M&A in the UK IT services sector –

Q2 2023

Robust M&A activity defies economic pressures

![]()

144

deals completed

![]()

+14%

Moore Kingston Smith

IT services index

![]()

60%

deals backed by PE

Our view of the market

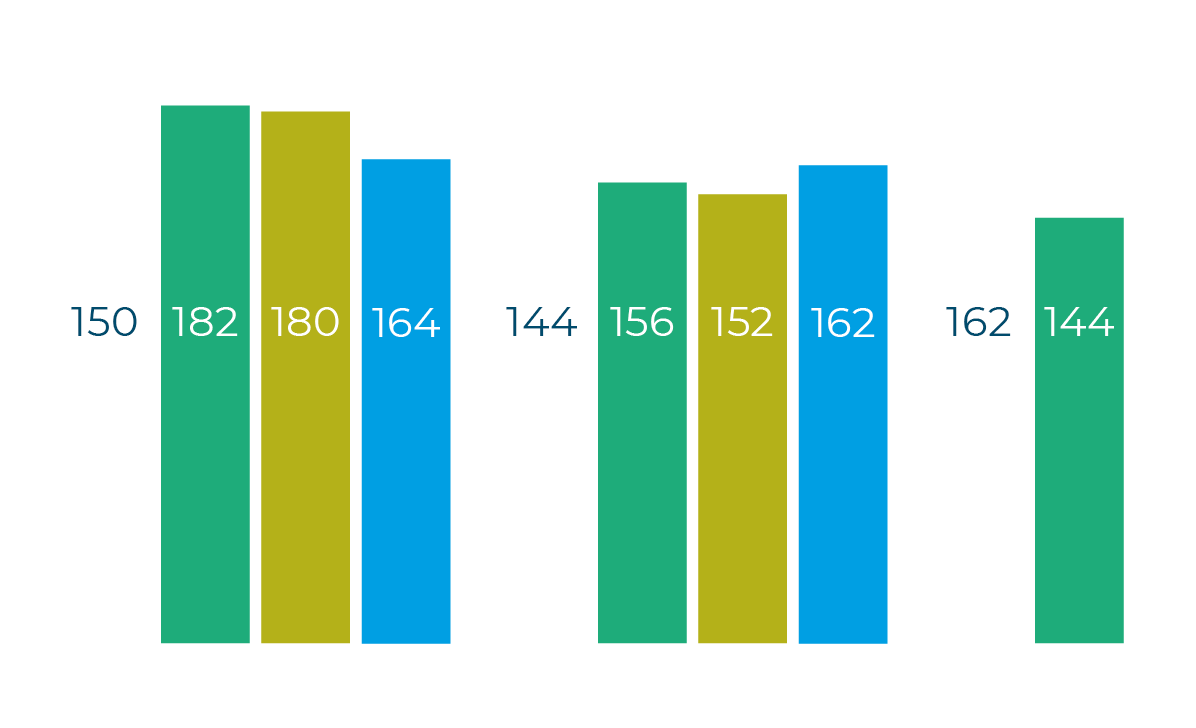

144 UK IT services deals were recorded in Q2 2023, an 11% drop on the previous quarter. 2023 did get off to a good start but acquirers have grown more cautious in recent months, reacting to rising interest rates and persistently high inflation in the UK.

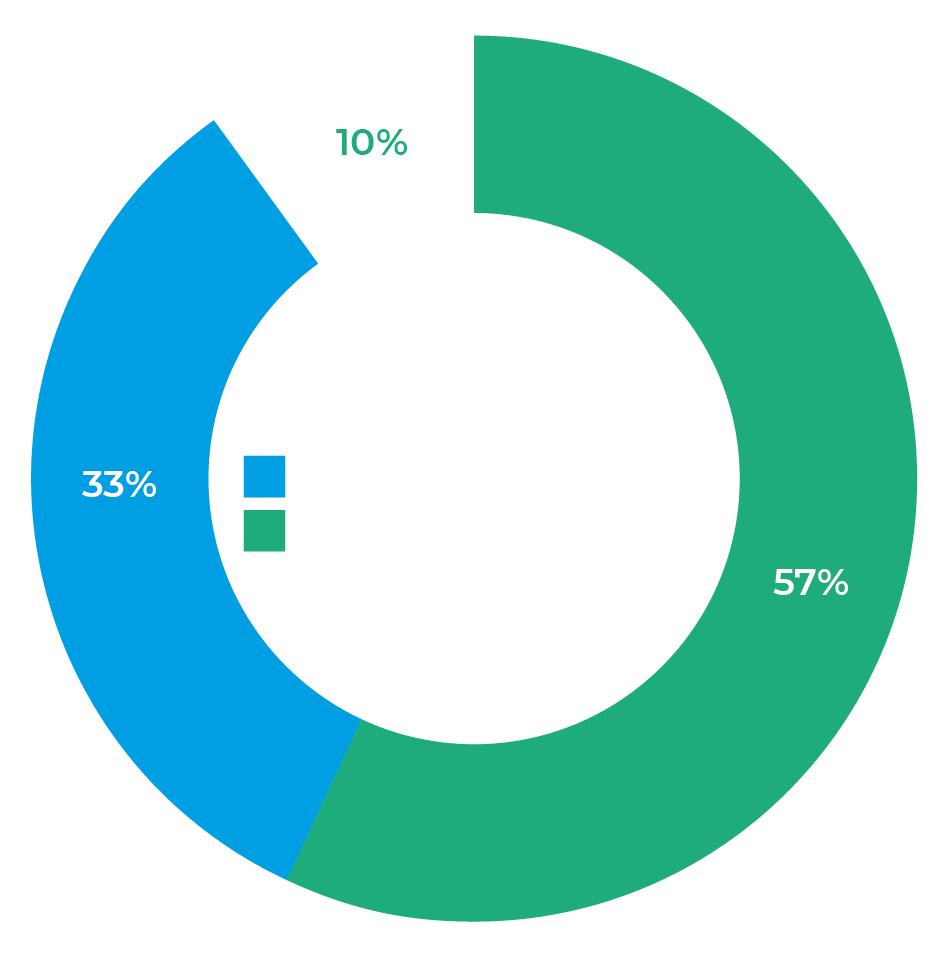

The percentage of transactions involving PE has come down from recent levels. Some PE houses may be finding it more difficult to transact while interest rates remain high. In addition, many listed IT services companies have seen their share prices increase significantly this year, meaning they represent an increasingly competitive threat to PE when it comes to bidding in M&A auctions.

Nick Thompson, Partner, comments: “While it is disappointing to see a drop in the number of deals done in Q2, we believe that this is a result of short- term UK economic issues and that the outlook for the sector as a whole, and for global interest in the UK’s IT services sector, remains positive.”

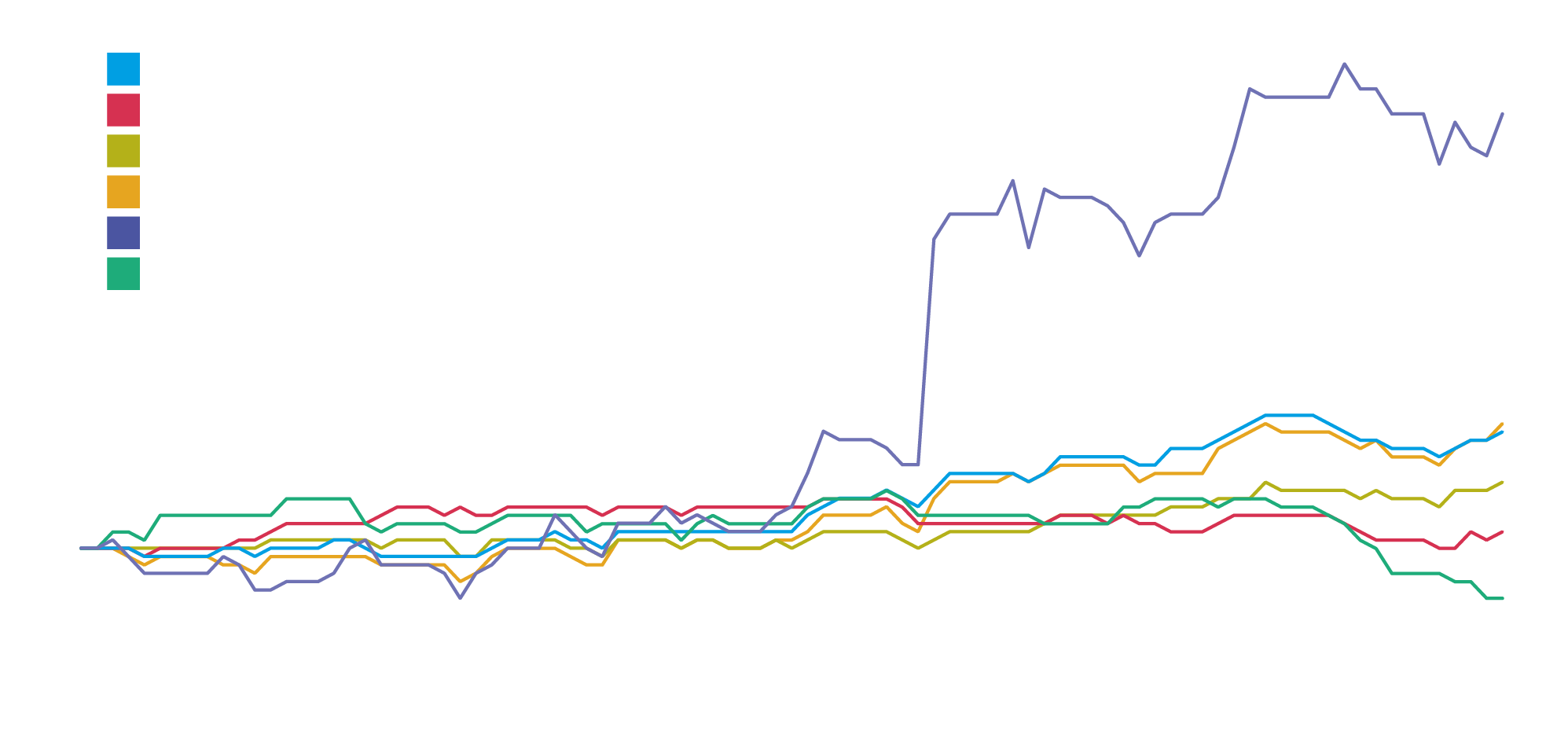

Quarterly deal volume

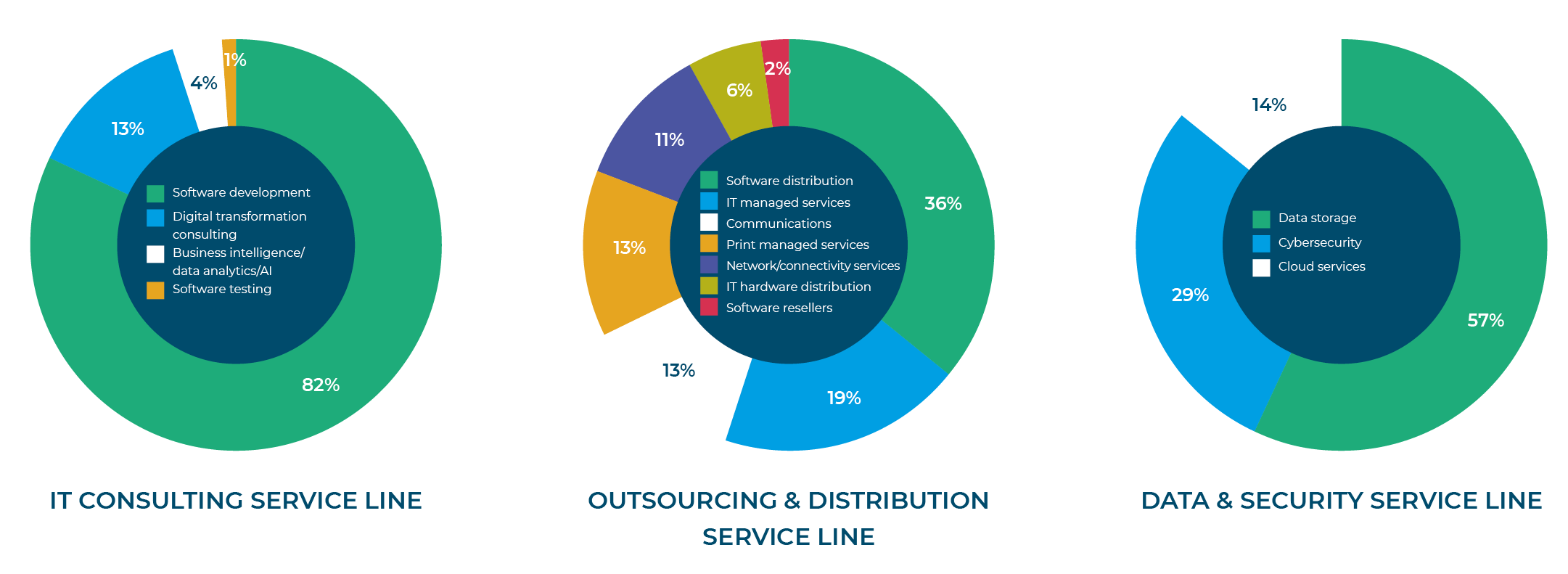

Trending: data and security

Global concern over cyber security has never been higher, with ransomware and denial- of-service attacks from bad actors coming in ever-growing numbers. Organisations are under pressure to increase their spending on cyber security and upgrade their systems. Businesses providing data and security services are operating in a growth market and are attractive to acquirers.

Moore Kingston Smith was active in the data and security space in Q2. Its corporate finance and tax teams advised the UK arm of NYSE- listed CACI on the acquisition of Bitweave, which provides bespoke software engineering and data analytics service solutions to the national security sector in the UK.

“With the explosion of cyber attacks on organisations, a culture of mitigation is important which means there is an immediate need for robust defence frameworks to be implemented into company processes, with constant review, this is leading to more value on those business operating within the data privacy and cyber security sector.”

Benn Davis, Managing Director, Moore ClearComm

Spotlight on: print managed services

Print managed services deals made up 13% of all the transactions we recorded in the outsourcing and distribution space, after a fallow Q1 in which no print deals were recorded. As well as allowing clients to optimise their traditional document output, print service providers are increasingly offering technologically advanced 3D printing solutions.

UK-based Solid Solutions, which was itself acquired by US-based TriMech in 2022, made two acquisitions in the outsourcing and distribution space in Q2: 3D printing service supplier 3DPRINTUK, and outsourced design optimisation services provider GRM Consulting.

Deals by sector

“Private equity activity may be down this quarter but we should not lose sight of the fact that PE still underpins the majority of UK IT services deals. We are confident that once inflation starts to come down and interest rates stabilise, leveraged deals will come back. For the time being, we are likely to see more smaller deals that may not require significant debt to sit alongside an investor’s equity cheque.”

Katharine Stone, Corporate Finance Director

Private equity activity

PE-backed investments accounted for 60% of all IT services deals completing in Q2 2023. This is not just significantly down on Q1 but is the lowest figure we have recorded since the beginning of 2021.

More UK IT services deals are still PE-backed than not, and PE remains an enduring and significant driver of M&A activity in the UK. However, PE transactions, particularly larger leveraged deals, are harder to put together in a high interest rate environment. It is unsurprising to see some decline in activity at this juncture.

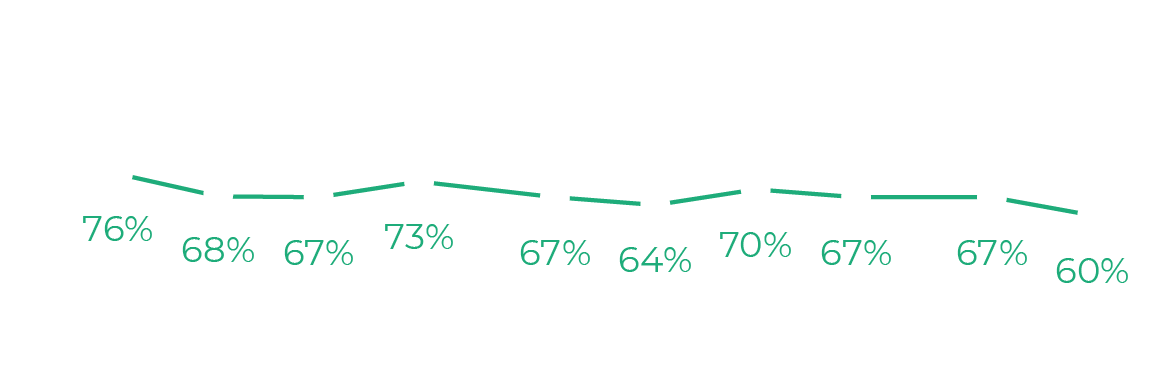

Percentage of PE-backed deals

Notable UK mid-market deals

Evotix, a UK-based EHS software provider, was acquired by US PE-backed enterprise risk management company SAI360 for a reported £120 million.

UK PE house YFM Equity Partners backed the £24 million buy-out of Cheshire ERP business Resulting IT.

UK IT services group Daisy acquired AIM- listed cyber security service provider ECSC in a recommended takeover offer valuing ECSC at £5.4 million.

Stock market performance

The second quarter of 2023 saw global stock markets continue the recovery that we saw in Q1. The S&P 500 was up by 8% in Q2. The Moore Kingston Smith IT Services Index outperformed

the market and was up 14% across the period. This was also ahead of one of our technology-specific indices, the FTSE TechMark Focus index, which only saw a 2% increase in the quarter. However, the best-performing index was the MSCI World Information Technology index, which ended Q2 up an impressive 15%.

Of the 21 companies in the Moore Kingston Smith IT Services Index, eighteen ended the quarter in positive territory. The star performer in Q2 was NVIDIA, up 52% in Q2, which had already seen a 90% increase in its share price in Q1. AI-specialist

NVIDIA released guidance to the market in May that suggested Wall Street’s forecasts of its revenues needed to be upgraded, leading to its share price increasing by 27% in a single day.

Our worst performer in Q2 was Spirent, which saw its share price decline by 6% across the period, having already seen a decline of 32% in Q1. The company launched a share buy-back programme in the period to try and halt the share price decline but this was not particularly effective.

Moore Kingston Smith IT services index

Sector subcategories