Advertising sector goes from strength to strength and M&A continues unabated in Q3 2022

M&A in the media and marketing services sectors – Q3 2022

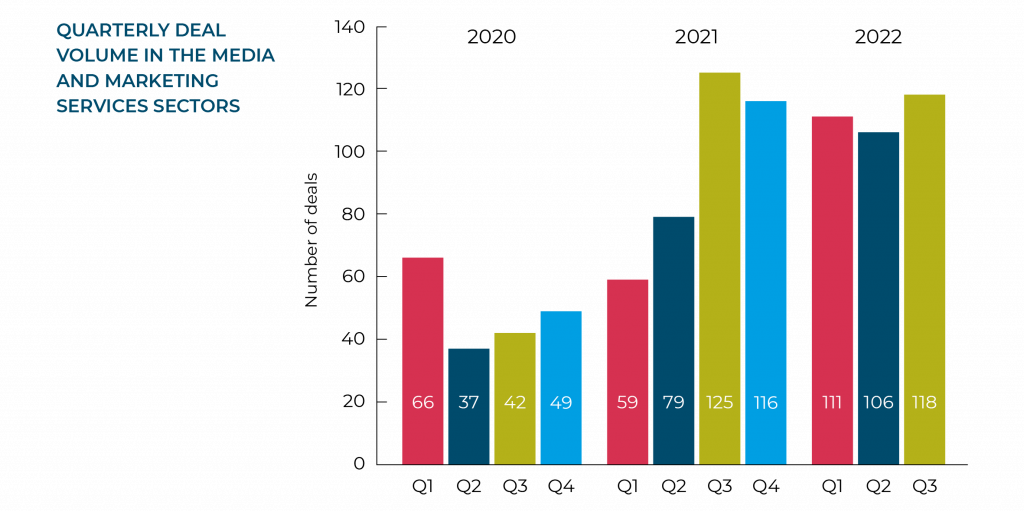

Moore Kingston Smith’s deal tracker recorded 118 UK media and marketing services deals as having completed in Q3. This makes it the most active quarter of the year so far, up 11% on the 106 deals we recorded in Q2.

The UK economy may be experiencing difficulties but these do not yet appear to have dampened the enthusiasm of corporate and private equity investors for the media and marketing services sector. Provided M&A activity doesn’t fall away significantly in the final quarter, 2022 is on track to see a significant increase in deal doing over 2021.

Sector activity

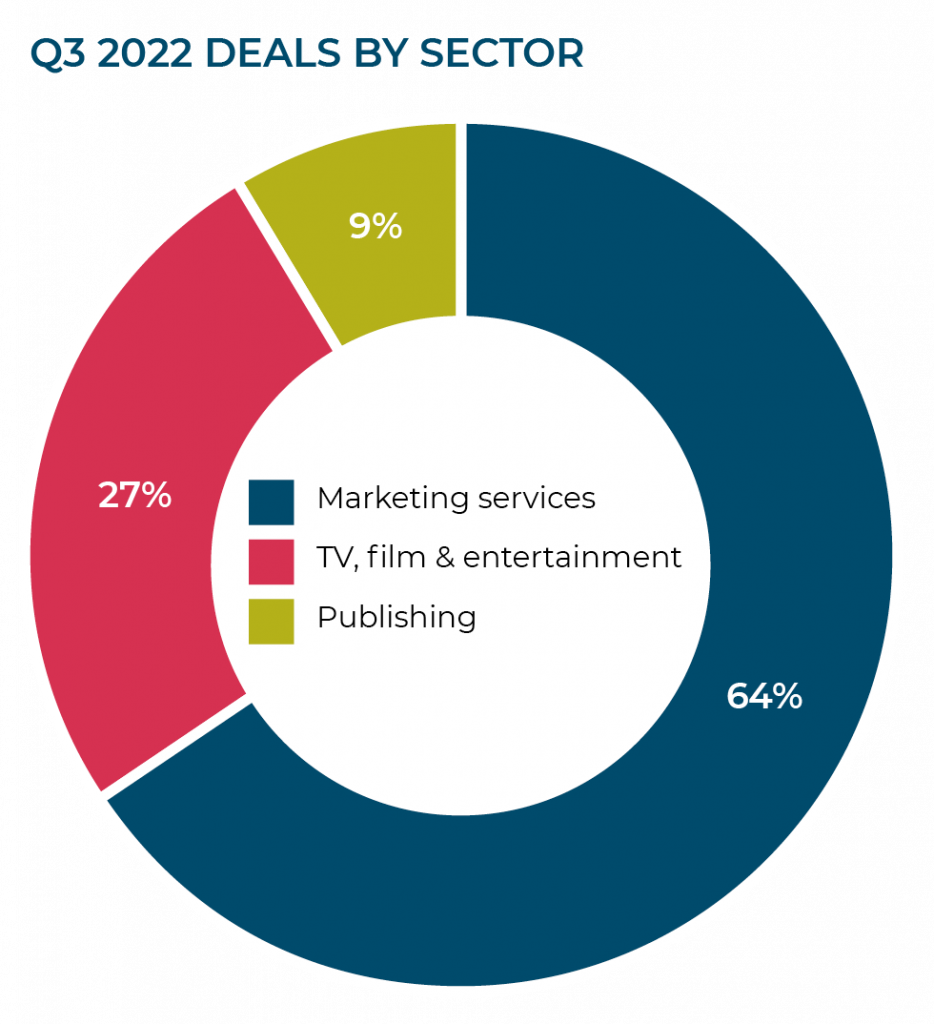

Media and marketing services covers a broad range of activities, so for the purposes of this report, we allocate transactions to three main categories: marketing services; publishing; and TV, film and entertainment (which includes gaming and music).

64% of our 118 Q3 deals fell within the marketing services sector, with a total of 75 transactions completed. TV, film and entertainment also had a busy Q3, with 32 deals announced. This compares with just 20 transactions reported in Q2, and TV film and entertainment accounted for 27% of all transactions in Q3, which is a significant increase on the 19% we recorded in Q2. Publishing showed a slight decline in activity, with just 11 transactions recorded in Q3, compared with 13 in the prior quarter.

Hot marketing services disciplines

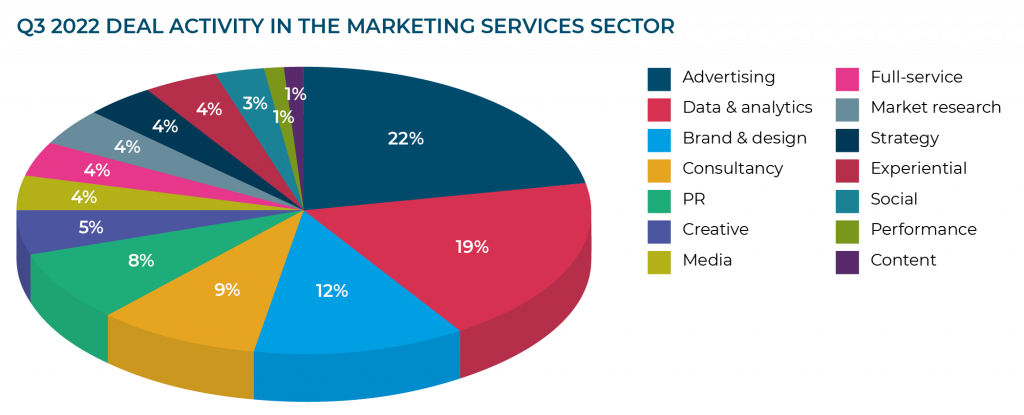

Our analysis of the 75 marketing services transactions completed last quarter enables us to determine whether the company acquired was a full-service agency or a specialist in one of the marketing services disciplines, such as PR or advertising.

In Q3 2022, advertising specialists were the clear favourite with acquirers, followed by data and analytics businesses.

Our Q2 report reflected on the recent resurgence of interest in advertising. It represented just 7% of marketing services deals in Q1 2022, rose to 15% in Q2, and now accounts for more than a fifth of all transactions that completed in Q3. Advertising agencies are predicting continued growth in advertising throughout the remainder of the year. This is partly as a post-pandemic rebound but also because of certain cyclical events, such as the US mid-term elections and the FIFA World Cup taking place next quarter.

Moore Kingston Smith’s corporate finance team has been busy in the advertising space throughout 2022. The team completed yet another transaction in Q3, advising integrated marketing and communications group Selbey Anderson on its acquisition of creative advertising agency AML Group. AML Group creates global advertising campaigns for clients in complex and regulated markets, including finance, security and business services. Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith, led the team advising Selbey Anderson and says: “high quality advertising and creative capabilities are currently highly sought after, particularly due to the fragmented acquirer landscape. There are a lot of different acquirers with a requirement for a jewel in their creative crown.”

Spotlight on martech and adtech

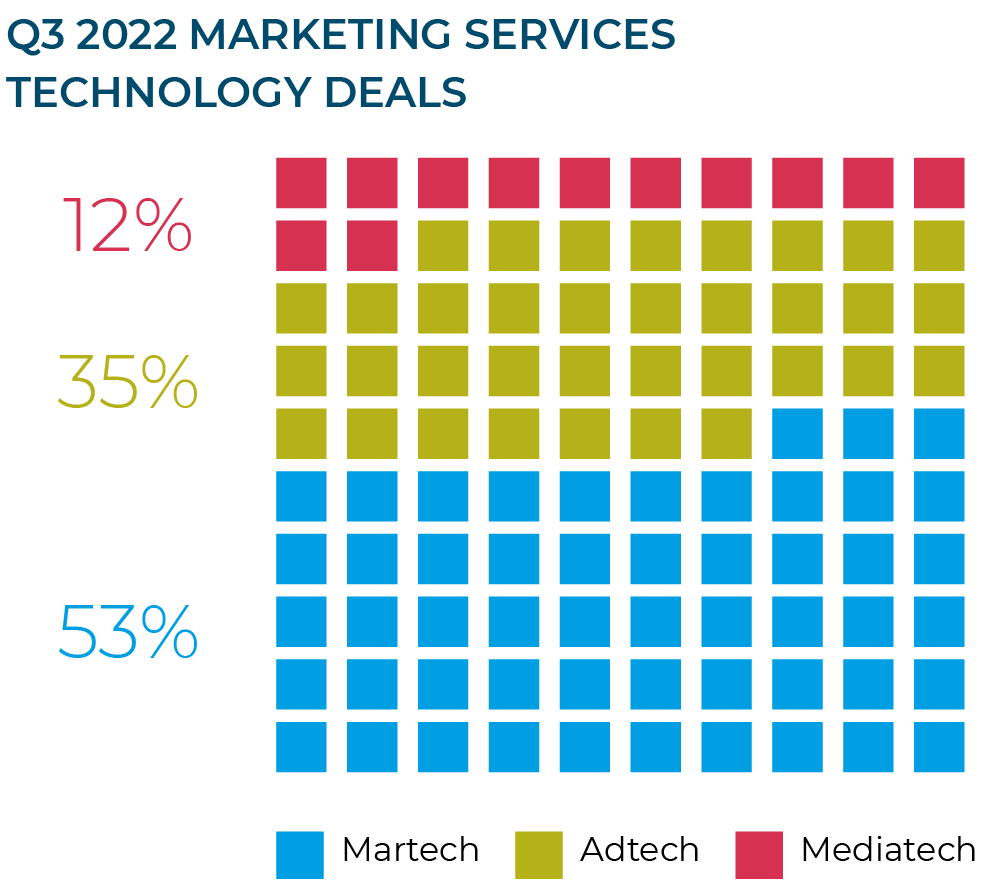

In the marketing services sector, while most deals involved the acquisition of traditional service-led agencies, 23% of the deals we recorded in Q3 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.

Over half of these transactions related to martech companies – companies developing and using technology to assist with a digital marketing strategy, including such elements as content and social, lead generation, customer acquisition and retention, and data and analytics.

UK martech companies were snapped up by eager acquirers in Q3, including London-based fan data management and digital marketing solutions provider Sports Alliance, which New York-headquartered KORE Software acquired. This acquisition marks an expansion for KORE in the EMEA market and is its second acquisition in 2022 – it bought professional sports business and AI-powered social and digital analytics platform Hookit in February.

Adtech also proved popular last quarter, accounting for 35% of the marketing services technology deals we recorded. Adtech refers to specific solutions or tools used for digital advertising, such as programmatic advertising tools, data management platforms and ad exchanges.

“While most deals involved the acquisition of traditional service-led agencies, 23% of the deals we recorded in Q3 were technology-led.”

An important adtech transaction in Q3 was Criteo’s acquisition of IPONWEB, the engineering company credited with building much of the underlying infrastructure for the adtech ecosystem. The deal completed in August with a price tag of $250 million, some $130 million lower than the anticipated price when Criteo and IPONWEB first revealed they were in discussions at the end of 2021. IPONWEB was founded in the UK but most of its engineering team was based in Russia. The deal was impacted by the situation in Russia and Ukraine, and the iresulting sanctions. IPONWEB closed its Russian operations and relocated employees, largely to Germany, before the deal could be done. This contributed to the reduced headline price.

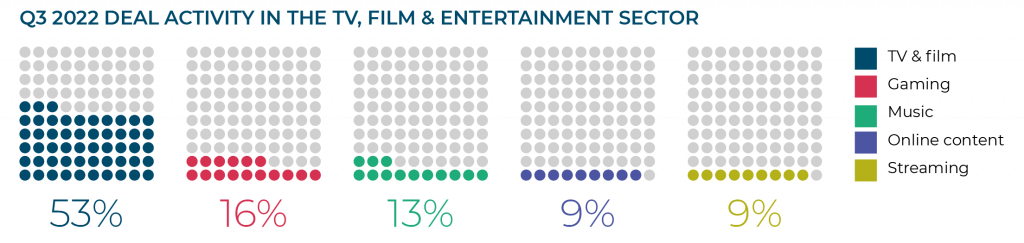

TV, film and entertainment

Within the TV, film and entertainment category, the gaming sector was the most active in the first two quarters of this year. However, TV and film overtook gaming to secure the top spot in Q3.

Production services deals were the most prominent, accounting for 38% of the transactions we recorded in this space. Technology-led deals accounted for a further 28%, with pure content plays making up 16% of the deals recorded in Q3.

One of the most notable deals in the TV and film sector last quarter was the acquisition of London-based immersive film and television events specialist Secret Cinema by US-headquartered mobile ticketing platform TodayTix Group, in a deal reported as being worth c. $100 million. The transaction is expected to benefit British taxpayers who had a stake in Secret Cinema, through the UK government having invested £4 million in Secret Cinema in 2020 via its Future Fund, which supported innovative businesses during the pandemic.

In August, Moore Kingston Smith’s corporate finance team, led by Corporate Finance Partner Nick Thompson, advised award-winning production company The Edge Picture Company on its sale to AIM-listed factual content specialist Zinc Media. The Edge is an international film production and marketing agency for corporate and commercial audiences. Following the transaction, it will sit alongside Zinc Communicate, Zinc Media’s publishing and content creation unit.

Nick Thompson and the team also acted on a cross-border TV and film deal in Q3, advising UK-based Take 1, a provider of transcription and captioning services for the media and entertainment sector, regarding its sale to New York-headquartered Verbit. Take 1 specialises in start-to-finish transcription and captioning services for video content, from the time the first scene is filmed to the final release on air. Its customers include global media brands such as ITV America, NPR and Warner Bros. Discovery. It has an established presence in the OTT market in both the US and UK, with nearly half of its customers providing content to streaming platforms, in all languages. The transaction bolsters Verbit’s growing presence in Europe following its acquisition of UK market research specialist Take Note in March.

“TV Production remains a fragmented sector and we expect the recent consolidation in the space to continue. Companies are focusing on extremely strategic acquisitions as they look to adapt their business to the rapidly changing entertainment and technology landscape. Netflix’s recent announcement on subscriber numbers exceeding expectations should provide a further boost to businesses in this space and fuel further deal activity,” said Nick Thompson, Corporate Finance Partner at Moore Kingston Smith.

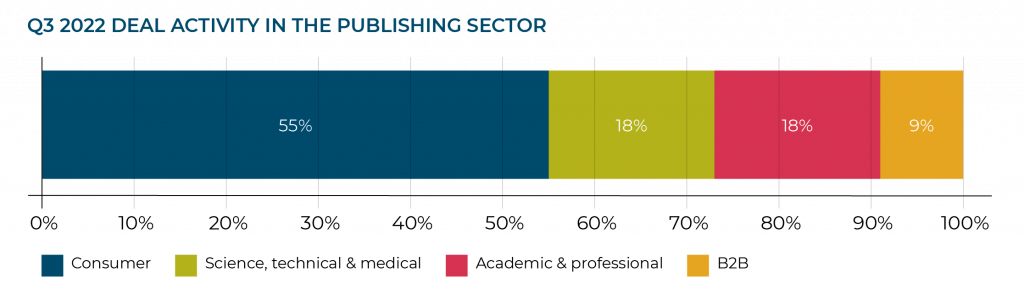

Publishing

Consumer publishing saw the most deals in Q3, representing 55% of the deals recorded.

The largest publishing deal of Q3 was the c. $4 billion business combination between global visual content publisher and marketplace Getty Images with a NYSE-listed special purpose acquisition company. This enabled Getty Images to become a publicly traded company, ending a 14-year absence from the public markets.

Within the consumer publishing space, we spotted US-based NFT Plazas’ acquisition of UK monthly publication MagNFT, a magazine that played a major role in developing cryptoart and popularising NFTs. MagNFT was first published in December 2019 and, as well as being printed, was minted on the blockchain platform Codex. It was the first ever on-chain magazine using the Codex Protocol.

Marketing services networks roundup

Major holding companies

Q3 proved to be a relatively quiet quarter for the major holding companies, with no new transactions for Omnicom, Dentsu, Publicis and Interpublic.

WPP completed three deals in Q3. In July, it revealed it was acquiring Corebiz, a Latin American ecommerce agency. It followed that with two deals in September. On 1 September, it announced that it had acquired Newcraft, a data-first European ecommerce consultancy based in the Netherlands. The 155-strong business will join WPP’s Wunderman Thompson global network. Later that month, WPP announced that it had acquired JeffreyGroup, an independent corporate communications, public affairs and marketing consulting firm headquartered in Miami with offices throughout Latin America.

Havas also remained active on the M&A front. In early September, it announced the acquisition of Edinburgh-based data-led creative agency additive+. That same month, it announced it had acquired full-service ecommerce and Amazon consultancy Expert Edge to accelerate its global expansion of ecommerce agency Havas Market from the UK. Expert Edge was founded in 2016 by Alex Walker with David Jennison joining to lead and run the business in 2018. They had previously worked together at Amazon, where Jennison launched Amazon Global Selling before joining Expert Edge. Jennison will remain CEO of Expert Edge following the transaction but will also become Managing Director of Havas Market.

Challenger networks

In July, S4Capital announced its latest “combination”, as it chooses to style all its acquisitions, with LA-headquartered XX Artists, a social media marketing agency founded in 2018. XX Artists helps clients such as Google, YouTube, Logitech and Ancestry.com formulate and execute their social and influencer content strategies. XX Artists also touts an industry-leading talent social practice, working with over 40 top musicians, actors, artists and public figures on their digital platforms.

Stagwell announced two deals in July: the acquisition of US-based Apollo Program, a real-time AI-powered SaaS platform, and a Ukrainian content and production agency, Pep Group.

Our Q2 report said that, at the end of May, Selbey Anderson had announced that it had closed a new £10 million funding round “to continue its aggressive UK expansion”, and that a new acquisition was “being finalised”. This deal was the July acquisition of AML Group, which the Moore Kingston Smith corporate finance team advised on, as already mentioned above.

The battle for control of M&C Saatchi, which we detailed in Q2’s report, has rumbled on into Q3 and has yet to be resolved. One of the rival bidders, ADV, chaired by M&C’s deputy chair and single biggest shareholder, would appear to be out of the running, having failed to garner enough support for its bid by the end of September. However, M&C shareholders must still formally choose whether or not to back the rival proposal of Next Fifteen, the agency group that this year acquired Engine. M&C’s board members previously backed that deal but later pulled their recommendation when Next Fifteen’s share price fell some way below the level it was at when it originally tabled its offer. Perhaps we will know which way the deal is going to go in Q4.

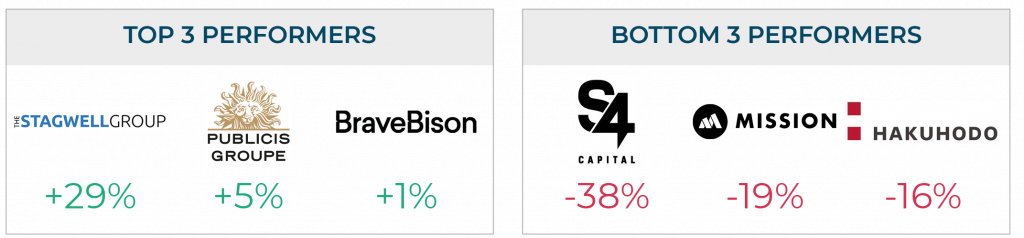

Marketing services industry stock performance

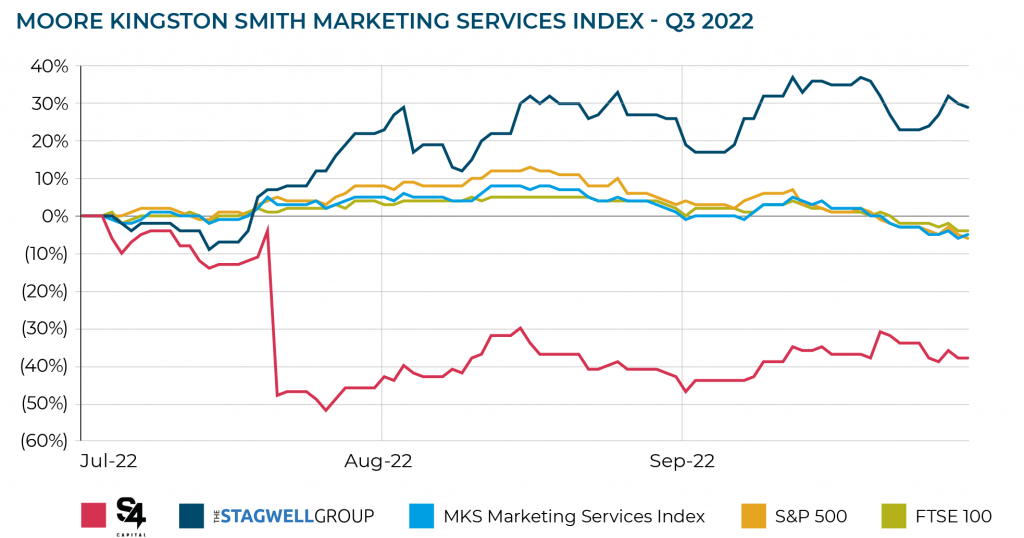

Moore Kingston Smith has plotted the share price performance of 14 listed marketing services groups, which together make up the Moore Kingston Smith Marketing Services Index, to see how they have fared in the last quarter compared with the FTSE 100 and S&P 500 indices. We have also highlighted the share price movements of Stagwell and S4 Capital, which represent the best and worst performance from our sample this quarter.

“Q3 2022 saw stock markets generally in decline, following a similarly poor Q2. The FTSE 100 declined by 4% across the period and the S&P 500 fell by 6%.”

Q3 2022 saw stock markets generally in decline, following a similarly poor Q2. The FTSE 100 declined by 4% across the period and the S&P 500 fell by 6%. The Moore Kingston Smith Marketing Services Index largely kept pace with the market, showing a 5% fall in value, which is considerably better than the 17% decline it experienced in Q2.

Of the 14 companies that make up the index, just five ended the quarter in positive territory. These rises were largely marginal, save for star performer Stagwell which saw a 29% increase in its share price. Stagwell’s share price had been in decline until the end of June, but then saw a substantial recovery ahead of its Q2 earnings presentation in early August. The results it announced were positive, and largely as investors expected, with its year-on-year quarterly results showing growth in both net revenue and adjusted ebitda.

By way of contrast, the worst performer in Q3 was S4 Capital. It saw its share price fall by 44% in a single day in July, as it announced it was revising its full year profit forecast downwards as a result of an increase in hiring costs. It recovered a little from that low to end the quarter 38% down, and is now approximately 70% down year to date.

Private equity is driving media and marketing services M&A

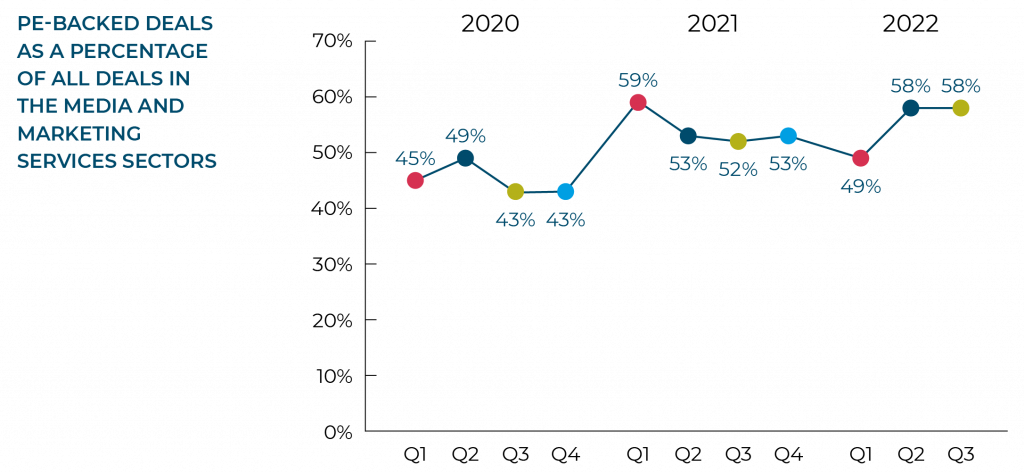

Since the start of the pandemic, private equity has substantially underpinned deal-doing in the UK’s media and marketing services sectors. Institutional investors are both making new investments and backing their existing portfolio companies in their buy-and-build strategies.

Private equity-backed investments accounted for 58% of all deals completing in Q3 2022, exactly the same level as we recorded in Q2, and still very high against historical norms.

Key PE-backed acquirers in the quarter included UK B2B specialist The Marketing Practice, which is backed by Horizon Capital. In September, The Marketing Practice acquired Rombii, an ABM, demand and media agency with offices in Singapore and Sydney. This deal follows the acquisition of two US-based businesses by The Marketing Practice in the first half of this year.

Out-of-home (OOH) advertising has proved popular with private equity this quarter. On 2 August, it was announced that European private equity firm Antin Infrastructure Partners was to acquire Wildstone, the UK-based owner of independent outdoor media infrastructure assets. The next day, Wildstone announced that it had acquired a key portfolio of OOH assets from Forrest Group in Scotland. A month later, Wildstone announced it had acquired a Spanish OOH business, Grupo Redext. With this last addition, Wildstone now counts more than 5,000 billboards in its portfolio across the UK, Ireland, the Netherlands and Spain.

Also in the OOH space, July saw the sale of Mayfair Equity Partners-backed Talon Outdoor to new PE owner Equistone. Mayfair originally invested in Talon in 2017, acquiring the company from Omnicom. Since Mayfair’s investment, Talon has grown its team to over 200 employees across global locations and completed four strategic acquisitions. Equistone is reportedly keen to support Talon in growing even further.

Secondary transactions – the sale of portfolio companies from one PE-backer to another – account for some of the deals that we have recorded this quarter. One example is MiQ, a marketing specialist working with companies to turn data into advertising campaigns, which was founded in London in 2010. ECI Partners invested in the business in 2017 and, in September 2022, sold its majority stake to Bridgepoint in a deal reportedly valued at $900 million, representing a 6.1x return for ECI. Bridgepoint has said that it is looking to support MiQ on its international expansion and client growth.

PE houses generally expect to realise the value of their investments within a three-to-five-year timeframe. Additionally, PE has featured in approximately half of all transactions in the media and marketing services sectors since the start of 2020, so we can expect more secondary transactions to come.

“Private equity interest and activity in the sector remains high. If there is a softening in the M&A market driven by the macro-economic environment, this is likely to be driven by non-private equity backed trade buyers who are more likely to put a freeze on acquisitions, than private equity backed groups who will continue to execute buy and build strategies regardless of macro-economic uncertainty,” said Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith.

Outlook

The results for Q3 2022 show no let-up in the enthusiasm for UK M&A deals in the media and marketing services sectors. So far, transactions have not been affected by macroeconomic and geopolitical factors – the situation in Ukraine, commodity shortages and price rises, concerns about global warming, increasing inflation and declining retail sales.

Apart from global challenges, the UK is dealing with domestic issues, as the financial markets react to the UK government’s fiscal plans. A key factor for M&A is the cost of debt, as many transactions require leverage. As the rate for UK government borrowing increases, so do the rates for personal and corporate borrowing. However, a decline in the value of sterling can make UK-based assets look “cheap” to overseas acquirers, particularly from the US.

The UK M&A market continues to be busy and the Moore Kingston Smith corporate finance team continues working on transactions in the media and marketing services sectors. We remain optimistic about the outlook for the remainder of the year, despite the market volatility.

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to consider their exit options.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

Contact us

Methodology

In compiling our deal tracker we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller (or both) and where the target company is classified as marketing services, publishing or TV, film & entertainment, the transaction is entered into the deal tracker. We classify marketing services into fifteen sub-categories; TV, film & entertainment into seven sub-categories; and publishing into four sub-categories.

As well as the data extracted from Pitchbook we have used information from the following sources: koresoftware.com, marketingdive.com, adexchanger.com, take1.tv, nftplazas.com, havasgroup.com, wpp.com, thedrum.com, deadline.com, businesswire.com, ft.com, fortune.com, themarketinpractice.com, antin-ip.com, wildstone.co.uk, media4growth.com, pehub.com.

Any assumptions, opinions and estimates expressed in the information contained in this content constitute the judgment of Moore Kingston Smith LLP and/or its associated businesses as of the date of publication and are subject to change without notice. This information does not constitute advice and professional advice should be taken before acting on any information herein. No liability for any direct, consequential or other loss arising from reliance on the information is accepted by Moore Kingston Smith LLP or any of its associated businesses.