Increased interest in advertising and growing PE appetite fuel M&A Q2 2022

M&A in the media and marketing services sectors – Q2 2022

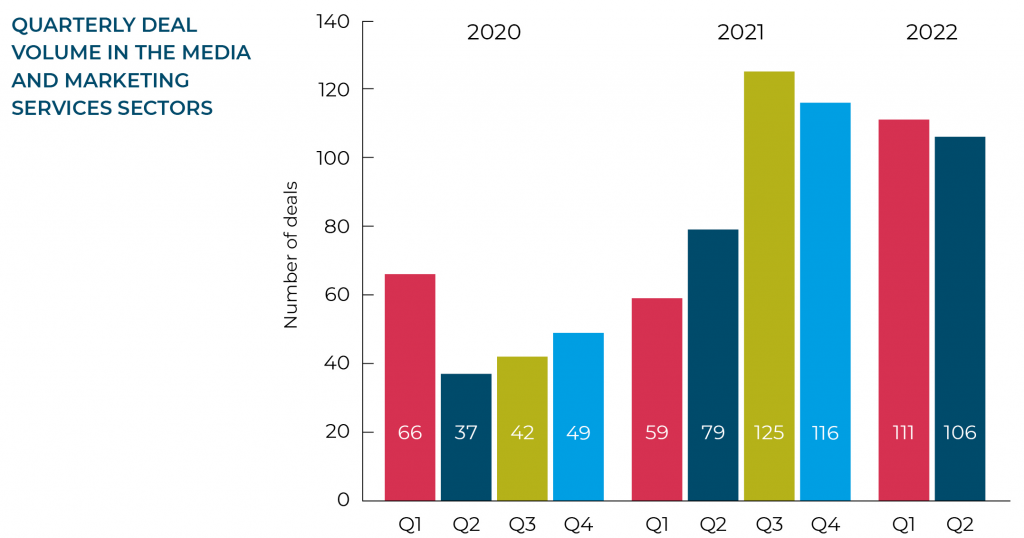

This quarter, Moore Kingston Smith’s deal tracker recorded 106 UK media and marketing services deals, continuing the slight quarter-on-quarter decline we have seen over the last year. This level of activity is, however, still far ahead of the transaction volume level we saw during the pandemic, reflecting the industry’s post-Coronavirus recovery.

The latter half of 2021 was a bumper period for M&A in the media and marketing services arena. Successful businesses that had weathered the Coronavirus storm started to focus on investing to thrive rather than simply survive. The pursuit of growth was very much on the agenda in 2021, and M&A was, for many, the preferred strategic option to accelerate growth.

Since the start of 2022, new macroeconomic and geopolitical factors have come to the fore, which might be dampening enthusiasm, but the impact appears relatively slight. The numbers of deals we are seeing complete in 2022 are still extremely high when compared with recent historical norms.

Sector activity

Media and marketing services covers a broad range of activities. For the purposes of this report, we allocate transactions to three main categories: marketing services, publishing, and TV, film and entertainment (which includes gaming and music).

69% of our 106 Q2 deals fell within the marketing services sector, with a total of 73 transactions completed. TV, film and entertainment also had a busy Q2 with 20 deals announced, while we noted 13 transactions in the publishing sector.

Hot marketing services disciplines

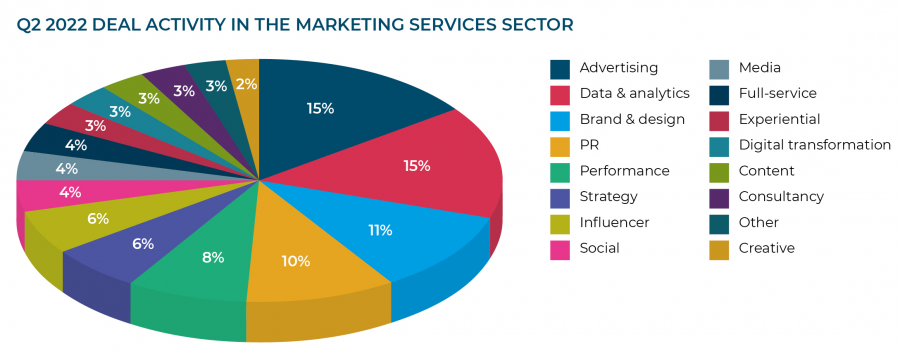

Our analysis of the 73 marketing services transactions completed last quarter enables us to determine whether the company acquired was a full-service agency or a specialist in one of the marketing services disciplines, such as PR or advertising.

In Q2 2022, advertising specialists and companies specialising in data and analytics were most popular with acquirers. In Q1, data and analytics was the out-and-out favourite. The biggest change this quarter has been in the number of deals featuring advertising companies – in Q1 they accounted for just 7% of the total but that has more than doubled this quarter to 15%.

That advertising is proving increasingly popular during a period of mounting economic concerns might seem counterintuitive. Despite such issues as rising inflation, the situation in Ukraine, commodity price increases and shortages, and talks of an impending economic recession, agencies still see continued overall growth in ad spending in the aftermath of the pandemic. Three prominent global ad agencies – Zenith, MAGNA and GroupM – all recently released updated mid-year forecasts for the latter part of 2022 and predicted growth resulting from certain cyclical events, such as the US mid-term elections and the FIFA World Cup, which will take place in the fourth quarter of the year for the first time.

Following several completed transactions in 2021, Moore Kingston Smith’s corporate finance team announced a cross-border advertising deal in May 2022, having advised Creature London, a UK independent advertising agency, on its sale to Dutch marketing and communications group Candid Platform. Creature, whose clients include Moonpig, Dunelm, Clearscore, Atom Bank and eve Sleep, will be Candid’s lead creative agency. It is the third UK agency to be acquired by the Dutch platform in the last six months, after Brand Potential and digital agency Positive. Nick Thompson, Corporate Finance Partner at Moore Kingston Smith, was the lead adviser to Creature London’s shareholders. “Digital skillsets are imperative to remain competitive in the sector,” Nick says. “There has been a focus recently on deals targeting digital advertising agencies, which are the result of changing advertising budgets from the fallout of Coronavirus. Creature has found a great home in Candid and I look forward to seeing what the future holds for both parties.”

“The biggest change this quarter has been in the number of deals featuring advertising companies – in Q1 they accounted for just 7% of the total but that has more than doubled this quarter to 15%.”

Spotlight on martech and adtech

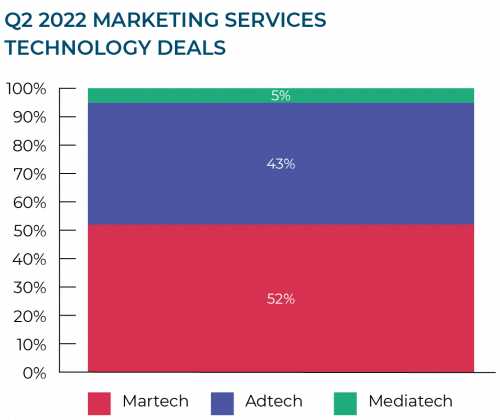

In the marketing services sector, while most deals saw traditional service-led agencies being acquired, 29% of the deals in Q2 were technology-led, involving businesses that have developed and are selling innovative software and technology solutions to their clients.

Over half of these marketing services technology transactions concerned martech companies – companies developing and using technology to assist with a digital marketing strategy, including lead generation, customer acquisition and retention, content and social, and data and analytics.

While martech predominated, adtech also proved popular last quarter, accounting for 43% of the marketing services technology deals we recorded. Adtech usually refers to specific solutions or tools used for digital advertising, such as programmatic advertising tools, data management platforms and ad exchanges.

One notable adtech transaction in Q2 was the merger of LandVault – a builder of virtual experiences in metaverse worlds such as The Sandbox – with London-based Admix, a developer of in-game advertising technology. “We are integrating LandVault (creative capabilities) and Admix (monetisation tech) to become a one-stop-shop offering for brands or IP to enter the metaverse,” says Sam Huber, CEO of Admix, adding: “In an immersive environment like the metaverse, we foresee that intrusive advertising will disappear and native and in-play experiences will become the de facto standard, giving us an edge.”

Several UK martech companies were snapped up by eager acquirers in Q2, including machine-learning technology company Bibblio, which was acquired by Walt Disney-backed, US-headquartered EX.CO in April. The acquisition of Bibblio is EX.CO’s second acquisition within the past 12 months and will allow the company to provide more personalised video, interactive experiences and product recommendation solutions to brands, publishers and e-commerce businesses.

“Companies cannot continue to deliver the same experience to different types of website visitors if they want to improve their conversion rates,” says Tom Pachys, co-founder and CEO at EX.CO. “This acquisition of Bibblio allows us to scale our technology and propel businesses into a new era of hyper-personalisation so they can easily tailor their digital properties with dynamic content to create unique experiences.”

TV, film and entertainment

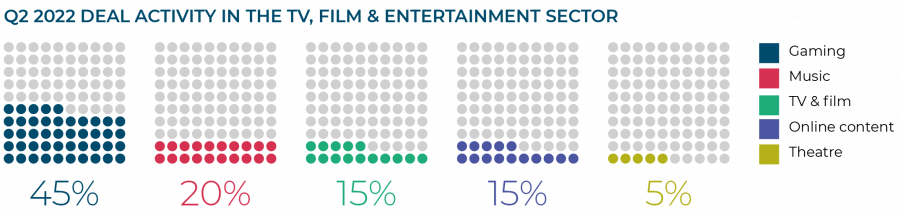

Within the TV, film and entertainment category, the gaming sector was the most active in Q2, as in Q1, followed by music.

Within music, US tour promoter Outback Presents acquired UK-based Robomagic, with the two companies saying they are together pursuing a “joint mission to create more equitable touring opportunities in partnership with artists”. Robomagic was founded in 2015 by Rob Hallett, who had launched AEG Live’s UK division ten years earlier. Robomagic had a brief stint operating as part of Live Nation UK, before becoming independent again in 2020.

As we saw with marketing services, technology-led deals were prominent in the TV, film and entertainment sectors, accounting for 35% of the transactions we recorded in this space. Pure content plays accounted for a further 25%, with production services making up 20% of the deals recorded in Q2.

One of the most notable cross-border gaming deals last quarter was the announcement by London-based games technology business Playstack that it was acquiring San Francisco-based remote games development studio Magic Fuel Games. Magic Fuel Games was founded by former Electronic Arts veterans, one of whom, Kevin Shrapnell, will become Playstack’s new COO as part of the transaction. The acquisition brings together Playstack’s experience in game publishing and Magic Fuel’s specialism in the simulation and city-building genres.

Publishing

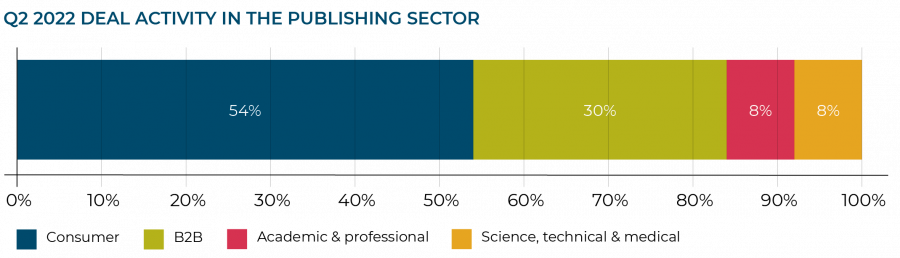

Consumer publishing saw the most deals in Q2, representing 54% of the deals recorded. B2B publications were second in popularity.

One notable deal was the acquisition of US-based women’s lifestyle platform Who What Wear by listed UK publishing group Future, which owns such titles as Marie Claire and Country Life. Terms were not disclosed but press reports indicated the price was around $100 million. The acquisition will make Future the sixth-largest fashion and beauty publisher in the US.

“Consumer publishing saw the most deals in Q2, representing 54% of the deals recorded. B2B publications were second in popularity.”

Marketing services networks remain active

Major holding companies

Q2 proved to be a relatively quiet quarter for the major listed holding companies, with Omnicom, Dentsu and Interpublic announcing no new transactions.

Havas was the most active of the majors last quarter and kicked off Q2 with the announcement in early April of its purchase of Leeds-headquartered digital agency and Google partner Search Laboratory.

In May, Publicis announced that it was acquiring e-commerce insights platform Profitero in a deal reported to be worth around €200 million, according to Reuters. Profitero was established in 2010 and employs 350 people across three offices in Boston, London and Shanghai. The company says its technology tracks 70 million products across hundreds of mobile apps and retailer sites, spanning more than 50 countries. Those insights help brands optimise their e-commerce campaigns. The acquisition strengthens Publicis’ ability to help clients bolster their digital retail presence as e-commerce continues to grow.

On the last day of Q2, WPP announced that it had agreed to acquire the business of Bower House Digital, a marketing technology services agency located in Australia, which it intends to fold into its Ogilvy global network.

Challenger networks

Having completed 12 transactions in 2021, S4 Capital had been rather quiet on the acquisition front this year, perhaps distracted by its well-publicised delay in publishing its audited results and the resulting decline in its share price in Q1. The company’s results were finally released on 6 May with an apologetic message from Sir Martin Sorrell to shareholders, saying: “The delay in producing these results is totally unacceptable and embarrassing to all of us.” No doubt the company will be keen to leave this issue behind. Indeed, on 17 May, it announced its latest ‘combination’ (as it chooses to style all its acquisitions), with LA-headquartered TheoremOne, a full-stack innovation, engineering and design digital transformation business.

However, the most exciting challenger network story of Q2 involved AIM-listed Next Fifteen, which decided to become involved in a takeover battle for M&C Saatchi in Q2. M&C Saatchi was originally put into play by its deputy chair and single biggest shareholder, tech entrepreneur Vin Murria. Her investment vehicle, ADV, made an initial offer for M&C Saatchi in January, which was rejected by the board. It then increased its offer a further three times, culminating in a bid worth 207.5p a share, which the board still dismissed as “derisory”.

Next Fifteen then sought to gazump ADV by tabling a £310 million offer for M&C Saatchi, worth 247p a share, which the board accepted on 20 May and decided to recommend to shareholders. However, as Next Fifteen’s offer was a cash and share offer, and because the value of its shares fell by some 30% following the announcement of its offer, on 17 June M&C Saatchi’s board did a U-turn and withdrew its recommendation for the Next Fifteen bid, saying that it no longer represented a fair value for the company. At the time of writing, both ADV’s and Next Fifteen’s offers remain on the table and the M&C Saatchi board is advising its shareholders not to accept either of them. However, it is also saying that if it had to choose one, it would prefer M&C Saatchi to be owned by Next Fifteen as opposed to ADV! The battle rumbles on, and may not be resolved until Q4 this year.

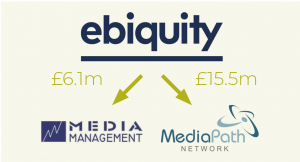

AIM-listed Ebiquity announced the completion of two transactions in April. First it acquired US-focused media audit services firm Media Management for an initial payment of £6.1 million. Later it closed on the £15.5 million acquisition of Swedish company MediaPath Network, a media consulting company specialising in agency selection processes, media performance measurement and media benchmarking.

Also in April, Definition Group announced its acquisitions of brand strategy and experience consultancy Brand Vista and Schwa, a specialist in tone of voice. The two deals mark the completion of five acquisitions in eighteen months for Definition Group, bringing the group’s revenue to £10 million and adding a Manchester office to its bases in Leeds and London.

Selbey Anderson, which regularly features in these reports, made no new acquisitions in Q2 but did announce at the end of May that it had closed a new £10 million funding round “to continue its aggressive UK expansion” and that a new acquisition was “being finalised”. Details to follow in our review of Q3!

AIM-listed Brave Bison ended April by announcing it had acquired a small digital commerce company, Best Response Media, for a total purchase price of approximately £1 million.

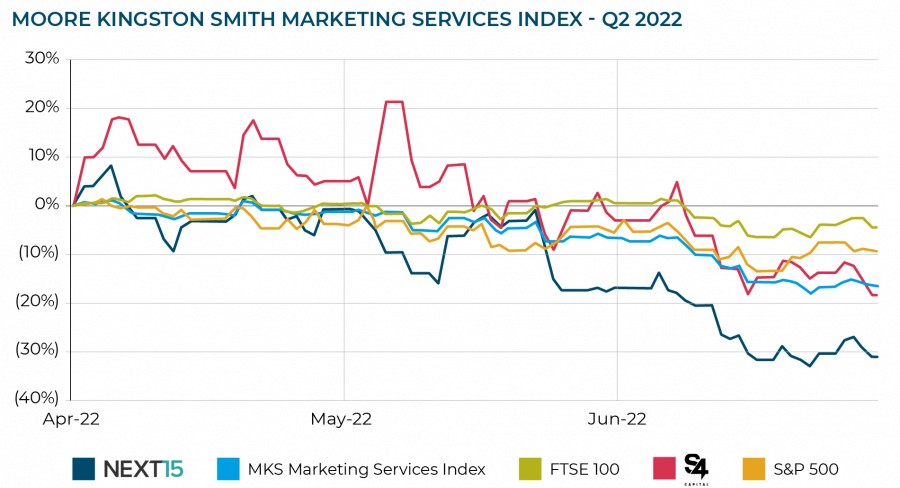

Marketing services industry stock performance

Moore Kingston Smith has plotted the share price performance of 14 listed marketing services groups, which together make up the Moore Kingston Smith Marketing Services Index, to see how they have fared in the last quarter in comparison with the FTSE 100 and S&P 500 indices. We have also highlighted the performance of S4 Capital and Next Fifteen, since their recent actions are discussed in this report.

Q2 2022 was not a great quarter for stock markets generally, with the FTSE 100 declining by 5% across the period and the S&P 500 falling by 9%. However, the Moore Kingston Smith Marketing Services Index underperformed the market, showing a 17% fall in value. Of the 14 companies that make up the index, only two – Brave Bison and Cheil Worldwide – ended the quarter in positive territory, with their share prices increasing by 16% and 1% respectively. The worst performers were Kin & Carta with a 33% decline; Next Fifteen, down 32%; and Enero, with a 26% fall in its share price. Having had a dreadful Q1, S4 Capital recovered some territory at the start of Q2 but faltered again in mid-May and ended the quarter 19% down.

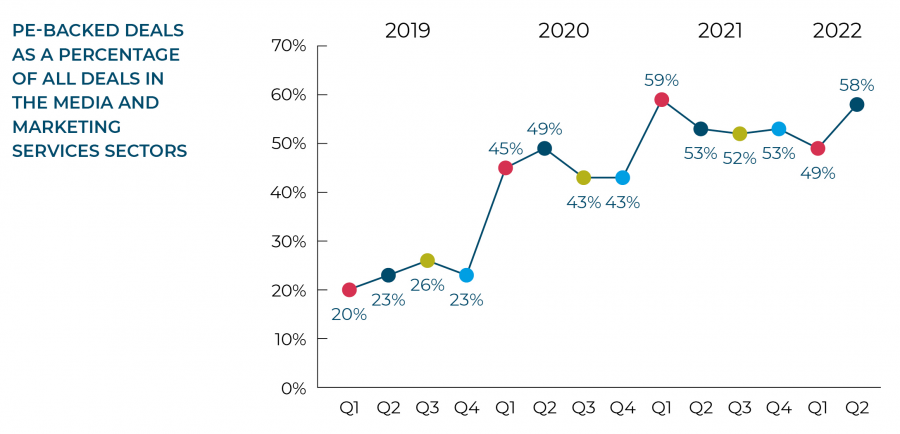

Private equity driving media and marketing services M&A

Since the start of the pandemic, private equity has substantially underpinned deal-doing in the UK’s media and marketing services sectors, with institutional investors making new investments and backing their existing portfolio companies in their buy-and-build strategies.

Private equity-backed investments accounted for 58% of all deals completing in Q2 2022, which is the second-highest level we have recorded in the last three years.

Key PE-backed acquirers in the quarter included UK B2B specialist The Marketing Practice, which is backed by Horizon Capital. The Marketing Practice completed the acquisition of US ABX specialist Campaign Stars in April, its second US acquisition this year, having acquired 90octane in March.

Gravity Global, backed by Elysian Capital since September 2021, continued its expansion into the US through the acquisition of ABM specialist Mojo Media Labs, which it announced in June. The acquisition comes only eight weeks after Gravity Global’s acquisition of US firms 9th Wonder and Morsekode.

Livingbridge-backed Brainlabs was one of the more prolific PE-backed acquirers in 2021, completing five transactions in that year. In May 2022, it returned to the fray with the acquisition of influencer marketing agency Fanbytes, which works across such platforms as TikTok, YouTube and Snapchat.

The largest deal we recorded last quarter in the publishing arena was the sale by Informa of its pharma intelligence division to New York-based PE house Warburg Pincus for £1.9 billion. The deal was originally announced in February but completed on 1 June. The acquisition includes Informa’s full portfolio of specialist

brands, which includes the Citeline suite of products (Trialtrove, Sitetrove, Pharmaprojects) as well as Biomedtracker, Clinerion, Datamonitor Healthcare, Pink Sheet, Scrip, Generics Bulletin, In Vivo, Medtech Insight, HBW Insight, Skipta and TrialScope. Abu Dhabi-based Mubadala Investment Company has joined Warburg Pincus in the £1.9 billion investment, while Informa retains a 15% equity interest in the business.

“Private equity interest in the media and marketing services sectors remains high,” says Paul Winterflood, Corporate Finance Partner. “This is driving deal volumes and we expect this to remain the case despite the current challenging economic environment as institutions continue to look to deploy capital. In the marketing services space specifically, where private equity houses started investing three or four years ago, many are now approaching the end of an investment cycle. As a result, we expect to start seeing a wave of secondary buyouts leading to a future round of bolt-on investments, such as in the case of Brainlabs which has publicly announced it has appointed an adviser to find a new private equity owner.”

Outlook

2021 was an outstanding year for UK M&A deals in the media and marketing services sectors, and 2022 appears to be broadly following suit, albeit slightly off the record pace set by the latter half of last year.

However, there are clearly some macroeconomic and geopolitical factors that could act as a drag on transactions. The situation in Ukraine, commodity shortages and price rises, concerns about global warming, increasing inflation and declining retail sales all serve to inject a note of caution into any forecast for the rest of the year.

We have not yet seen these wider concerns affect deal flow. Paul Winterflood comments: “We remain positive about the outlook for 2022. Even if there is a period of economic uncertainty, the era of digital transformation will continue to drive transactions in this sector. High-performing and differentiated businesses with specialist digital capabilities will continue to attract the attention of PE-backed acquirers. We are continuing to see an extremely busy market. It may be that the market will turn into a dual-speed one, with the aforementioned high-performing digital specialists being highly sought-after, while more traditional capabilities, particularly those businesses with undifferentiated propositions, may find it increasingly challenging to find buyers.”

We continue to be in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to consider their exit options. For more information, get in touch with the Moore Kingston Smith corporate finance team.