Growth Capital Update: Q3 2023

Investors waiting for macroeconomy

to improve

![]()

237

deals completed

![]()

-21%

number of deals

![]()

£1.098 billion

growth capital raised

Our view of the market

In this growth capital report, which includes the summer months, we analyse this traditionally quieter period of the year. It has been even more marked, as constant interest rate rises have made some transactions unaffordable. However, the outlook for the UK’s growth capital market is positive, as we have a well-developed investment ecosystem motivated to fund exciting growth opportunities. Last quarter, we reported initial signs of recovery in the UK’s growth capital market, reflecting investor hopes that interest rates, which affect the affordability of transactions, had peaked. Unfortunately, Q3 has in fact been rather quiet, with the volume of transactions declining noticeably during the summer months. It appears that investors have enjoyed a protracted summer holiday this year.

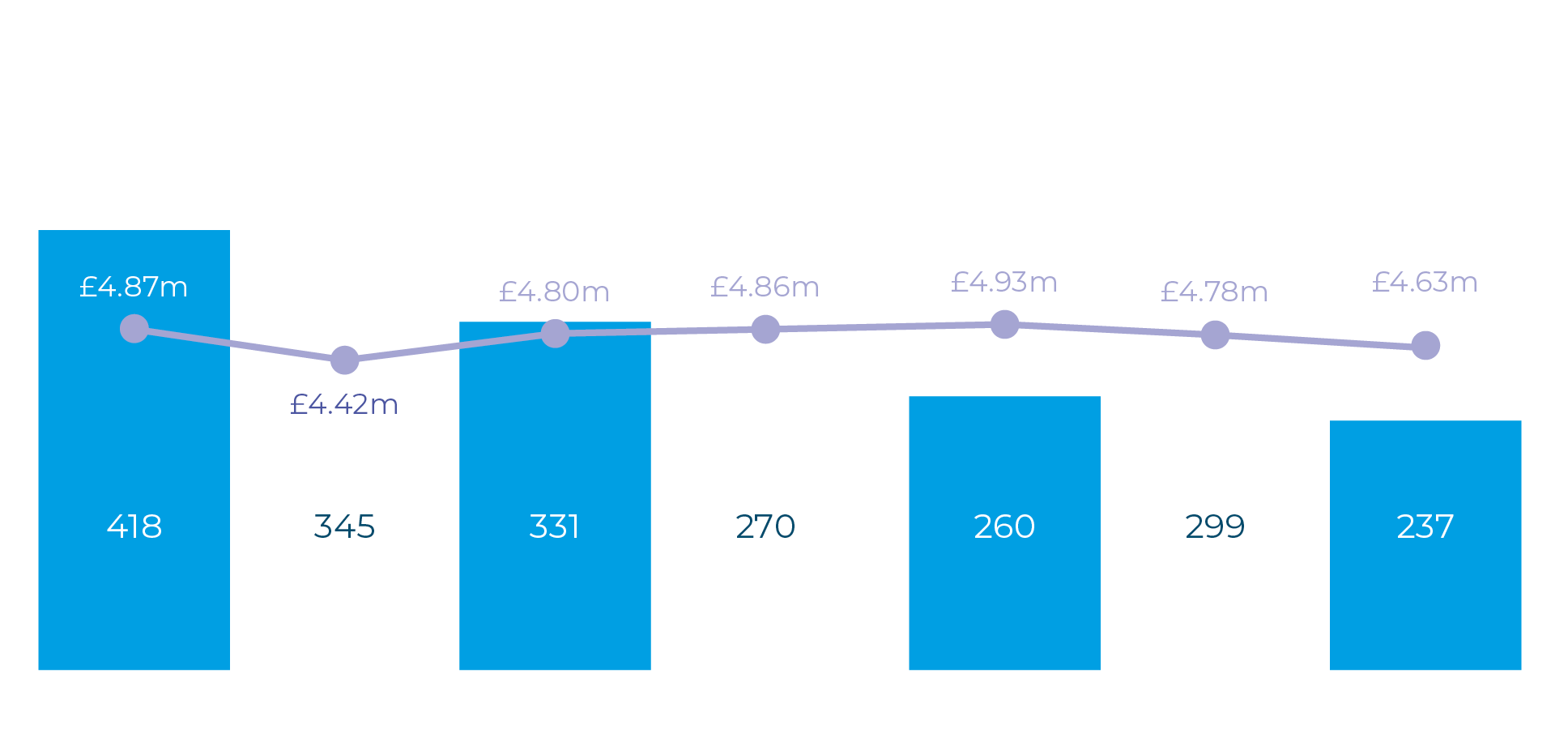

According to our latest research into UK private companies raising between £1 million and £20 million of growth equity capital each, 237 UK businesses raised a total of £1.098 billion in the third quarter of 2023. The average deal size was £4.63 million.

Our Q3 2023 figures reveal a 21% decline in the number of deals completing and a 23% fall in the overall amount of growth capital being raised when compared with Q2’s 299 deals raising £1.430 billion.

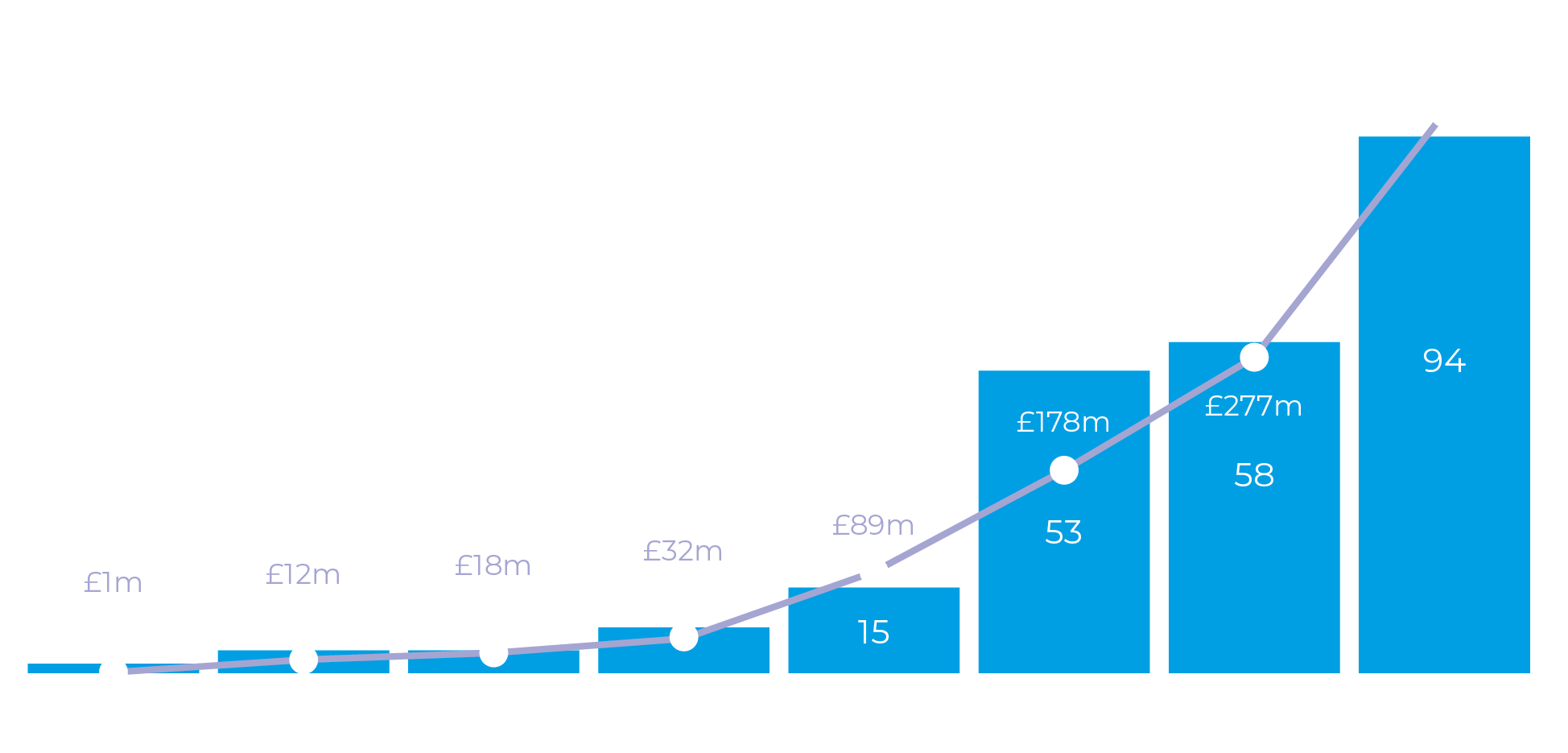

Later-stage VC deals were the most common type of transaction in Q3 2023, accounting for 40% of all deals completed and 45% of total funds invested. Early-stage VC and seed round deals, which typically require less leverage than later-stage deals, made up the bulk of the remaining transactions.

Technology sector

“It is clear that the investor universe is currently cautious, and the summer months, which normally see a decline in activity, have been even quieter than usual this year. However, we believe this to be temporary and that the longer-term prospects for the UK’s growth capital sector remain strong.”

John Cowie, Head of Growth Capital

Notable UK tech sector deals

Phasecraft, a quantum computing start-up led by academics from UCL and the University of Bristol, raised £13 million from investors including Albion Capital.

An Edinburgh-based AI infrastructure planning company, Continuum Industries, raised $10 million in a Series A funding round led by Singular.

“The UK has established itself as a leading tech economy, with a strong digital sector and world-leading research and start-up ecosystem. UK technology businesses are well-positioned to benefit from renewed investor interest when the market resumes higher levels of activity.”

Paul Winterflood, Corporate Finance Partner

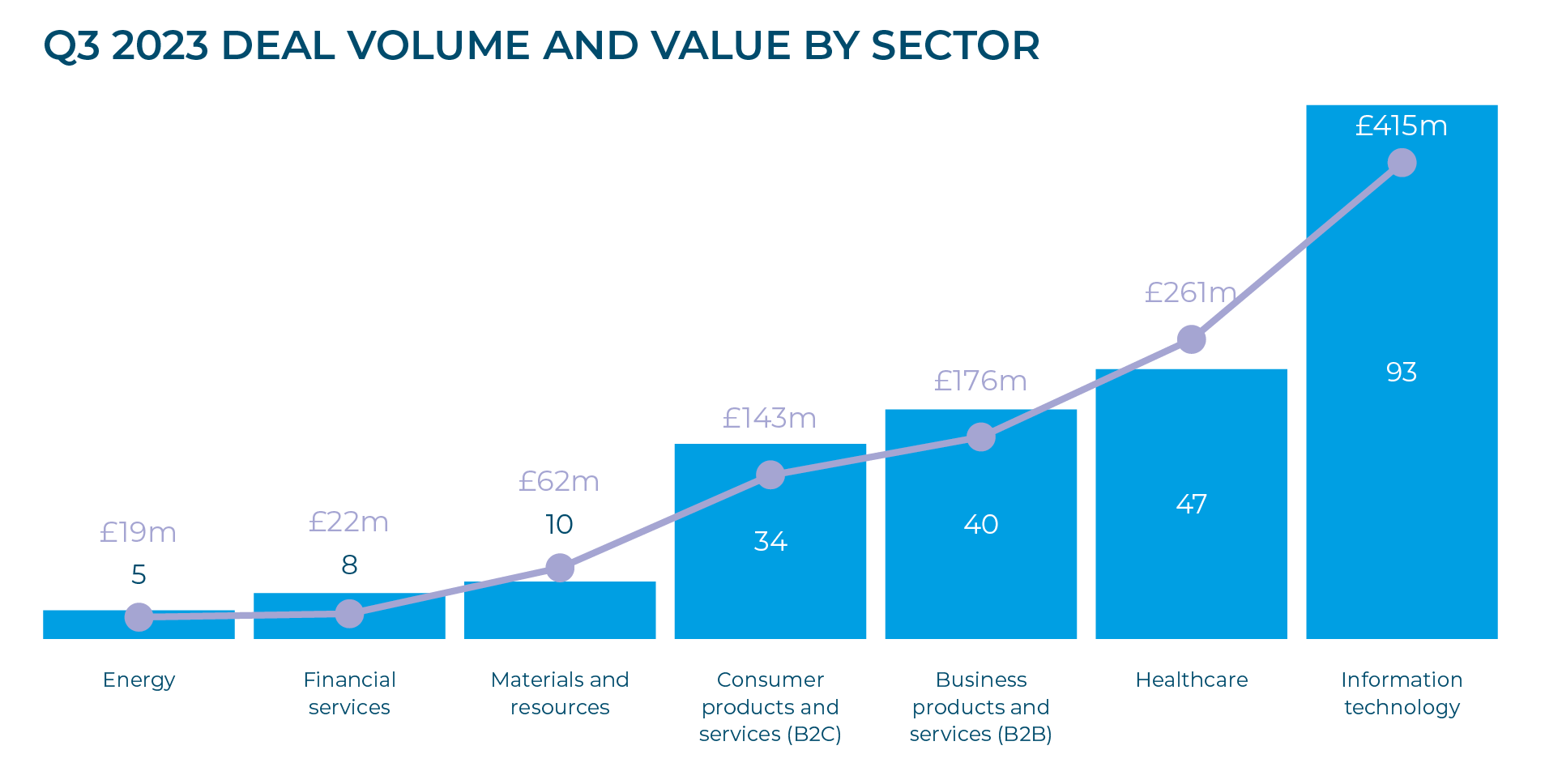

Trending: B2B products and services

The B2B sector was the third most popular with UK investors in Q3 2023, having been in fourth place in the previous two quarters. B2B deals accounted for 17% of all transactions by volume and 16% by value in Q3. In times of uncertainty, B2B investments are attractive to investors because of their more predictable and stable revenue streams, which reduce risk. In addition, the B2B sector often allows PE investors to implement operational improvements and cost efficiencies through restructuring and synergies.

Notable B2B deals

Abingdon-based Intralink, which enables western companies to expand in Asia, received a £19.6 million investment from UK PE house Mobeus.

Revalue Nature, a London-based company specialising in carbon projects, announced it had raised $10 million in a Series A round led by Ecosystem Integrity Fund and SJF Ventures, two venture firms focused on climate and impact.

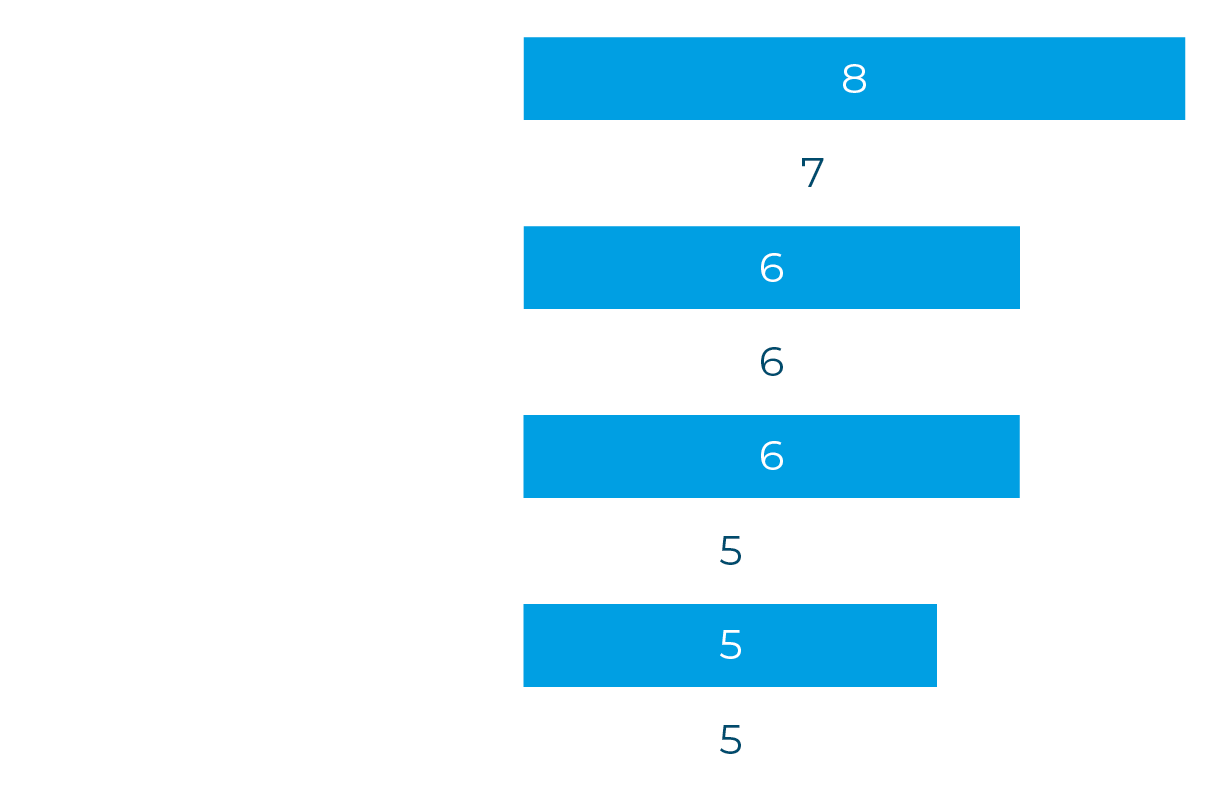

Active investors

Mercia Asset Management was the most active investor in Q3 2023, with eight deals completed – one more than we recorded in Q2 when Mercia was in second place in our table. Scottish Enterprise came second, with seven deals completed.

Mercia invested largely in healthcare and technology businesses in Q3, including:

- leading a £7.8 million Series A funding round into Camena Bioscience, a Cambridge-based company which provides synthetic genes to the pharmaceutical and biotech industries.

- participating in the £13.5 million fundraising led by Calculus Capital into Laverock Therapeutics, which is developing a gene-silencing platform for creating programmable advances therapies.

- investing £1.5 million in Lincoln-based Iventis, whose events software platform was used to help plan the 2023 Special Olympics in Berlin.

Scottish Enterprise’s investments in Q3 were largely in technology. They included:

- participating in a £3 million fundraising into Glasgwegian scale-up Krucial, which utilises space technology to provide digital solutions to the energy, rail, aquaculture and agriculture markets in the UK and internationally.

- joining Equity Gap and NoBa Capital in a £1 million funding round into Edinburgh-based workplace productivity start-up Trickle.

Q3 2023 top investors

“The market for synthetic genes is growing rapidly but a lot of demand is for complex genes which are extremely difficult to produce accurately. Camena can provide a solution that no other provider can deliver. We’re really excited to be supporting Camena on its next stage of growth.”

Lee Lindley, Camena Board member and Investor at Mercia Investment

Outlook

The summer months often lead to Q3 being slightly quieter than Q1 and Q2, but this year the difference in activity is decidedly marked. It seems that investors have taken a longer summer break than usual and are cautiously waiting to see what the rest of the year brings in terms of inflation and high interest rates. Despite these temporary local difficulties, the longer-term outlook for the UK’s growth capital market is positive. It has a well-developed investment ecosystem motivated to fund exciting growth opportunities, and that is not likely to change any time soon. Investors may be keeping their powder dry for the time being but they will be keen to deploy their funds as soon as the macroenvironment improves.

Contact us

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner for you. Contact us to find out more about our raising finance and growth capital services. We also assist investors and are experts at providing advice throughout the acquisition or investment process. Our team can help identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.