M&A in the UK IT services sector – Q3 2023

Investors tempted back to the market

![]()

158

deals completed

![]()

-3%

Moore Kingston Smith

IT services index

![]()

63%

deals backed by PE

Our view of the market

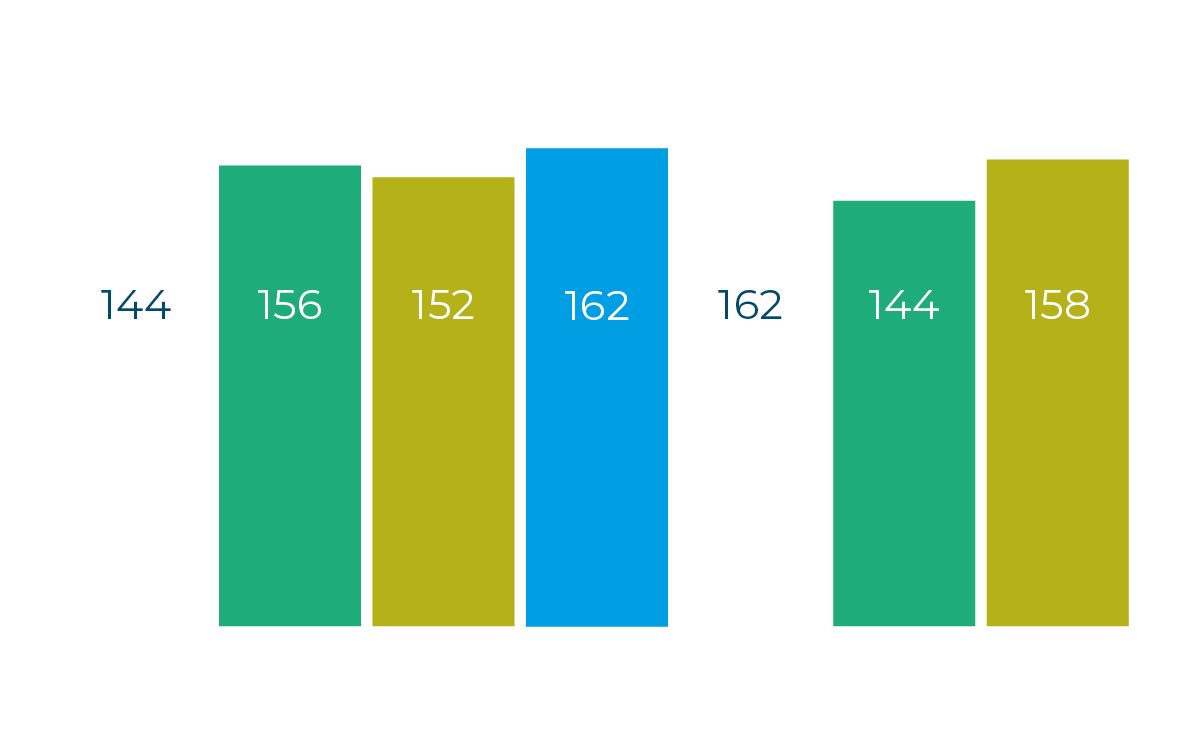

Last quarter, we reported on a dip in the number of UK IT services deals. This reflected the fact that acquirers were exhibiting caution, reacting to rising interest rates and persistently high inflation. However, Q3’s data reveals a turnaround in the market – 158 UK IT services deals were recorded in Q3 2023, a 10% increase on the previous quarter. The summer months often see less activity but it appears that investors in the UK IT services sector cut their summer holidays short this year, tempted back by the market’s prospects.

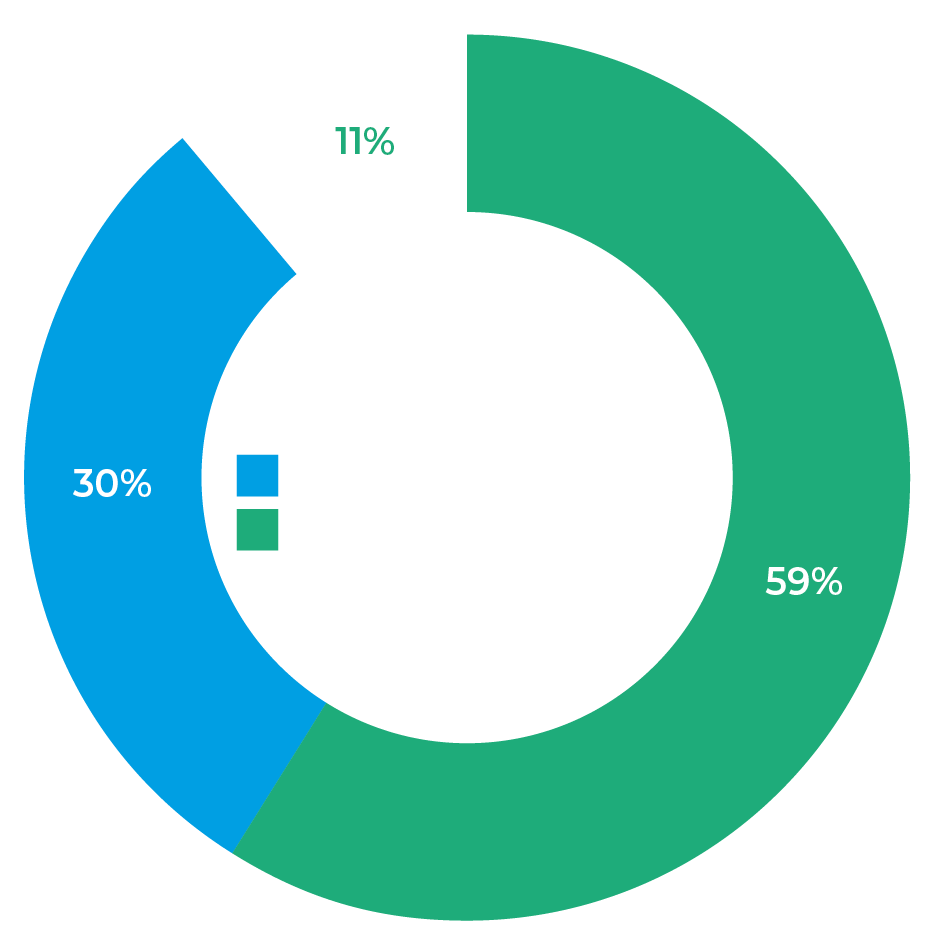

The percentage of transactions involving private equity has ticked up this quarter. However, it is still running below recent levels, probably because leveraged deals are harder to put together in a high-interest rate environment.

Nick Thompson, Partner, comments: “We are delighted to see an increase in the number of deals done in Q3, in what is traditionally a somewhat quieter quarter. Investors do face economic challenges but clearly the positive outlook for the sector as a whole means they are willing to face these challenges down, so as not to miss out on opportunities.”

Quarterly deal volume

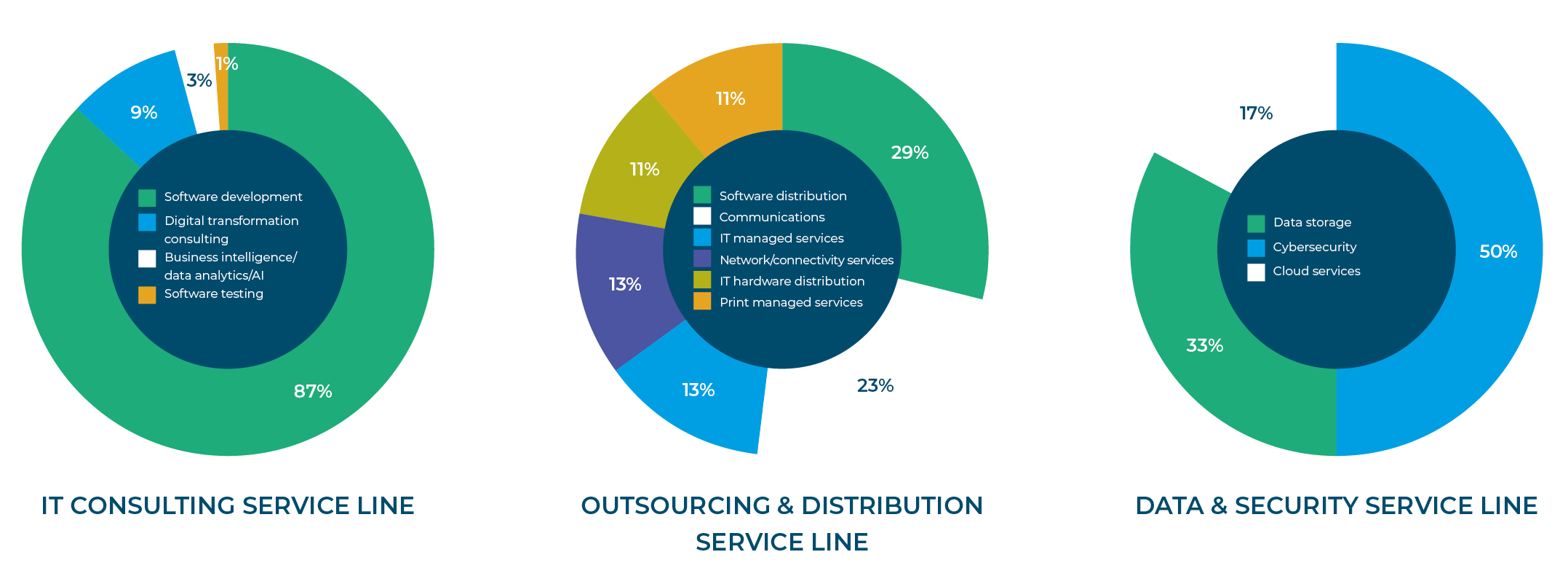

Trending: cyber security

Cyber security deals accounted for 50% of all the Q3 transactions we recorded in the data and security space, up from the 29% we recorded

in Q2. As cyber security becomes increasingly important to end clients, we are seeing managed service providers using cyber security specialists as a service and partnering with these firms, rather than developing their own cyber security offering within their service portfolio.

Two notable UK cyber security deals in Q3 were the acquisition of the UK identity validation and mobile fraud prevention specialist, Phronesis Technologies, by TMT Analysis and the acquisition of the cyber attack simulation platform, Covert Swarm, by Beech Tree Private Equity.

“The elevated number of cyber security deals in Q2 is reflective of the focus businesses are placing on their cyber security posture to mitigate the risk of business interruption and reputational damage in the wake of increasing numbers of high-profile cyberattacks. We expect this trend to continue as the complexity of cyber security increases and solutions continue to evolve.”

Matt McRae, Director at Moore Kingston Smith

Spotlight on: communications

Communications deals made up 23% of all the Q3 transactions we recorded in the outsourcing and distribution space, significantly up from the 13% that we recorded in Q2. Acquirers are increasingly targeting this service line, as well as communications specialists expanding into other IT services disciplines.

Serial acquirer Croft Communications made four acquisitions in Q3: IT support specialists Boldfield; communications business Direct Line; telephony technology specialists ClearLink; and communications company Blackstar. These four deals bring Croft’s total to an impressive eight deals completed in 2023 so far.

Deals by sector

“Despite the UK’s economic headwinds, the IT services sector continues to be of significant interest to both trade and private equity. The relentless push for talent, market share and a broader portfolio of services remain as key drivers for growth by acquisition.”

James Paton- Philip, Partner at Hill Dickinson LLP

Private equity activity

Private equity-backed investments accounted for 63% of all IT services deals completing in Q3 2023, which is up on Q2. However, it is not quite back to the levels we recorded in the first quarter of this year or throughout 2022.

New investments in the quarter included specialist software and services-focused investor FPE Capital’s buy-out and merger of two UK Oracle NetSuite partners – NoBlue and Elevate2. Following the merger in June, to form NoBlue2, FPE Capital funded the subsequent acquisition in September of another NetSuite solution partner, BrightBridge Solutions.

Percentage of PE-backed deals

Notable UK mid-market deals

InstaDeep, a UK AI and machine-learning company, was acquired by Nasdaq-listed German biotech business BioNTech, in a deal worth c. €500 million.

Capita sold five non-core software businesses, including data and compliance solutions platform Synaptic, and resource-software Retain, for a combined enterprise value of £33 million, to LSE-listed acquisition vehicle AdvancedAdvT.

The LSE-listed manufacturer of customised electronics, discoverIE Group, bought Silvertel, a Newport-based designer of differentiated high- performance power-over-ethernet modules, in a deal worth up to £44 million.

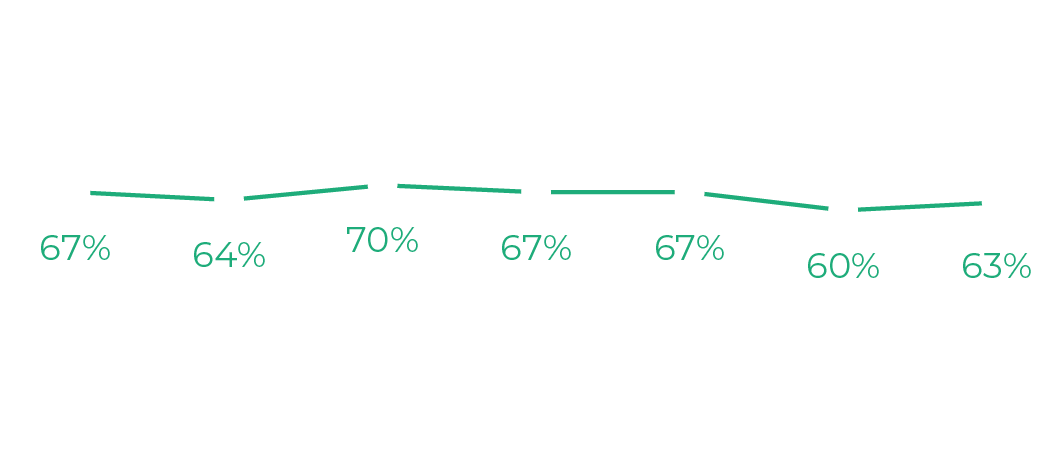

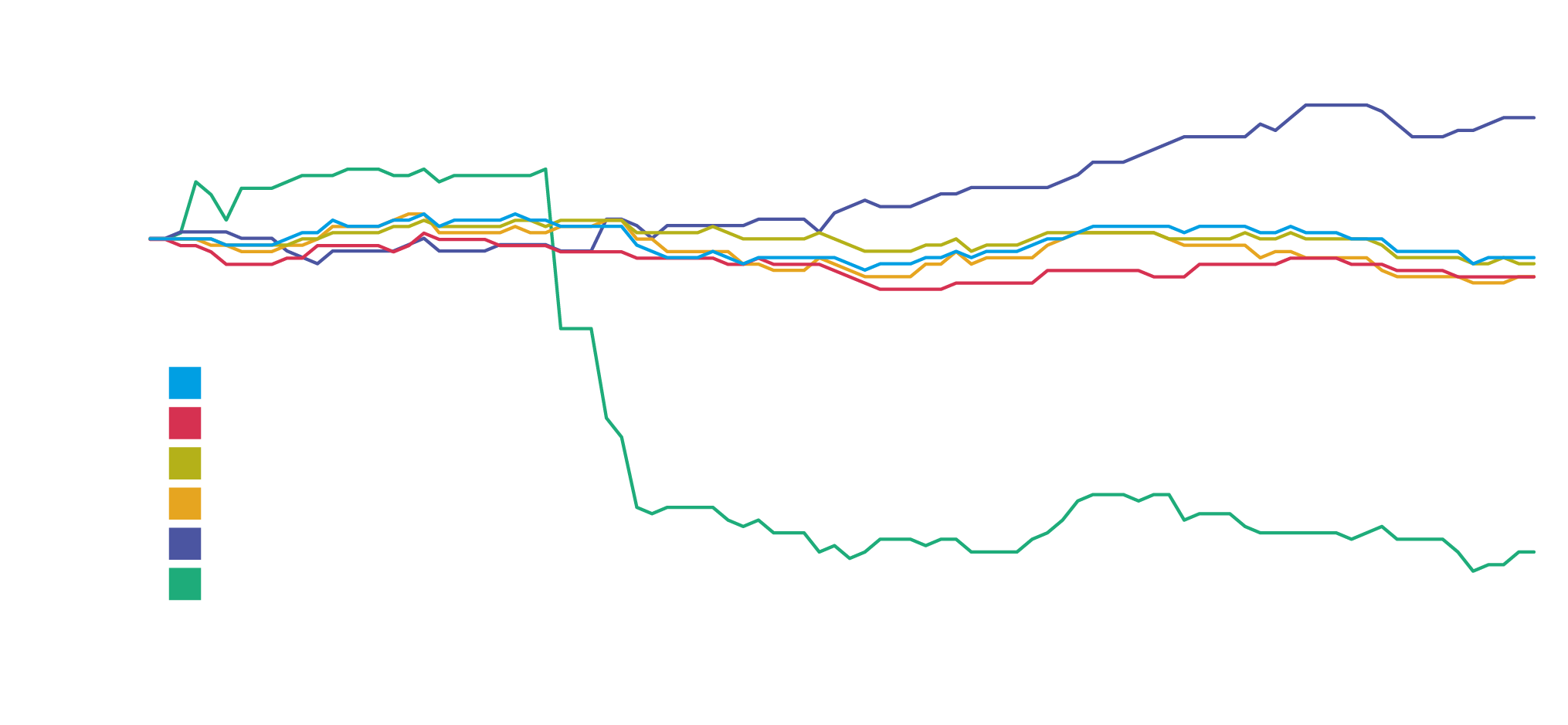

Stock market performance

After a positive first six months of 2023, global stock markets fell back over the summer. The S&P 500 was down by 4% in Q3. The Moore Kingston Smith IT Services Index slightly outperformed the market, down only 3% across the period. This was also ahead of our technology-specific indices, the FTSE TechMark Focus index and the MSCI World

Information Technology index, both of which ended Q3 down a disappointing 6%.

Of the 21 companies in the Moore Kingston Smith IT Services Index, twelve ended the quarter in positive territory. The star performer was NEC, up 19% in Q3, which had already seen a 37% increase in its share price in Q2. AI specialists have been the darlings

of the markets in recent months. The share price of Japan’s AA-rated IT services group NEC appears to have benefited from its decision to look to AI

to provide solutions in various areas, from retail to traffic management.

Our worst performer in Q3 was Atos, which saw its share price decline by 49% across the period. At the end of July, the struggling French tech group

reported a wider than anticipated half-year loss. This was due to restructuring costs related to its planned split into two separately listed companies and its shares slumping as a result.

Moore Kingston Smith IT services index

Sector subcategories