M&A activity in the UK media and marketing services sectors – Q2 2023

Signs of a slow down

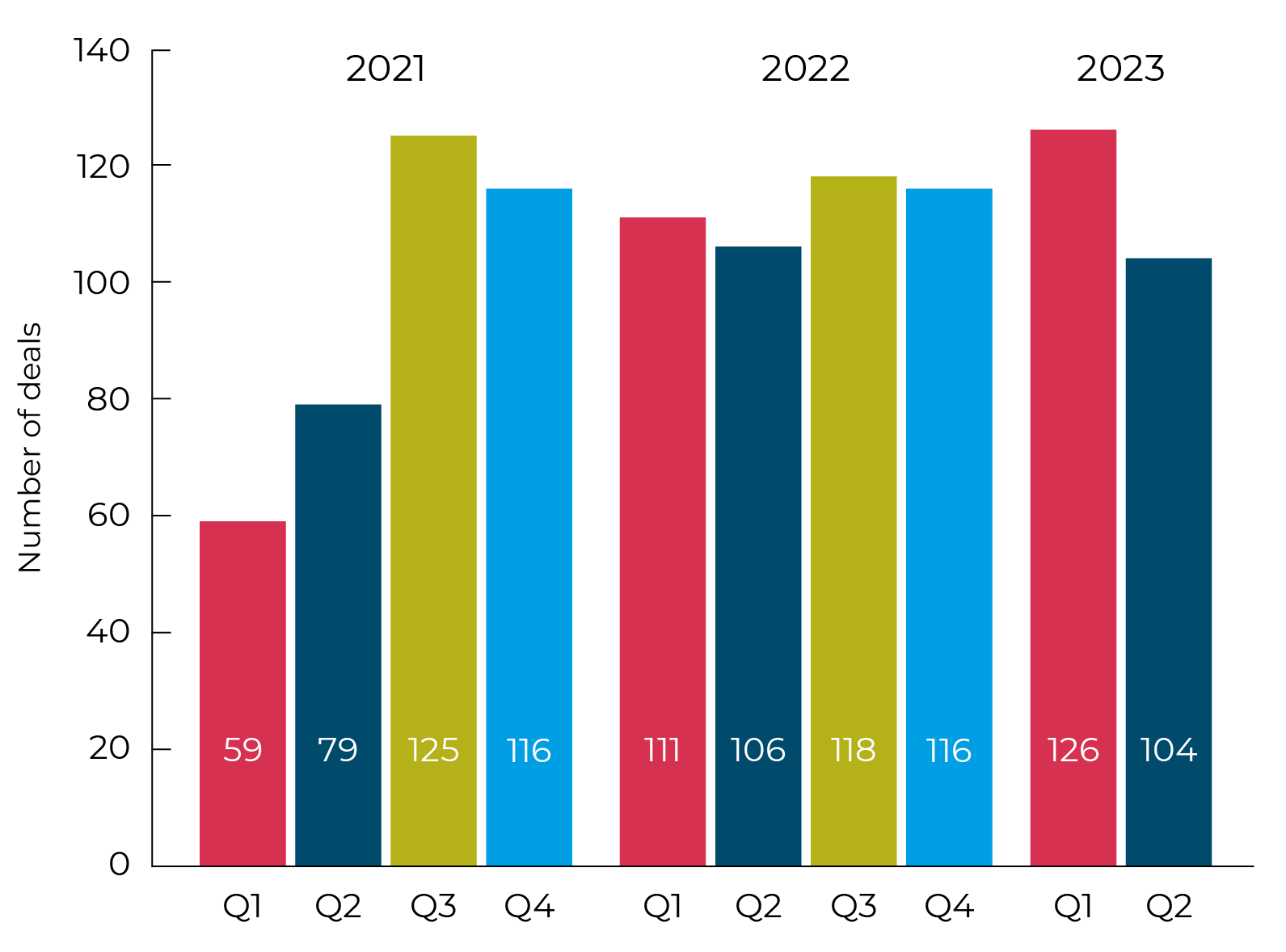

Moore Kingston Smith’s deal tracker recorded 104 UK media and marketing services deals in Q2 2023, a 17% drop on the 126 transactions we reported last quarter, but only two less than the 106 reported for the comparative period in 2022. 2023 got off to a flying start but acquirers have grown more cautious in recent months, reacting to rising interest rates and persistently high inflation in the UK.

Many listed media and marketing services companies have seen their share prices decrease significantly in Q2. This means they may be finding it harder to use their shares as acquisition currency and are therefore less active as acquirers. The percentage of transactions involving private equity has also come down from recent levels. Some PE houses may be finding it more difficult to transact while interest rates remain high.

Paul Winterflood, Corporate Finance Partner, comments: “While it is disappointing to see a drop in the number of deals done in Q2, we believe that this is largely due to short-term UK economic issues. High inflation rates and increasing interest rates do not create a benign environment for M&A. However, as those factors start to resolve, hopefully towards the end of the year, global interest in the UK’s media and marketing services sectors should turn positive again.”

Quarterly deal volume in the media and marketing services sectors

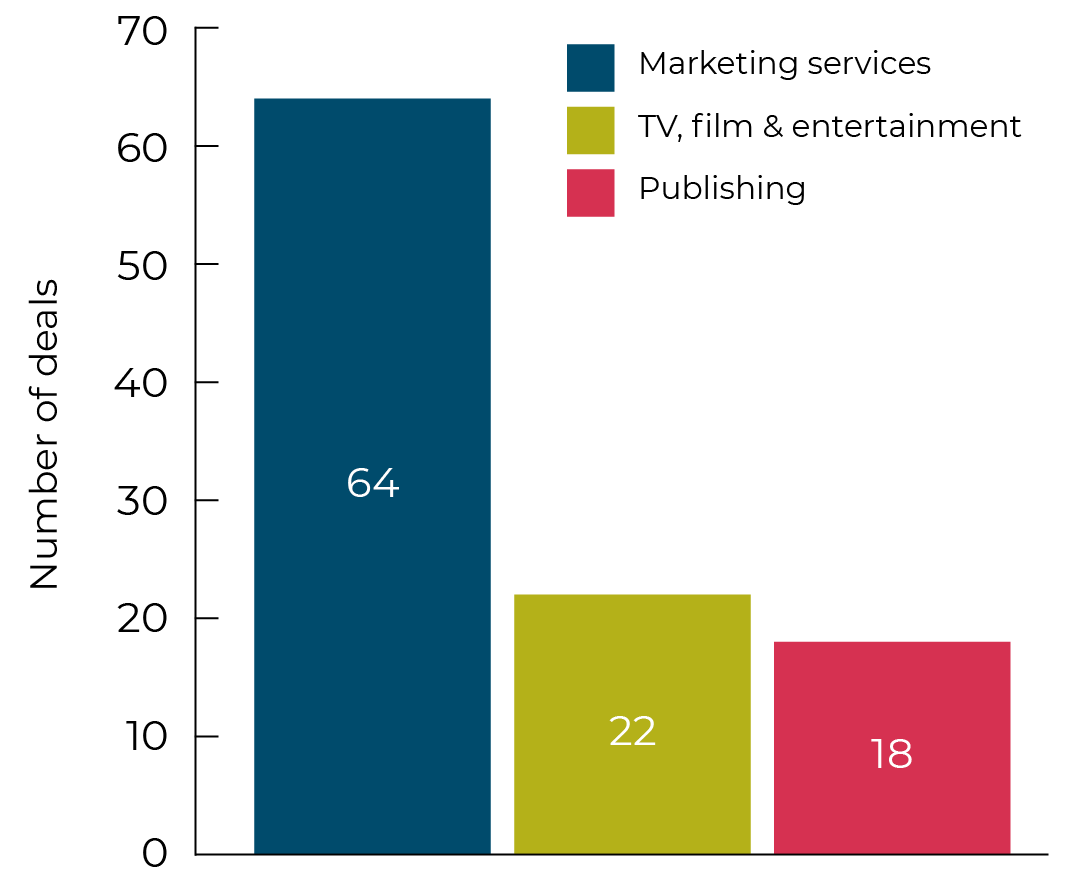

Sector activity

Q2 2023 deals by sector

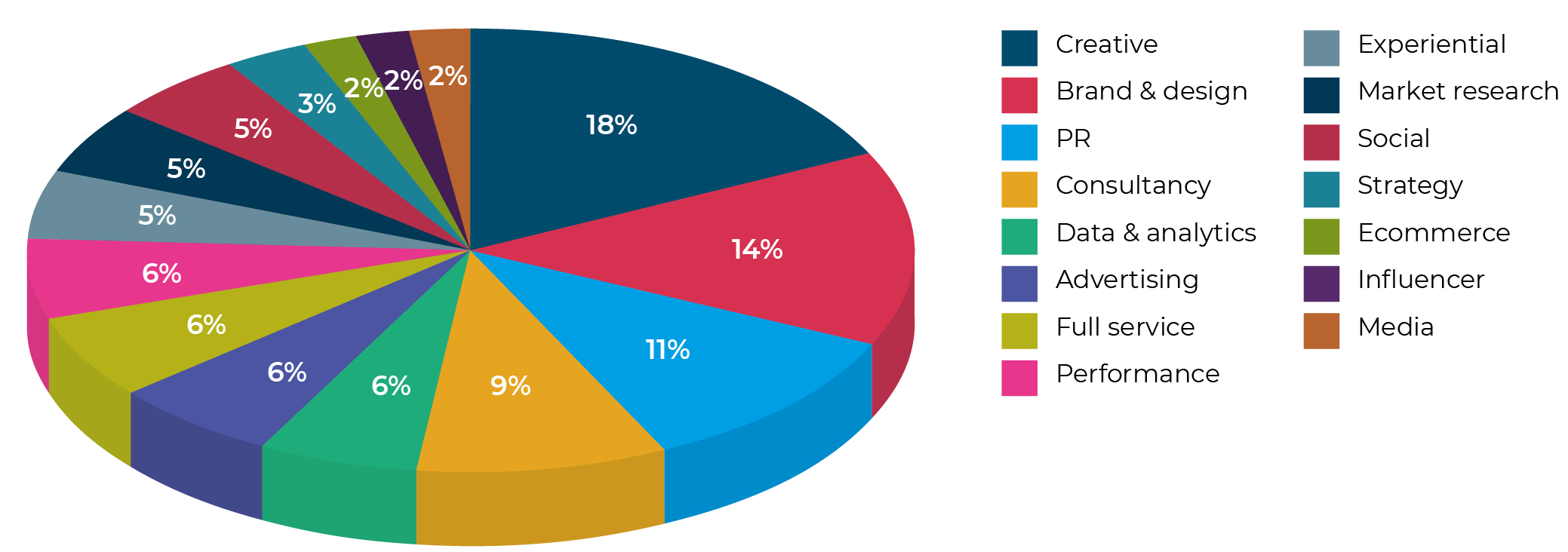

Q2 2023 deal activity in the marketing services sector

Focus on creative

Serial acquirer Definition Group completed its third acquisition in the last twelve months, with the announcement in May that it was adding London-based creative marketing agency OTM to its portfolio. OTM is a creative marketing agency that specialises in B2B technology, financial services and the public sector, with clients including HSBC, SS&C Advent, 8×8, ION Group and Transport for London.

One of the major holding companies, Omnicom, also added to its creative capabilities in Q2, announcing that its TBWA Worldwide division was acquiring UK sports creative agency Dark Horses. Dark Horses’ work includes supporting major sponsorship deals for global brand Nissan, helping TikTok reach new audiences through its relationship with UEFA EURO 2020, creating Shelter’s #NoHomeKit campaign which encourages football clubs to give up their home kit in aid of those without a place to call home, and launching Peloton to the UK market.

“We are seeing an uptick in demand for creative agencies fuelled by increased demands for talent from agency clients. This is due to a trend of moving away from large, infrequent campaigns towards more frequent and unique creative work, fit for social media.”

Moore Kingston Smith’s media corporate finance team predicts that the B2B and sports sectors will be considered ‘hot property’ in the market over the coming years.

Decline in technology-led transactions

In Q2, just 16% of the marketing services deals we recorded were technology-led, i.e. involving businesses that have developed and are selling innovative software and technology solutions to their clients. This is a significantly lower percentage than we have seen in recent quarters where technology-led transactions tended to represent around a third of all deals. It seems that, as the M&A market contracts and acquirers become more cautious, they are prioritising traditional professional service-led agencies as targets.

“It seems that, as the M&A market contracts and acquirers become more cautious, they are prioritising traditional professional service-led agencies as targets.”

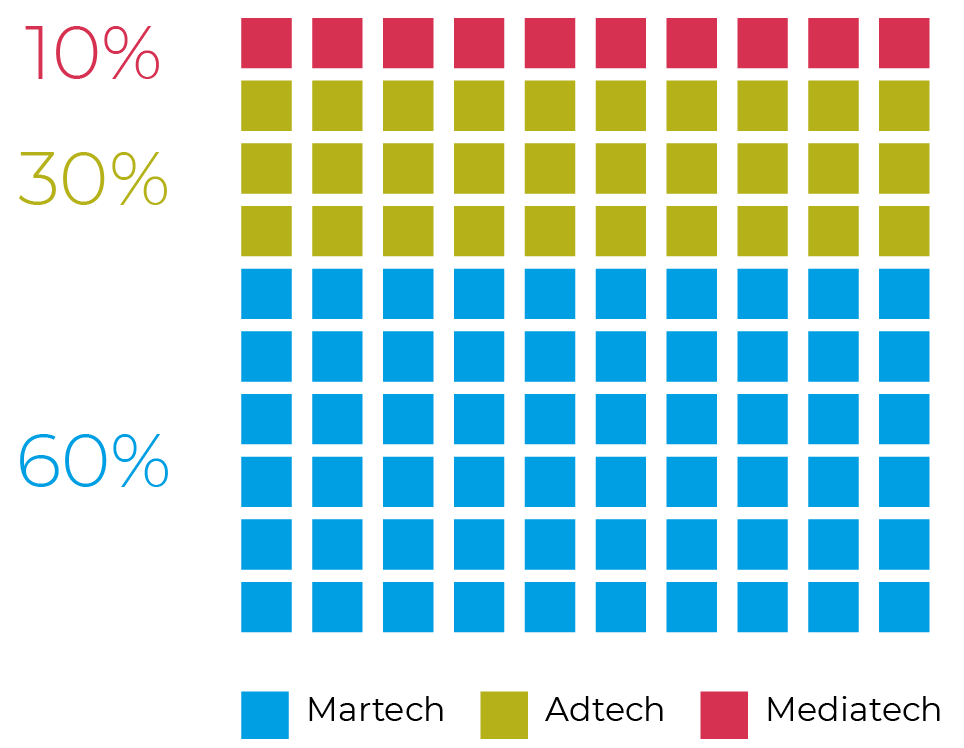

Q1 2023 marketing services technology deals

TV, film and entertainment

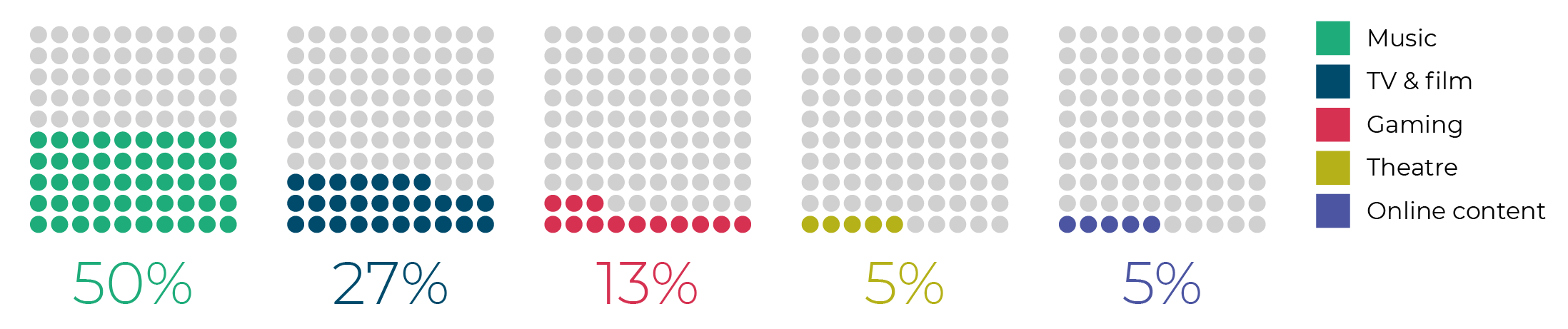

Within the TV, film and entertainment sector, music retained the top spot in Q2 2023, accounting for 50% of the deals we recorded, a sizeable increase on the impressive 39% that we recorded in Q1.

Technology deals were the most prominent in Q2 accounting for 32% of the transactions we recorded in the TV, film and entertainment sector. Production services accounted for a further 27%, while pure content plays made up 14% of the deals recorded in Q2.

The most active acquirer in the music space was Superstruct Entertainment. The company was founded in 2017 by Creamfields founder and former Live Nation president of electronic music James Barton and is backed by Providence Equity Partners. In Q2, Superstruct bought London-based festivals Mighty Hoopla and Cross the Tracks, as well as Austria’s Snowbombing, touted as Europe’s biggest snow and music festival.

Within the theatre industry, Trafalgar Entertainment acquired its first Scottish venue – The Pavilion Theatre in Glasgow. The Pavilion Theatre will become part of the group’s Trafalgar Theatres division and will sit alongside other prestigious venues within the portfolio, including Trafalgar Theatre in London’s West End, the Theatre Royal Sydney in Australia and 12 UK regional theatres, including Southend Cliffs Pavilion, the New Theatre (Cardiff), G Live and Wycombe Swan, the 2021 acquisition of which Moore Kingston Smith advised on.

Q1 2023 deal activity in the TV, film and entertainment sector

“Music retained the top spot in Q2 2023, accounting for 50% of the deals we recorded, a sizeable increase on the impressive 39% that we recorded in Q1.”

Publishing

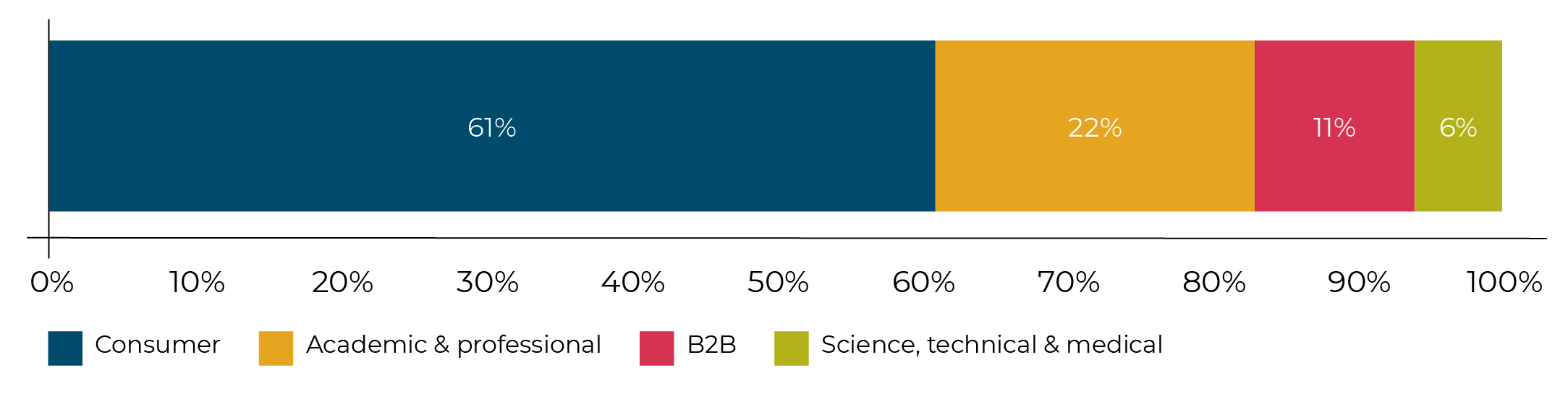

In what was a relatively busy quarter for the publishing sector overall, consumer publishing retained the top spot, representing 61% of the deals we recorded in Q2.

Within the consumer publisher space, HarperCollins UK announced in April that it had acquired award-winning children’s publisher Barrington Stoke. The company, founded in 1997, publishes dyslexia-friendly fiction and non-fiction by a stable of highly acclaimed authors and illustrators, with the aim of enabling every child to become a reader.

Q1 2023 deal activity in the publishing sector

Marketing services networks round-up

After an extremely busy Q1, the major holding companies had a much quieter quarter, with most announcing just a single acquisition apiece.

Omnicom kicked off Q2 with the early April announcement of its acquisition of UK creative agency Dark Horses, which we have already covered in this report.

“After an extremely busy Q1, the major holding companies had a much quieter quarter, with most announcing just a single acquisition apiece.”

Also in April, WPP announced that it was acquiring the global sonic branding agency, amp, to expand its generative AI and brand experience design offering. The company will join WPP brand & design consultancy Landor & Fitch. Mark Read, CEO of WPP, said: “With the rise of streaming, podcasting and short-form media, audio has become a critical component of the marketing mix. The acquisition of amp enhances our offer to clients, helping them create immersive experiences that engage consumers on a deeper level and drive their competitive advantage.” As well as the acquisition of amp, WPP announced in June that it was forming a strategic partnership with US-based creative agency Majority, purchasing a 30% minority stake in that business.

Havas announced the acquisition of Vancouver-based digital agency and data consultancy Noise Digital in April. Founded in 1998, Noise Digital empowers brands to make better strategic investment decisions and capitalise on data-informed, consumer-centric media buying strategies that unlock new opportunities and brand experiences.

In May, Publicis announced the acquisition of Publicis Sapient AI Labs, an artificial intelligence research and development joint venture launched in 2020 in partnership between Publicis Sapient, Elder Research and Tquila. Publicis Sapient AI Labs will fully become part of Publicis Sapient, Publicis’ digital business transformation company.

Interpublic-owned FCB announced in April that it was acquiring majority control of Kinnect, a digital-first creative agency based in India. FCB had first picked up a minority stake in Kinnect in August 2021.

Dentsu made no new acquisitions in Q2 but was presumably kept busy working on the planned acquisition of Tag Worldwide, the announcement of which we covered in our Q1 report.

Challenger networks

We saw very little activity from the challenger networks in Q2, with a few notable exceptions.

In April, Next 15’s Palladium announced the acquisition of data-led, digital-first advisory firm onefourzero.

In May, we saw the announcement by Definition that it had acquired creative marketing agency OTM, which we have already covered in this report.

Nasdaq-listed Stagwell completed two acquisitions in Q2. In April, it announced that the Dublin-based creative agency, In the Company of Huskies, was to join Stagwell’s Forsman & Bodenfors. In May, it announced that its SKDK public affairs agency had acquired Jasper Advisors, a firm providing c-suite strategic advisory services.

The Brandtech Group also completed two acquisitions in Q2. In June, it announced that it had acquired global digital media and marketing group Jellyfish. The deal concluded after almost a full year of exclusive negotiations, which were first announced in August 2022. Put together, the firms generate some $1 billion in revenue, according to Brandtech Group’s founder and CEO David Jones, who said the company essentially has two core models sitting above a unified technology platform: an in-housing model through its Oliver content creation shop, and then Jellyfish’s end-to-end integrated model.

“It gives us two really compelling core offers because not everyone wants the same thing. Some people want it all joined up, some people want it in-house,” said Jones. “I think the one thing that is absolutely consistent is, everybody wants to deliver content better, faster and cheaper using tech.”

French PE house Fimalac, which owned a majority stake in Jellyfish, becomes one of the largest shareholders in the expanded Brandtech Group as a result of the transaction. Following the Jellyfish acquisition, Brandtech also announced that it had acquired Pencil, a generative AI creative and distribution SaaS platform.

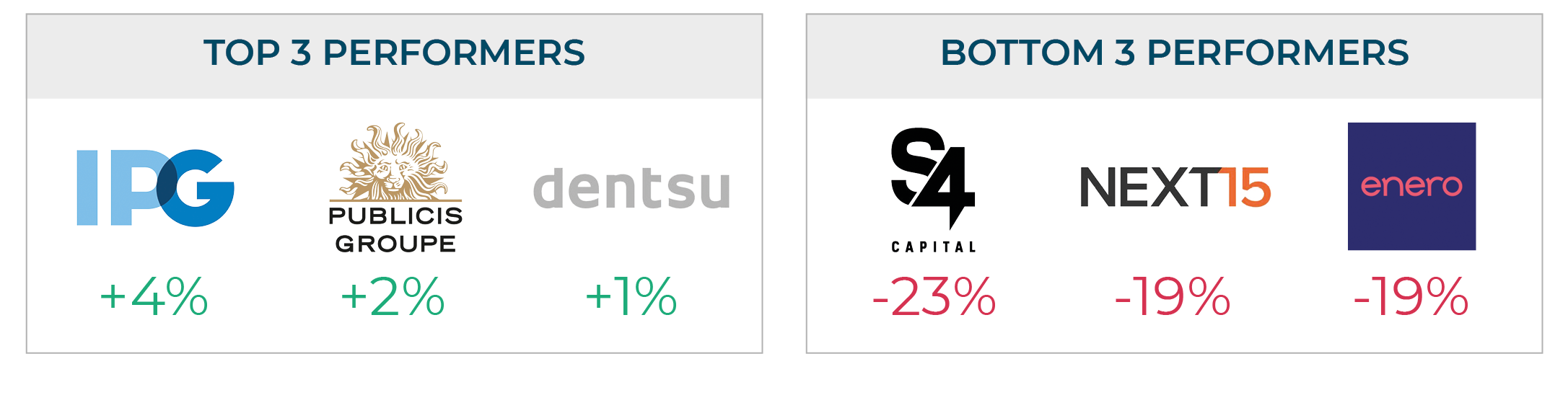

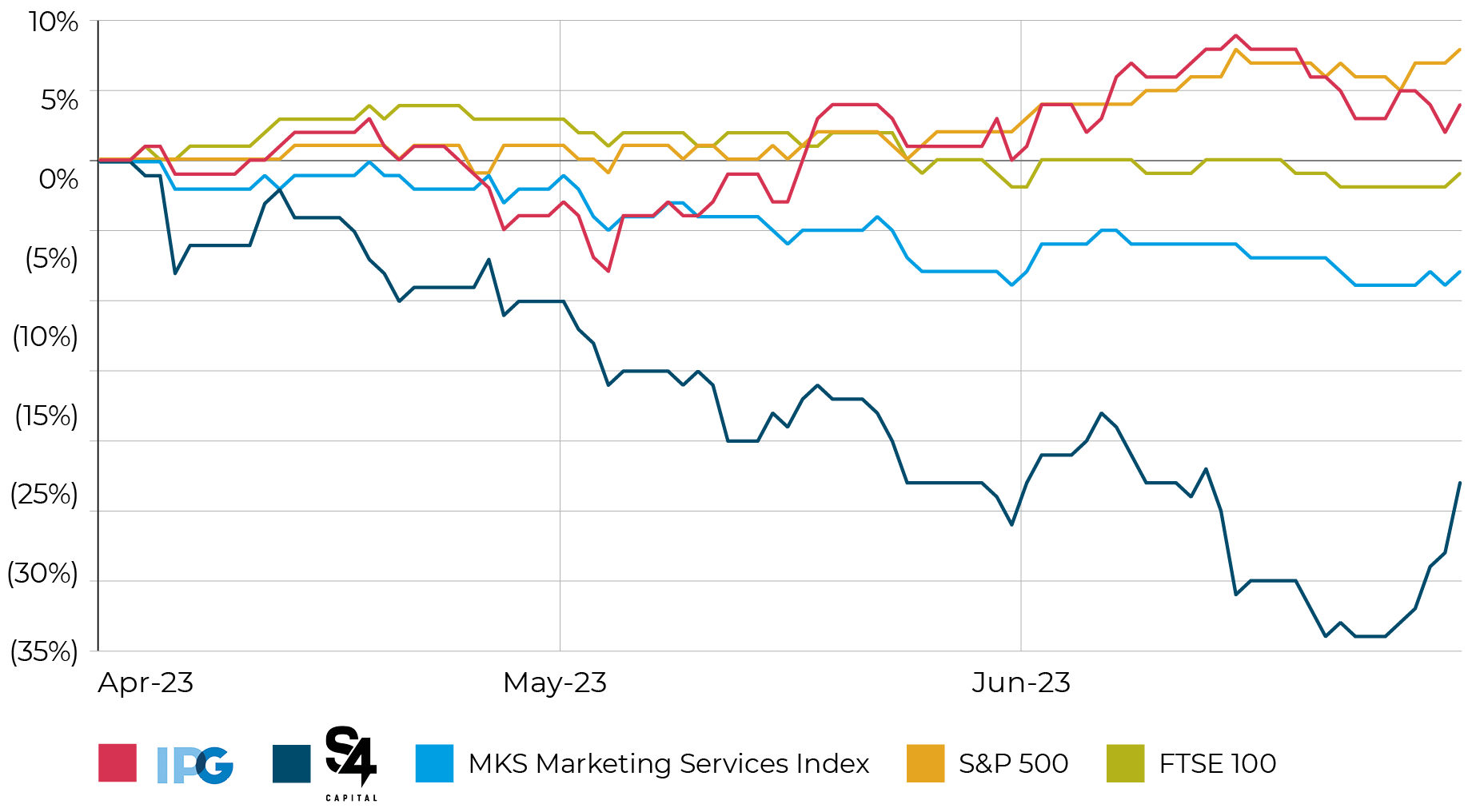

Marketing services industry stock performance

Moore Kingston Smith has plotted the share price performance of 14 listed marketing services groups, which together make up the Moore Kingston Smith Marketing Services Index, to see how they have fared in the last quarter compared with the FTSE 100 and S&P 500 indices. We have also highlighted the share price movements of Interpublic and S4 Capital, which represent the best and worst performance from our sample this quarter.

The second quarter of 2023 saw the US stock market continue the recovery that we saw in Q1. The S&P 500 was up by 8% in Q2, having increased by 7% in Q1. However, the UK market did not fare so well. The FTSE 100 fell in value by 1% in Q2. Media stocks significantly underperformed the domestic and global markets – the Moore Kingston Smith Marketing Services Index was down 8% across the period.

“Media stocks significantly underperformed the domestic and global markets – the Moore Kingston Smith Marketing Services Index was down 8% across

the period.”

Of the 14 companies that make up the index, only five ended the quarter in positive territory. The to performer this quarter was Interpublic, with a modest share price increase of 4%.

Our worst performer in Q2 was S4 Capital, which saw a 23% decline in its share price in the period. Having had a terrible 2022 when it saw a 70% fall in its share price due to accounting difficulties and profit warnings, the downward trend has continued into 2023. The sale by S4 Capital’s CEO in May of a quarter of his personal stake in the business cannot have helped to bolster investor confidence.

Moore Kingston Smith marketing services index – Q1 2023

Private equity falls back

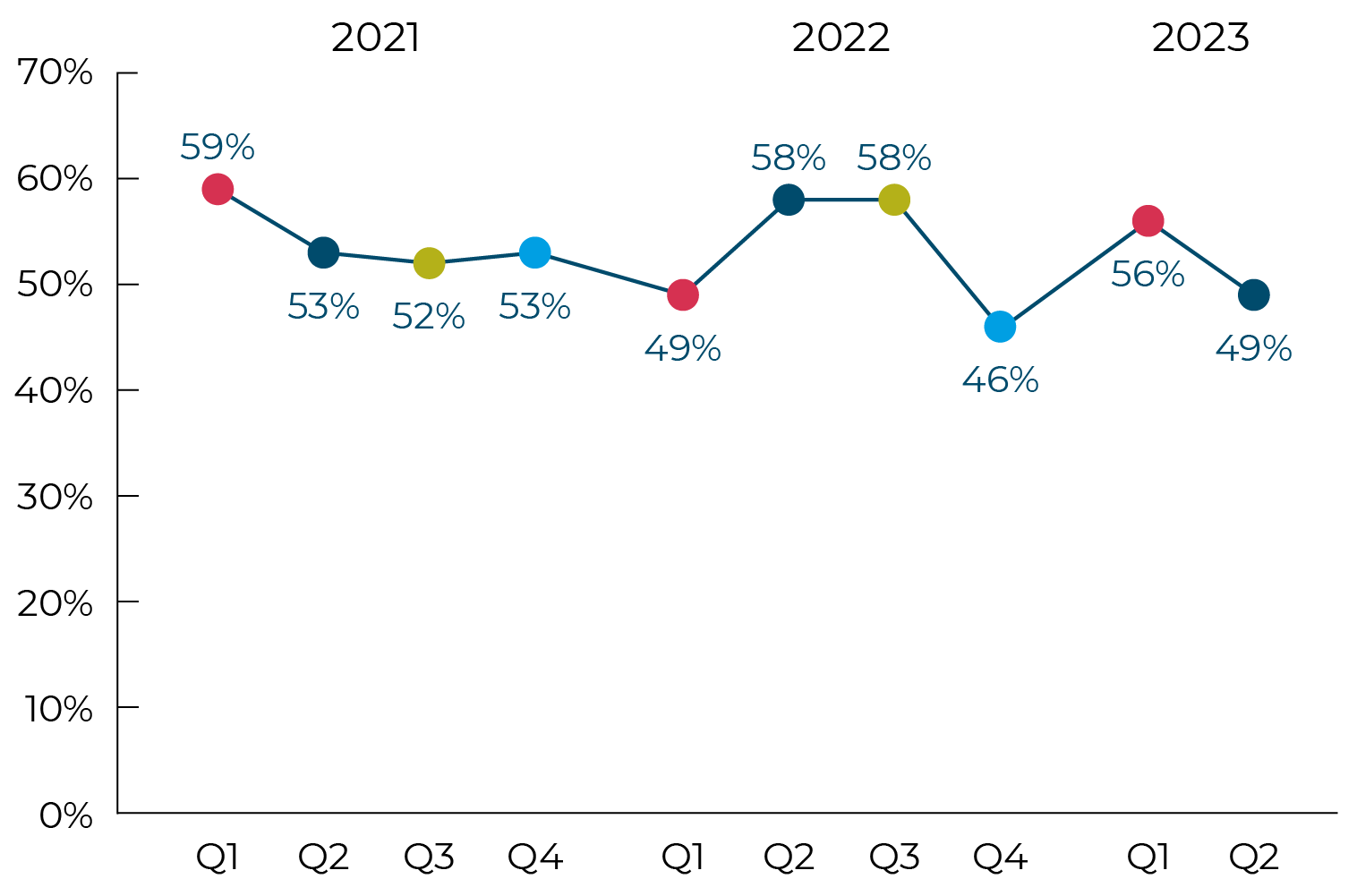

PE-backed investments accounted for 49% of all deals completing in Q2 2023, which represents a considerable drop-off from the 56% level we saw last quarter.

Underpinning almost half of the transactions we recorded, PE remains an enduring and significant driver of M&A activity in the UK’s media and marketing services sectors. However, PE transactions, particularly larger leveraged deals, are much harder to put together in a high interest rate environment, so it is unsurprising to see some decline in activity at this juncture.

In June, London-headquartered adm announced that it was buying Singapore-based digital and shopper marketing agency DASS. PE house Equistone invested in adm in 2021, and since then adm has made three strategic acquisitions.

Also in June, PE-house LDC announced that it was selling its agency business MSQ to new private equity investor One Equity Partners. LDC first invested in MSQ in 2019, and backed it in five acquisitions, including the transformational £20.6 million public-to-private acquisition of the Be Heard Partnership, which completed in September 2020. LDC will reinvest in MSQ as a minority partner alongside One Equity Partners to support the next phase of MSQ’s growth.

This is expected to include accelerating international growth and building out its creatively led, data-driven and tech-enabled model, both organically and through further acquisitions.

PE-backed deals as a percentage of all deals in the media and marketing

services sectors

“Private equity activity may be down this quarter, but we should not lose sight of the fact that PE still underpins almost half of all UK media and marketing services deals. We are confident that once inflation starts to come down and interest rates stabilise, leveraged deals will come back. Until then we are likely to see more smaller deals that may not require significant debt to sit alongside an investor’s equity cheque.”

Dan Leaman, Corporate Finance Partner at Moore Kingston Smith

Outlook

2022 was a record year for UK M&A deals in the media and marketing services sectors. 2023 started in a similar vein but the results from 2022 show that the market has started to soften. PE is finding it harder to transact, and the major global holding companies who were so active last quarter have reduced their activity. Most of the quoted major holding companies and challenger networks have not performed well on the stock markets in Q2, hampering their ability to do deals.

We do believe that this dip in activity is temporary, and that the outlook for the sector as a whole, and for global interest in the UK’s media and marketing services sectors, remains positive. There are still many interested buyers for well-managed profitable companies, so shareholders in media and marketing services companies should not put off planning for an exit.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

Contact us

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to start planning for an exit.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

Methodology

In compiling our deal tracker we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller (or both) and where the target company is classified as marketing services, publishing or TV, film & entertainment, the transaction is entered into the deal tracker. We classify marketing services into sixteen sub-categories; TV, film and entertainment into seven sub-categories; and publishing into four sub-categories.

As well as the data extracted from Pitchbook we have used information from the following sources: theguardian.com, ft.com, revolutionworld.com, mrweb.com, wpp.com, venatus.com, gramophone.co.uk, musicbusinessworldwide.com, lse.co.uk, corporate.telegraph.co.uk, group.dentsu.com, publicisgroupe.com, havasgroup.com, adweek.com, next15.com, londonstockexchange.com, waterland.nu, talonooh.com, commercenext.com, exhibitionworld.co.uk, thetimes.co.uk, propellergroup.com, prolificnorth.co.uk, radiotoday.co.uk.