M&A in the UK IT services sector – Q1 2023

An encouraging start to the new year

![]()

162

deals completed

![]()

+14%

Moore Kingston Smith

IT services index

![]()

67%

deals backed by PE

Our view of the market

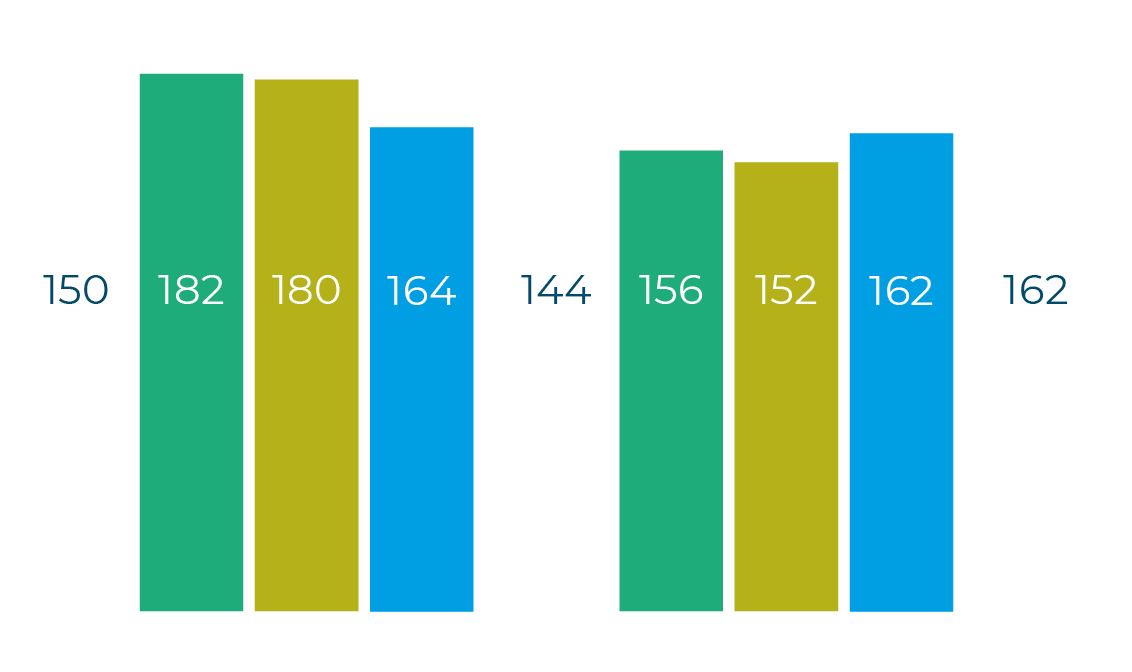

162 UK IT services deals were recorded in Q1 2023, 13% higher than the equivalent period in 2022, and 8% up on the same quarter in 2021, which was a record year for M&A.

2023 appears to be off to a very good start. Private equity interest in the sector, that we thought might start to soften with a rise in interest rates, has held firm, and cross-border interest in UK technology companies remains strong.

Nick Thompson, Partner: “Based on our recent deals activity and our insight into what buyers and investors are looking for, we are optimistic that demand for good IT businesses will hold strong in 2023. Whether that demand will be strong enough to protect valuation multiples that are under pressure due to high interest rates remains to be seen.”

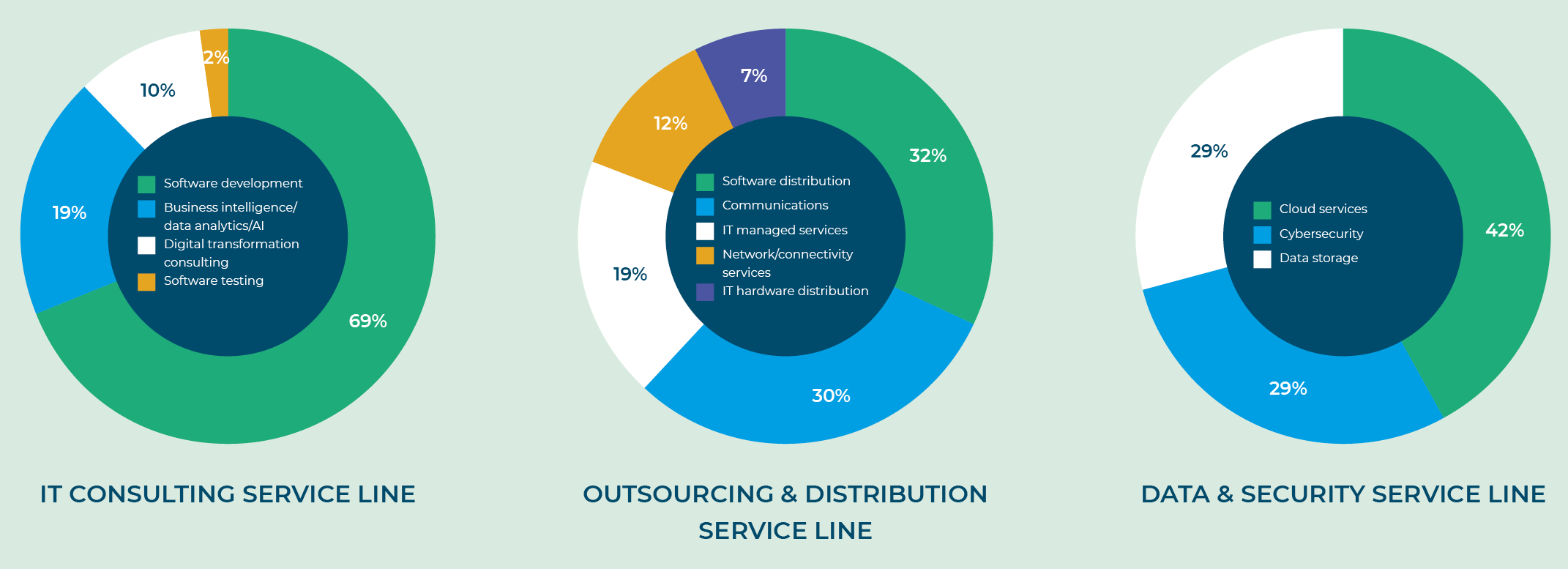

Quarterly deal volume

Trending: communications

Communications deals made up 30% of all transactions we recorded in outsourcing & distribution. Acquirers are increasingly targeting this service line, as well as communications specialists expanding into other IT services disciplines.

Several UK communications technology and cloud communications specialists made acquisitions last quarter Onecom, backed by private equity house LDC, made two; serial acquirer Croft Communications made two in IT managed services; while Graphite Capital-backed Babble, one of the most prolific acquirers in 2022, made a further five.

“As businesses continue to evolve their cloud infrastructure, we expect hosted communications to become part of the all-inclusive IT managed service offering and, with that, increased M&A activity involving these providers.”

Katharine Stone, Corporate Finance Director

Spotlight on: artificial intelligence

AI has become an integral part of the IT services sector, offering new opportunities for innovation and growth. Apart from automating tasks, AI enables organisations to analyse vast amounts of data in real time, enhancing decision-making and improving efficiency and accuracy. It has also revolutionised cyber security regarding threat detection and response.

AI-related deals in Q1 include: Lansweeper, a Belgium-based provider of monitoring solutions, acquiring UK automated vulnerability management company RankedRight; and Candid, a Bristol-based insurtech company (part of the global CLARK Group) purchasing Anorak, a fully-automated life insurance advice platform.

Deals by sector

“Private equity remains the key driver of deal-doing within the UK IT services sector. Institutional investors are making new stand-alone investments and also backing their existing portfolio companies in their buy-and-build strategies.”

Matt McRae, Corporate Finance Senior Manager

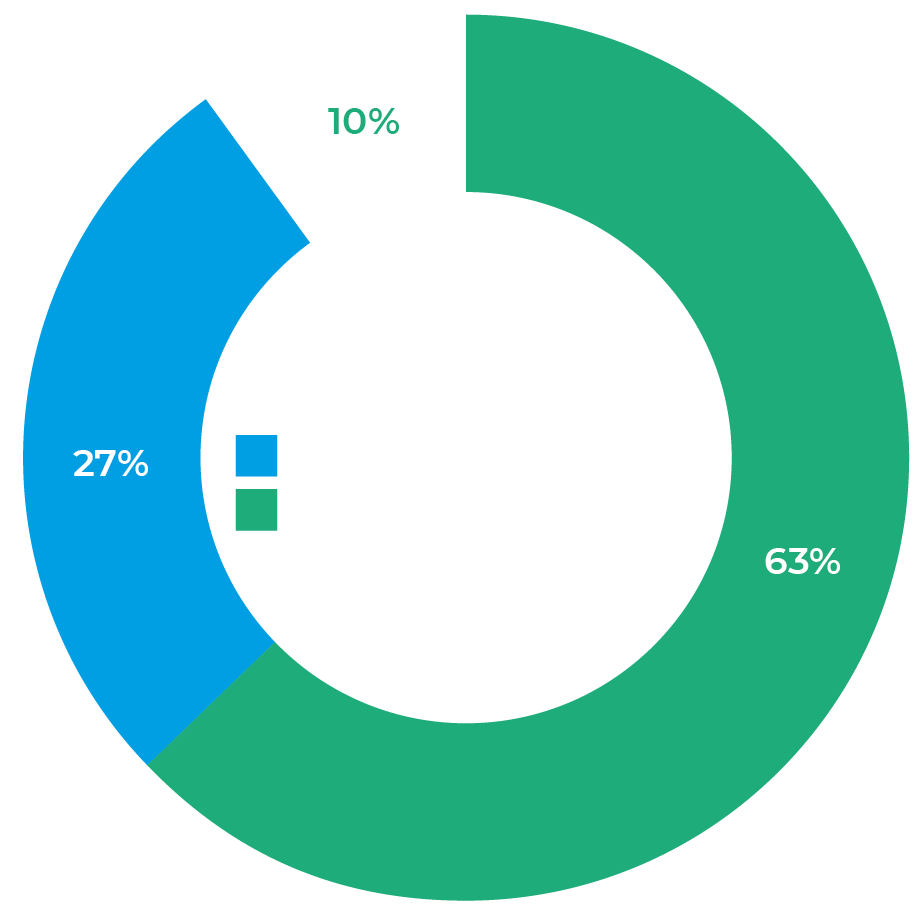

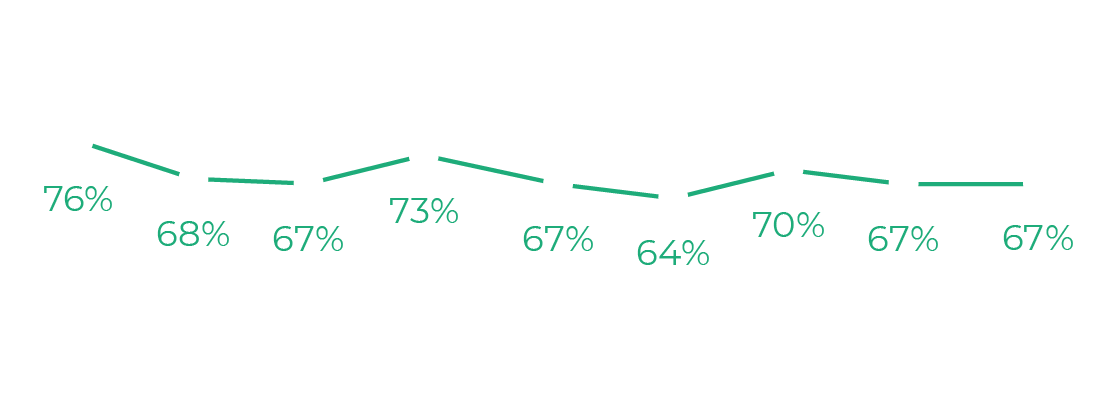

Percentage of PE-backed deals

Private equity-backed investments accounted for 67% of all IT services deals completing in Q1 2023, the same as last quarter. The sector is particularly attractive to private equity as companies continue to embrace digital transformation and the recurring nature of revenue that typifies the IT services business models.

New investments in the quarter included the sale by existing investor NorthEdge of a majority stake in Manchester-based Cloud Technology Solutions to Los Angeles-based global private equity house Marlin Equity Partners.

Percentage of PE-backed deals

Notable UK mid-market deals

Syrinix, a provider of remote intelligent water monitoring solutions, was acquired by New York listed Badger Meter for £15 million.

Intechnica, a Manchester based technology firm, was acquired by US PE-backed firm Crosslake Technologies for £14.5 million.

Techquarters, a Cloud Solution provider, was acquired by Babble, one of five acquisitions made by the PE backed business.

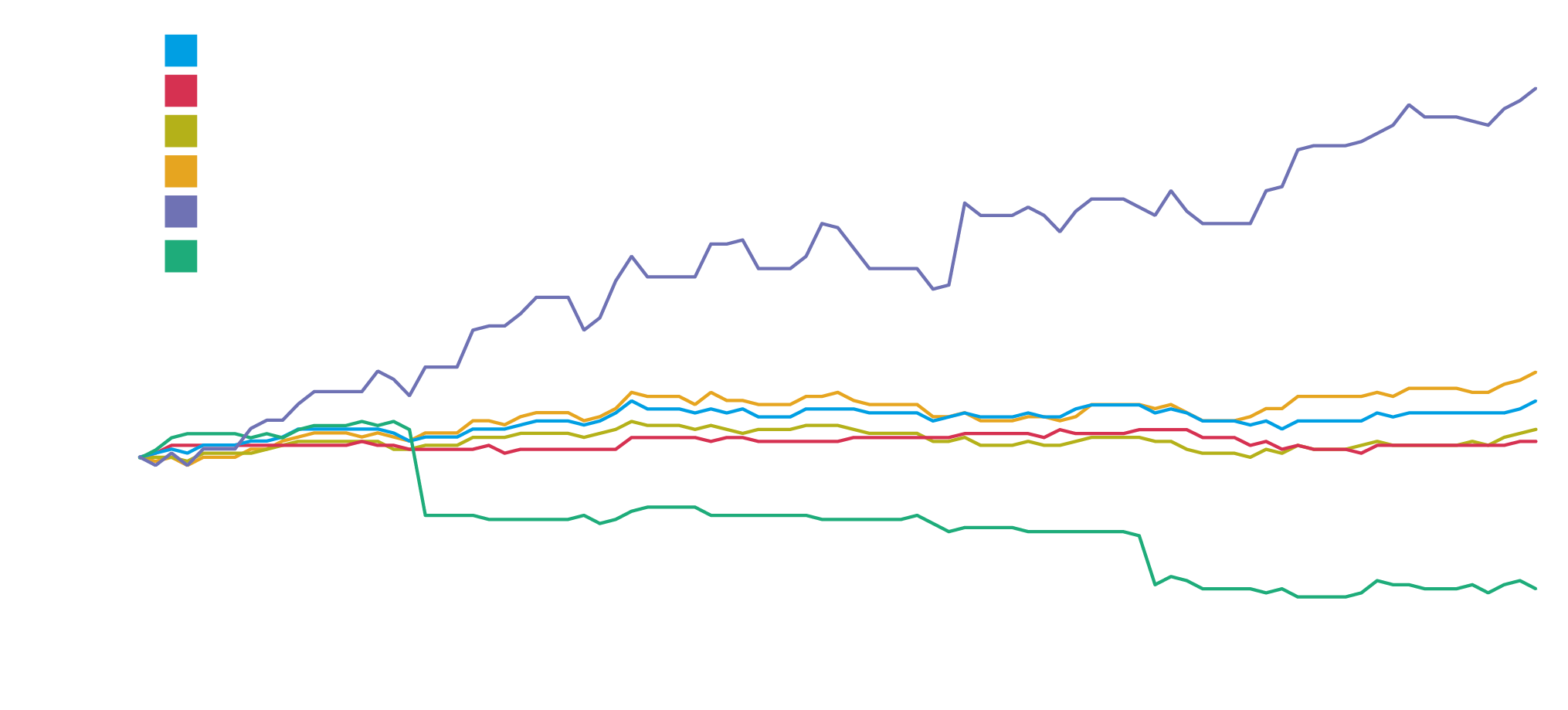

Stock market performance

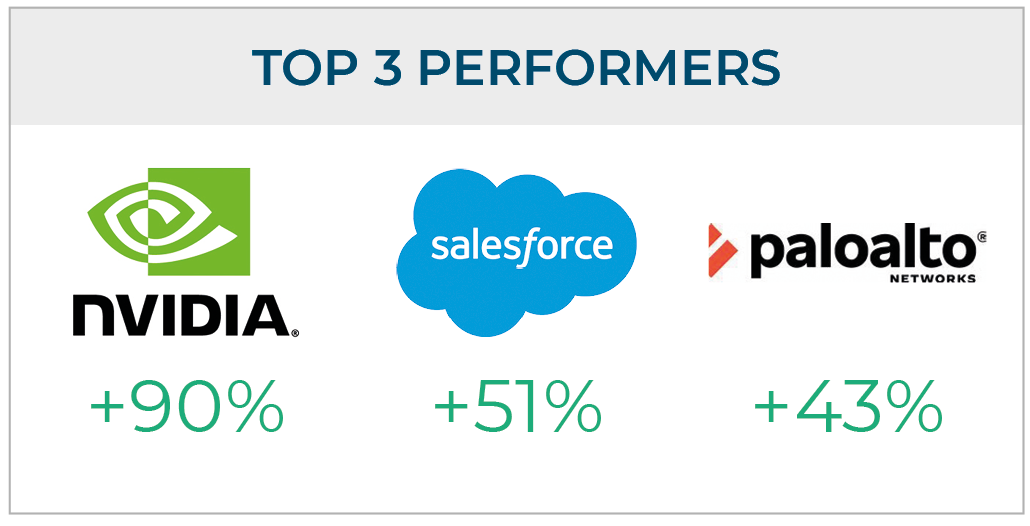

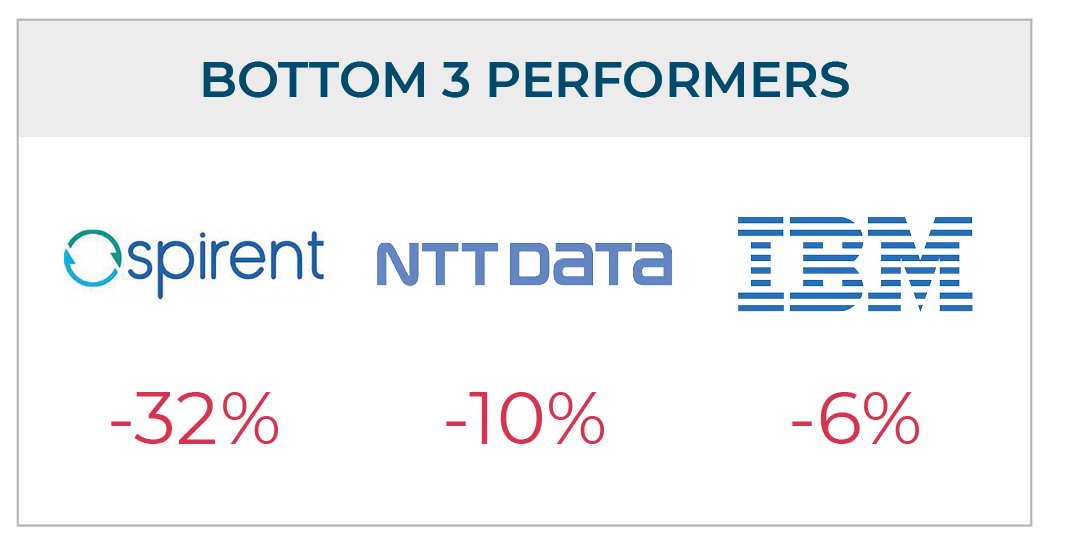

The first quarter of 2023 saw global stock markets continue the recovery that we started to see at the end of 2022. The S&P 500 was up by 7%, having increased by 4% in Q4 2022. The Moore Kingston Smith IT Services Index outperformed the market and was up 14% across the period. This was also ahead of one of our technology-specific indices, the FTSE TechMark Focus index, which failed to match the market with only a 4% increase. However, the best performing index was the MSCI World Information Technology index, which ended up an impressive 21%.

Micro Focus was previously part of the Moore Kingston Smith Index. Following its delisting and acquisition, we have instead included its acquirer, OpenText, as part of the index. Of the 21 companies remaining in the index, seventeen ended the quarter in positive territory.

The star performer was NVIDIA, up 90%, following a series of broker upgrades, all suggesting the company will continue being a major player in the burgeoning AI market.

Conversely, our worst performer was Spirent, which saw its share price decline by 32% across the period. The company disappointed the market by saying it expected earnings to be weighted towards the second half as customers delayed investment decisions.

Moore Kingston Smith IT services index

Sector subcategories