Foreign interest remains strong, though inflation hampers activity – manufacturing report 2022

Manufacturing is at the heart of the UK economy – it’s a large part of its heritage, it’s one of a few sectors of the UK economy that remained open throughout the pandemic, and it will play a big role in the country’s economic recovery. The sector attracts financial and strategic investors alike, with conditions ripe for heightened investment activity, according to research from Moore Kingston Smith.

Foreign investment in UK manufacturing businesses was strong in 2021, highlighting belief in the country’s potential. The latest Make UK report shows the manufacturing sector accounted for 9% of GDP and 51% of the UK’s total exported goods in 2021. This is in spite of a challenging couple of years with the pandemic, as well as Brexit, driving a 10% reduction in output in 2020. A year on from leaving the EU, the majority of companies surveyed in the report feel the impact will linger in terms of customs delays due to import checks and changes in product labelling. Despite this, manufacturing growth is set to be approximately 6% in 2022.

The toll caused by Brexit and the pandemic are reflected in the Purchasing Managers’ Index (PMI). Having dipped to a 7 and a half-year low in 2020, the PMI’s rally at the end of 2020 gained steam as 2021 got underway, peaking in May 2021 at nearly 66 but then falling again to end the year at 57.9 – only marginally ahead of a year earlier. The fluctuations will have been caused by myriad factors, not least fresh Coronavirus restrictions, as well as some forward-purchasing as buyers looked to beat price hikes as inflation took hold.

The UK economy is buoyed by the incredible resilience of its entrepreneurial people. This has been greatly tested over the last two years, but the agility gained as businesses were forced to pivot has meant many firms are generally in better shape now than before the pandemic.

What is clear from the statistics, as well as our own experience in advising firms, is that the UK economy is buoyed by the incredible resilience of its entrepreneurial people. This has been greatly tested over the last two years, but the agility gained as businesses were forced to pivot has meant many firms are generally in better shape now than before the pandemic.

- Foreign interest in UK manufacturing drives activity to three-year high

- UK still leads Europe in deal volume, though market share of activity falls

- PE, VC and M&A investors hungry and well capitalised to transact – but high valuations and substantial inflationary issues around energy, raw materials and labour hamper activity

- Packaging makers in demand

- ESG increasingly on radars of manufacturers

- M&A in manufacturing investor view: Rockpool investments

- View from the factory floor: Wearwell

- Looking ahead

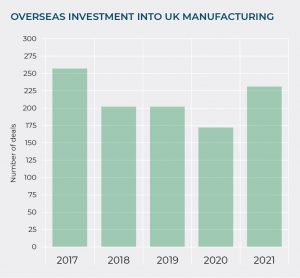

Strong foreign investment in UK manufacturing

2021 saw more foreign investment into UK manufacturing companies than in any of the last three years with 231 such transactions in 2021, up from 172 in 2020.

In September 2021, global coatings manufacturer Hempel completed the acquisition of luxury paint and wallpaper specialist Farrow & Ball from Ares Management Corporation, a financial backer. The c£500m acquisition is intended to support Denmark-based Hempel’s goal of doubling its business to £3bn by 2025.

“The UK remains a highly attractive market to overseas investors, with certain sectors deemed incredibly strong. Manufacturing continues to rank highly, with infrastructure projects such as HS2 driving large investment and homeowners looking to improve ageing housing stock driving private investment,” says Jeremy Read, Head of Manufacturing and Distribution at Moore Kingston Smith.

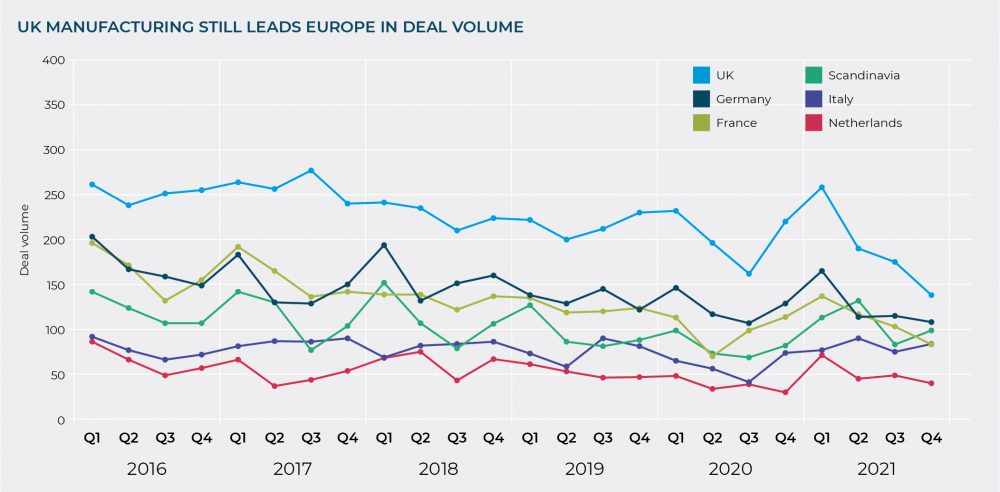

UK manufacturing still leads Europe in deal volume

The UK remains the busiest market for manufacturing investment, consolidating its position as the top investor destination over the last few years. The upturn seen at the end of 2020 was likely fuelled by the vaccine roll-out and firms rushing to complete deals before leaving the EU. However, this optimism waned as a number of variants took hold in 2021, each bringing with it fresh restrictions and uncertainty. Each quarter saw a drop on the last, with the end of the year the steepest fall. France was the only other country in Europe to witness such a dramatic decline, while Scandinavia and Italy saw upturns at the end of the year.

The quarterly data is characterised by rolling dips and surges as cautious periods give way to pent-up demand, meaning the lacklustre end to 2021 may point to a boost in 2022. 2016 saw a Brexit pause followed by a post-referendum ‘recovery’, and the pandemic trough then saw a surge as investors were hungry for resilient businesses well placed to trade in the recovery.

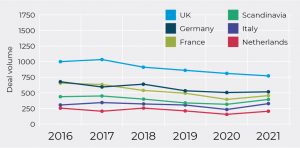

European investment levels recover as UK continues slide

Looking at the data annually, we see that the decline in European investment activity over the last couple of years started to reverse. Italy and Scandinavia have both attracted more deals in 2021 than in 2019, while France, Germany and the Netherlands are nearing pre-pandemic investment activity levels.

It is a different story for the UK, which continues its decline. This may be down to Brexit worries following the 2016 referendum, and/or high valuations in the UK which make domestic assets relatively expensive.

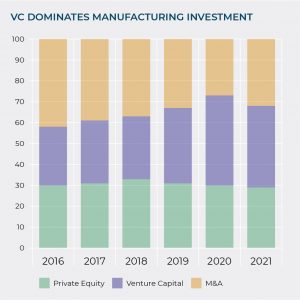

VC dominates manufacturing investment

Venture capitalists have been the most active investors in manufacturing for the third year in a row, making up 39% of investment activity (by number of deals) in 2021. M&A and private equity were close, accounting for 32% and 29% respectively. Strategic M&A investors had been the most prominent for years, but have accounted for a decreasing share of activity since 2016, eventually losing dominance to VCs in 2019. Private equity players on the other hand have retained a steady share of activity at around 29-32% each year.

“It continues to be the case that financial and strategic investors have different drivers. Whereas strategics typically paid higher premiums for businesses, we are seeing increasing numbers of private equity firms who are well-capitalised and keen to invest across cycles also offering full prices for assets. While absolute deal numbers are down, the entry multiples being paid for the deals that do get done are very attractive for vendors,” explains Marc Fecher, Partner at Moore Kingston Smith.

Packaging makers in demand

While the manufacturing sector has challenges including inflation and supply chain disruptions, the packaging market is well-placed to pass related cost spikes onto consumers as online shopping soars. The e-commerce packaging market is forecast to grow at 14% CAGR between 2020 and 2027.

A healthy number of deals in the space is testament to the attractiveness of this segment:

- Packaging giant Mondi had been pursuing smaller bolt-ons, with its Q1 2021 interest in fellow FTSE 100 packager DS Smith – a £6bn revenue business employing around 30,000 people – signalling a possible shift in growth strategy. This may have been made possible, or accelerated, by events of the previous 12 months.

- Glasgow-headquartered Macfarlane’s UK subsidiary wholly acquired Wiltshire-based GWP in February 2021 in a £15m deal. The LSE-listed purchaser has 70 years’ experience in UK packaging and is looking to grow its business.

- Go-Pak UK was acquired by Thailand-based SCG Packaging for over £130m in January 2021 as the purchaser looks to grow its food service packaging and access Go-Pak’s UK, European and North American client base.

Manufacturing impact: ESG on the agenda

Environmental, social and governance (ESG) issues have been on radars for years, though the manufacturing sector has been a laggard in terms of embracing metrics to improve ESG credentials. There are indications this is now changing, with the Make UK report suggesting around two-thirds of manufacturers are intending to focus more on net zero in 2022. Around half of companies are investing in green technologies and energy efficiency measures to drive this agenda which has been more front of mind since 2021’s COP26 Summit in Britain.

An example of a rare frontrunner in the ESG space is Marley, a specialist roof tiling company. As the first UK construction materials provider to achieve ISO 14001 environmental compliance in 2001, it is clear the firm has focused on sustainability for decades. It has been backed by Inflexion Private Equity since 2019 and has been ramping up its already impressive efforts since then, with clear objectives and targets built up around carbon reduction and equality around the workforce. The firm announced it was sourcing 100% renewable electricity last year and acquired Viridian to expand into solar roof systems.

“Private equity and venture capital investors are driving the shift from ESG as a nice-to-have to a need-to-have. This is because houses’ own investors are increasingly demanding it and because they are aware of the premium typically enjoyed by firms that have robust ESG metrics in place,” says Jeremy Read.

Get in touch to find out how we can help you on your ESG journey.

M&A in manufacturing investor view: Rockpool investments

Some of today’s challenges can be mitigated through acquisitions, according to Guy Nieuwenhuys of SME growth investor Rockpool, which has invested over £500m in over 80 companies since 2012.

It’s a trying time for businesses, with the manufacturing sector no exception. Myriad challenges including energy prices, inflation and tax hikes mean manufacturers have to absorb costs in the short-term before they can think about passing them on to their customers. “It is having a big impact on management time and postponing investment plans,” according to Guy.

Rockpool is working closely with its portfolio to navigate the current headwinds. Its support of greenhouse manufacturer Hartley Botanic since 2016 saw the business double in size before its sale last year, at which time – despite the tricky backdrop – it was generating more than half of its £16m sales from customers in the US.

Support in the current environment includes reviewing cost and pricing trends at least quarterly and helping to justify price increases to customers in response to inflation. A tight labour market means Rockpool’s companies are trying to offer more competitive packages to entice new employees. Supply chains are being reviewed on an ongoing basis as management looks to manage rising costs.

Such challenges can distract from growth, but some firms are embracing the opportunities that arise. “In the current environment, M&A is a great way to achieve economies of scale,” enthuses Guy, who says it can reduce cost pressure in uncertain markets. “Targeted acquisitions can help companies to mitigate the risks we currently see by diversifying vertically into the supply chain, as well as horizontally in a market where organic growth is more challenging.”

While there is clearly much to gain from this growth strategy, M&A can suffer a bit of pain too – the graft of identifying and then funding the deals, for example. Here is where an experienced backer can help – particularly in today’s market. Rockpool supports financially, but crucially in other ways too: “We help with market mapping exercises either in-house or through our network of corporate finance teams. We bring in experienced non-execs to assist owner managers and then get heavily involved in modelling, price negotiations and discussions for integration post-deal,” Guy explains.

Guy is cautiously optimistic for the sector. “If we can manage headwinds, there remain great opportunities for strong businesses. And rising consumer spending and an improved tightening labour market may bring welcome tailwinds later this year.”

View from the factory floor: Wearwell

Richard Wright is no stranger to manufacturing. He joined workwear maker Wearwell in 2017 as part of a Rockpool-led £5m BIMBO, bringing with him over 15 years’ relevant experience.

The last two years have been a perfect storm: Brexit caused delays on shipments and imports and then Coronavirus came and stopped things in their tracks. “We were coming to terms with the changes of Brexit when demand waned, but then it came back and we had to rise to that challenge,” recalls Richard.

Fortunately, Wearwell wears its UK roots well. More than three-quarters of its supply is domestic, meaning it has been able to step in where supply chains were disrupted. In 2020, the UK Government turned to Wearwell to supply PPE for a period and now it’s infilling by manufacturing for its competitors. “I’m making goods in my UK factory for my competitors whose ships are stuck at ports.”

When it comes to managing challenges, Rockpool brings its portfolio experience to bear. Says Richard: “They bring sound advice and focus on stock rotations, cashflows, and help with JIT and inventory management to boost cash reserves.”

As a smaller business, Wearwell can manage costs more carefully, and the soaring cost of containers is making the UK seem more competitive. The company also has a second manufacturing plant in Tunisia, which enables near-shoring when it suits and helps with some Brexit issues.

Richard expects to return to more normal trading once the red-tape falls away, and is looking ahead to the second half of 2022 with a strategic plan to invest more in industry and product diversity. An acquisition in that direction was underway at the time of writing.

But if the last two years have taught us anything, it’s that the only certainty is uncertainty itself. “It’s a very volatile market so we have to be agile.”

Looking ahead

An industry that endured a bumpy year now looks ahead to further challenges and opportunities. While growth for UK manufacturing is forecast to reach 6%, the perennial issues of access to labour and supply chain disruption persist. This became more acute in the last two years as Brexit saw an exodus of certain workers and added to the pandemic’s detrimental effect on supply chains. Now as 2022 gets underway, rising inflation is being driven by soaring prices for raw materials and energy, labour and shipping costs and hikes in NI and Corporation Tax.

That said, the Make UK survey suggests almost three-quarters of companies feel conditions for the sector will improve in 2022, with a similar number believing the opportunities for their businesses outweigh the risks.

Corporate buyers are on the lookout for strategic acquisitions of businesses that may be more willing to sell now than a year or two ago, and financial investors continue to use buy-and-build as a tool to create value. “Valuations are high when you base them on historical performance and this may tempt some owners to consider sales,” explains Marc Fecher, adding that they aren’t high enough to thwart would-be buyers: “Buyers typically build in a value creation angle prior to any deal and so enter into negotiations with confidence despite hefty price tags. Our own experience shows corporates are still willing to pay strategic premiums for assets, with private equity more willing to do so if it is an add-on to an existing platform. Both buyer types are expecting to engage swiftly in what has become a fast-paced transaction environment, meaning sellers need to ensure their businesses are in the best shape for an accelerated process.”

Contact us

If you’re an ambitious manufacturing business with revenues of at least £10 million and are looking to scale up or exit, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner or acquirer. Contact Jeremy Read or Marc Fecher to find out more about raising finance and our M&A services.