A record year for M&A transactions in 2022

M&A activity in the UK media and marketing services sectors – a review of 2022

2022 has been a difficult year for many, with the domestic and global economies affected by such factors as the situation in Ukraine, commodity shortages, increasing inflation, higher borrowing costs and industrial disputes. However, political and economic uncertainty has created opportunities for confident dealmakers, and M&A within the UK media and marketing services sectors has gone from strength to strength throughout the year.

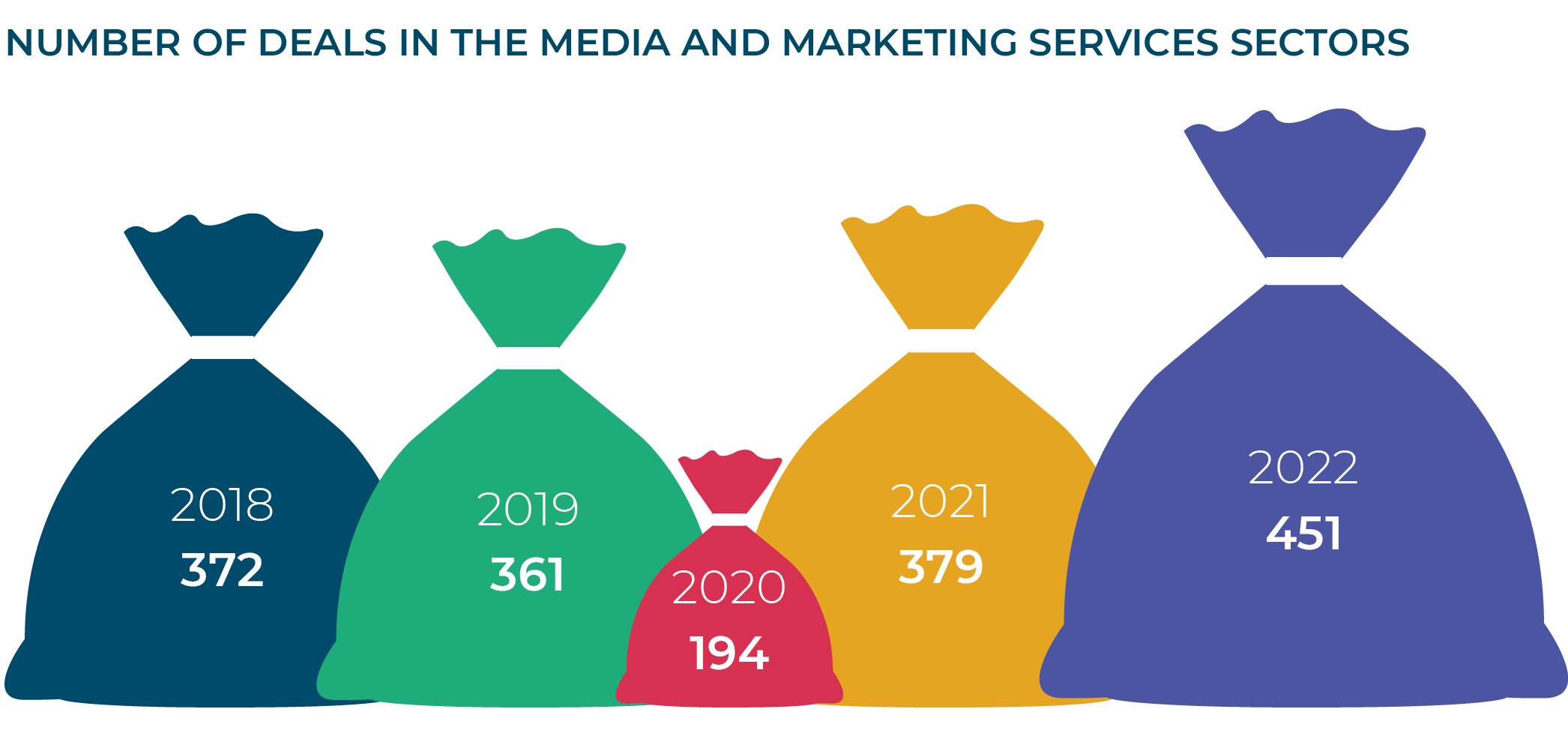

According to our research, 2022 produced a total of 451 UK deals, which is 19% up on 2021, and represents a record level of activity, up significantly even on pre-pandemic levels.

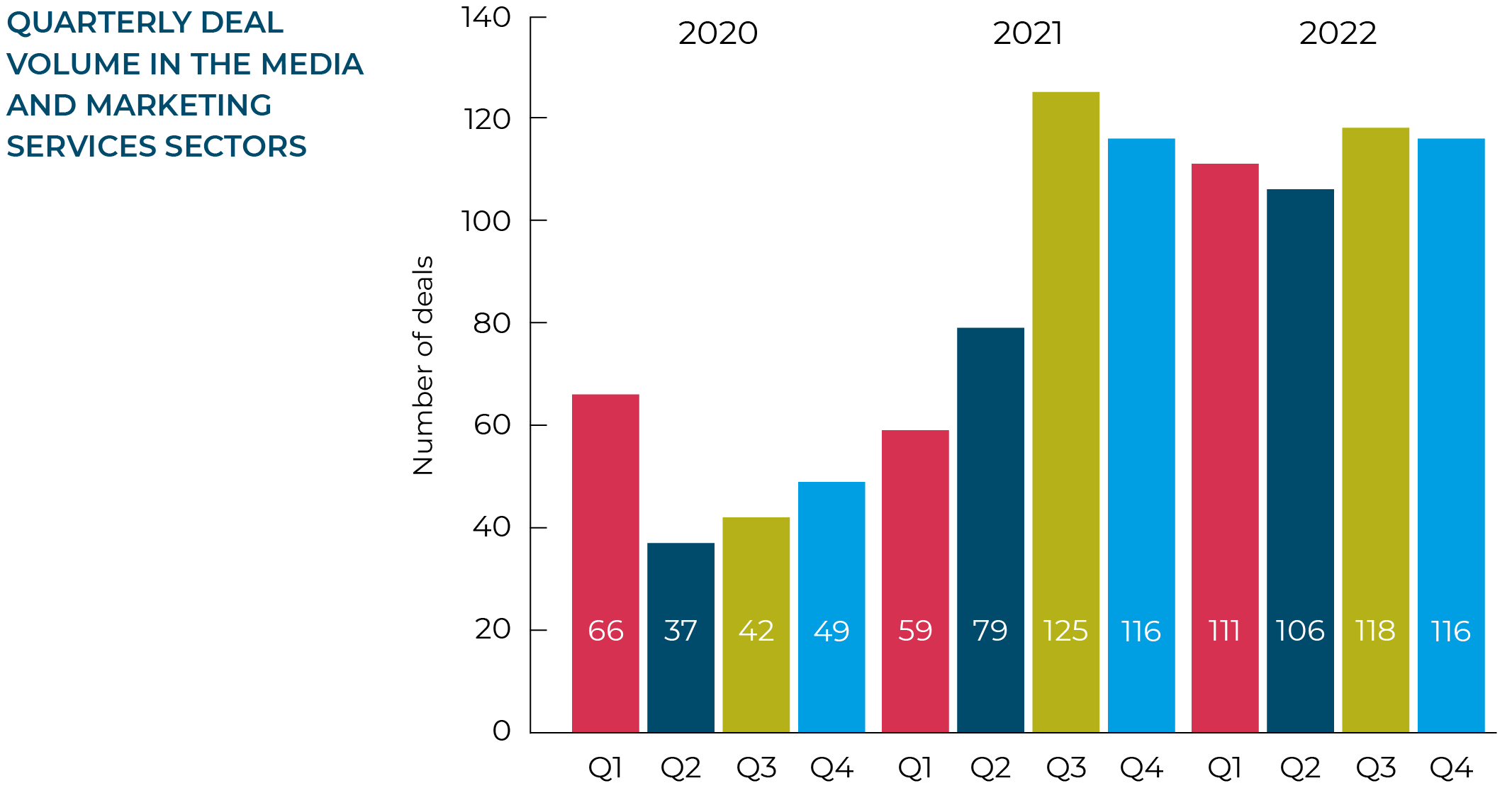

When we look at the quarterly data, we see that there has been a consistently high level of activity throughout the entire year. The post-pandemic resurgence in M&A, which we first started to see in the second half of 2021, has continued apace throughout 2022, and no amount of commentary regarding macro or microeconomic difficulties has derailed it.

Moore Kingston Smith’s deal tracker recorded 116 UK media and marketing services deals as having completed in Q4. This makes it the second most active quarter of the year, only marginally down on the 118 deals we recorded in Q3.

In each of this year’s quarterly reports, we have celebrated the strength and resilience of the UK market for deals in the media and marketing services sectors but questioned whether we might start to see some caution creeping in. The data says no – if anything the UK market is hotter than it has been for some years. Pent-up demand and corporate M&A plans put on ice during the pandemic are fuelling this rebound in activity, along with continued enthusiasm from the private equity sector for technology-driven media and marketing services assets, albeit we are anticipating a slightly quieter market in the first half of 2023.

Sector activity

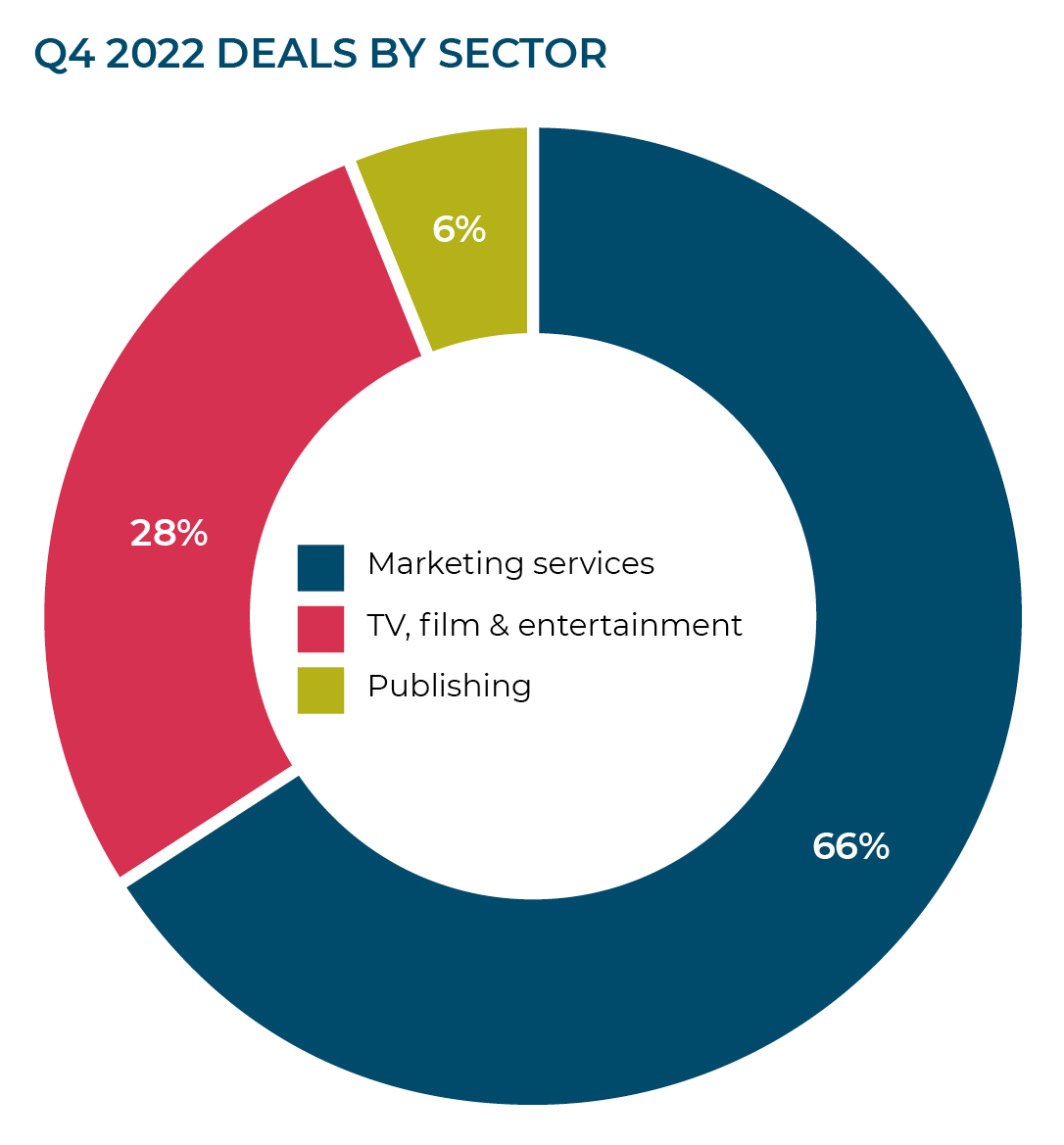

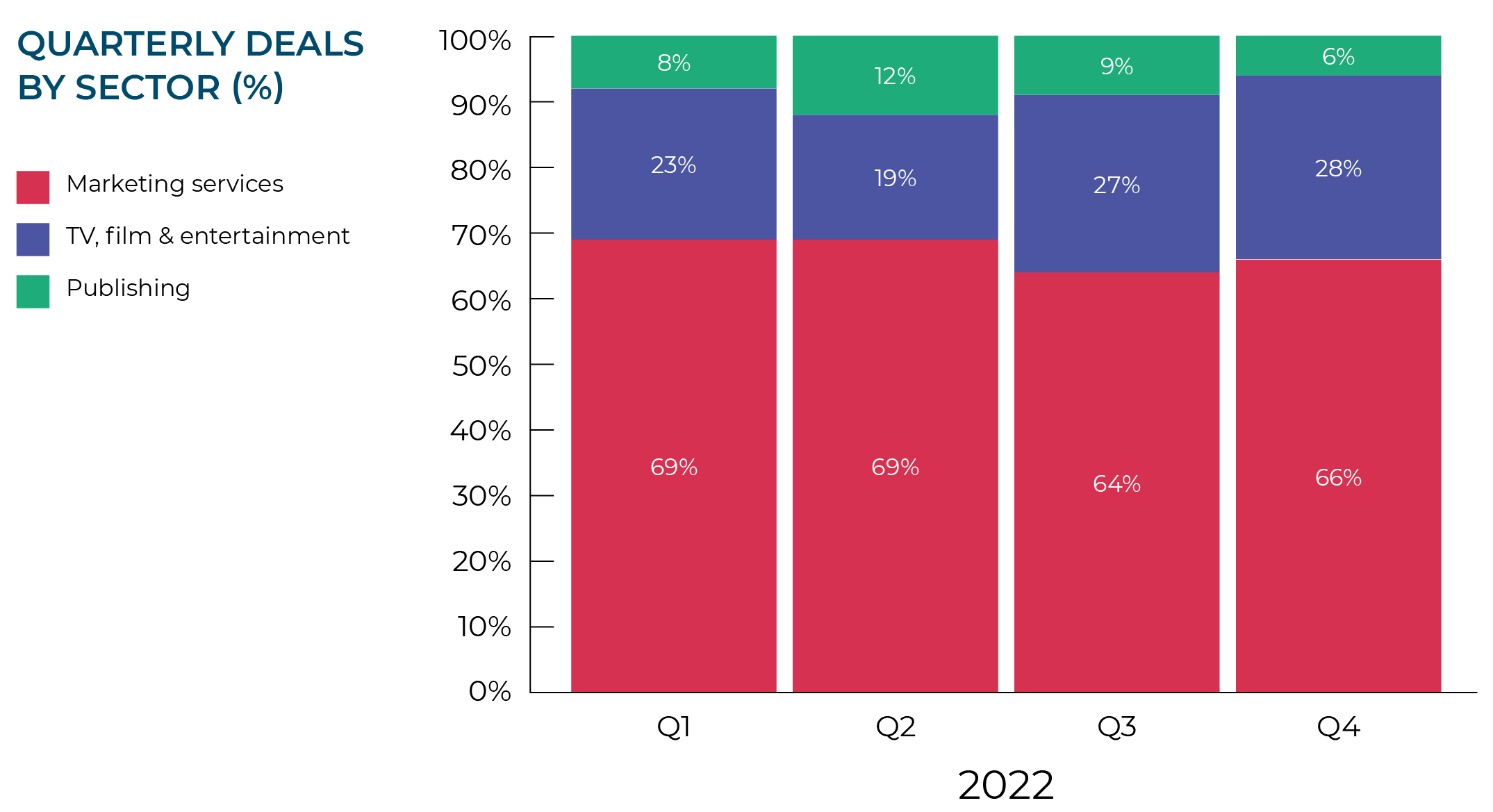

Media and marketing services covers a broad range of activities, so for the purposes of this report, we allocate transactions to three main categories: marketing services; publishing; and TV, film and entertainment (which includes gaming and music).

66% of our 116 Q4 deals fell within the marketing services sector, with a total of 77 transactions completed. TV, film and entertainment also had a busy Q4, with 32 deals announced, representing 28% of all transactions. Publishing showed a decline in activity, with just seven transactions recorded in Q4, compared with 11 in the prior quarter.

Q4’s sector splits are consistent with those we have seen throughout 2022, where deals in the marketing services sector accounted for two-thirds or more of all deals in every quarter. Of the 451 deals we recorded in 2022, 302 involved marketing services companies.

We tend to record fewer deals in the publishing and TV, film and entertainment sectors. In the whole of 2022, we saw 40 publishing transactions and 109 deals in TV, film and entertainment. However, this is not an indication of their popularity among acquirers, more a reflection of the smaller number of UK companies operating in these sectors than in marketing services. There have been some extremely high-value UK transactions reported in publishing, and TV, film and entertainment during 2022.

“There have been some extremely

high-value UK transactions

reported in publishing, and TV,

film and entertainment during 2022.”

Hot marketing services disciplines

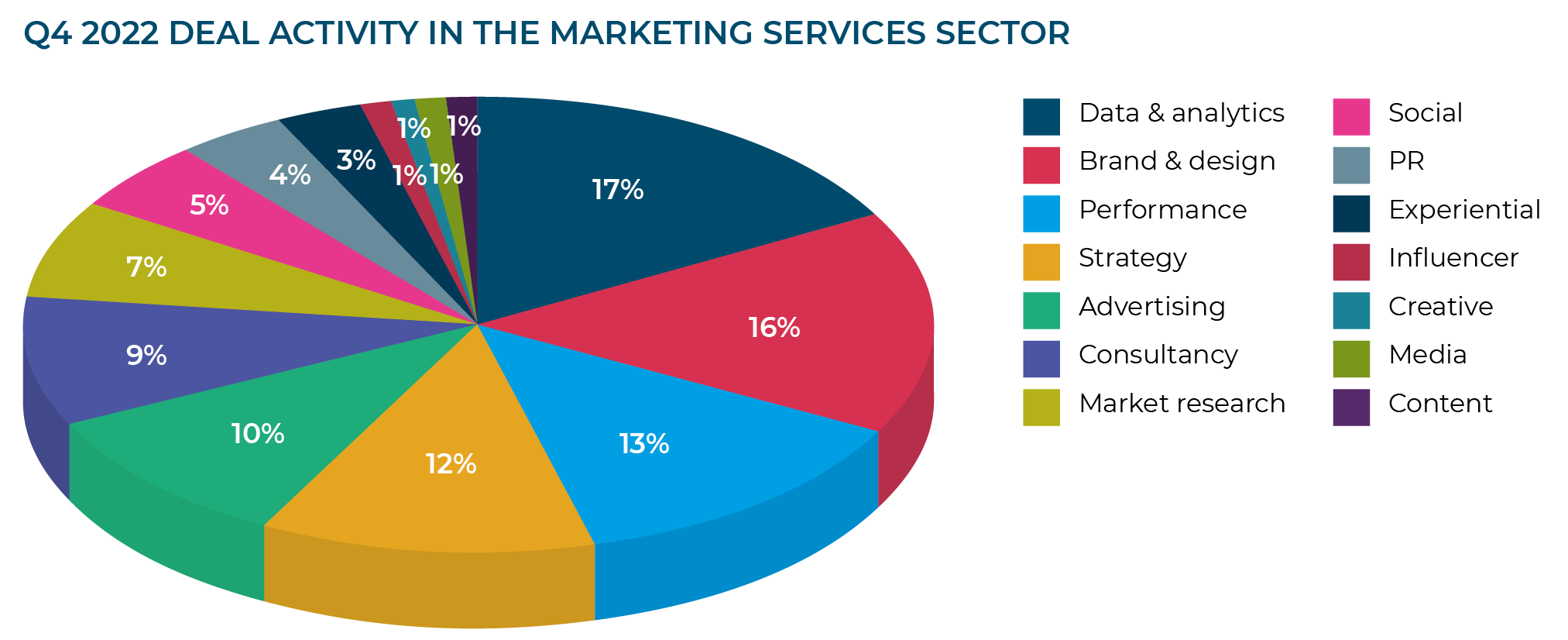

Our analysis of the 77 marketing services transactions completed last quarter enables us to determine whether the company acquired was a full-service agency or a specialist in one of the marketing services disciplines, such as PR or advertising.

In Q4 2022, data and analytics specialists were the clear favourite with acquirers, followed by brand and design businesses. Advertising, which was our most favoured discipline in Q2 and Q3, 2022 fell back into fifth place in Q4. We have commented in previous reports that the advertising sector was expected to receive a short-term boost from the US mid-term and FIFA World Cup in Q4 2022. It appears that advertising companies were acquired ahead of this anticipated uptick in the market. Now that those events have taken place, the number of advertising deals has decreased.

If we look at 2022 as a whole, data and analytics was the most popular sector across the year, with 51 deals recorded, representing 17% of the year’s marketing service deals. We saw 40 advertising deals in 2022, which makes it the second most popular sector, with 13% of the year’s transactions.

Having been busy all year, Moore Kingston Smith’s corporate finance team finished off 2022 with a flurry of deals in the marketing services sector. In November, they advised 23red, a London-based purpose-driven creative agency, on its sale to global business and technology services business Capgemini. 23red delivers projects for clients, including the UK government, that focus on immediate actions to drive long-term change. The 23red team will join frog in the UK, part of Capgemini Invent.

Also in November, Moore Kingston Smith supported Broadlight, a group of B2B marketing agencies, in its acquisition of Chillibyte, a digital marketing specialist. The transaction is the third acquisition made by Broadlight in the last 11 months.

Still in November, the Moore Kingston Smith team supported Cadastra, a global marketing, technology, business strategy, data and analytics solutions company, in its second transaction of the year: the purchase of UK digital marketing agency Digital Ethos. Headquartered in Leicester, Digital Ethos is s a full-service digital marketing agency, serving clients across 15 countries.

In December, Moore Kingston Smith advised CRC Group, a data-led B2B consultancy on its sale in a management buy-out backed by Coniston Capital. Also in that month, Moore Kingston Smith advised Red Brick Road on the sale of its customer experience agency subsidiary, Emerald Thinking Group, to Team ITG, a multichannel marketing activation business.

“2022 was a record year for us and the marcoms sector. The first half of 2023 is likely to be quieter, but strong acquirer interest in capabilities such as data & analytics, e-commerce, purpose and performance will continue to drive deal volumes.”

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith

Spotlight on martech and adtech

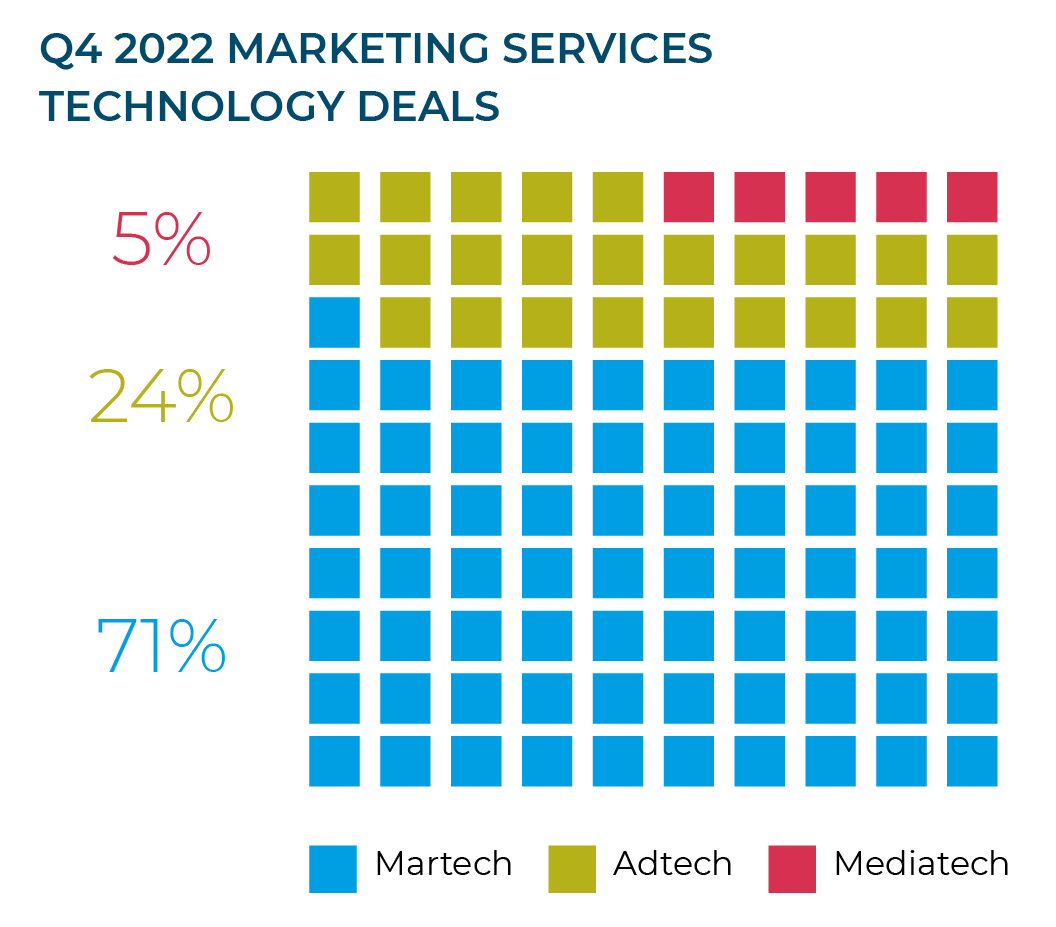

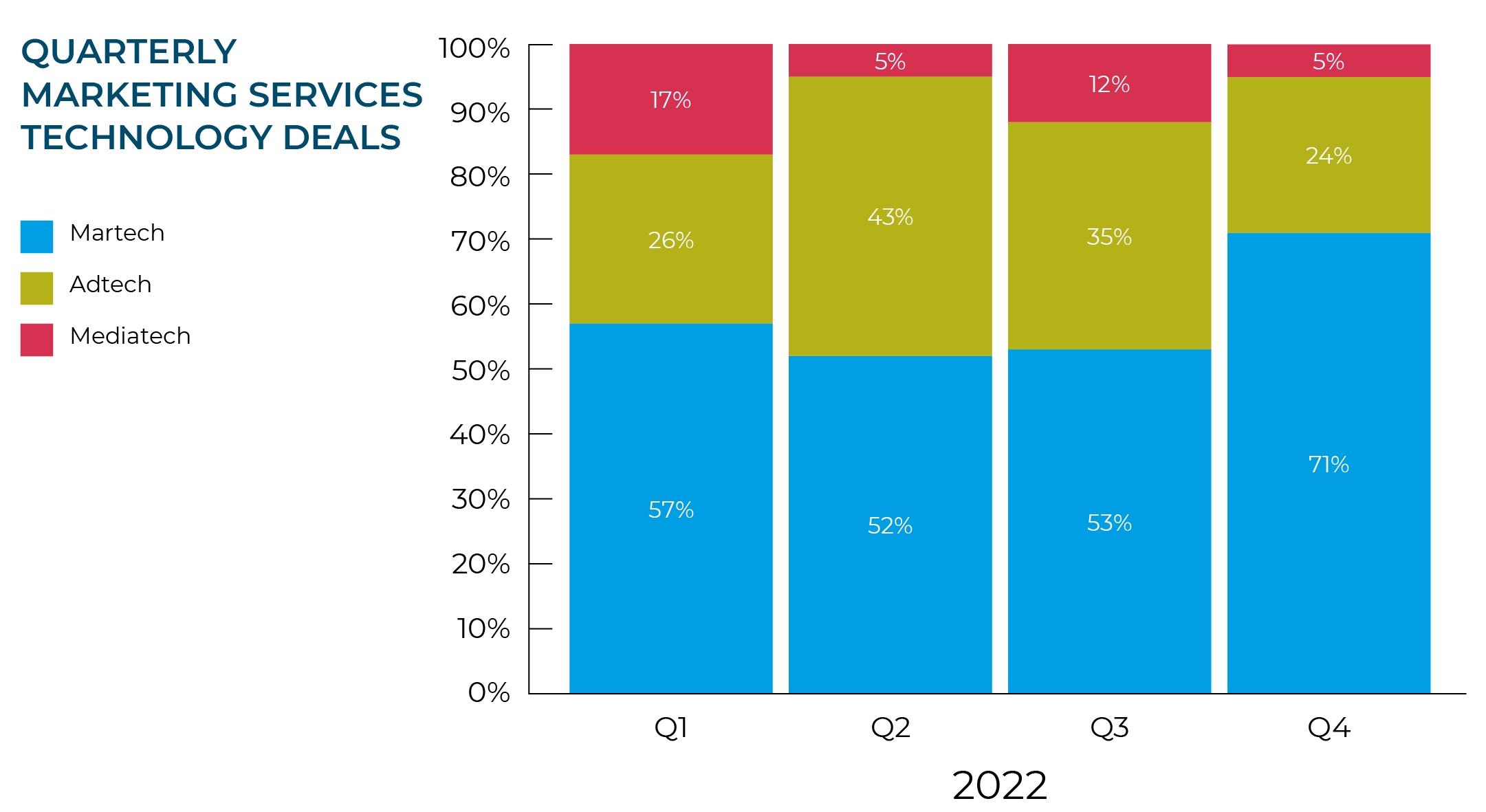

In the marketing services sector, while most deals involved the acquisition of traditional service-led agencies, 27% of the deals we recorded in Q4 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.

71% of these transactions in Q4 related to martech companies – companies developing and using technology to assist with a digital marketing strategy, including such elements as content and social, lead generation, customer acquisition and retention, and data and analytics.

Some of the challenger marketing networks were active in the martech space in Q4. In October, Sideshow Group announced that it had acquired UK-based marketing and data science business, more2, while the highly acquisitive Stagwell announced that it had bought customer experience and insights data platform Maru Group.

Adtech also proved popular last quarter, accounting for 24% of the marketing services technology deals we recorded. Adtech refers to specific solutions or tools used for digital advertising, such as programmatic advertising tools, data management platforms and ad exchanges.

A notable adtech transaction last quarter was global programmatic media specialist MiQ’s November acquisition of UK-based AirGrid, a “privacy-first” audience platform. AirGrid claims to be the only platform which enables marketers to connect directly to publishers for privacy-first and cookieless audience creation and activation. Instead of using cookie-based data, AirGrid uses machine learning to segment publisher audiences without the use of any identifiers. It then stores, models and activates locally on-device or “at the edge” so that user data never leaves a device. MiQ’s acquisition of AirGrid comes just two months after PE house Bridgepoint acquired MiQ from its previous PE backer ECI Partners, a transaction we highlighted in our Q3 report.

As well as being the most popular technology category in Q4, martech accounted for well over half of all technology-led marketing services transactions recorded throughout 2022. Across the year, 58% of the technology deals we recorded were martech, 32% adtech and 10% mediatech transactions.

In November, Moore Kingston Smith’s corporate finance team acted on a significant production services deal, advising VFX studio Absolute and its sister animation company, Blind Pig, on their sale to Envy.

TV, film and entertainment

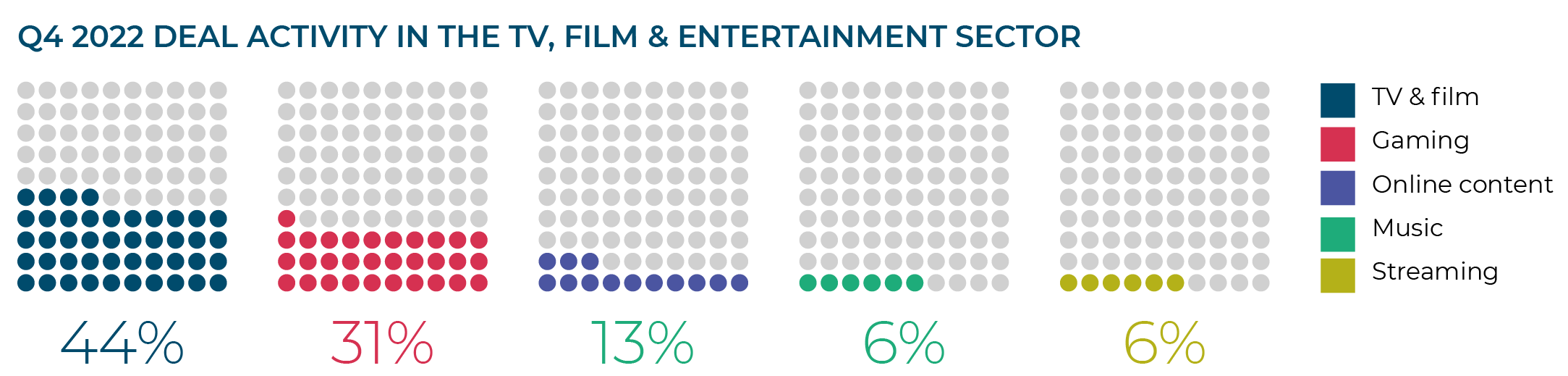

Within the TV, film and entertainment sector, TV and film held onto the top spot in Q4, accounting for 44% of the deals we recorded, down from the 53% we logged in Q3. Gaming, which was the most popular category in the first two quarters of the year, accounted for a respectable 31% of Q4 deals, having fallen to a low of 16% in Q3.

Production services deals were the most prominent in Q4, accounting for 47% of the transactions we recorded in this space. Pure content plays accounted for a further 28%, with technology-led deals making up 22% of the deals recorded in Q4.

We saw several transactions in the TV production space in Q4. In October, French group Banijay bought high-end drama producer Mam Tor Productions, its first UK acquisition since 2020’s purchase of Endemol Shine Group.

In November, BBC Studios, the BBC’s commercial arm, announced that it had taken full ownership of Voltage TV, the independent production company whose credits include Inside the Factory for BBC Two, DNA Journey for ITV and The British Tribe Next Door for Channel 4.

Not to be outdone by the BBC, in November, ITV Studios announced that it was expanding its international footprint by acquiring a majority stake in Australian production company Lingo Pictures. Lingo specialises in scripted drama and its clients include Paramount+, BBC One and Sky.

The RTL-owned global super-indie Fremantle, headquartered in London, made three acquisitions in Q4, snapping up majority stakes in Israeli production company Silvio Productions, as well as UK-based natural history producer Wildstar Films and documentary producer 72 Films.

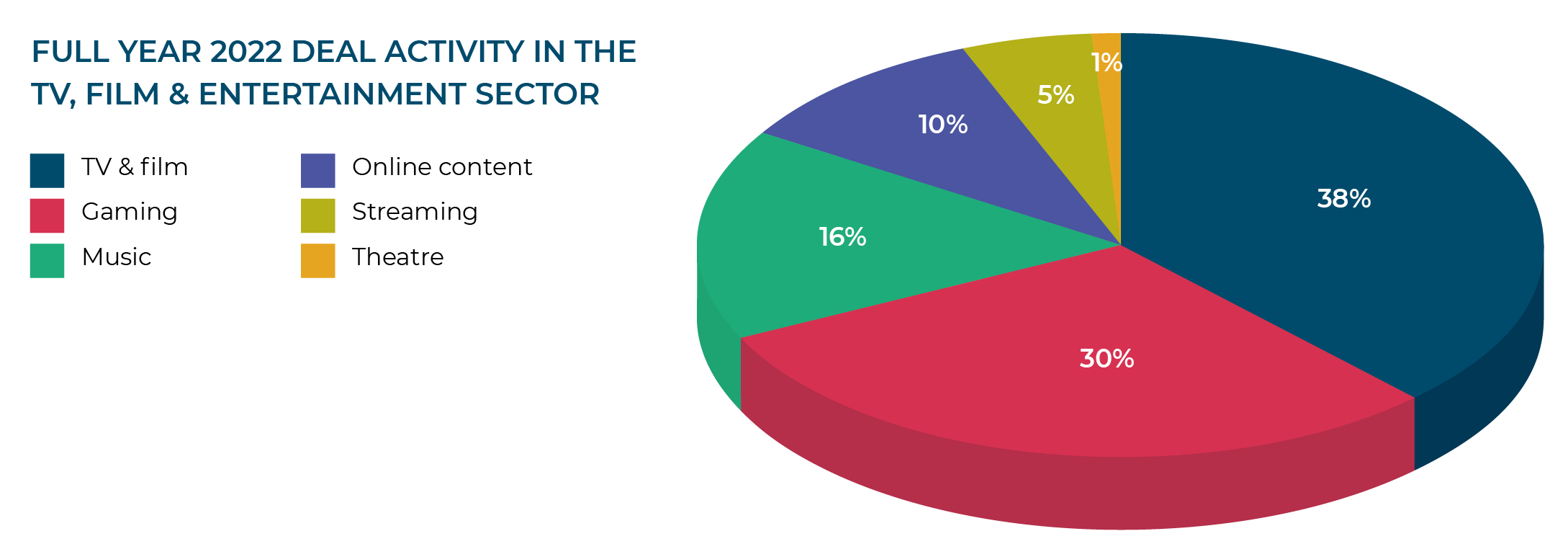

Besides being the most popular category in Q4, TV and film accounted for the highest percentage of deals in this sector throughout the year, with gaming in second place and music in third.

“TV and film accounted for the

highest percentage of deals in this

sector throughout the year.”

Publishing

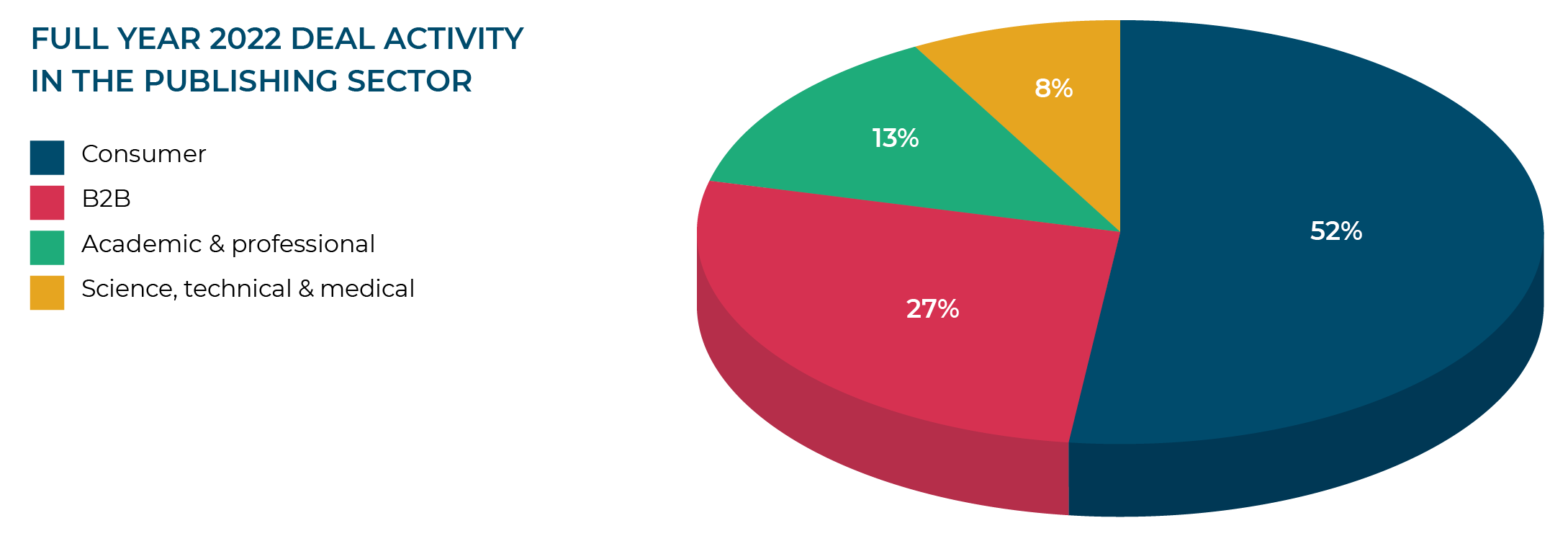

In what was a relatively quiet quarter for the publishing sector overall, consumer publishing tied with B2B publishing, both representing 43% of the deals we recorded in Q4.

Within the consumer publishing space, we spotted that online humour site The Poke was bought in December by Digitalbox, the owner of satirical website The Daily Mash, student news network The Tab and Entertainment Daily. The Poke launched in 2002 and “handpicks the funniest content on the web to enable its users to spend time well wasted”, whereas The Daily Mash publishes its own satirical spins on the news. Digitalbox said the acquisition, for an undisclosed sum, would “strengthen its position within the satire/ comedy space” and make it the UK’s leading destination for online humour by bringing together the reach of both sites.

While they tied in the final quarter, when we look at 2022 as a whole, we find that consumer publishing was the outright winner, accounting for the majority of all publishing deals last year.

Marketing services networks round-up

Major holding companies

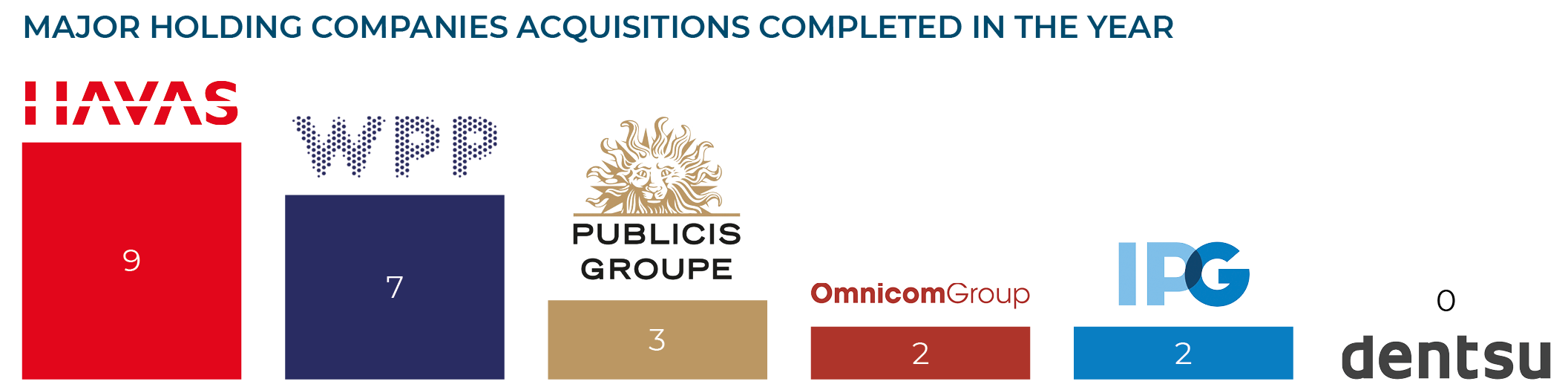

Two of the major holding companies announced no new deals in Q4 – Omnicom and Dentsu.

Publicis completed its third acquisition of 2022 in November, with the announcement that it had acquired Central and Eastern European affiliate marketing agency, VIVnetworks, and intended to integrate it into its existing global performance marketing platform, CJ.

Interpublic Group only completed two transactions in 2022; its second being the October acquisition of RafterOne, a provider of multi-cloud commerce solutions on the Salesforce platform.

In November, Havas announced that it had acquired Australian health communications agency Bastion Brands. Havas was the most active major network acquirer in 2022, completing a total of nine transactions during the year.

WPP completed two deals in Q4, bringing its total for the year to seven. In October, it announced the acquisition of Californian brand design agency Passport Brand Design and, in December, it announced the acquisition of Canadian commerce agency Diff, which specialises in developing solutions for the Shopify commerce ecosystem.

Challenger networks

Some of the more active acquirers in 2022 had a relatively quiet Q4, with no new deals announced by the likes of S4Capital, Selbey Anderson, Ebiquity or Definition Group. S4Capital completed 12 transactions in 2021. In 2022, it managed only three – hampered for much of the year by its failure to publish its results on time, profit warnings and a concomitant collapse in its share price.

We saw two deals from Sideshow Group in Q4. As already mentioned, it acquired marketing and data science business more2 at the end of October. The more2 transaction was announced only two weeks after the announcement of Sideshow’s largest deal to date – the acquisition of strategic design agency Nomensa. Sideshow has been growing organically and through acquisition, supported by investment from Waterland Private Equity in March 2021. Following these two recent acquisitions, Sideshow now has a headcount of 850, with offices across the UK as well as in Barcelona, Amsterdam and Vancouver.

The Mission Group also announced two deals in Q4. In December, it revealed that it was acquiring London-based specialist sports marketing agency Influence Sports & Media, as well as Cardiff-based social media agency Populate Social. The two agencies will retain their brands and identities post-acquisition and form an integral part of Mission’s newly created entertainment, sports and lifestyle agency Mongoose Group.

In November, Together Group, newly formed in Q1 2022 as the result of a merger of five founder-led agencies focused on the luxury and lifestyle sectors, announced it had acquired Folk, a London-based agency building social strategy and social commerce offerings for luxury brands.

The battle for control of M&C Saatchi, which we covered extensively in Q2’s and Q3’s reports, finally came to an end in October, with M&C Saatchi shareholders rejecting the offer from the last bidder standing – Next Fifteen – and electing instead to remain independent. Next Fifteen bought Engine for £77.5 million in February 2022, and was prepared to spend big money – over £300 million – for M&C Saatchi. Now that deal has collapsed, we might expect it to look to alternative acquisition targets in 2023.

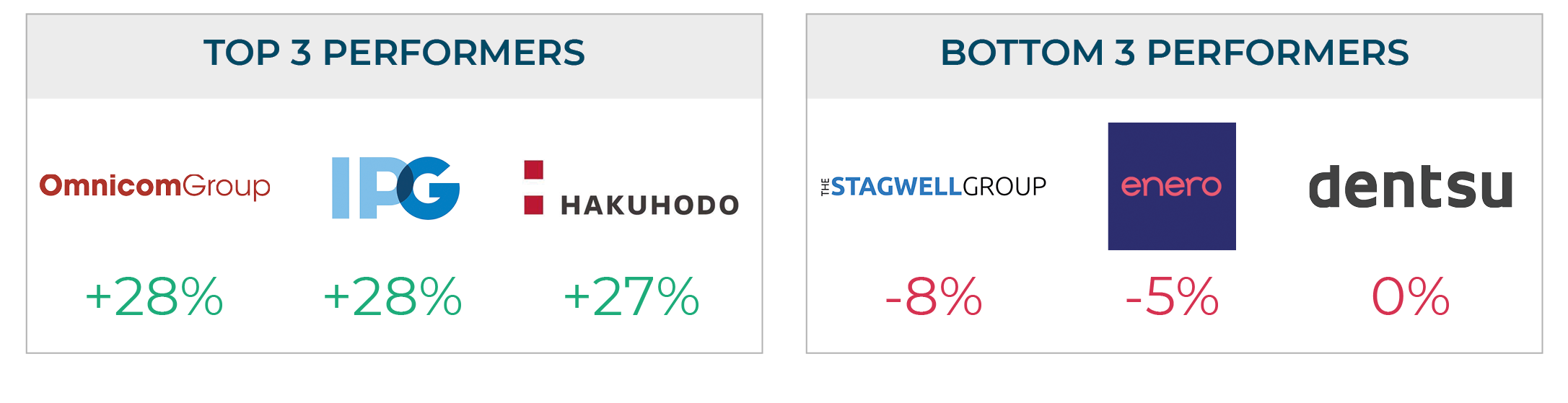

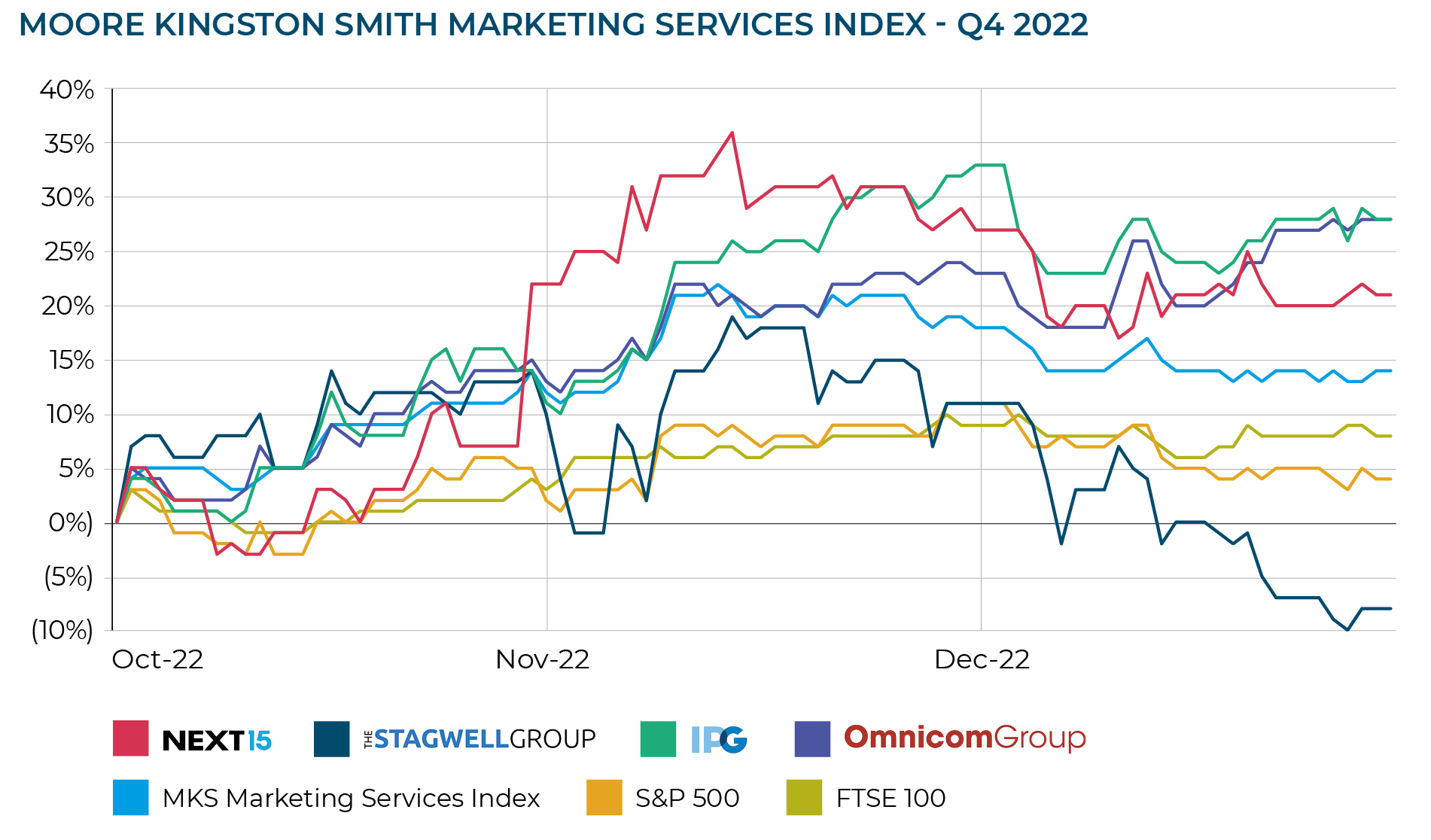

Marketing services industry stock performance

Moore Kingston Smith has plotted the share price performance of 14 listed marketing services groups, which together make up the Moore Kingston Smith Marketing Services Index, to see how they have fared in the last quarter compared with the FTSE 100 and S&P 500 indices. We have also highlighted the share price movements of Omnicom, IPG and Stagwell which represent the best and worst performance from our sample this quarter, and Next Fifteen, since we have been discussing its failed attempt to acquire M&C Saatchi.

The final quarter of 2022 saw global stock markets rally, after a couple of poor quarters. The FTSE 100 was up by 8% in Q4, having experienced declines of 4% and 5% in Q3 and Q2, respectively. The S&P 500 was also up 4% in Q4, having fallen by 6% in Q3 and 9% in Q2. In Q4, the Moore Kingston Smith Marketing Services Index significantly outperformed the market and was up 14% across the period, driven by the strong share price performance of a number of the constituents of our index.

Of the 14 companies that make up the index, twelve ended the quarter in positive or flat territory, and more than half of these saw their share prices increase by more than 20%. The star performers this quarter were Omnicom and IPG who both saw their share prices increase by 28%. There was nothing particularly dramatic leading to these increases – they simply benefited from improving underlying market sentiment towards the marketing services sector generally.

Next Fifteen may have been disappointed that its takeover bid for M&C Saatchi failed, but its shareholders certainly weren’t. Next Fifteen’s share price went up by c. 14% on the day that the bid was finally rejected, implying the market thought it was better off on its own. Next Fifteen closed out the quarter up 21% overall.

Our top performer in Q3, Stagwell, was our worst performer in Q4, with an 8% decline in its share price. The decline appears to have been the result of profit-taking by investors towards the end of the year, and a less than enthusiastic reception by the market to its latest set of results.

Private equity pulling back?

Private equity-backed investments accounted for 46% of all deals completing in Q4 2022, which represents a considerable drop-off from the 58% levels achieved in both of the previous two quarters.

Some private equity-backed entities, such as MiQ and Sideshow, were active in the quarter, as we have already discussed, but others who have featured regularly in our quarterly reports, such as Brainlabs, The Marketing Practice and Gravity Global, announced no new acquisitions in the final months of the year.

“As borrowing costs increase, it may become

harder for private equity to compete with corporate

acquirers investing from their own balance sheets.”

While this may be just a blip, it is possible that this reduction in private equity-backed activity reflects concerns about rising interest rates and the affordability of transactions. Many M&A transactions require leverage – and private equity transactions require substantial leverage more often than not. As borrowing costs increase, it may become harder for private equity to compete with corporate acquirers investing from their own balance sheets.

Despite this decline in the final quarter, when we look at the year as a whole, we find that private equity-backed investments still accounted for the majority of deals done in 2022. Of the 451 deals we recorded, 237, or 53%, involved private equity investment either directly or via an existing portfolio company. This compares with the 54% we reported in 2021, 45% we reported in 2020 and is more than double the c. 25% levels we saw in 2019 and 2018. While Q4’s data does suggest private equity houses may be adopting a more cautious approach than they were earlier in the year, their enthusiasm for the media and marketing services sectors remains strong, especially when compared with historical norms.

“There is strong interest in the sector from private equity. In the coming 12 months I think we can expect to see some of the challenger groups taking on fresh private equity owners which will lead to a new wave of transactions. In the interim we are seeing a slight slowdown, but this is likely driven by private equity houses evaluating the market in anticipation of a slight cooling in multiples, off the back of the interest rate rises. Whether that happens remains to be seen.”

Nick Thompson, Corporate Finance Partner at Moore Kingston Smith

Outlook

2022 has been a record year for UK M&A deals in the media and marketing services sectors. Any fears that macroeconomic and geopolitical concerns would affect the market have not yet been realised.

The recent improvement in the share prices of the global listed marketing services holding companies is likely to increase their appetite for acquisitions, since they will find it easier and cheaper to use their paper as currency, which if there is a temporary reduction in private equity backed deal volumes, will help offset some of the reduction.

“2022 was a fantastic year for the sector. The rapidly transforming media and marketing services landscape is a fertile one for deal doing, and whilst the macro-economic headwinds, particularly the interest rate increases, may reduce activity in the short-term as a whole, the medium term outlook for the sector is very positive.”

Dan Leaman, Corporate Finance Partner at Moore Kingston Smith

The UK M&A market continues to be active and the Moore Kingston Smith corporate finance team continues working on transactions in the media and marketing services sectors. While we are expecting a quieter market in the first half of 2023, certain sought after capabilities will buck this trend. Regardless, we are bullish about the market’s performance in the second half of the year and beyond.

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to start planning for an exit.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

2022 – our year in media deals

2022 was a record year for Moore Kingston Smith’s media corporate finance team, with 19 deals completed. Our highlights include: the sale of purpose-driven creative agency 23Red to Capgemini; the sale of factual content specialist The Edge Picture Company to Zinc Media and the management buyout of data led B2B consultancy CRC, backed by Coniston Capital.