M&A in the UK media and marketing services sectors: Q1 2024

New year off to a good start

![]()

106

deals completed

![]()

+7%

Moore Kingston Smith

Marketing Services Index

![]()

45%

deals backed by PE

Our view of the market

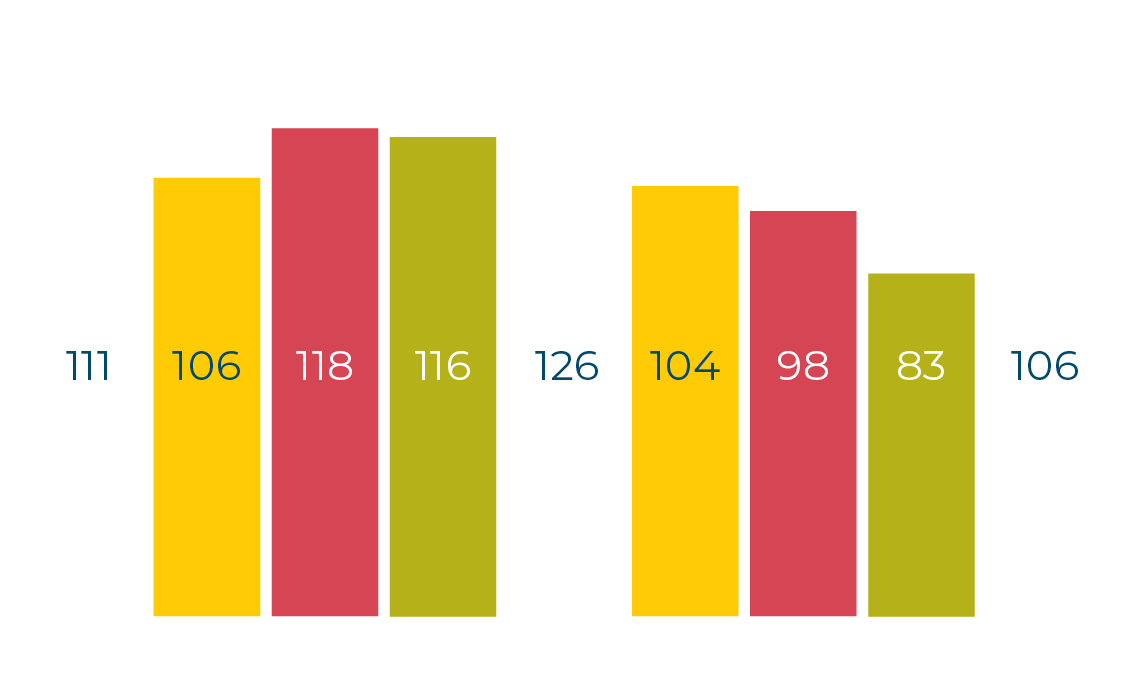

As we reported in our annual review, 2023 was a good year for M&A within the UK media and marketing services sectors. However, it was very much a year of two halves, with the final two quarters of the year showing a decline in activity. 2024 is showing a reversal of that trend, with a total of 106 UK deals completed in Q1 – a 28% increase on the 83 deals we counted in Q4 2023.

The percentage of transactions involving private equity has fallen this quarter, as leveraged deals remain challenging to put together in a high interest rate environment. However, anticipated interest rate reductions as we move through 2024 should ease the situation, and we expect to see much more PE involvement in the latter part of the year. Some of the major networks have been busy on the acquisition front; the challenger networks even more so. Most quoted holding companies saw their share prices increase in Q1, enabling them to do deals with more highly rated paper.

Paul Winterflood, Corporate Finance Partner, says: “We are already seeing an uptick in M&A activity as the economic environment improves – inflation is falling, and agencies are reporting an increase in client spend and improving profitability. Once interest rates start to come down from their current highs, we expect to see M&A activity, particularly PE-led M&A, increase still further.”

Quarterly deal volume

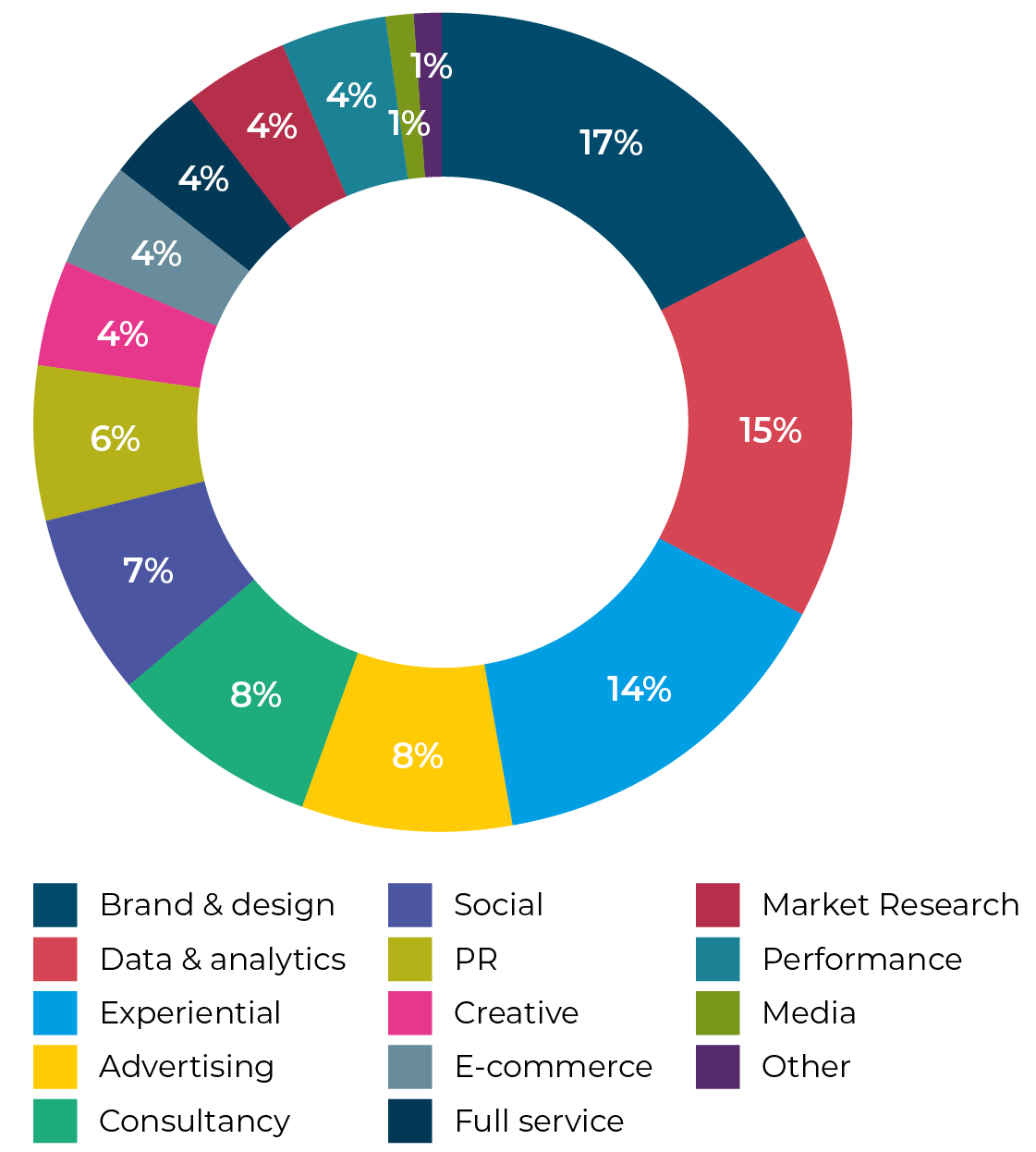

Trending: brand and design

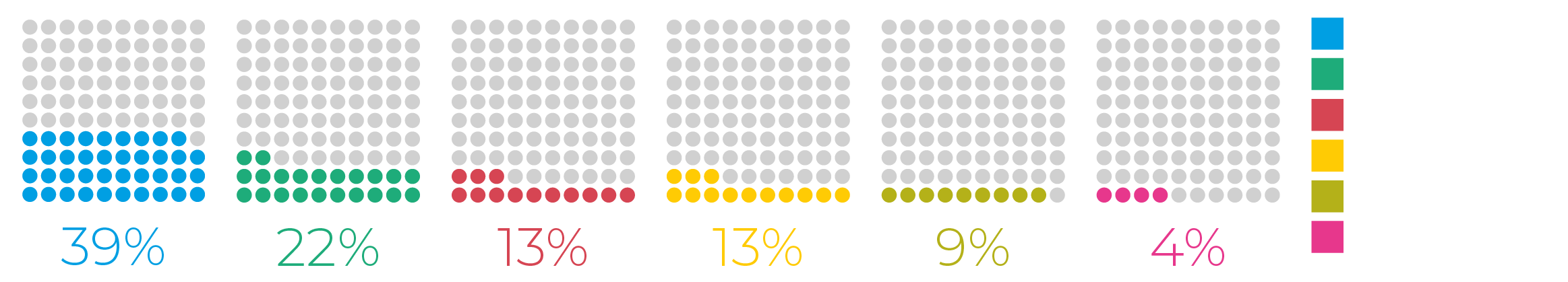

In Q1 2024, brand & design was the favourite marketing services category with acquirers. It made up 17% of all the marketing services deals we recorded, with data & analytics in second place on 16%.

As clients seek to adapt to economic challenges, they are increasingly looking to redefine their brands and their relevance to customers to differentiate themselves from their competitors. This means agencies with branding & design expertise are in demand.

In January, Paragon DCX, a full-service digital transformation and marketing agency, announced the acquisition of UK-based Twelve, a creative brand activation agency, to bring brand, advertising, shopper marketing, experiential, and an enhanced retail and leisure offering to clients.

Spotlight on: martech

In the marketing services sector, while most deals involved the acquisition of traditional service-led agencies, 18% of the deals we recorded in Q1 were technology-led. This is slightly down on the 19% we recorded in Q4 2023 and is still well below the level we saw a couple of years ago, where technology-led transactions tended to represent around a third of all deals. Technology, and particularly AI, continues to drive innovation in the marketing services industry. However, as the industry matures, we see technology already embedded in PR, advertising and creative agencies, rather than remaining the preserve of specialist technology plays.

Most of the technology-led transactions we recorded in Q1 2024 related to martech companies – companies developing and using technology to assist with a digital marketing strategy.

“The market has matured and is more sharply focused on profitability, as opposed to growth,” says Alun Davies, CMO at Bidnamic. “As a result, buyers are needing to see a stronger business case for any additional investment.”

Q1 2024 deal activity in the marketing services sector

Notable UK martech deals

US-based ecommerce search and personalisation platform Searchspring, which is backed by PE house PSG, acquired UK-based Intelligent Reach, a product marketing platform. This is Searchspring’s second UK acquisition within a year – in September 2023, it acquired Increasingly, which provides technology designed to increase basket size and conversion rates.

Global media intelligence software and research services group Carma acquired London-headquartered mmi, a media communication and ecommerce measurement platform for beauty, fashion and lifestyle brands.

Major holding companies

Notable transactions

Three of the major marketing services networks – WPP, Interpublic and Dentsu – made no new acquisitions in Q1. Publicis and Omnicom made one apiece, while our most prolific acquirer in 2023, Havas, acquired two UK-based companies.

![]()

![]()

In February, Havas announced the acquisition of B2B marketing agency Ledger Bennett, and followed that in March with the acquisition of social first marketing agency Wilderness.

“Havas has been one of the most acquisitive networks post-Coronavirus. Adding B2B to their roster of acquisitions through the purchase of Ledger Bennett is a strong move. We expect further PE houses and trade acquirers to follow suit to capitalise on the growth in the B2B space.” Paul Winterflood, Corporate Finance Partner

In March, Publicis announced the acquisition of Spinnaker SCA, a supply chain services firm that provides end-to-end supply chain strategy, planning and execution consulting services. Spinnaker SCA will become part of Publicis Sapient, Publicis’s digital business transformation company.

Omnicom announced in January that it had completed the acquisition of Flywheel Digital, the digital commerce business of LSE-listed Ascential, for £741 million. The acquisition forms part of the planned break-up of Ascential, with Apax Partners having acquired its product design business, WSGN, for £700 million in February. Ascential will now focus on its remaining events business.

Challenger networks

We saw quite a bit of activity from the challenger networks in Q1. In February, serial acquirer Stagwell bought UK-based Sidekick, which specialises in experiential, digital storytelling and branded content. Sidekick will join Allison, a global marketing and communications consultancy within Stagwell. This deal followed Stagwell’s January purchase of US-based creative agency Team Epiphany. The Wall Street Journal recently revealed that Stagwell made an offer for S4 Capital last year, which was rejected.

Since Brainlabs took on a new private equity partner, Falfurrias Capital Partners, in September last year, we have been expecting it to renew its acquisition spree. Q1 did not disappoint, with the revelation that Brainlabs was acquiring Sparro, Australia’s largest independent digital media agency.

In March, Together Group announced it had acquired Dubai-based luxury communications agency Frame Publicity. Frame is the tenth agency to join Together Group.

PE-backed fashion PR group The Independents acquired London-based Kennedy and Paris-based Atelier Athem in Q1.

In March, Moore Kingston Smith’s corporate finance team advised Common Interest on its acquisition of Otherway, a multidisciplinary design and communications studio. Common Interest was launched in 2023 and made its first acquisition with the purchase of TwentyFirstCenturyBrand, on which deal Moore Kingston Smith also advised. The group aims to acquire eight more companies in the next 18 months.

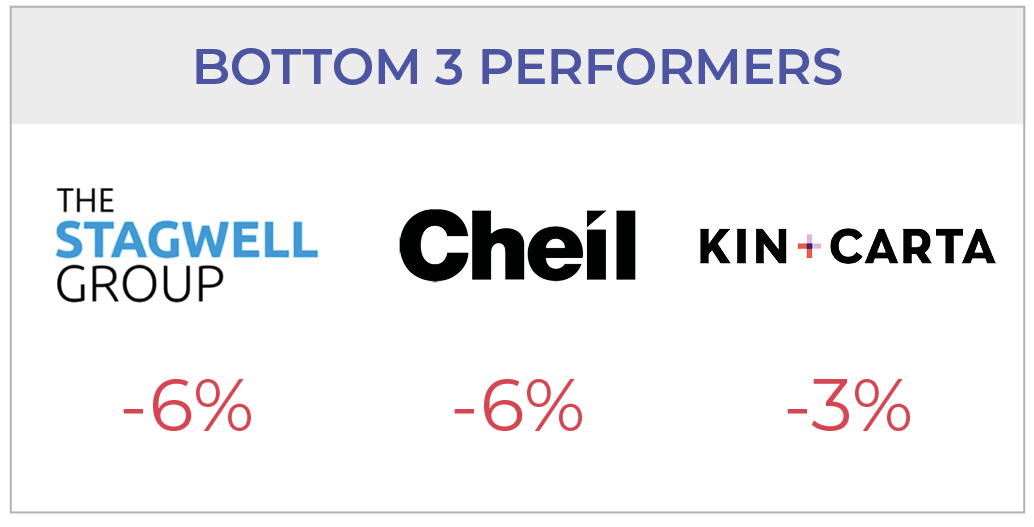

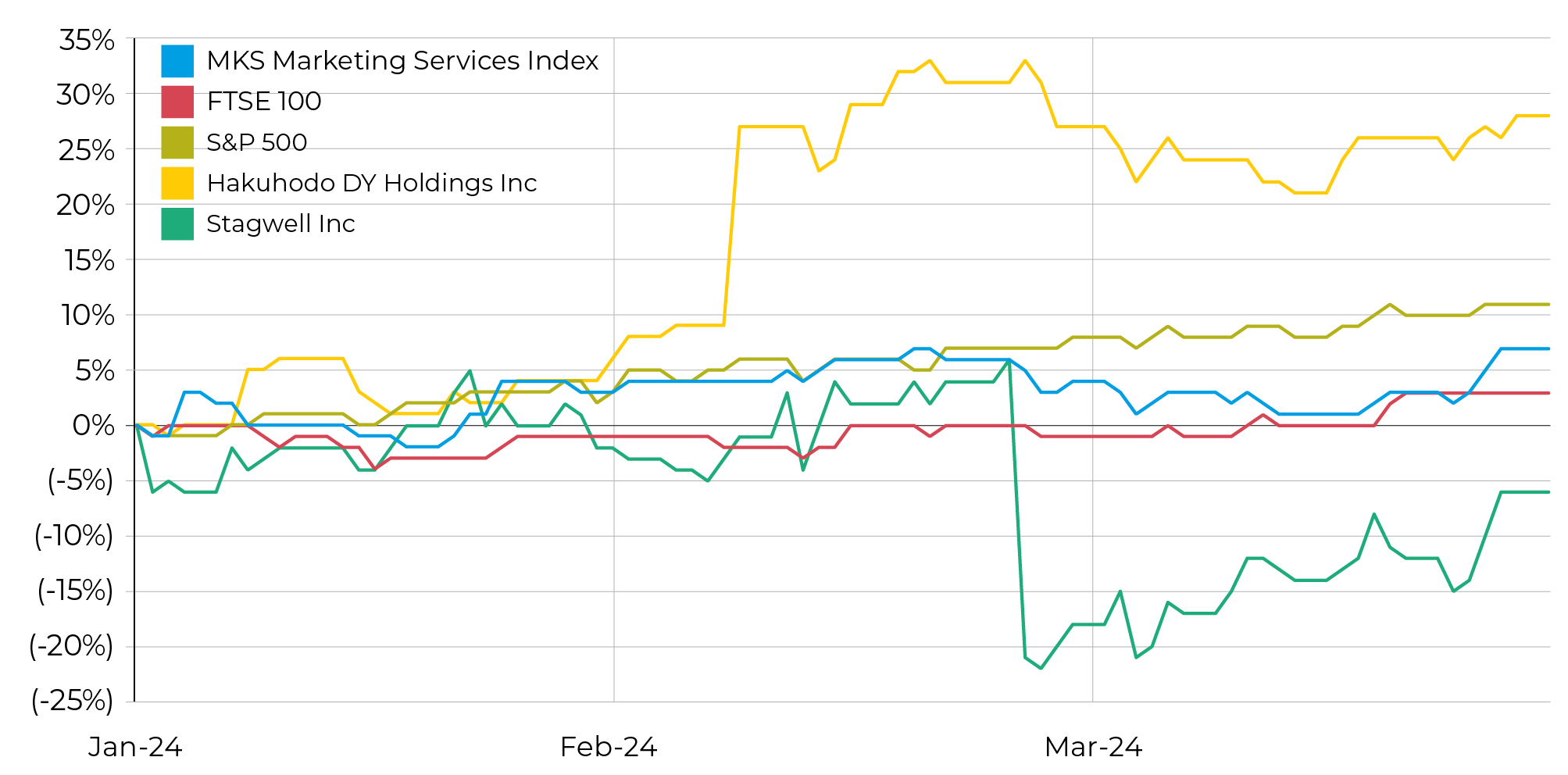

Marketing services industry stock performance

In Q1 2024, global stock markets continued the bull run that began in the final quarter of 2023. The S&P 500 was up by 11% in Q1. The FTSE 100 was also up, albeit only by 3%. The Moore Kingston Smith Marketing Services Index came in between the two indices, up 7% across the period. Of the 14 companies in the Moore Kingston Smith Marketing Services Index, nine saw their share prices rise in Q1; just five ended the quarter in negative territory.

Our best-performing share in Q3 and Q4 2023, Kin + Carta, features in our bottom three this time. This is because investors have concluded that there is no longer a chance of a higher offer emerging to compete with the 130p per share recommended offer from Valtech. Kin + Carta’s share price was trading at a small premium to that offer price but has now dipped to just below the offer level.

Q1’s star performer was Hakuhodo, which saw its share price increase by 28%, following a well-received trading update in February. This said that, while its billings and profitability had declined in the first half of its financial year, performance had turned around significantly in the third quarter.

Our worst performer in Q1 was Stagwell. It had been enjoying a good run, with its share price up by 6% from the start of the year. That was until it announced on 26 February that it had identified errors in its previously filed 2022 financial statements, which caused investors to take fright and the share price to drop by 25% in a single day. The share price recovered a bit throughout March, meaning Stagwell ended the quarter just 6% down overall.

Moore Kingston Smith Marketing Services Index Q1 2024

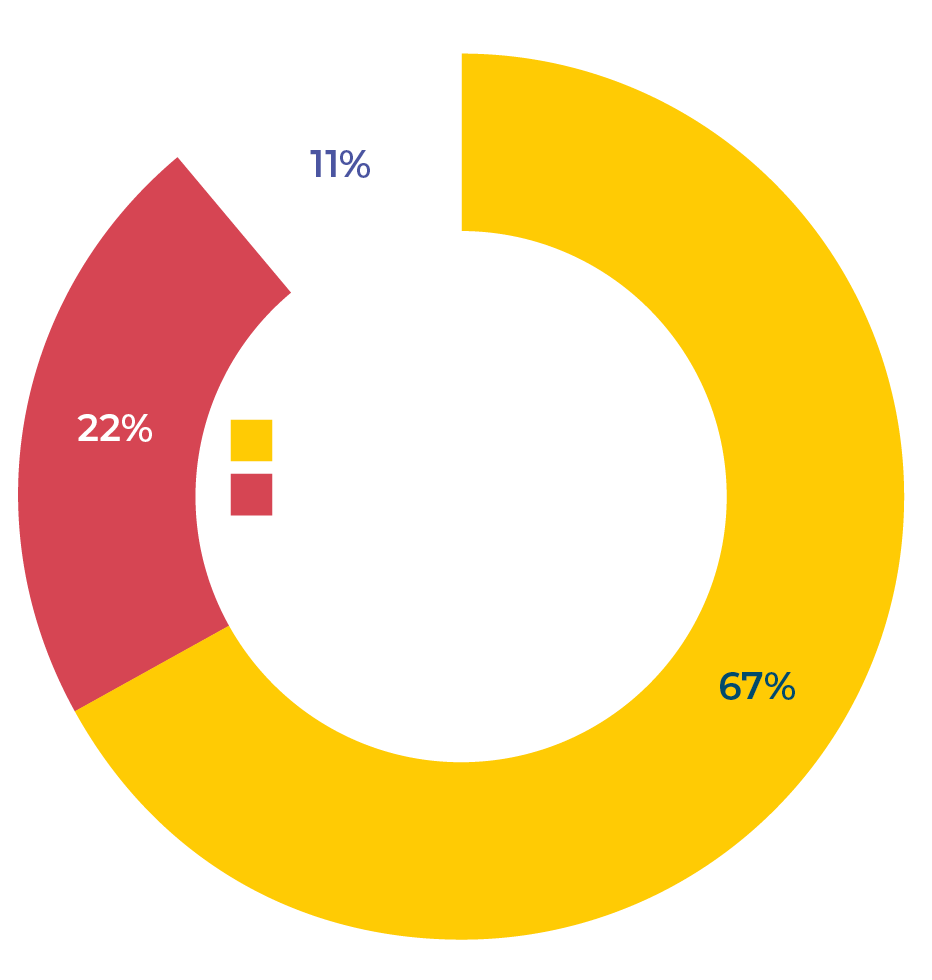

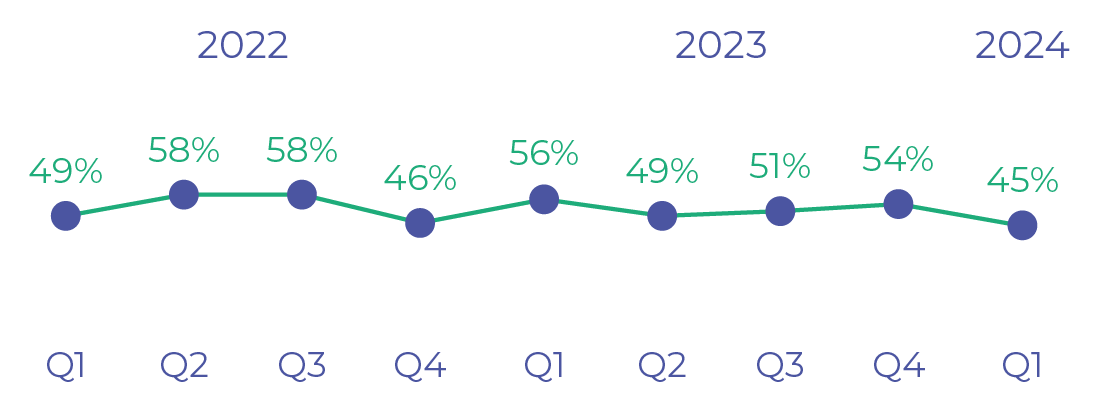

Private equity

PE-backed investments accounted for 45% of all deals completing in Q1 2024, which is 9% down on the previous quarter, and somewhat below the recent historical average. Interest rates have not yet come down, so leveraged deals remain challenging to put together in a high interest rate environment. However, the anticipation of lower rates in later 2024 should ease the situation, so we do expect to see a resurgence in leveraged PE-backed transactions as we move through the year.

Most of the challenger networks, which are particularly active in the M&A sphere, are themselves PE-backed. We’ve already commented on Brainlabs renewing its hunt for acquisitions, having secured a new funding partner in PE house Falfurrias Capital Partners, in late 2023.

Fashion PR group The Independents, which acquired London-based Kennedy and Paris-based Atelier Athem in Q1, did so on the back of having raised c. $580 million of new equity finance in 2023, in a round led by TowerBrook Capital. The Independents has its sights set on doubling in size by 2025, through both international expansion and “an ambitious acquisition strategy”, according to a statement by the company.

PE remains an enduring and significant driver of M&A activity in the UK’s media and marketing services sectors. We expect to see further secondary PE transactions following Brainlabs and MSQ in 2023.

Notable UK mid-market deals

![]()

![]()

![]()

Tryzens, a digital commerce agency, acquired Nottingham-based Juno, a Shopify Plus agency. Tryzens is backed by PE house WestBridge, following its purchase in a secondary buy-out from Scottish Equity Partners in August 2023.

![]()

![]()

![]()

HH Global, which is backed by PE house Blackstone, acquired UK-based provider of retail marketing services Displayplan, which was previously backed by YFM.

![]()

![]()

Swedish video solutions provider Accedo, which is backed by Scandinavian PE house SEB, acquired UK-based Easel TV, a provider of advanced streaming technology and digital media solutions.

Percentage of PE-backed deals

“The advertising and media world that haven’t got themselves into too much debt, are highly cash-generative and quite low capital users are quite interesting businesses for private equity people to come into. We might see some interesting shifts in investors into our sector because we’re low capital users and high cash generators.”

Richard Pinder, CEO, Rankin Creative

TV, film and entertainment

Within the TV, film and entertainment sector, TV and film transactions proved to be the most popular with acquirers in Q1. This accounts for 40% of the deals we recorded, a sizeable increase on the 25% that we recorded in Q4 2023.

Production services deals were the most prominent in Q1, accounting for 43% of the transactions we recorded in this space. Technology-led transactions accounted for a further 26%, while pure content plays accounted for 13% of the deals recorded in Q1.

The most significant TV and film transaction in Q1 was RedBird IMI’s £1.15 billion purchase of London-headquartered All3Media from its joint owners Warner Bros., Discovery and Liberty Global. RedBird IMI is a joint venture between US-based RedBird Capital Partners and International Media Investments, the investment vehicle for UAE vice president Sheikh Mansour bin Zayed al-Nahyan, focused on building high-growth companies in media, entertainment and sports. All3Media has produced top global shows, such as The Traitors, Squid Game: The Challenge, Gold Rush, Midsomer Murders, American Nightmare, The Circle, Call the Midwife, The Tourist, Life On Our Planet, The Long Shadow and Gogglebox.

Notable UK mid-market deals

![]()

![]()

BBC Studios, the BBC’s commercial content studio and media streaming business, took full ownership of specialist streaming service BritBox International, acquiring ITV’s 50% shareholding for £255 million.

![]()

![]()

In March, London-headquartered Fremantle completed the purchase of global production house Asacha Media. We previously reported on Q3 2023’s acquisition by Asacha of UK factual TV production company Arrow International. In Q1 2024, we saw the acquirer become the target.

In January, Universal Music Group announced the acquisition of UK-based South Asian record label Oriental Star Agencies, whose catalogue comprises approximately 18,000 songs, and concert and video recordings by Pakistani and Indian artists.

Q3 2023 deal activity in the TV, film and entertainment sector

Publishing

Consumer publishing was in the top spot in Q1 2024, representing 58% of all the publishing deals we recorded. B2B publishing came second, accounting for a third of publishing transactions.

In January, Thomson Reuters announced the acquisition of London-headquartered World Business Media, a subscription-based provider of news and analysis on the insurance and reinsurance market. World Business Media is one of a series of recent acquisitions undertaken by Thomson Reuters as part of its plan to expand its offerings for its professional clients. In August 2023, the company closed its $650 million cash acquisition of Casetext, a California-based AI company that helps legal professionals conduct research and analysis, and prepare documents. In February 2024, it acquired Sweden’s Pagero Group, an e-invoicing and tax solutions firm, for $800 million. Thomson Reuters said last year it earmarked $10 billion for acquisitions and about $100 million per year for investments in AI capabilities.

Notable UK mid-market deals

![]()

![]()

![]()

Carwow, the online car-changing marketplace, announced it had acquired Autovia (formerly Dennis Publishing), the automotive content and commerce media company, which publishes automotive the titles Auto Express, Carbuyer, evo and DrivingElectric.

Paris-headquartered North Star Network acquired UK sports news site SportsMole for an unspecified seven-figure sum.

Q1 2024 deal activity in the publishing sector

Outlook

After the slow-down we witnessed in the latter part of 2023, it is heartening to see M&A in the UK media and marketing services sectors rebound in 2024. The year is off to a good start, bolstered by an improving economic environment, and a more positive outlook for many agencies’ underlying businesses. If we add interest rate cuts later in the year to the mix, the stage is set for PE to return to the sector with a vengeance, and for highly-rated publicly quoted companies to compete with PE, fuelling an appetite for deals.

“In 2024, the UK will hold a general election, the Olympics will take place in Paris, and the US will have a presidential election—all events likely to stimulate growth in the marketing and advertising sectors. We expect the coming months to offer an increasingly favourable landscape for companies and investors seeking to engage in deals.”

Paul Winterflood, Corporate Finance Partner