Investors start to apply the brakes – Q2 2022 growth capital update

Growth capital update – a review of Q2 2022

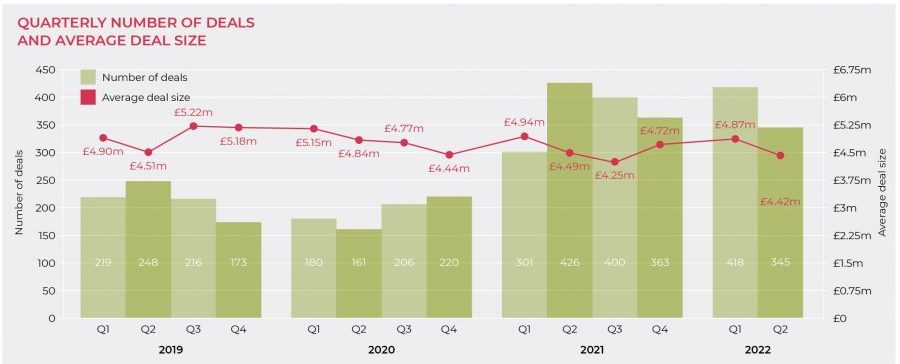

2021 was an exceptional year for the UK’s growth capital market. Q1 2022 got this year off to a flying start. But it couldn’t go on for ever – the market contracted in Q2, although activity is still at a very high level when viewed in the wider historical context.

According to our latest research into UK private companies raising between £1 million and £20 million of growth equity capital each, 345 UK businesses raised a total of £1.524 billion in the second quarter of 2022. The average deal size was £4.42 million.

In the first quarter of 2022, we saw 418 deals with an average deal size of £4.87 million, and £2.035 billion raised in total. Our Q2 2022 figures therefore represent a 17% decrease this quarter in the number of deals completing and a 25% decrease in the overall amount of growth capital being raised.

A review of Q2 2022

The decrease in activity in Q2 was most likely a result of investor concerns about various macroeconomic and geopolitical factors, such as the situation in Ukraine, commodity shortages and price increases, higher than anticipated inflation figures and declines in retail sales. The number of transactions completing in Q2 2022 was the lowest we have seen since Q1 2021.

However, even this reduced level of activity is still far ahead of what we saw throughout the whole of 2019, so it is certainly not a depressing statistic when viewed against historical norms. It simply means that 2021, which was a phenomenal year for the UK’s growth capital market, might not be outdone by 2022. It all depends on whether we see an uptick in activity in the second half of this year or whether caution continues to impose a drag on transactions.

John Cowie, Head of Growth Capital at Moore Kingston Smith, comments: “It would appear that institutions are beginning to take a more guarded approach to investing – unsurprising in the circumstances – but we mustn’t forget how high the bar was set in 2021.

“It would appear that institutions are beginning to take a more guarded approach to investing.”

It feels like there may be further contraction in the number of deals and the amount invested in the latter part of the year as investors tighten the purse strings, but they still have capital to deploy for the right opportunity. We’ll be watching the data with interest.”

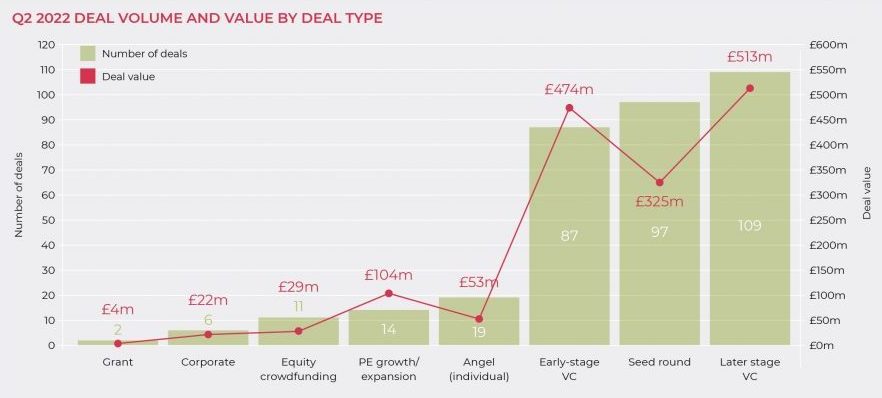

As far as the types of deals that were most common in Q2 2022 are concerned, later-stage VC achieved the top spot, accounting for 26% of all deals by number and 25% by value. Seed rounds were the second most common types of transactions.

The market remains hungry for tech deals

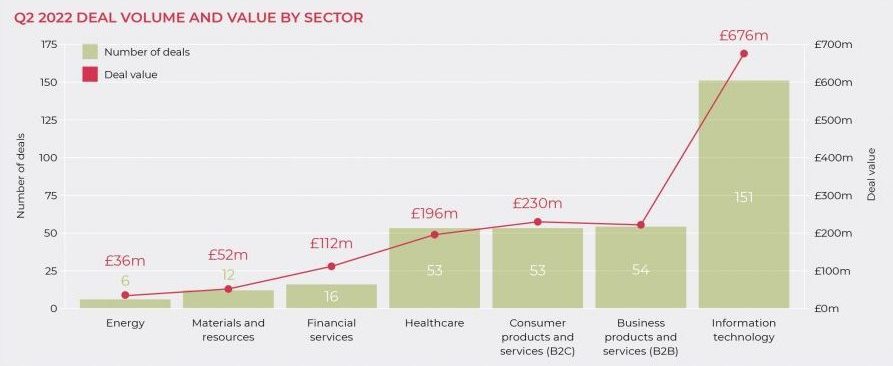

Technology retained its position as the most popular sector for investors in Q2 2022, accounting for 44% of all transactions both by volume and by value. Investor appetite for B2B, B2C and healthcare businesses also remained strong.

Notable deals in the tech space in Q2 included the £15 million investment by Maven in ProofID, a specialist provider of identity and access management services. Founded in 2014, ProofID provides consultancy and managed services for enterprise customers across the UK, Europe and North America from its headquarters in Manchester and a US office in Colorado Springs. Data security continues to be a top priority for organisations in today’s digital age as they protect themselves from more sophisticated cyber attacks and need to comply with increasing regulations. The investment will support the company’s acquisition strategy and enable further investment in its sales, marketing and technical resources.

“Technology retained its position as the most popular sector for investors in Q2 2022, accounting for 44% of all transactions both by volume and by value.”

Q2 also saw the announcement by London-based SLAMcore that it had raised $16 million in Series A capital to deliver low-cost spatial understanding technology to robots, autonomous machines, consumer electronics products and the metaverse. The company’s technology combines AI with consumer-grade cameras, sensors and processors to solve the complex challenges of mapping and navigating for a wide range of autonomous machines and devices. The funding round was led by ROBO Global Ventures and Presidio Ventures who invested alongside Amadeus Capital Partners, Global Brain, IP Group, MMC and Octopus. Strategic investors Samsung Ventures, Toyota Ventures and Yamato Holdings also joined the round.

Active investors in Q2

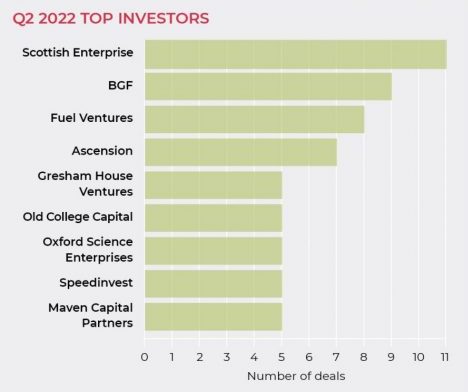

Scottish Enterprise’s investments in Q2 were largely in the healthcare and pharmaceuticals arena and included its follow-on participation in an £8 million investment round, led by BGF and Scottish National Investment Bank, into Elasmogen. Elasmogen is a biopharmaceutical company discovering and developing new therapeutics using technology based on molecules naturally found in shark immune systems, which are the equivalent of human antibodies but smaller and more stable. Before this new round, Elasmogen had secured grant funding from Scottish Enterprise and the Biotechnology and Biological Sciences Research Council. It had raised upwards of £9 million from investors such as Deepbridge Capital and grant funding bodies such as Innovate UK, to support the development of its technology and facilitate growth into key markets.

Scottish Enterprise also participated in a £9 million funding round led by Epidarex Capital into University of Edinburgh spin-out Kynos Therapeutics, which is developing treatments for critical illness post-surgery, in conditions driven by inflammation and in cancers where inflammation is preventing the immune system from fighting back. This financing will be used to build out its core team and fund preclinical indication expansion studies, as well as initiate development of oral formulations of its treatments.

As well as leading the Elasmogen transaction, BGF’s Q2 deals included a £19 million investment into bar operator Arc Inspirations, which operates the brands Banyan Bar & Kitchen, BOX and Manahatta. The investment will support the company’s ambition to double the business from its current 18 venues, delivering at least four new site openings per year over the next three to five years.

BGF also joined Gresham House Ventures in a £10 million funding round into Panthera Biosciences which recruits patients and runs clinical trials on behalf of pharmaceutical companies. It made a £10 million follow-on investment into Lisburn-based Mzuri Group –which trades as Decora – and designs, engineers, manufactures and distributes window blinds and shutters. It also invested £9 million into Triangle Fire Systems which specialises in the design, installation and maintenance of sprinkler systems in domestic, commercial and retail buildings across the UK.

Outlook

2021 was a record-breaking year for the UK’s growth capital market. While Q1 2022 continued in much the same vein, we have now started to see a slowing down in Q2, reflecting investor concerns about what is currently happening in Ukraine and other macroeconomic and geopolitical factors, such as increasing inflation, worries about a recession and concerns about global warming.

However, the market is still very active and we remain optimistic about the outlook for 2022 as a whole. Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith, says: “We are still positive about the outlook for the months ahead. Even if there is a period of economic uncertainty, the era of technological transformation will continue to drive transactions with high-performing and differentiated businesses, particularly tech-enabled ones, attracting the attention of investors.”

We are in contact with an ever-growing pool of private equity investors with substantial amounts of capital to deploy, so we expect the market to prove resilient in the coming months.

“The era of technological transformation will continue to drive transactions with high-performing and differentiated businesses, particularly tech-enabled ones, attracting the attention of investors.”

Contributors

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner. Contact us to find out more about our raising finance and growth capital services.

We also assist investors, providing expert advice throughout the acquisition and investment processes. Our team helps identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology

Moore Kingston Smith’s research analyses transactions by UK-based companies that involve the issue of less than 50% of equity share capital to third parties and funds raised of between £1 million and £20 million. Accordingly, these numbers do not include senior debt and mezzanine debt fund raisings and smaller fund raisings by companies and start-up funding unless more than £1 million is raised. Start-up funding is generally significantly less than this amount.

The research aims to capture all transactions by UK companies that fall within the criteria. Inevitably there will be transactions that have not been captured. The research is based on data extracted from Pitchbook and information from the following sources: robotics247.com, proactiveinvestors.co.uk, bgf.co.uk, uktechnews.info, nordic9.com and techcrunch.com.