Growth Capital Update: Q2 2023

Initial signs of recovery

![]()

299

deals completed

![]()

+15%

number of deals

![]()

£1.43 billion

growth capital raised

Our view of the market

2022 saw a rapid cooling in the UK’s growth capital market, most likely as a result of increasing interest rates, which affect the affordability of transactions. This cooling down continued into the first quarter of 2023 but Q2 2023 has revealed a significant resurgence in activity.

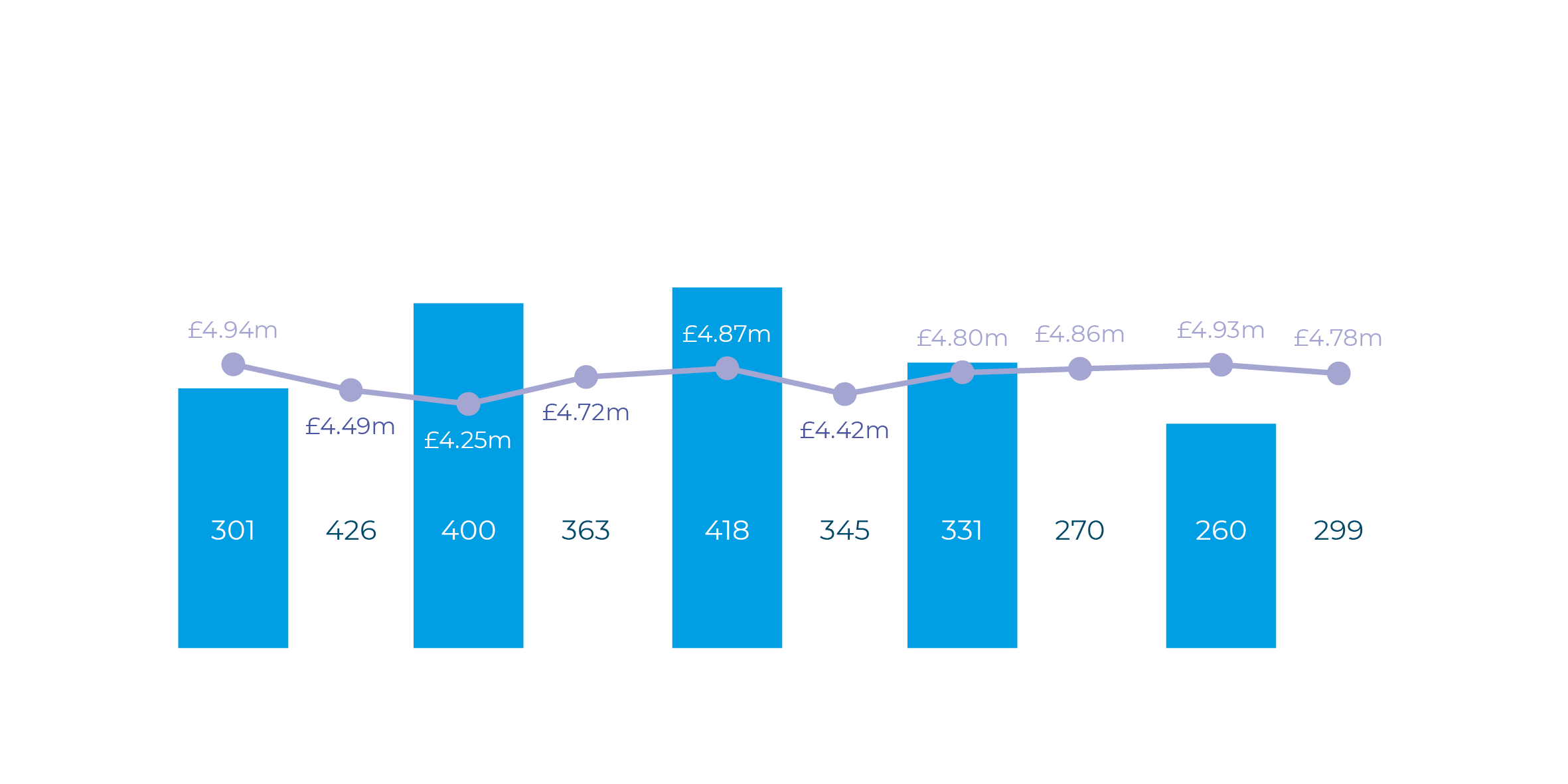

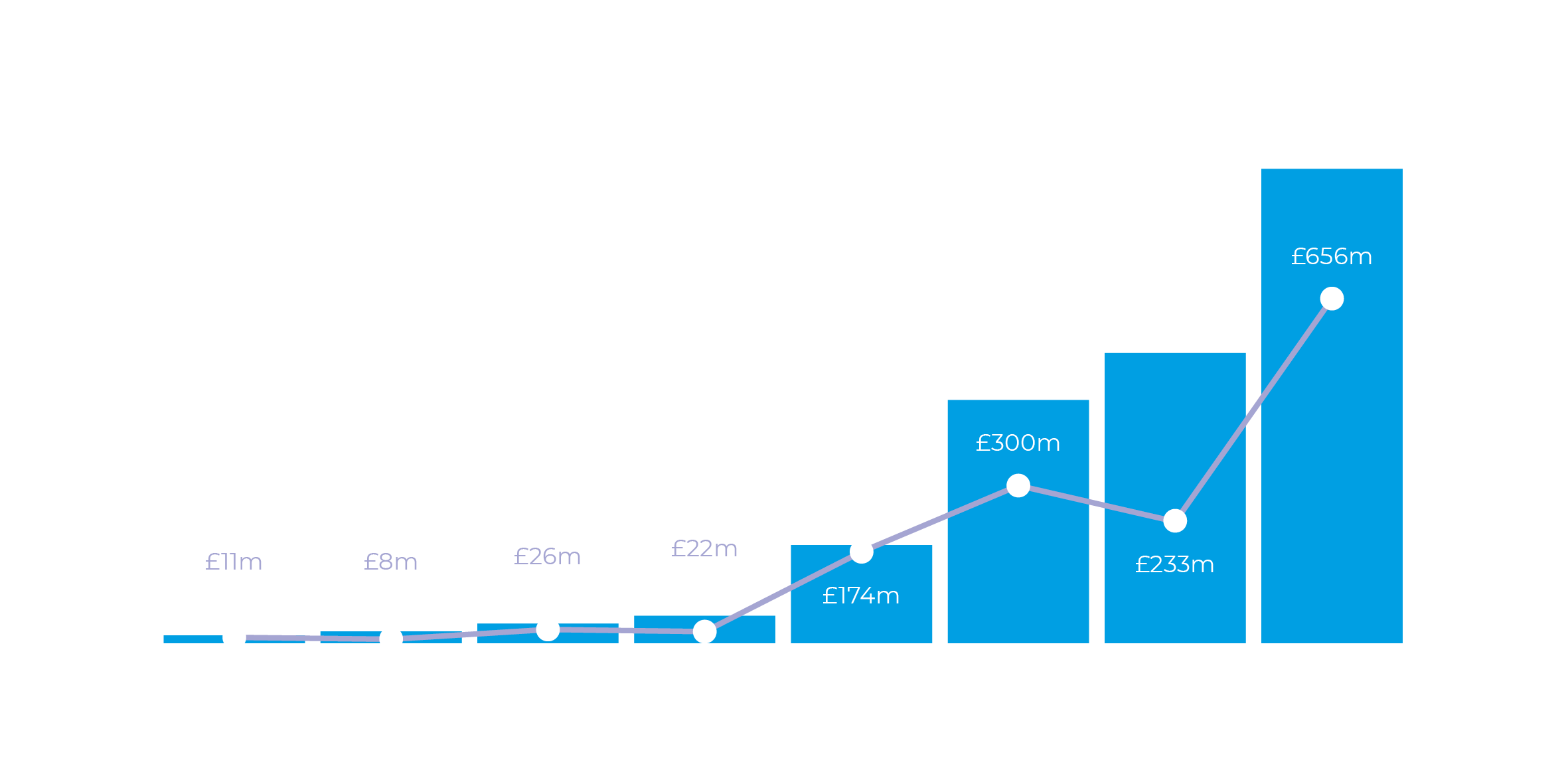

According to our latest research into UK private companies raising between £1 million and £20 million of growth equity capital each, 299 UK businesses raised a total of £1.430 billion in the second quarter of 2023. The average deal size was £4.78 million.

Our Q2 2023 figures reveal a 15% increase in the number of deals completing and a 12% increase in the overall amount of growth capital being raised when compared with Q1’s 260 deals raising £1.282 billion. Activity is still considerably lower than the equivalent period in 2022, but Q2 2023 represents the first quarter in which we have been able to report an increase in the number of transactions since the start of 2022.

Later-stage VC deals were the most common type of transaction in Q2 2023, accounting for 40% of all deals completed and 46% of total funds invested. However, despite the continuing predominance of later-stage bigger transactions, we also saw a marked increase in seed round deals in Q2 2023 – up 25% on the previous quarter, demonstrating a renewed interest in earlier-stage deals, which require less leverage. The return of early-stage investors to the UK market helps to explain why average deal sizes were lower this quarter than previously.

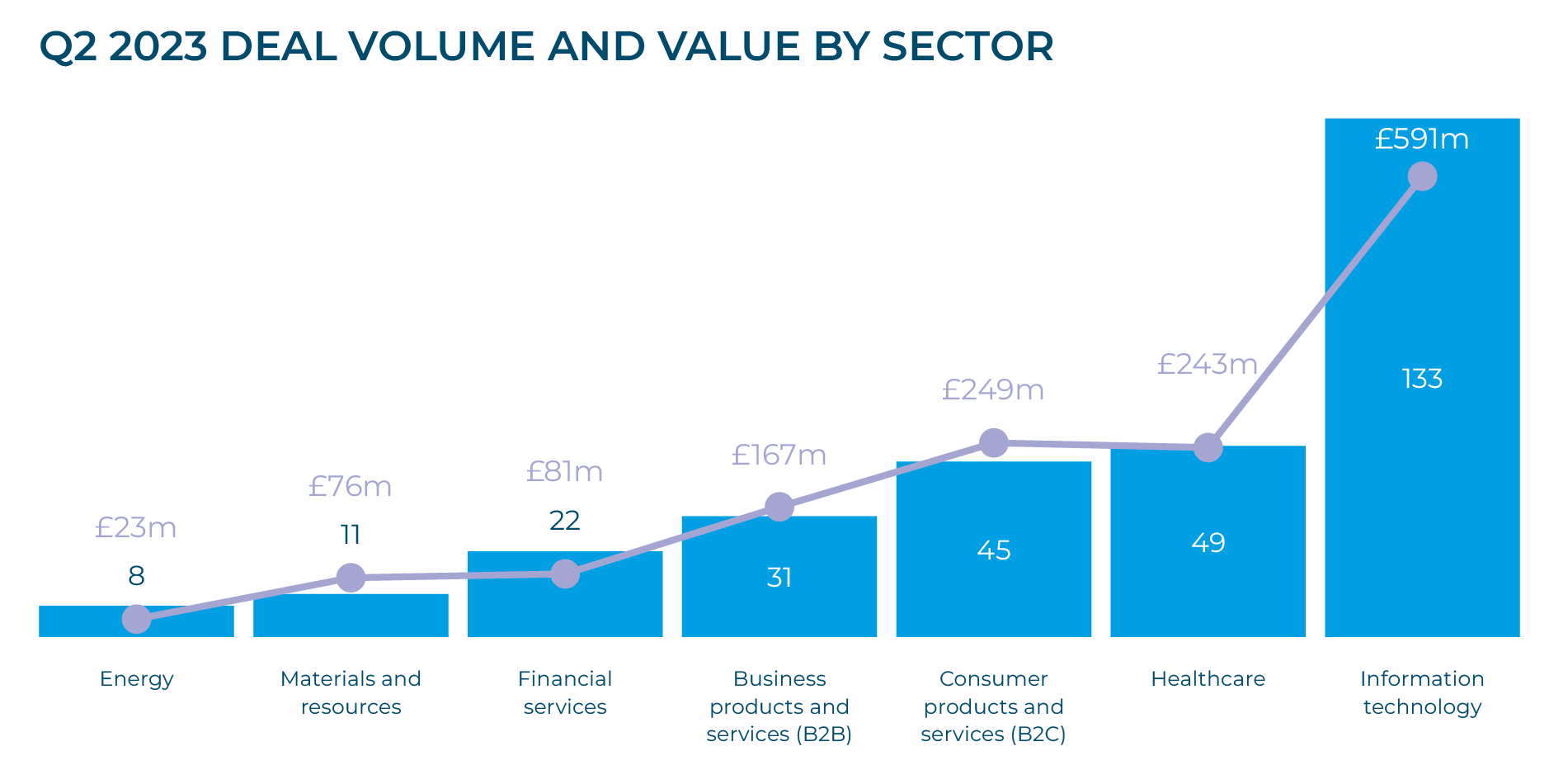

Technology sector

Technology was the most popular sector for investors in Q2 2023, accounting for 44% of all transactions by volume and 41% by value. According to the recently published 2023 Tech Nation Report, the UK tech ecosystem is currently valued at just over $1 trillion and is projected to be worth $2.6 trillion if the momentum of the last decade is maintained through the current one. Tech Nation also reported that the UK is in third position globally (behind only China and the US) for total investment in technology start-ups and scale-ups, and remains the dominant player in Europe, with investment in the UK exceeding that in France and Germany combined.

“We are encouraged to see a return to growth in Q2 2023 and renewed enthusiasm by investors, particularly for earlier-stage transactions. While there remain some economic hurdles to overcome, the resilience of the UK’s growth capital market and the quality of opportunities that exist mean that there are still plenty of deals to be done.”

John Cowie, Head of Growth Capital

Notable UK tech sector deals

Mypinpad, a Cardiff based provider of mobile cards payments and identity authentication solutions, raised $13 million in a round led by South African fintech investor Crossfin.

Adarga, a London-based AI software raised $20 million in a round led by US tech investor BOKA.

“The UK is a world-leader in technology and innovation, and therefore it is unsurprising to see technology growth capital transactions dominate in our survey. We expect this trend to continue throughout the remainder of 2023.”

Paul Winterflood, Corporate Finance Partner

Trending: healthcare

Healthcare was the second most popular sector with investors in Q2 2023, overtaking B2C investments which were in second place in Q1. Healthcare deals accounted for 16% of all transactions by volume and 17% by value in Q2. Short-term economic difficulties notwithstanding, the growth of healthcare is driven by several long-term trends, such as aging populations and the rise of chronic diseases. Investors willing to commit to this space, who can identify highly differentiated assets, will find themselves ahead when more favourable economic conditions return.

Notable healthcare deals

Cambridge-based BIOS Health, which uses AI to develop precision medicine for the nervous system, raised $20 million in a round led by UK biotech investor Selvedge Venture and XTX Ventures.

Caristo Diagnostics, an Oxford-based company specialising in cardiac and vascular disease diagnostics, announced it had raised £13 million in a Series A round led by Oxford Science Enterprises.

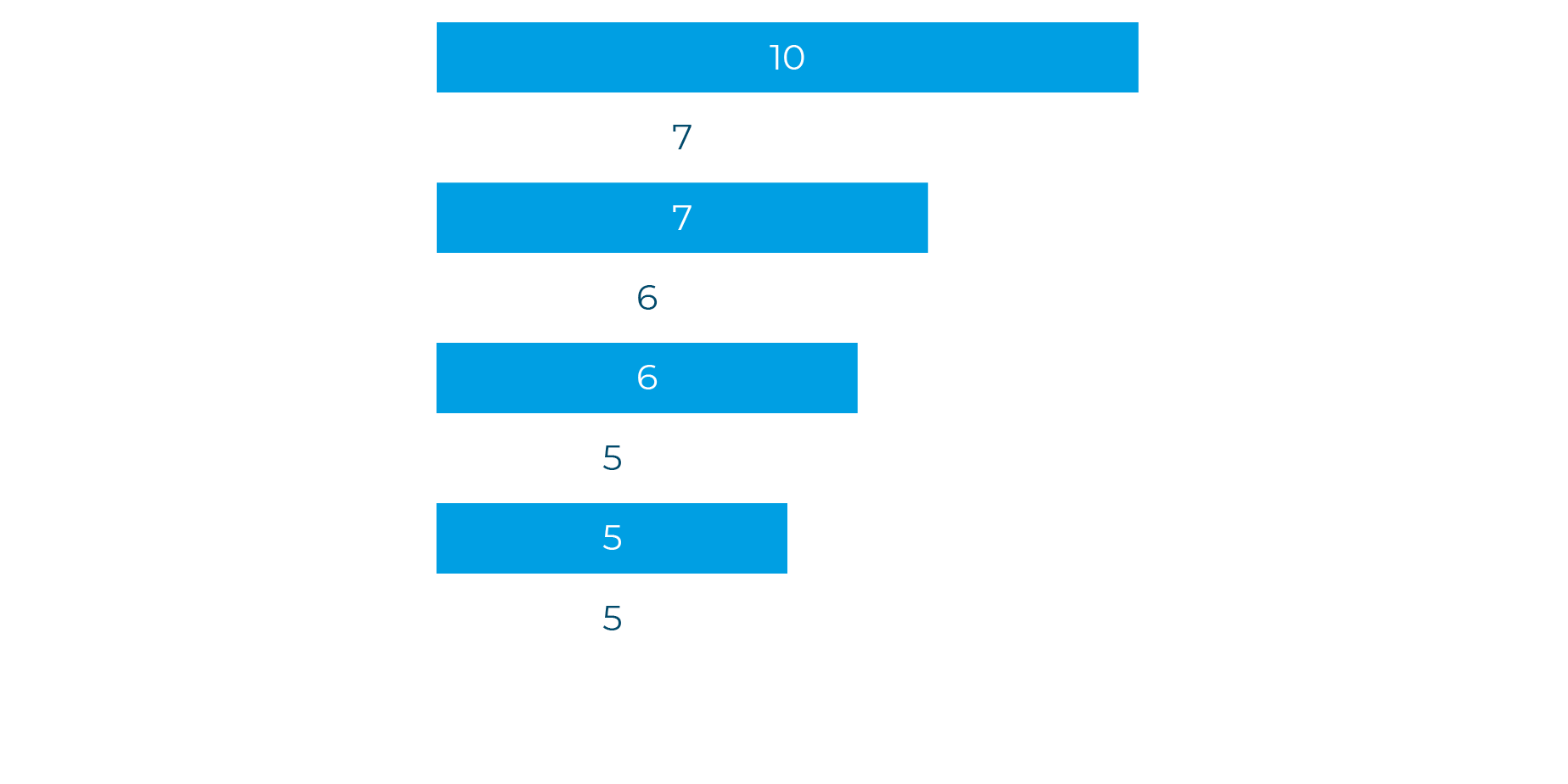

Active investors

BGF was the most active investor in Q2 2023, with ten deals completed – the same number as it achieved in Q1. Mercia Asset Management, which tied for first place with BGF in Q1, dropped back into second position in Q2, with seven deals completed. BGF invested in technology, healthcare, B2B and B2C businesses in Q2, including:

- co-leading with Morningside Ventures a £13.4 million investment round into Cyted, a Cambridge-based early cancer diagnostics company.

- investing £9 million into Voicescape, a Manchester-based provider of communications software for social housing providers and local authorities.

- enabling Newcastle-based technology consultancy, hedgehog lab, to acquire York-based digital product consultancy Netsells, as part of a £6.3 million capital injection.

Mercia’s investments in Q2 were largely in technology. They include:

- investing £3.3 million into London-based Centuro Global, an AI-powered platform that helps companies expand overseas.

- providing a follow-on investment of £2 million to existing portfolio company Adludio, a London-based mobile advertising platform operator.

Q2 2023 top investors

“We are delighted to be supporting hedgehog lab on the next stage of its growth journey. The company has already established itself as a leading global digital product consultancy and the acquisition of Netsells will combine the talent and capability of two great teams, unlocking more opportunities in this exciting sector and positioning the business as a credible player of scale in the global digital marketplace.”

John Healey, Investor at BGF

Outlook

In our Q1 report, we said we expected the second half of 2023 to see an uptick in deal activity. Q2’s data suggests that this uptick has come a little earlier than we thought, which is certainly good news. The UK still faces economic uncertainties, especially around inflation and high interest rates. However, it seems that confident investors are taking a longer-term view and have a renewed enthusiasm to write equity cheques for UK businesses, particularly those in the technology and healthcare spaces. We remain optimistic about the outlook for the UK’s growth capital market throughout the remainder of this year.