Growth Capital Update: Q4 2022

2022 in review: the UK’s growth capital market starts to come off the boil

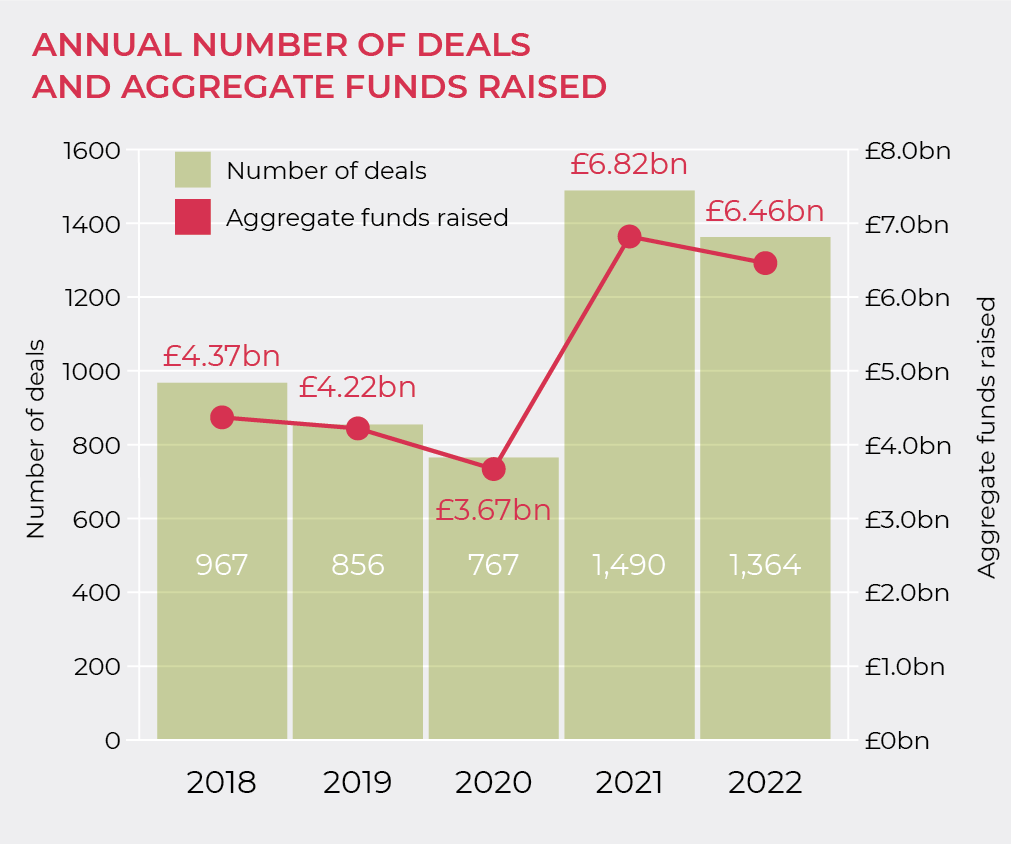

The UK’s growth capital market had another very good year in 2022 but was unable to match the dizzy heights of 2021, which was itself a record year for dealmaking. Interest in backing UK companies with high growth potential remained strong, but there was a distinct cooling down in the market as the year progressed, driven by global and domestic economic factors.

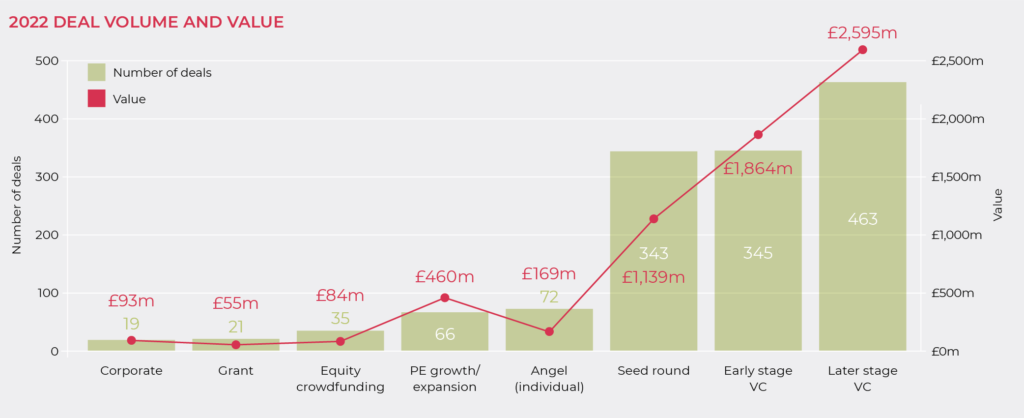

Our research into UK private companies raising between £1 million and £20 million of growth equity capital each finds that, in 2022, 1,364 UK businesses raised a total of £6.46 billion. This is 8% down on 2021 in terms of number of deals completed, and 5% down in terms of funds raised. However, 2022 compares favourably to previous years, representing the second-best year within the last five. The average deal size in 2022 was £4.74 million, which is larger than the £4.57 million we recorded in 2021. This may reflect a larger number of later-stage deals attracting funding in the past year.

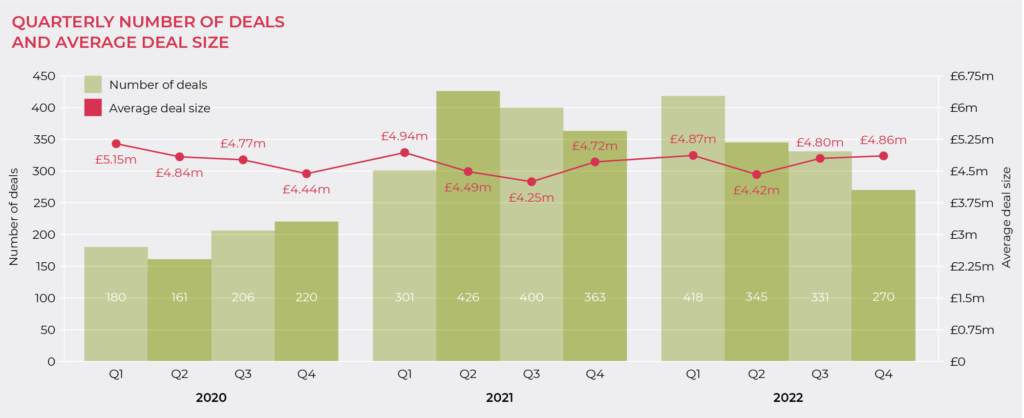

2022 has been a difficult year for many businesses. The domestic and global economies have been affected by such factors as commodity shortages, increasing inflation, higher borrowing costs and industrial disputes, not to mention the situation in Ukraine. It seems that investors were largely unaffected by such concerns in the first quarter of the year, but we did see an easing off in activity quarter-on-quarter, and this became especially obvious in the final quarter of the year.

Our Q4 2022, research reveals that 270 UK businesses raised a combined £1.311 billion of growth equity capital between October and December 2022. The average deal size was £4.86 million.

In the third quarter of 2022, we saw 331 deals complete with an average deal size of £4.80 million, and £1.590 billion raised in total. Our Q4 2022 figures therefore represent a c. 18% decrease this quarter in both the number of deals and the overall amount of growth capital being raised. That is a significant decline in activity, and highlights that the market for growth capital in the UK has become more difficult in recent months.

This is most likely the result of recent increases in interest rates, which affect the affordability of transactions. While our report focuses on equity fundraisings, these transactions often also require leverage, and therefore the cost of debt is an important factor.

“It’s clear that macroeconomic factors began to play a part in deal-doing in the latter part of 2022 but the slowdown was not as marked as we might have expected. It may be that the full impact of the rise in interest rates is yet to filter through – we are certainly hearing that lenders are being more cautious – so we’ll be watching Q1’s data carefully.”

John Cowie, Head of Growth Capital at Moore Kingston Smith

Regarding the types of deals that were most common in 2022, later-stage VC held onto the top spot it had achieved in 2021. Later stage VC increased its share of the market this year, accounting for over a third of all deals completed and over 40% of total funds invested.

In 2021, it accounted for 30% of deals and 36% of funds invested. This helps to explain the higher average deal size we recorded this year, and shows that companies with a proven track record were more attractive to investors in 2022 than early-stage businesses.

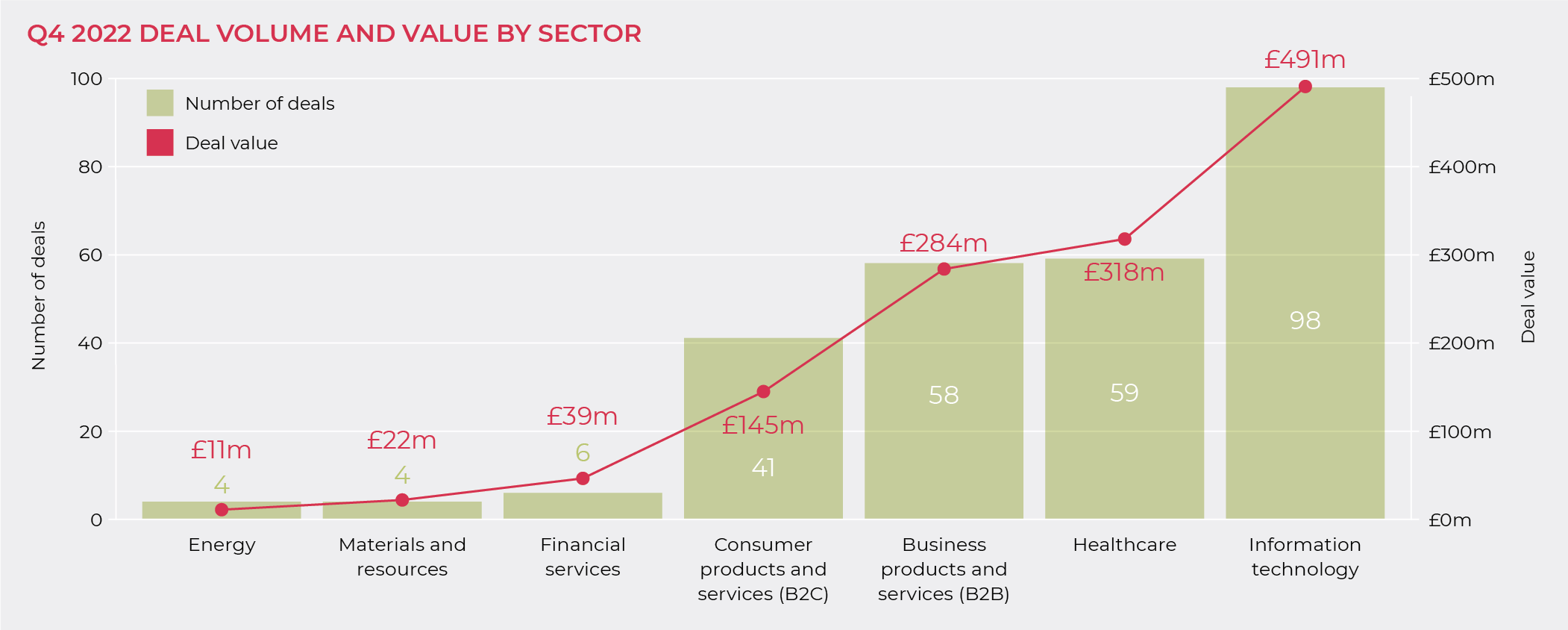

Tech deals most popular throughout 2022

Technology was the most popular sector for investors every quarter last year, accounting for 36% of all transactions by volume and 37% by value in Q4 2022. Investor appetite for healthcare and B2B businesses also remained strong.

Notable deals in the tech space in Q4 included the announcement by London-based TreeCard that it had secured $23 million in a Series A funding round led by PayPal co-founder Peter Thiel’s Valar Ventures. TreeCard is a fintech that plants trees when money is spent using its wooden card – it plants one tree for every $50 spent. Founded in 2020, TreeCard says it has already planted more than 200,000 trees. Valar Ventures was joined in the TreeCard Series A by World Fund, EQT Ventures, Seedcamp, Episode 1, Dylan Field and Josh Browder. Tom Mendoza, partner at EQT Ventures, said: “At EQT Ventures, we believe that some of the largest consumer companies in the coming decade will emerge from the intersection of climate and fintech.”

Q4 also saw Giraffe360, a London-based 360-degree real estate camera business, announce that it had raised $16 million in a new fundraising led by the pan-European early-stage VC Founders Fund, and supported by existing Giraffe360 investors, including Hoxton Ventures and Change Ventures. Giraffe360’s product is a bespoke HDR 3-in-1 camera that lets developers quickly whip up a 360-degree virtual tour of their real estate while also digitising the property’s floor plans. The latter requires precise measurements taken using Giraffe360’s AI-controlled laser technology, which the company says can record floor measures at near-perfect (98%) accuracy. The company has previously raised funds on at least three occasions. It secured €500,000 in pre-seed funds from Koha Capital in 2016, adding £1 million from Change Ventures three years later. The company’s formal seed round came in November 2020, raising a total of $4.5 million from LAUNCHub Ventures and Hoxton Ventures (both co-leading the round), along with HCVC and Change Ventures.

“Despite the financial performance of some of the global tech giants, investors will continue to be attracted to tech start-ups and scale-ups, regardless of the economic back drop, as investments in the right assets will lead to market beating returns.”

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith

Active investors in Q4

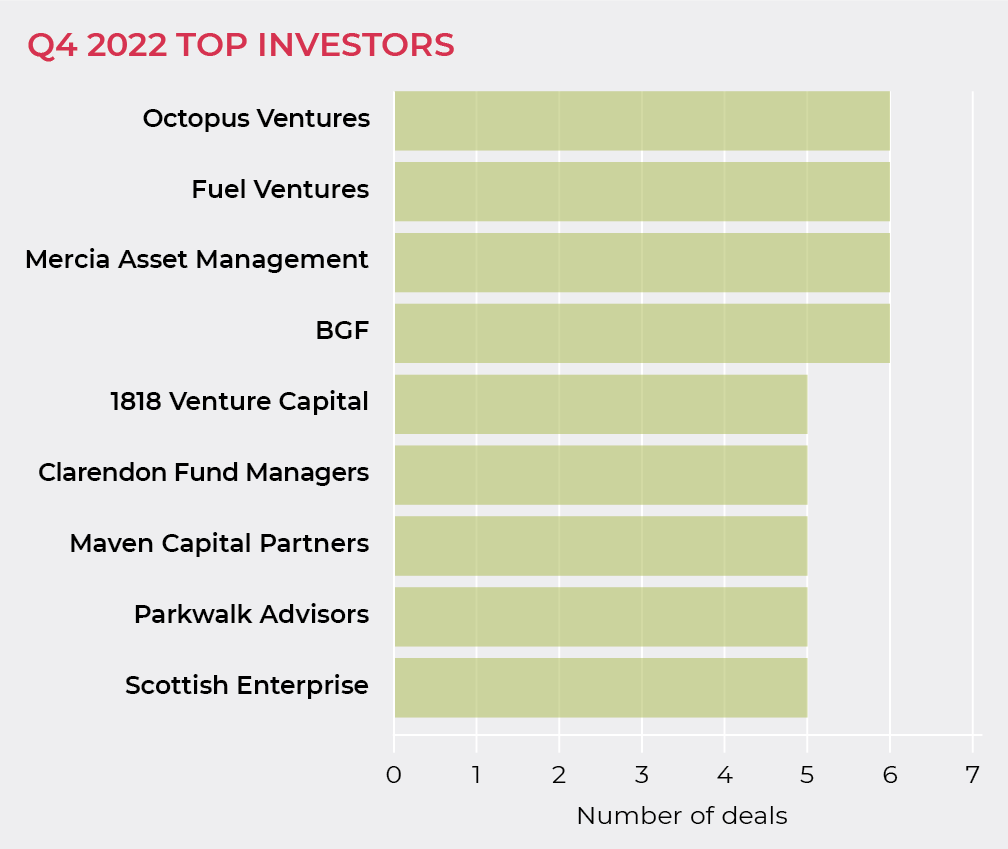

Our most active investor from Q3, Octopus Ventures, continued to be busy in Q4, but had to share the top spot with three other houses: Fuel Ventures, Mercia Asset Management and BGF, all of which completed six deals in the quarter.

BGF was our most active investor when looking at 2022 as a whole, closely followed by Octopus Ventures and Scottish Enterprise. Octopus Ventures’ investments in Q4 were largely in the technology space. They included leading the £4 million seed funding round into Phlux Technology, a designer of high-performance infrared sensors, and leading a $7 million fundraising into BondAval, an insurtech start-up with offices in London and Austin, Texas, which helps independent retailers access better credit terms from suppliers.

As well as making new investments in Q4, Octopus also invested further in one of its existing portfolio companies, Intrepid Owls (trading as Rest Less) – a digital community, advocate and financial services platform for people aged over 50, which raised £6 million in its latest funding round in December.

The latest funding round was led by Moneta Venture Capital, an Israeli fintech fund, with additional new investment from Sony Financial Ventures/Global Brain and Exceptional Ventures. Rest Less began in 2019 as a work and careers site matching age-inclusive employers with its member base but has rapidly expanded to offer thousands of tailored articles, guides and advice to support members as they navigate a wide range of midlife transitions including work, health, pensions, relationships and money. Sara Stephens, Co-founder and CTO of Rest Less, commented: “Historically the tech industry has ignored this large and growing section of society (for anything apart from later life care solutions). This is despite them being an enormous consumer market, controlling over 75% of all household wealth and being chronically underserved in many key dimensions.”

“Investments in Q4 were largely in the

technology space.”

BGF’s investments were more eclectic and in Q4 included B2B, B2C and healthcare as well as technology. In December, BGF led a £10.5 million funding round into tepeo, the British designer of the Zero Emission Boiler (ZEB), which was supported by tepeo’s existing investors Clean Growth Fund (CGF), Bonheur and Renewable Environmental Investments. tepeo’s patented ZEB is a direct plug-n-play replacement for a gas, oil, LPG or electric boiler, and is a low-carbon alternative which the company says does not compromise on performance. Instead of relying on fossil fuels, its proprietary technology is powered by electricity and works like a battery to store heat efficiently until it is needed. The funding will enable the company to develop its Wokingham head office, growing its production, R&D, assembly and commercial teams, as well as expanding sales across the UK. The goal is to decarbonise domestic heating and provide grid stability services that will support the deployment of further renewable generation across the national grid.

Outlook

2022 sprinted out of the blocks with a powerful first quarter which led us to hope that the year might even overtake the record-breaking level of activity we saw in 2021. However, it was clear from Q2 onwards that investors were starting to apply the brakes. Now that we have a full year’s data, we can see that the market has slowed considerably from the start of the year. 2022 was still a bumper year for investment in UK companies – the second-best in the last five years – and investors remain willing to commit funds. However, investment does seem to be gravitating towards fewer, larger deals involving companies with a proof of concept and a strong track record.

While interest rates remain higher than they have for some years, they will act as a drag on activity and we suspect the slow-down will continue into the first half of 2023. However, we remain optimistic about the market’s performance in the second half of the year and beyond.

“UK tech companies will continue to be of interest to investors, particularly where they demonstrate a reliable recurring revenue model and consistent returns typical of SaaS businesses and those in healthcare/healthtech. This is despite wider fears over the UK market with rising inflation, cuts to the attractive R&D tax credit scheme for SMEs and an increased focus by investors on the route to profitability.”

Ryan Day, Partner – Head of Technology at Moore Kingston Smith

Contact us

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner for you. Contact us to find out more about our raising finance and growth capital services.

We also assist investors and are experts at providing advice throughout the acquisition or investment process. Our team can help identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.

Methodology

Moore Kingston Smith has analysed transactions by UK-based companies that involve the issue of less than 50% of equity share capital to third parties and funds raised of between £1 million and £20 million. Accordingly, these numbers do not include senior debt and mezzanine debt fund raisings and smaller fund raisings by companies and start-up funding unless more than £1 million is raised. Start-up funding is generally significantly less than this amount.

The research aims to capture all transactions by UK companies that fall within the criteria. Inevitably there will be transactions that have taken place but have not been captured. The research is based on data extracted from Pitchbook and information from the following sources: uktech.news, tech.eu, uktechnews.info, techcrunch.com, bgf.co.uk.