Growth Capital Update: Q1 2023

Investors remain cautious – bigger technology businesses benefit

In the second half of 2022, we began to see the UK’s growth capital market cooling down, most likely as a result of increasing interest rates, which affect the affordability of transactions. This cooling down has continued into the first quarter of 2023, but longer-established businesses and particularly technology businesses continue to attract investment. Investors are cautious but willing to back quality companies with a proven track record.

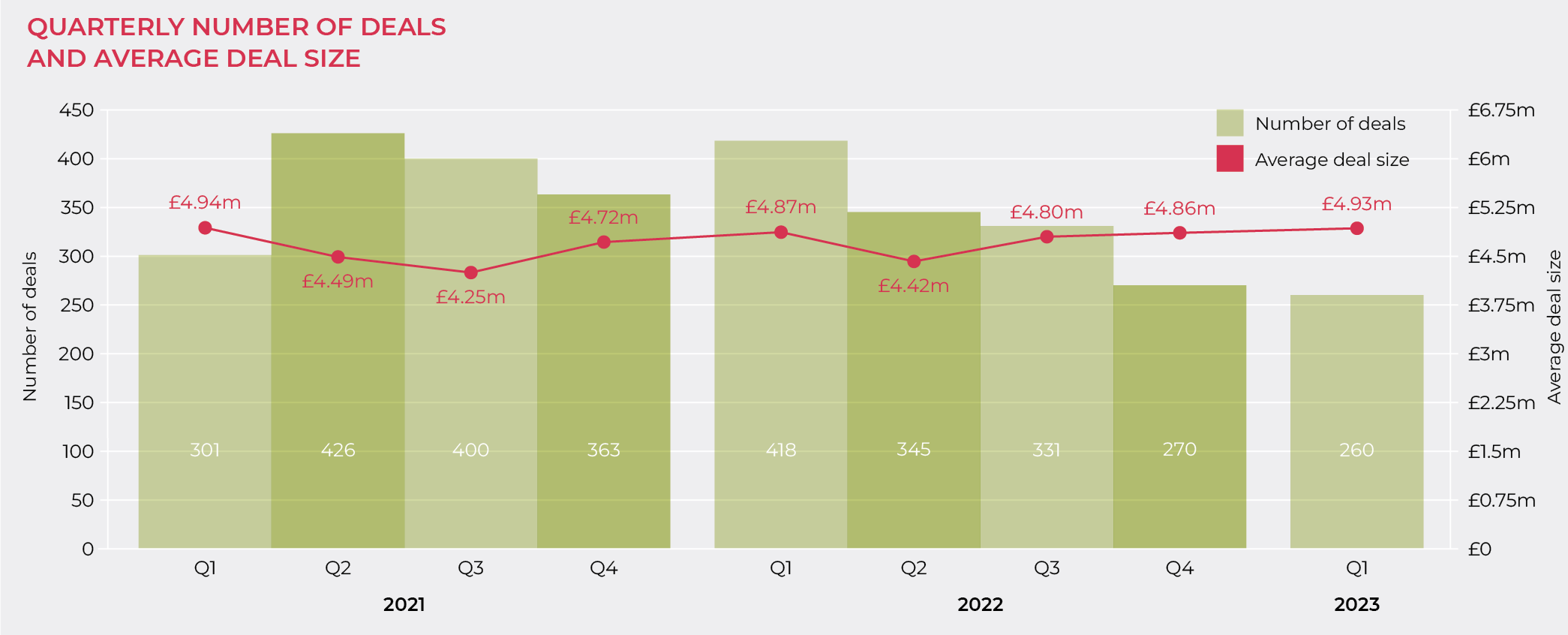

According to our latest research into UK private companies raising between £1 million and £20 million of growth equity capital each, 260 UK businesses raised a total of £1.282 billion in the first quarter of 2023. The average deal size was £4.93 million.

In the final quarter of 2022, we saw 270 deals with an average deal size of £4.86 million, and £1.311 billion raised in total. Our Q1 2023 figures therefore reveal a 4% decrease in the number of deals completing and a 2% decrease in the overall amount of growth capital being raised. Deal-making can be seasonal, so we also note that activity, in terms of numbers of deals, in Q1 2023 is 38% lower than the equivalent period in 2022, and 14% down on the same quarter in 2021.

“Longer-established businesses and

particularly technology businesses continue

to attract investment. Investors are cautious

but willing to back quality companies with a

proven track record.”

Average deal sizes have steadily increased over the last nine months, which is consistent with a higher proportion of deals being later-stage deals, since later-stage fundraisings usually raise larger amounts than early-stage transactions.

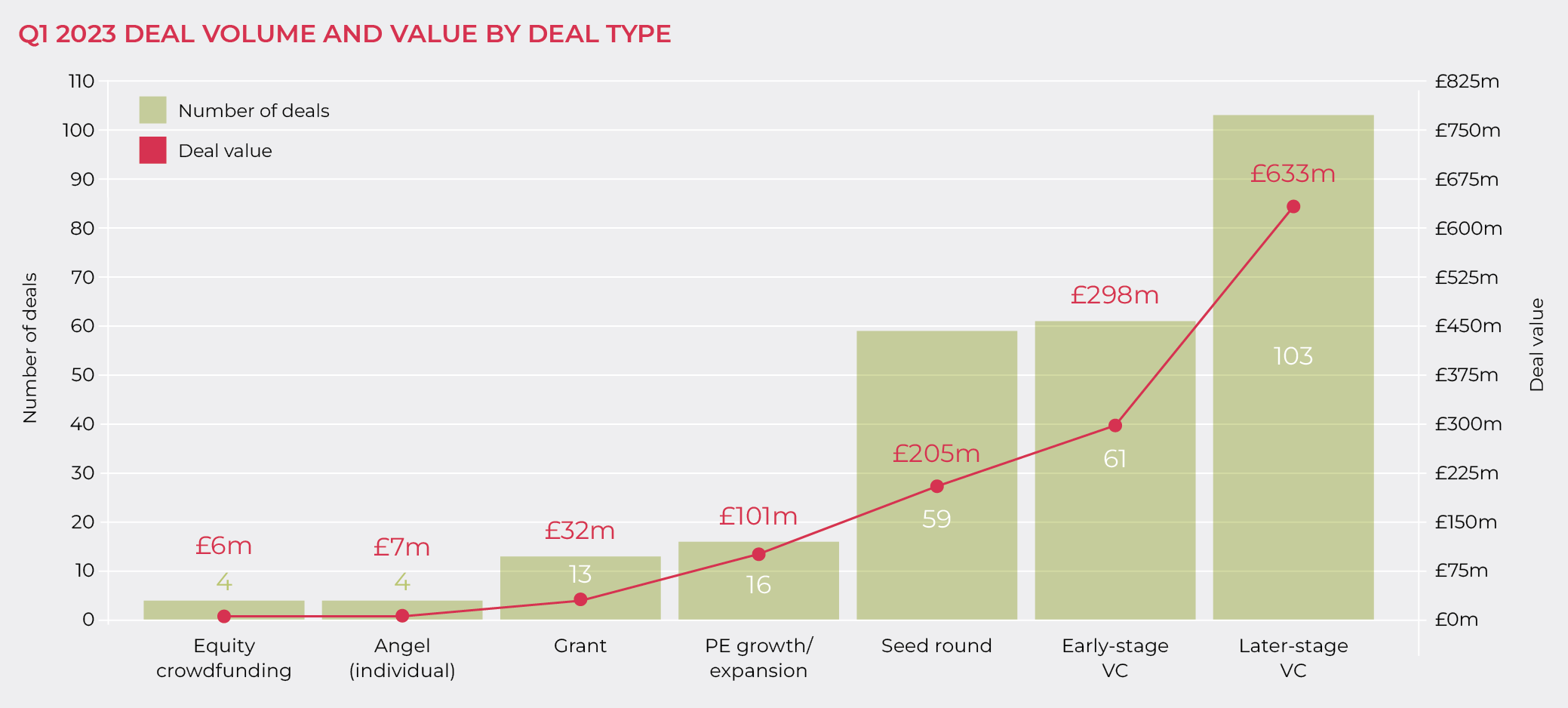

Later stage VC deals were the most common type of transaction in Q1 2023, accounting for 40% of all deals completed and very close to half of total funds

“Companies with a proven track record are continuing to be more attractive to investors in 2023 than early-stage businesses.”

invested. While deal activity is down overall, when we compare Q1 2023 with Q1 2022, we see that different types of deals have seen different levels of decline. The number of later-stage VC deals in Q1 2023 was some 30% lower than those we saw in Q1 2022, but early-stage VC and seed rounds were 40% lower, while the number of angel fundraisings completing in Q1 2023 was only 10% of the level achieved in the same quarter of 2022.

“The slowdown in Q4 2022 has continued into the first quarter of 2023, as we suspected it would. Quality opportunities haven’t gone away, though, so we think that once some stability returns – inflation easing, base rates stabilising, energy prices normalising – debt markets should ease and investors will begin to deploy capital more freely again.” John Cowie, Head of Growth Capital at Moore Kingston Smith.

This helps to explain the pattern we have seen of increasingly higher average deal sizes, and shows that companies with a proven track record are continuing to be more attractive to investors in 2023 than early-stage businesses.

Tech deals remain on top

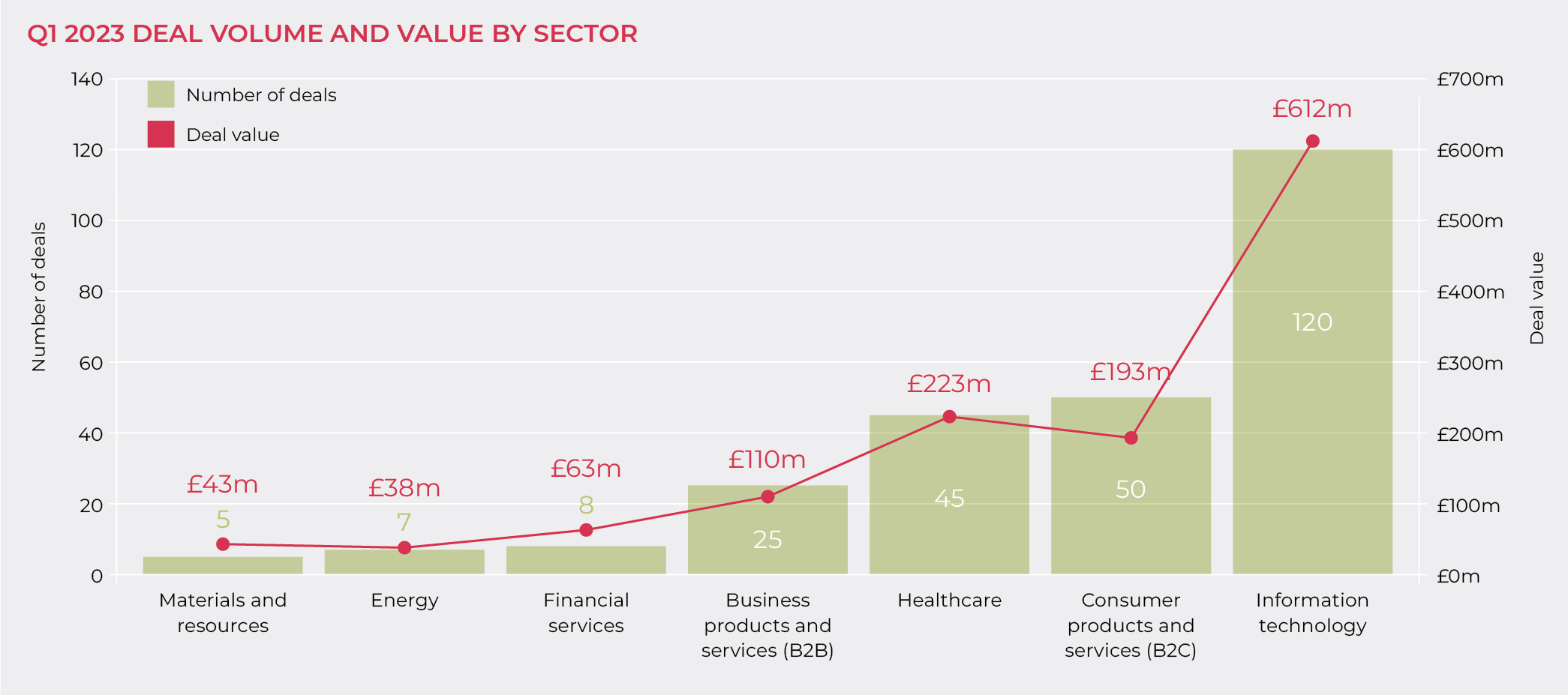

Technology was the most popular sector for investors in Q1 2023, accounting for 46% of all transactions by volume and 48% by value. Although it placed top in every quarter last year as well, these percentages represent a significant increase in technology’s market share: it represented 36% of transactions by volume and 37% by value in Q4 2022. This increase in market share seems to have come at the expense of investment in B2B products and services, which accounted for just 10% of all transactions in Q1, having made up over 20% in Q4 2022.

“Once some stability returns debt markets should ease and investors will begin to deploy capital more freely again”.

John Cowie, Head of Growth Capital

at Moore Kingston Smith

Notable deals in the tech space in Q1 included the announcement by London-based start-up Seldon that it had raised $20 million in a Series B funding round led by new investor Bright Pixel. Also participating were existing investors Albion, Cambridge Innovation Capital and Amadeus Capital Partners. Seldon specialises in development tools to optimise machine learning models. Its tools are used by data scientists and machine learning engineers to transition an AI algorithm into every-day, working production models. The idea is to improve the model’s automation while also keeping an eye on business and regulatory requirements around bias, as well as other aspects of AI.

Q1 also saw Chester-based AeroCloud, a cloud-native airport management software business working with dozens of airports around the world, announce that it had raised $12.6 million in a Series A round of funding, led by US fund Stage 2 Capital. I2BF Global Ventures, Triple Point Ventures, Praetura Ventures and Starburst Ventures also joined in the round along with existing investors Playfair Capital and Haatch. Founded by former professional racing driver George Richardson (CEO) and airport operations innovator Ian Forde-Smith (CTO), AeroCloud uses technologies such as AI and machine learning combined with hardware to transform airport operations, drive communication amongst stakeholders, and increase airport efficiency and operating margins. The platform enables everything from faster passenger processing times to improved self-service check-in and bag drop and facilitates increased communication between stakeholders to deal with real-time fluctuations in processes to ensure that airports work better and communicate with their customers.

“When the investment community starts to turn a little cautious, it is not surprising to see technology investments become even more popular than before. A shrinking market leads to a flight to quality, and investors will often prize technology businesses over other sectors for their potential to innovate and disrupt, thereby presenting the opportunity to deliver superior returns.”

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith

Active investors in Q1

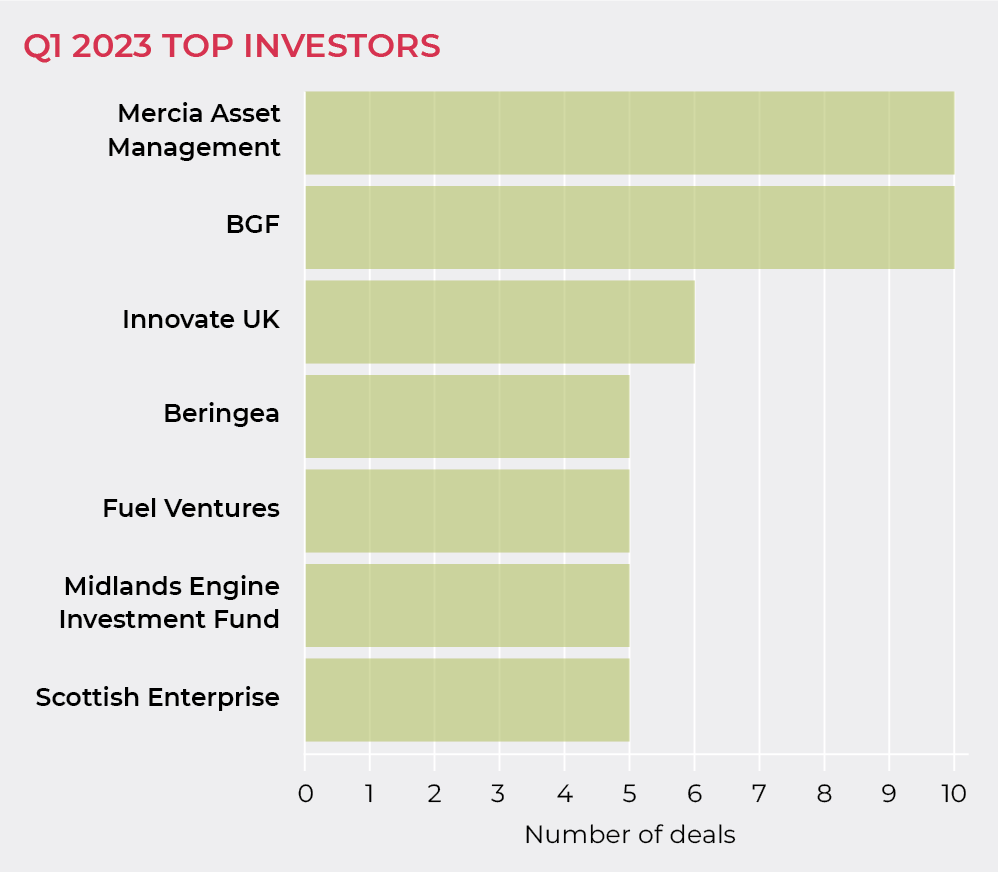

Mercia Asset Management and BGF were the most active investors in Q1 2023, with ten deals completed apiece. The UK’s national innovation agency, Innovate UK, came in third with six deals.

Mercia’s investments in Q1 were largely in technology and healthcare. They included co-leading the £9.7 million Series A investment round into Dxcover, a Glasgow-based company developing a blood test for the detection of early-stage cancers. Mercia has supported Dxcover since its inception in 2019, investing from its EIS funds including its Mercia EIS Knowledge Intensive Impact Fund. Julian Dennard, Head of EIS funds at Mercia, said: “Dxcover analyses tumour signals and non-tumour signals that genetic tests cannot detect. We are excited about the recent results which show its ability to detect multiple cancers at the earliest stage, when more lives can be saved. The investment will build on the traction created by that study and aims to make Dxcover a leader in the fast-growing market for cancer diagnostics.”

The majority of BGF’s investments were also in technology and healthcare. In February, BGF participated in the £13 million Series A funding into biotechnology company Biotech Maxion Therapeutics. Cambridge-based Maxion Therapeutics will put the capital towards its antibody drugs treating ion channels and G-protein-coupled receptors, which are the cell surface proteins associated with diseases such as chronic pain and autoimmune conditions. BGF also invested £4.2 million in Gateshead-based website accessibility software business Recite Me, which has worked with brands including Boots and Coca Cola. Via its plugin, it enables customers to customise their online experience with the aim of removing obstacles for those with disabilities, such as visual impairments and learning difficulties, as well as those who speak English as a second language.

Outlook

In our round-up of 2022, we said that while interest rates remain higher than they have for a number of years, they will act as a drag on activity and therefore we suspected the slow-down would continue into the first half of 2023. Our suspicions are borne out by Q1’s data. However, once the market starts to believe that interest rates are at or near their peak, and on the back of better economic data about the functioning of the UK economy and consumer confidence, we expect the second half of 2023 to see an uptick in activity. For the time being, investors will continue to be interested in transactions involving companies with a proof of concept and a strong track record, particularly in the technology sector.

“Once the market starts to believe that interest rates are at or near their peak, and on the back of better economic data about the functioning of the UK economy and consumer confidence, we expect the second half of 2023 to see an uptick in activity.”

Contact us

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner for you. Contact us to find out more about our raising finance and growth capital services.

We also assist investors and are experts at providing advice throughout the acquisition or investment process. Our team can help identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology

Moore Kingston Smith has analysed transactions by UK-based companies that involve the issue of less than 50% of equity share capital to third parties and funds raised of between £1 million and £20 million. Accordingly, these numbers do not include senior debt and mezzanine debt fund raisings and smaller fund raisings by companies and start-up funding unless more than £1 million is raised. Start-up funding is generally significantly less than this amount.

The research aims to capture all transactions by UK companies that fall within the criteria. Inevitably there will be transactions that have taken place but have not been captured. The research is based on data extracted from Pitchbook and information from the following sources: techcrunch.com, brpx.com, aerocloudsystems.com, mercia.co.uk, uktech.news, insidermedia.com.