Proceed with caution – review of Q3 2022

Growth Capital Update – a review of Q3 2022

Our Q2 report reflected on what appeared to be signs of a slow-down in the UK growth capital market, with investors starting to take a more guarded approach to investing. That slow-down has continued into Q3, with the market remaining essentially flat. The number of deals has declined slightly, while the total amount of capital has increased slightly. Activity is still at a very high level when viewed in the wider historical context. However, there seems little doubt now that 2022 will not manage to match up to 2021’s dizzy heights, which was the best year for the growth capital market in recent memory.

According to our latest research into UK private companies raising between £1 million and £20 million of growth equity capital each, 331 UK businesses raised a total of £1.590 billion in the third quarter of 2022. The average deal size was £4.80 million.

In the second quarter of 2022, we saw 345 deals with an average deal size of £4.42 million, and £1.524 billion raised in total. Our Q3 2022 figures therefore represent a 4% decrease this quarter in the number of deals completing but a 4% increase in the overall amount of growth capital being raised, suggesting larger deals have a better chance of completing.

The reduction in activity in Q2 and Q3 was most likely a result of investor concerns about macroeconomic and geopolitical factors, such as Ukraine, commodity shortages and higher-than-anticipated inflation figures. At the very end of Q3, we have not just had to contend with global issues, but also some very specific domestic ones, as the financial markets have punished what they have seen as the UK government’s fiscal irresponsibility.

While our report focuses on equity fundraisings, these transactions often also require leverage, and therefore the cost of debt is a factor. As the rate for UK government borrowing increases, so do the rates for personal and corporate borrowing. However, a decline in the value of sterling can make UK-based assets look attractive to overseas acquirers, thus underpinning the market.

John Cowie, Head of Growth Capital, says: “Although investors are clearly taking a more guarded approach as we move through 2022, we mustn’t forget that 2021 was a record-breaking year for the industry. Moreover, while the public markets falter, private company growth capital continues to offer an attractive alternative for ambitious entrepreneurs.”

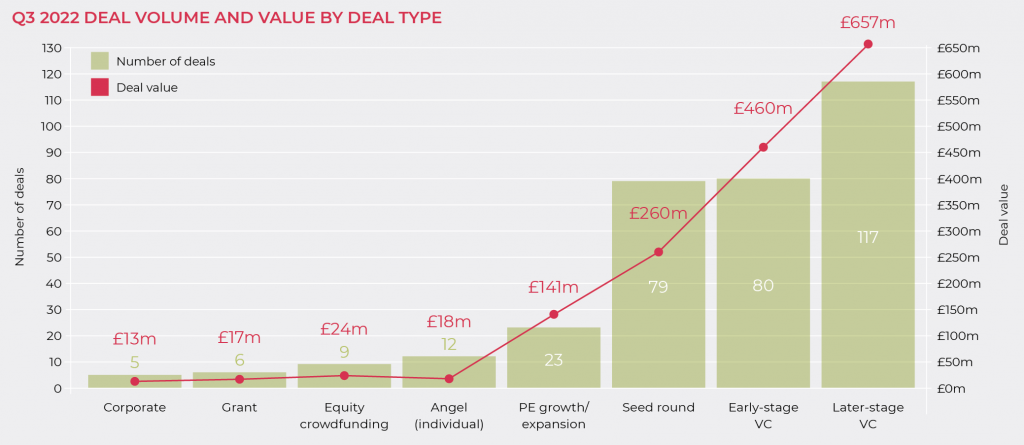

As far as the types of deals that were most common in Q3 2022 are concerned, later-stage VC achieved the top spot, accounting for 28% of all deals by number and 32% by value. Early-stage VC rounds were the second most common types of transactions, closely followed by seed rounds.

Tech deals continue to dominate

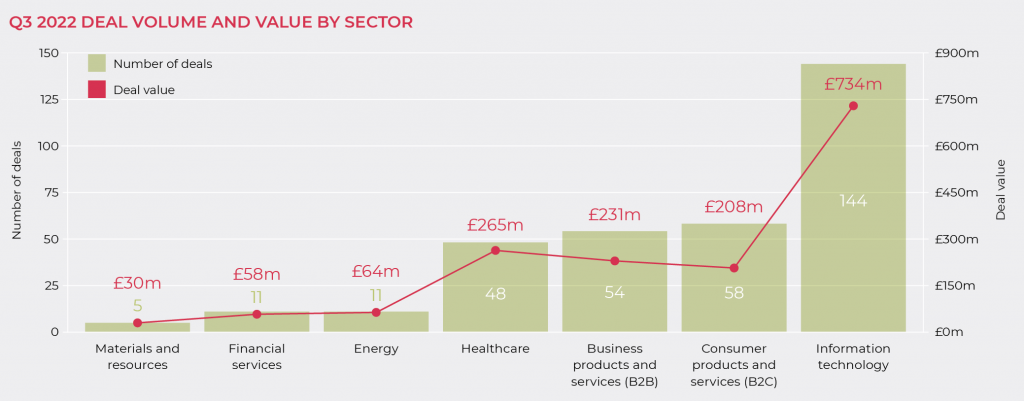

Technology retained its position as the most popular sector for investors in Q3 2022, accounting for 44% of all transactions by volume and 46% by value. Investor appetite for B2C, B2B and healthcare businesses also remained strong.

Notable deals in the tech space in Q3 included the $21 million raised by regtech scale-up SteelEye, in a series B round led by Ten Coves Capital. Headquartered in London, SteelEye is a compliance technology and data analytics firm whose clients include some of the largest financial services firms in the world, including Fidelity International and Schroders. SteelEye provides its clients with a Saas-based platform that allows them to simplify their compliance processes across various UK, EU and US market regulations. The $21 million fundraising is designed to allow the firm to accelerate its global expansion, with an emphasis on North America.

Q3 also saw Unlikely AI announce the close of a $20 million seed round involving a range of prominent UK venture capital funds and angel investors. Unlikely AI is a start-up which will use the funding to boost the development of its approach to artificial intelligence and expand its team. Unlikely AI was founded by William Tunstall-Pedoe, best known for his role in developing Amazon Alexa. His first start-up, Evi Technologies, developed technology for natural language understanding and question-answering. Evi launched a voice assistant with the same name in 2012 that saw millions of downloads in the first few months. The company was then acquired by Amazon, where the technology, team and know-how were used to create, launch and further develop Alexa – the world-famous AI assistant that saw more than a hundred million devices sold during its first few years on the market. William left Amazon in 2016 and Unlikely AI is his next big venture. Amadeus Capital Partners and Octopus Ventures co-led the over-subscribed round, which also included participation by Cambridge Innovation Capital, Skype founder Jaan Tallinn’s Metaplanet and others.

Active investors in Q3

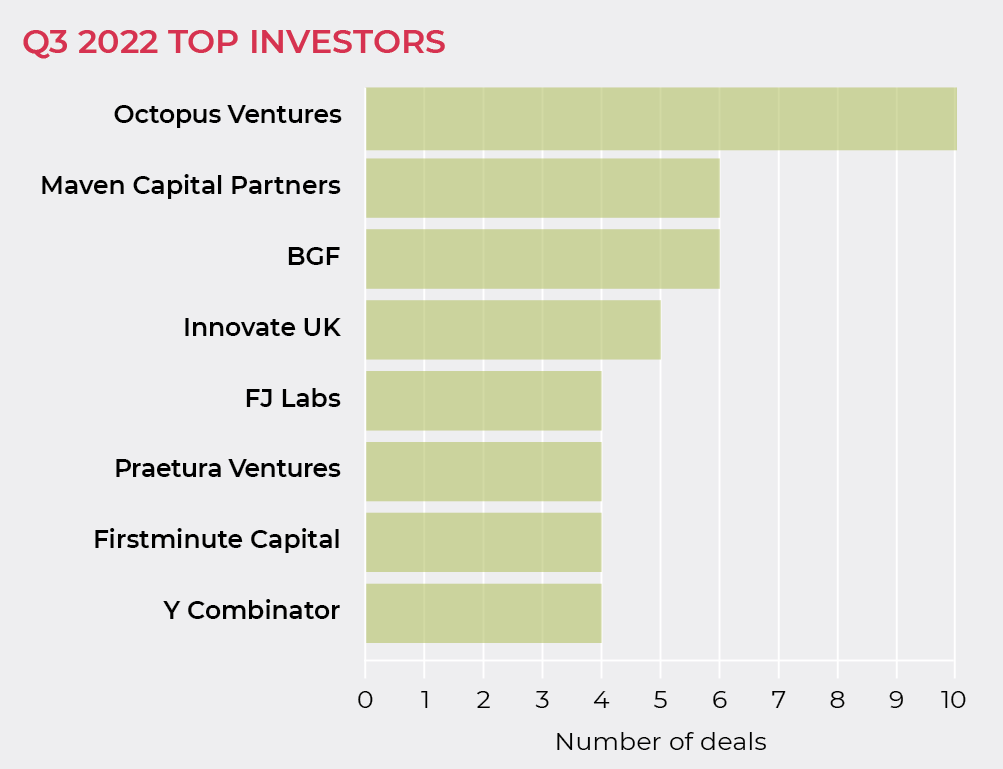

Octopus Ventures was the most active investor in the third quarter of 2022, with ten deals completed. Maven Capital Partners and BGF shared second place, with six deals apiece.

Octopus Ventures’ investments in Q3 were largely in the technology space. They included taking part in the $20 million seed round, led by Amadeus, into Unlikely AI, which has already been mentioned above. Octopus also participated in a £20 million series A funding round undertaken by Living Optics, which makes computational hyperspectral cameras, built on technology from Oxford University’s physics department.

Outside the technology space, Octopus invested further in one of its existing portfolio companies, Anikin (trading as Katkin) – a direct-to-consumer service for personalised cat food, which raised an £18.6 million series A round in August. Katkin’s clients pay for a monthly subscription of cat food that has been tailored to their cat’s attributes and needs and is delivered to their home. Katkin will use the funds to expand its manufacturing capability, research and development, and marketing.

Maven Capital Partners also focused on technology in Q3, with its deals including participation in a £5.9 million investment round into Leeds-based independent games studio and virtual reality developer XR Games. The investment will support XR Games’ expansion as it moves into a brand-new studio in the centre of Leeds later this year. It will enable the business to grow its team as it invests in intellectual property, the development of new games, and research into VR and augmented reality technologies, following the success of its VR game Zombieland: Headshot Fever, launched in 2021.

Maven also invested in Zinc Systems to support the company’s continued growth. Northamptonshire-based Zinc is a SaaS-provider, specialising in safety, security and critical event management. Its products help organisations to optimise decision-making, mitigate risk and streamline business processes. The business delivers its services to a range of public sector agencies including the Environment Agency as well as a blue-chip client base which includes Kingfisher and Allied Universal. The new funding will enable Zinc to expand its sales and marketing teams as well as invest in further product development.

BGF’s investments were more eclectic and included B2B, B2C and energy as well as technology. In August, BGF backed international freight logistics and express courier specialist ITD Global with a £15 million growth capital investment. ITD Global is a tech-enabled logistics consolidator, which brokers parcel and freight solutions for e-commerce clients. Currently, the company operates in six locations across the UK, Netherlands, China and Hong Kong, with an additional site in Glasgow opening in early 2023. Featured in the Sunday Times Fast Track 100, the company generated more than £60 million revenue in the last financial year. The investment from BGF will help the business to deliver its ambitious growth plans through the expansion of its UK depot network, further development of its technology platform and growing its newer services in fulfilment and returns to provide a holistic service offering to its clients.

Outlook

Activity within the UK’s growth capital market remains strong. However, an air of caution has been introduced in the last two quarters by investors considering emerging geopolitical and macroeconomic factors when weighing up whether and where to invest. We expect the final outturn for the number of deals completed in 2022 to look extremely good in comparison with most recent years, but think it is now highly unlikely that 2022 will beat 2021’s record. Alex Sleigh, Investment Director at Maven, commented: “Deal activity has continued to be robust in spite of the challenging macroeconomic environment. We continue to see interesting opportunities and tougher market conditions will mean that our quality bar will remain higher than ever.”

We remain in contact with a large pool of private equity investors with substantial amounts of capital to deploy, so we expect the market to prove resilient in the coming months.

Contact us

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner. Contact us to find out more about our raising finance and growth capital services.

We also assist investors and are experts at providing advice throughout the acquisition or investment process. Our team can help identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology

Moore Kingston Smith has analysed transactions by UK-based companies that involve the issue of less than 50% of equity share capital to third parties and funds raised of between £1 million and £20 million. Accordingly, these numbers do not include senior debt and mezzanine debt fund raisings and smaller fund raisings by companies and start-up funding unless more than £1 million is raised. Start-up funding is generally significantly less than this amount.

The research aims to capture all transactions by UK companies that fall within the criteria. Inevitably there will be transactions that have taken place but have not been captured. The research is based on data extracted from Pitchbook and information from the following sources: steel-eye.com, amadeuscapital.com, livingoptics.com, uktechnews.info, forbes.com, mavencp.com, bgf.co.uk.