M&A in the UK IT services sector – Q4 and 2023

IT services sector outperforms as valuations increase

![]()

156

deals completed

![]()

+11%

Moore Kingston Smith

IT services index

![]()

66%

deals backed by PE

Our view of the market

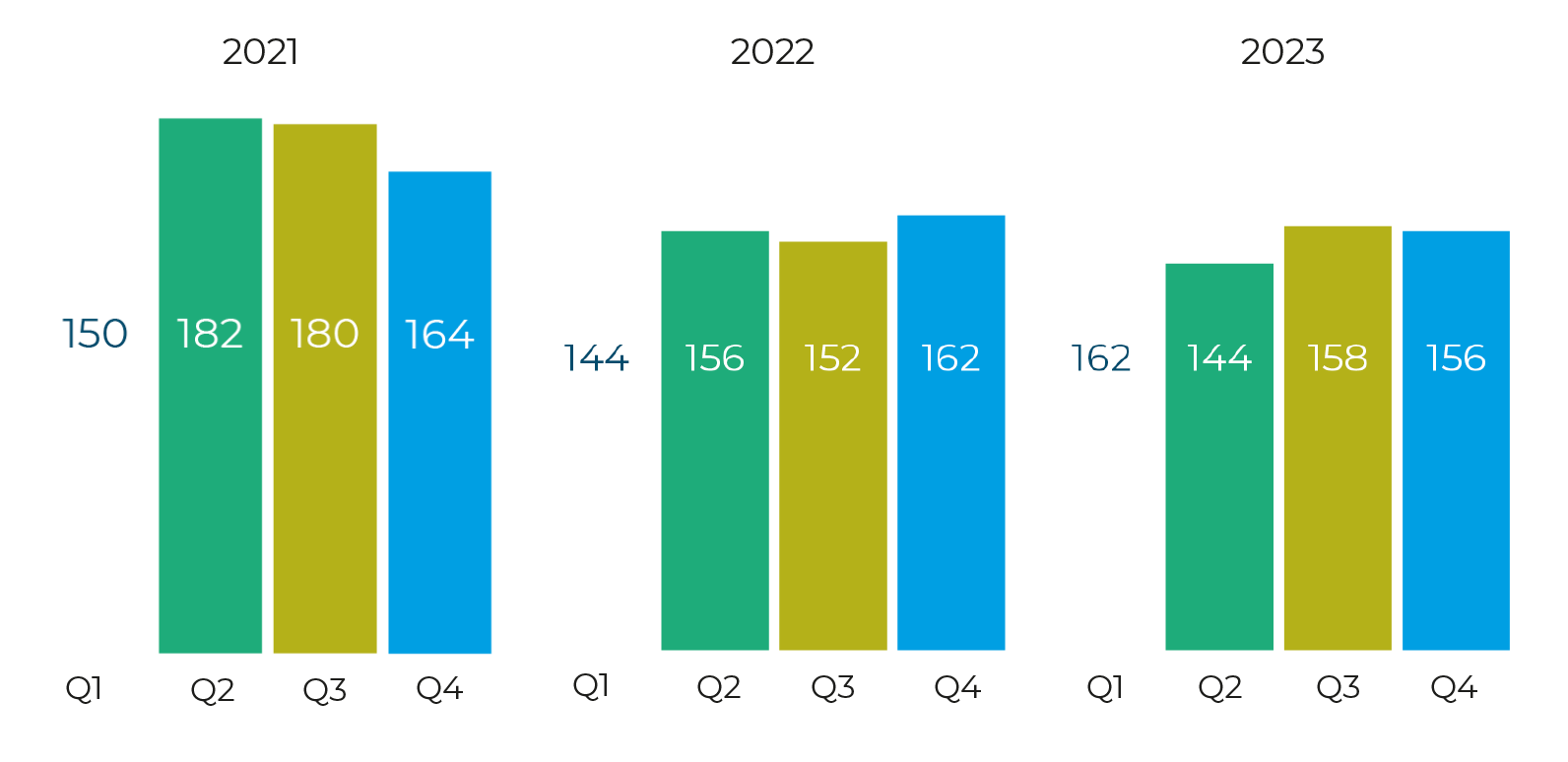

2023 was a good year for M&A within the IT services sector. We counted a total of 620 UK deals in 2023, which is marginally ahead of 2022’s total but not quite up to the records set in 2021.

After a blip in Q2 due to the combination of high- interest rates and general global uncertainty, Q3 and Q4 both delivered strong quarters for deal volume and we expect this to continue into 2024. This compares favourably with the pattern we have seen in other sectors, where there was a marked decline in completed M&A transactions in the second half of the year. We think this is due to the impact of high interest rates on leveraged transactions and general market uncertainty. It appears that the UK IT services sector is so attractive that it is just too tempting for investors, who have put aside such concerns and continue to transact.

Annual deal volume

“M&A in the IT services sector held up extremely well in 2023, outperforming many other industries. As the economic environment continues to improve, we expect to see many more transactions in 2024.”

Nick Thompson, Partner

2024 outlook: artificial intelligence

One of the key drivers of IT services M&A has been AI, and the need for acquirers to expand their skills in this area in response to customer demand. AI has increasingly become an integral part of the IT services offer, providing new opportunities for innovation and growth. We expect to see this trend to continue in 2024.

In Q4, Moore Kingston Smith advised full-service conversational AI agency Vixen Labs on its sale to House 337, part of AIM-listed Next 15. The acquisition is House 337’s first strategic acquisition, following its formation in 2022 through a merger of two specialist creative agencies.

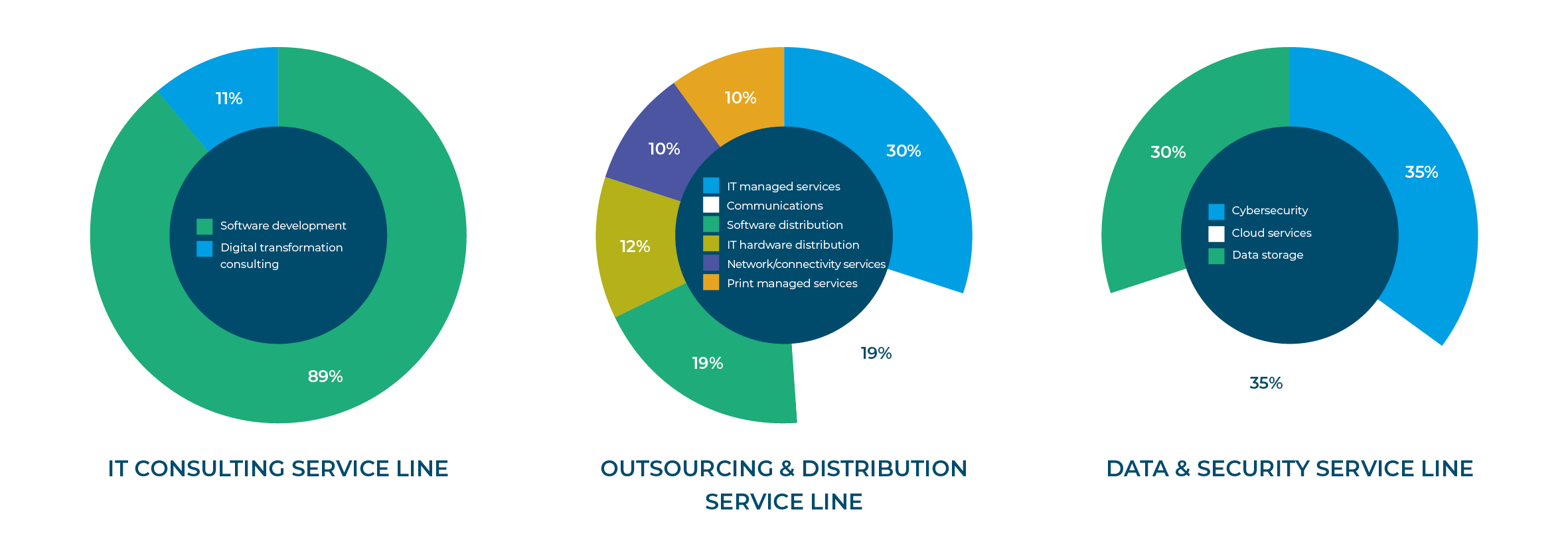

Q4 deals by sector

Spotlight on: cloud services

Cloud services deals accounted for 35% of all the Q4 transactions we recorded in the data and security space, more than double the 17% we recorded in Q3. According to technology consultants Pluralsight’s recent survey, the market is seeing a rapid adoption of cloud services. More than 70% of organisations report that more than half of their infrastructure is in the cloud, 44% of organisations are adopting the latest cloud products as soon as they are available, and 65% of organisations say their cloud environment is multi-cloud.

A significant UK cloud services deal in Q4 was the announced merger between Cloud Technology Solutions and Appsbroker to form the largest Google Cloud-only digital consultancy in Europe. The newly merged company is backed by Marlin Equity Partners and NorthEdge Capital.

Mike Conner, Founder and CEO of Appsbroker

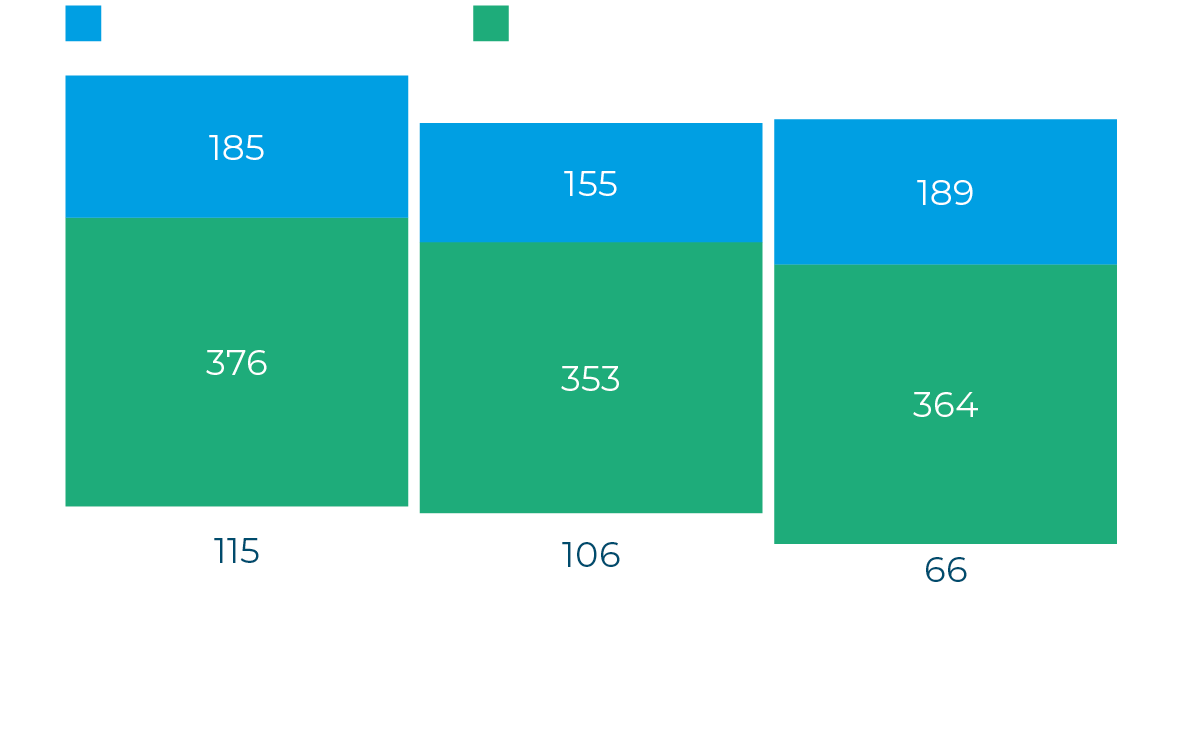

Private equity activity

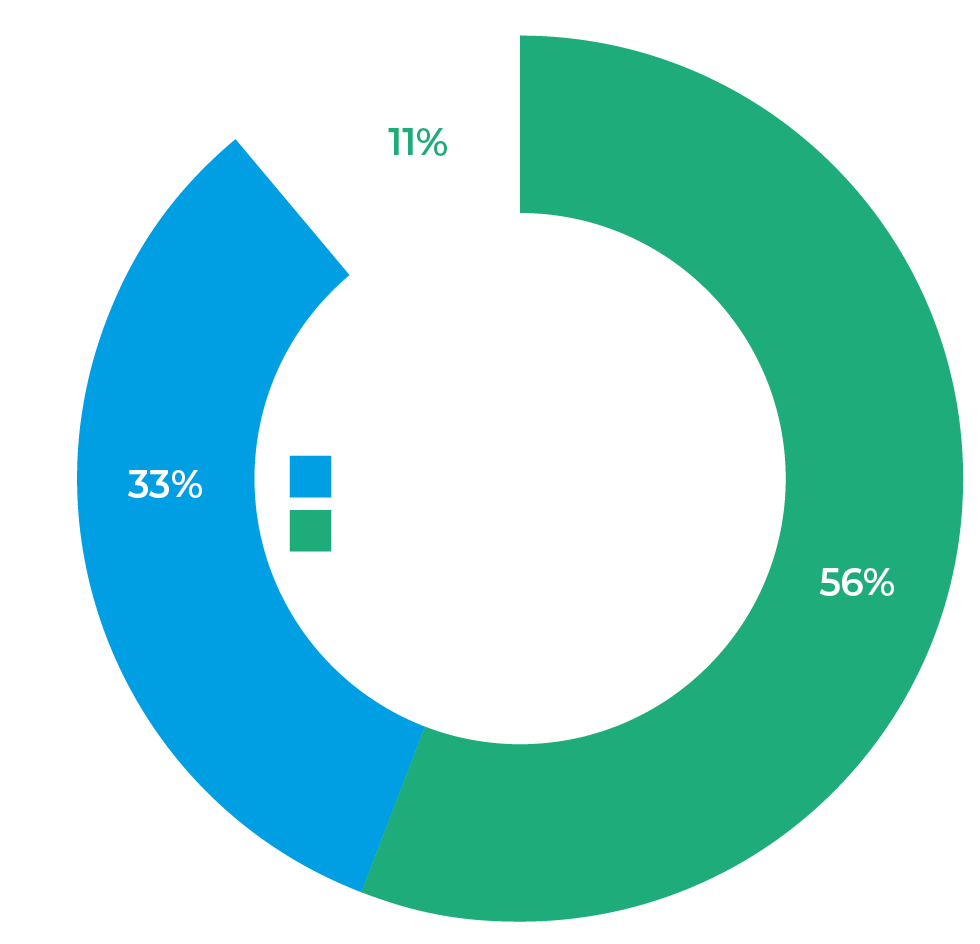

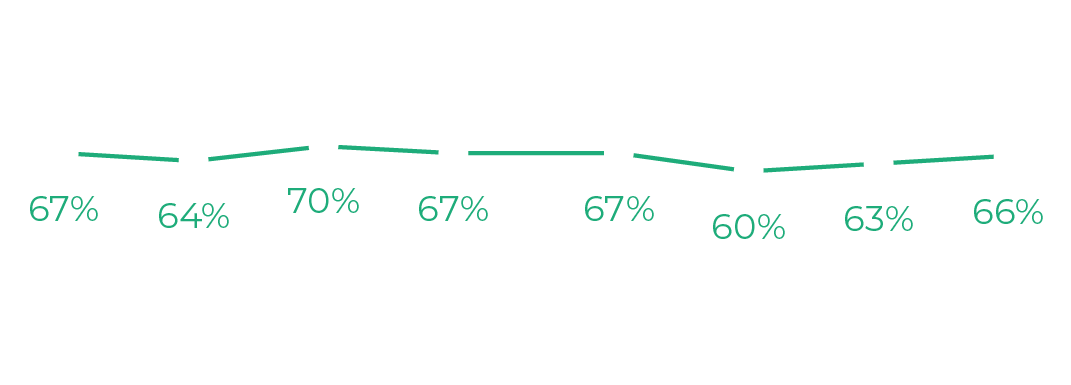

Of the 156 transactions we recorded in Q4, 66% involved private equity investment, either directly or via an existing portfolio company. This is an improvement on the levels we saw in the previous two quarters, and almost back up to the level we saw in Q1.

Looking at the year as a whole, we find that private-equity backed investments accounted for 64% of the 620 deals we recorded. This is down on the 67% we reported in 2022 and the 71% that we saw in 2021. Private equity remains the fundamental driver of M&A activity in the IT services market. However, high interest rates in 2023 have made leveraged transactions relatively less affordable and may have led to this slight decline in activity.

Percentage of PE-backed deals

“The IT services sector has a dedicated PE investor following. With the expectation that interest rates have now peaked and may start to fall in 2024, I think we can expect to see leveraged PE-backed transactions return to the market, fuelling more M&A.”

Nick Thompson, Corporate Finance Partner

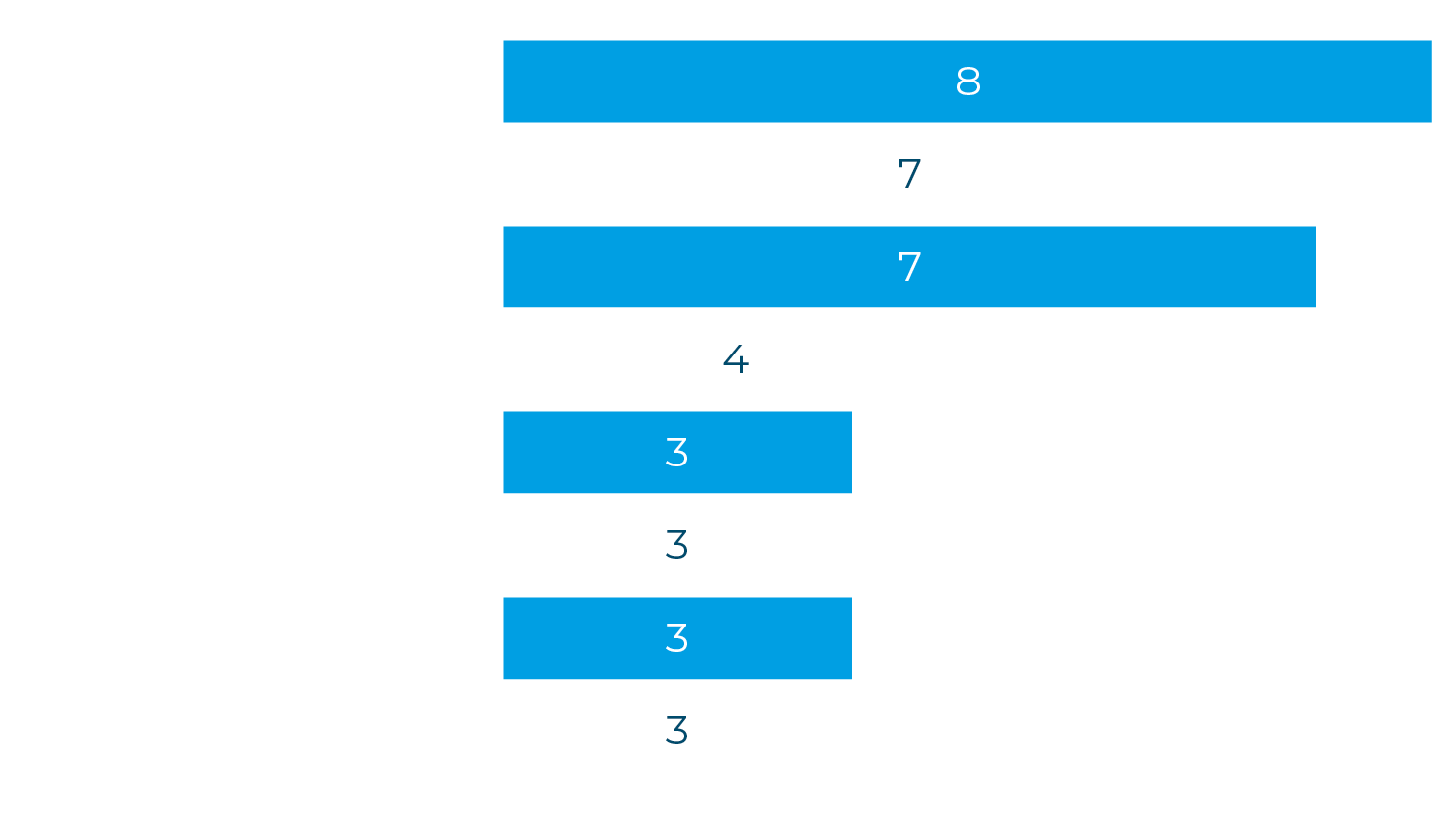

Active aquirers

Looking back at the deals we recorded in 2023, we see several organisations who were on an acquisition spree, concluding several transactions in the year. Top of our leader board was UK strategic acquirer Babble Cloud who made eight acquisitions in the year. Babble, backed by Graphite Capital, was closely followed by two other UK strategic acquirers: Croft Communications and Flotek Group, both completing seven transactions. This continues the trend of highly active, often private equity backed businesses looking to consolidate the UK mid-market space.

Q4 2023 Top investors

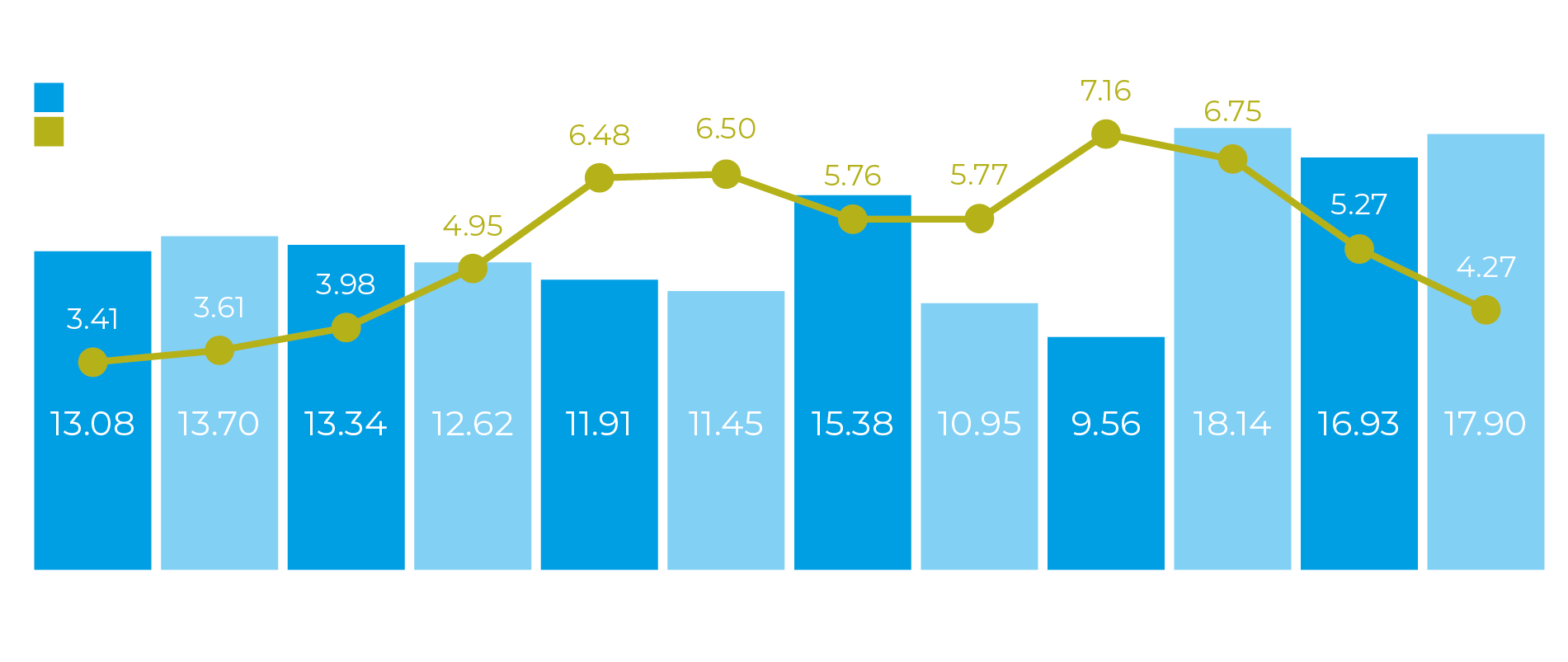

Valuations

Throughout the year, we analysed those IT services deals where pricing details can be determined (unfortunately most state “terms were not disclosed”). We found that in the last three quarters of 2023, EBITDA multiples increased dramatically from the levels we saw in Q1 and indeed those of the two prior years..

Revenue multiples declined at the same time but at nothing like the same rate. This implies that acquirers were prepared to pay significantly more for less profitable businesses than they were in 2022.

Quarterly average multiples

Notable UK mid-market deals

![]()

Just Develop It, a technology investment company, acquired Total Security, an online security company providing real time antivirus, online security and privacy products from System 1, in a transaction worth c. $340 million. The deal was backed by US PE house Avance.

Archimed, a French global healthcare private equity investor, concluded its £203 million take-private bid for AIM-listed UK-based drug development software developer Instem. The deal went ahead despite the opposition of two of Instem’s major shareholders, Liontrust and BGF, who felt the offer undervalued the business.

AIM-listed secure data erasure and mobile lifecycle solutions provider Blancco Technology was taken private by US PE house Francisco Partners, in an all-cash offer worth c. £175 million.

Outlook

2023 could not match up to the records set back in 2021. However, taken as a whole, it was still a great year for M&A deals in the UK IT services sector. The sector seemed largely unaffected by macroeconomic factors that have impacted M&A activity in other industries, buoyed by a resurgent market in publicly quoted IT stocks and significant PE interest. Valuations have gone up because of increasing competition for assets.

Inflation rates in the UK have come down significantly from their 2023 highs, and there is an expectation that interest rates have now peaked and could start to reduce. More positive news about interest rates should make leveraged transactions more affordable, thereby providing a fillip to the M&A market.

2024 will see a general election in the UK, the Olympics in Paris and a presidential election in the US, all of which may lead to an increase in investment activity. We therefore expect the coming months to be a positive environment for those companies and investors looking to do deals in the IT services sector.

Quarterly deal volume

Stock market performance

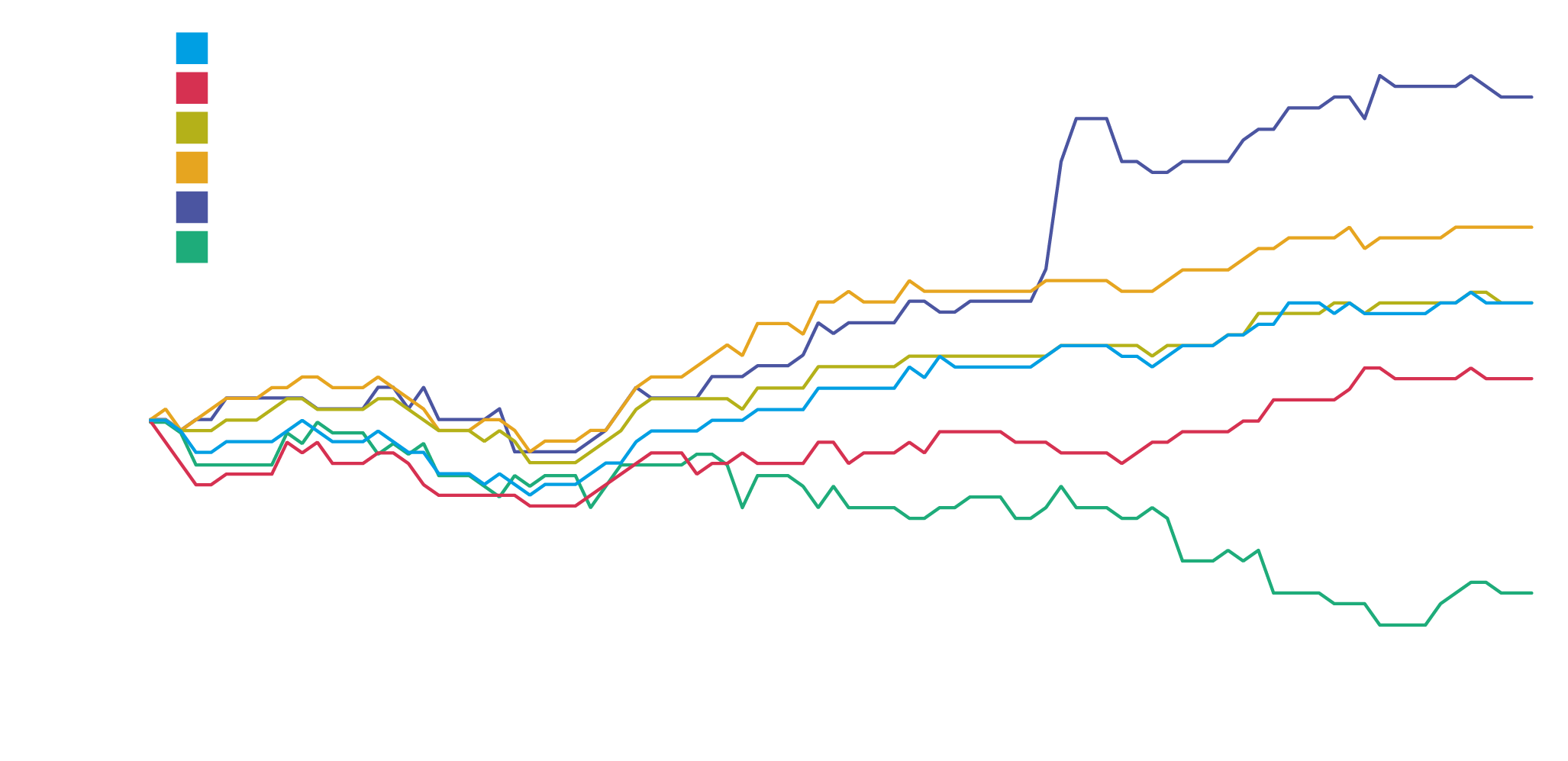

Global stock markets rallied in the final quarter. The S&P 500 was up by 11% in Q4. The Moore Kingston Smith IT Services Index was also up by 11% in the same period. This was significantly ahead of one of our technology-specific indices, the FTSE TechMARK Focus Index, which was only up

4%, but some way behind the MSCI World Information Technology Index, which ended Q4 up an impressive 18%.

Of the 21 companies in the Moore Kingston Smith IT Services Index, sixteen ended the quarter in positive territory. The star performer was Salesforce, up 30% in Q4, to end 2023 98% up on its share price at the beginning of January. In November, the company said it expected its profits to exceed market expectations. In December, some influential analysts upgraded their rating on Salesforce, saying they could see an additional 30% or more upside as the software maker’s shares continue to ride the AI wave.

Our worst performer in Q4 was Ricoh, which saw its share price slide by 16% across the period. The decline was gradual and does not appear to have been the result of any individual announcement by the company. However, it may be a reflection of investor sentiment turning away from hardware to software-oriented enterprises.

Moore Kingston Smith IT services index

Q4 sector subcategories