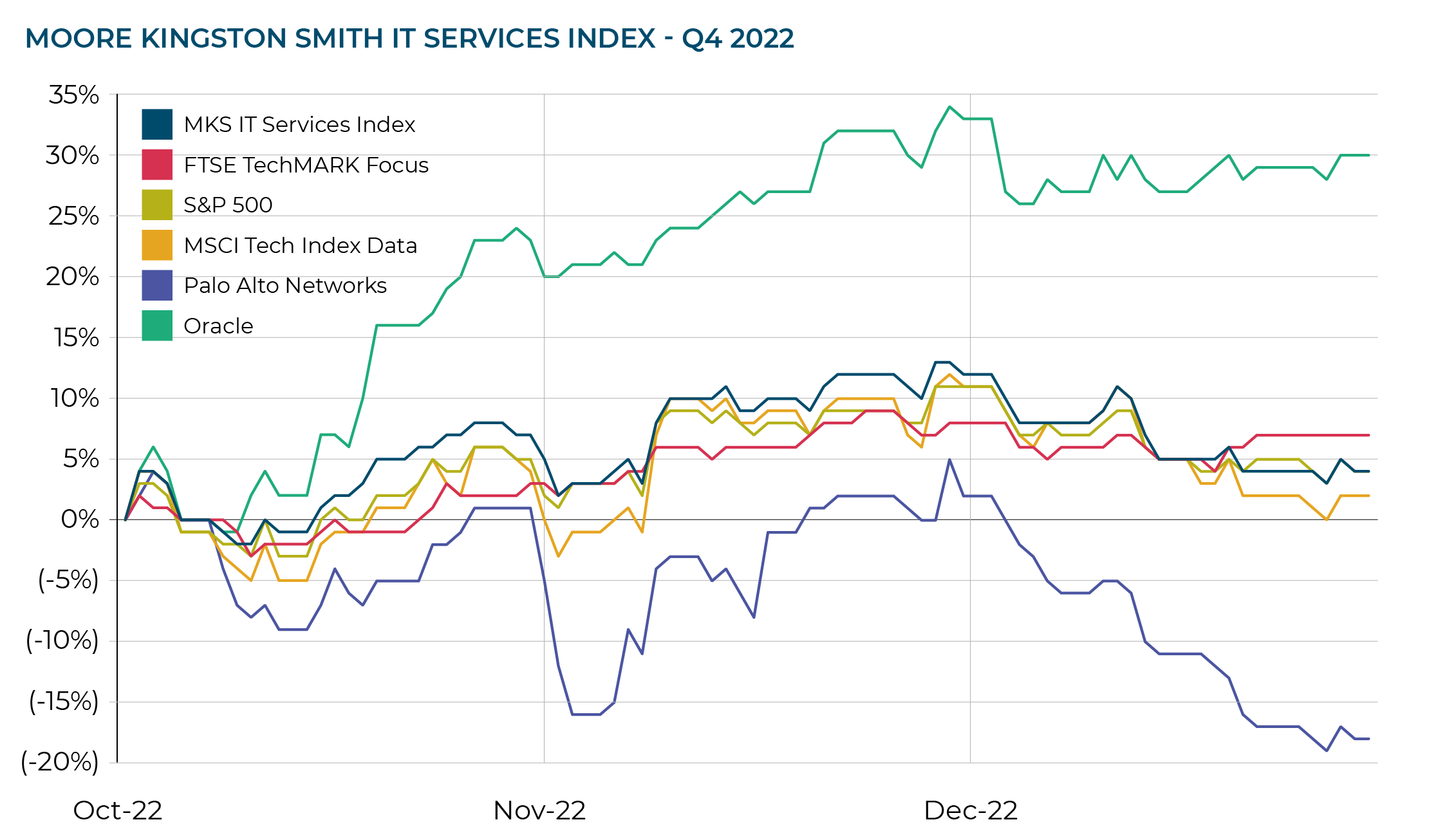

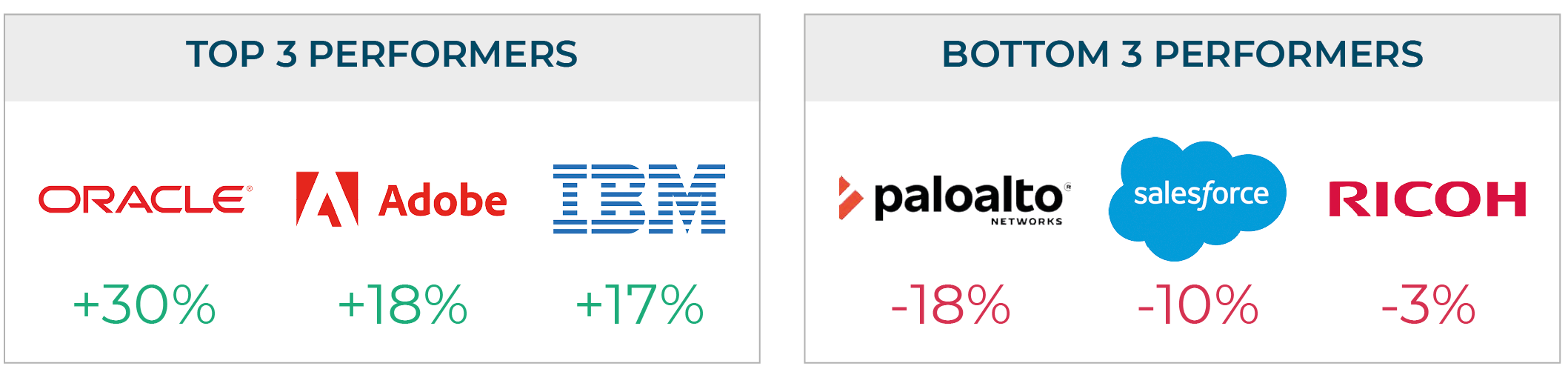

Moore Kingston Smith has plotted the share price performance of 21 listed IT services groups, which together make up the Moore Kingston Smith IT Services Index, to see how they have fared in the last quarter compared with the S&P 500 index and two specialist technology indices. We have also highlighted the share price movements of Oracle and Palo Alto Networks, which represent the best and worst performance from our sample this quarter.

The final quarter of 2022 saw global stock markets rally, after a couple of poor quarters. The S&P 500 was up by 4% in Q4, having experienced declines of 6% and 9% in Q3 and Q2 respectively. The Moore Kingston Smith IT Services Index matched the market and was also up 4% across the period. This was ahead of one of our technology-specific indices, the MSCI World Information Technology index, which failed to match the market, with only a 2% increase in the quarter. However, the best performing index was yet again the FTSE TechMark Focus index (which focuses on companies with market capitalisations under £4 billion) ending Q4 up 7%.

Of the 21 companies that make up the Moore Kingston Smith index, thirteen ended the quarter in positive territory, with just over a third seeing their share prices fall. The star performer in Q4 was Oracle, up 30% in Q4, following its quarterly earnings release which revealed that its revenues were up 18% year on year, well ahead of market expectations.

Conversely, our worst performer in Q4 was Palo Alto Networks, which saw its share price decline by 18% across the period. Palo Alto underwent a three-for-one stock split in September 2022, in a bid to enhance its liquidity, but it did not help the company’s share price, which saw a slow but steady decline from October to December. Two of Palo Alto’s directors sold stock in October, which may not have helped with investor confidence, and a number of brokers cut their target price for the stock in November.

“We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in IT services companies to consider their exit options.”

Nick Thompson, Corporate Finance Partner at Moore Kingston Smith

Contact us

Methodology

In compiling our deal tracker we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller or both. Where the target company is classified as IT consulting, outsourcing and distribution, or data and security, the transaction is entered into the deal tracker. We classify IT consulting into four sub-categories, outsourcing and distribution into eight sub-categories, and data and security into three sub-categories.

As well as the data extracted from Pitchbook we have used information from the following sources: idoxgroup.com, sage.com, insidermedia.com, osf.digital, intercede.com, cnbc.com, marketbeat.com, babble.cloud, pinnacle-online.com, pehubeurope.com, quoteddata.com.

Any assumptions, opinions and estimates expressed in the information contained in this content constitute the judgment of Moore Kingston Smith LLP and/or its associated businesses as of the date of publication and are subject to change without notice. This information does not constitute advice and professional advice should be taken before acting on any information herein. No liability for any direct, consequential or other loss arising from reliance on the information is accepted by Moore Kingston Smith LLP or any of its associated businesses.