Unlocking opportunity: private equity’s attraction to the IT sector

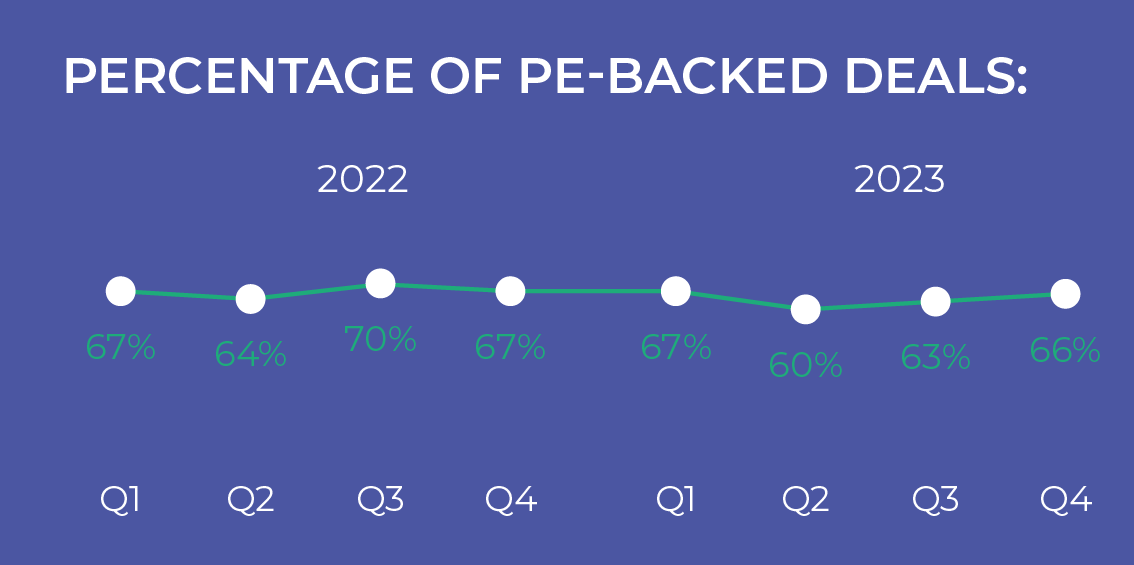

Despite the challenges that rising interest rates have imposed on M&A activity generally, the IT sector has seen a high level of transactions in 2023. As our quarterly reports on M&A in the sector show, it is private equity investment that is driving much of the activity in the IT sector, with over 65% of transactions being by private equity or a PE-backed business.*

Private equity activity in IT services in the last eight quarters

Why private equity is in investing in the IT sector

From start-ups to established firms, private equity’s interest in IT appears to be here to stay and provides an intriguing option for owner-managers seeking investment to drive growth or a potential exit. Here’s why private equity is particularly interested in investing in the IT sector:

Resilience and growth potential

The IT sector has demonstrated remarkable resilience, especially in times of wider economic uncertainty. Throughout various economic cycles, IT has consistently shown strong growth potential, driven by recurring revenue models, continuous innovation and technological advancements. Private equity firms are drawn to industries offering business-critical services with strong recurring models, and IT stands out as a beacon of stability amid turbulent market conditions.

Scalability in a fragmented market

IT businesses often boast highly scalable models, allowing for rapid expansion and efficient utilisation of resources. Whether it’s managed services, software-as-a-service (SaaS) platforms or digital infrastructure providers, IT companies offer scalability that appeals to private equity investors looking to maximise growth opportunities. This also makes IT companies ideal for a buy-and-build approach, where private equity makes an initial investment in a platform company, followed by ‘bolt-on’ acquisitions of further companies to achieve inorganic growth or add capabilities.

The fragmented landscape of the UK IT sector further enhances the suitability of a buy-and-build approach as the presence of numerous small to mid-sized companies offers opportunities for consolidation, fostering economies of scale and operational efficiencies.

Diverse investment opportunities

The IT sector encompasses a wide range of sub-industries and niches, offering private equity firms a diverse array of investment opportunities. From cyber security and ecommerce to fintech and healthcare IT, there’s no shortage of sectors within IT ripe for investment. This diversity allows private equity firms to build well-rounded portfolios, mitigating risk and optimising returns by tapping into multiple segments of the IT ecosystem.

Innovation and disruption

Innovation is the lifeblood of the IT sector. From artificial intelligence to blockchain and cloud computing, technological breakthroughs have the power to disrupt entire industries, creating new markets and redefining business models. Private equity firms recognise the immense value in investing in companies at the forefront of innovation, where they can capitalise on disruptive technologies and drive substantial returns on investment.

Attractive exit strategies

Private equity firms inherently focus on generating returns for their investors, and the IT sector offers numerous exit strategies to achieve this goal. Whether through strategic acquisitions, initial public offerings (IPOs) or secondary private equity buy-outs, IT investments provide multiple avenues for realising value. The fast-paced nature of the IT industry also means that investment cycles can be relatively short compared to other sectors, allowing private equity firms to unlock liquidity and reinvest capital efficiently.

*A private equity backed business is a company that has already received investment from private equity, whether in the form of growth capital or a full buyout, often referred to as a platform business. These platform businesses often make further acquisitions funded by their private equity investors.