M&A in the UK media and marketing services sectors: Q4 2023

Another good year for transactions despite market turbulence

![]()

83

deals completed

![]()

+7%

Moore Kingston Smith

Marketing Services Index

![]()

54%

deals backed by PE

Our view of the market

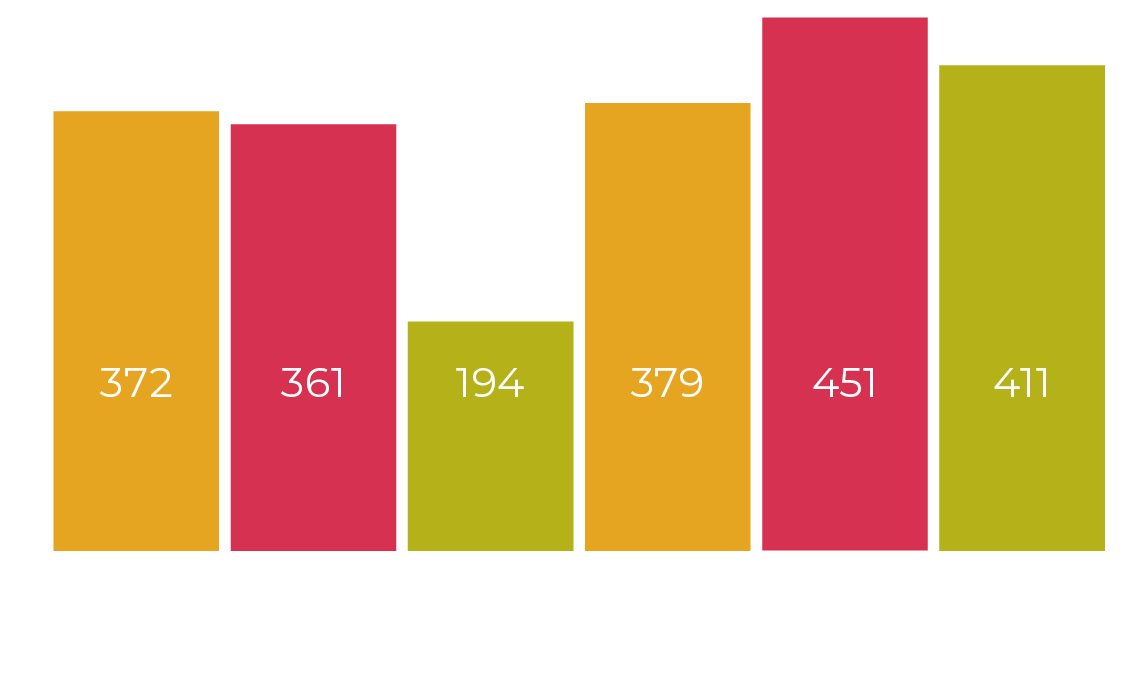

2023 could not quite match up to the dizzy heights of 2022 but it remained a good year for M&A within the UK media and marketing services sectors. We recorded a total of 411 UK deals in 2023, which is c. 9% down on the previous year but remains comfortably ahead of pre- pandemic levels of activity.

The picture is more nuanced when we examine the quarterly data. 2023 got off to a flying start, with Q1 outstripping any quarter in 2022. However, from Q2 onwards, we saw a steady decline in activity, due, we think, to deals being harder to complete because of tougher trading conditions in the sector, and vendors choosing not to sell in a more difficult environment. Q4 continued that trend: we recorded a total of 83 transactions, which is a 15% decrease on the prior quarter.

Annual deal volume

Quarterly deal volume

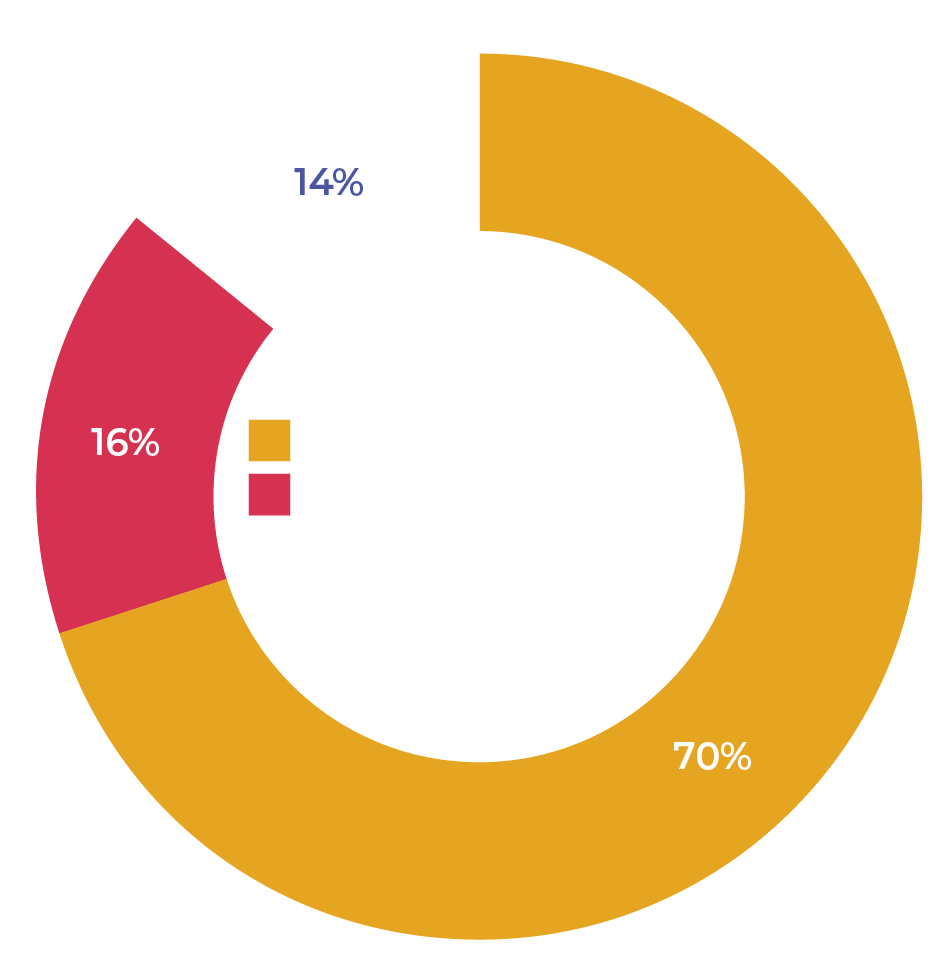

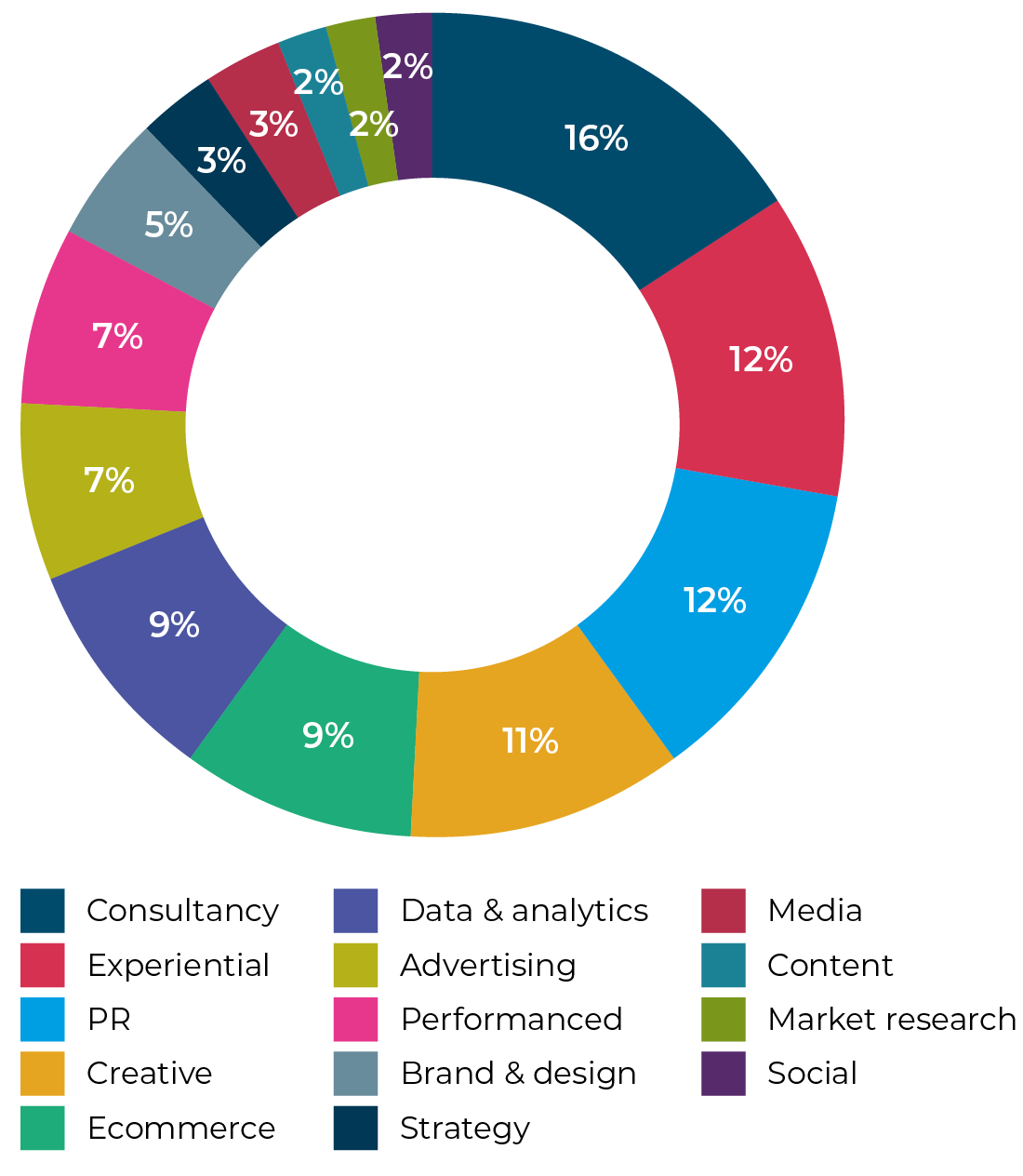

Trending: consultancy

In Q4 2023, consultancy was the favourite marketing services category with acquirers. It made up 16% of all the marketing services deals we recorded, with experiential and PR tied in second place on 12%.

Within the consultancy space, Moore Kingston Smith advised CACI Limited on its acquisition of digital transformation agency Cyber-Duck Limited in November. This marks the fifth acquisition by CACI in recent years, with Moore Kingston Smith also advising on its acquisition of Bitweave in May 2023.

We also saw Accenture on the acquisition trail in Q4, with its purchase of management consultancy Vocatus. Vocatus uses behavioural economics modelling to develop pricing strategies and sales concepts for B2B and B2C consumer models.

Spotlight on: martech

In the marketing services sector, while most deals involved the acquisition of service-led agencies, 19% of the deals we recorded in Q4 were technology-led. This is lower than the 22% we recorded in Q3 and remains considerably below the level we saw throughout 2022, where technology-led transactions tended to represent around a third of all deals. 55% of the technology-led transactions in Q4 related to martech companies – companies developing and using technology to assist with a digital marketing strategy while 27% to mediatech and 18% adtech.

“The level of investment in martech in 2023 was less than anticipated but we see great potential for a resurgence of interest in this space through 2024, as technology continues to drive innovation in the marketing services industry.”

George Hatswell, Associate Director at Moore Kingston Smith

Q4 2023 deal activity in the marketing services sector

Notable UK martech deals

![]()

Global content operations strategy and services business ICP acquired Team 6ix, a UK-based martech and content operations consulting firm. This was ICP’s first strategic acquisition since taking on PE investment from NorthEdge in 2021.

Online retail software provider CommerceHub acquired UK-based start-up Cadeera to expand its artificial intelligence capabilities. The acquisition coincided with CommerceHub rebranding as Rithum.

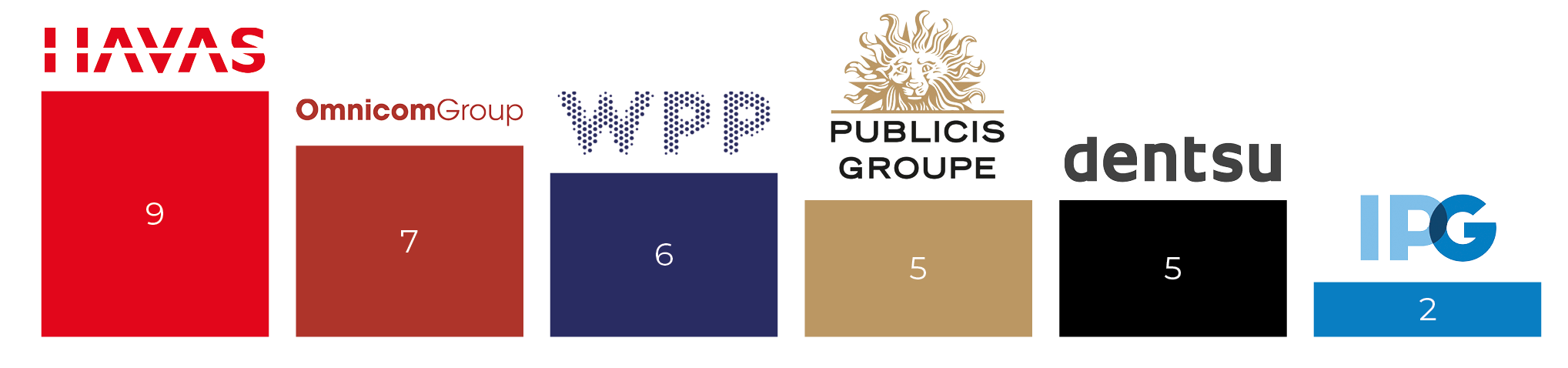

Major holding companies

Notable transactions

After a busy Q3, four of the major marketing services networks – Omnicom, Dentsu, Publicis and Interpublic – made no new acquisitions in Q4. WPP made one, while Havas completed four transactions in the quarter.

Havas started Q4 with the acquisition of Portugal-based PR and communications consultancy Cunha Vaz. It followed that with the announcement in November of two further acquisitions – Indian PR consultancy PR Pundit and Singaporean communications consultancy Klareco Communications. Finally, in December, it announced it had bought Hamburg-based performance marketing agency EPROFESSIONAL.

Havas was the most prolific network acquirer in 2023, just as it was in 2022, completing a total of nine acquisitions in each year. All the networks increased their M&A activity last year, completing a total of 34 transactions between them, compared with 23 in 2022.

Major holding companies acquisitions completed in 2023:

The challengers

Most of the challenger networks announced no new deals in Q4 2023. The only activity we saw came from Stagwell and Next 15.

In October, Stagwell announced the acquisition of US-based Left Field Labs, a digital transformation and immersive experiences agency. In November, it confirmed it had acquired Californian creative agency Movers+Shakers. On the divestment side, it announced that it had completed the sale of healthcare and wellness marketing agency ConcentricLife to Accenture for $245 million.

In December, Moore Kingston Smith advised AI consultancy Vixen Labs on its sale to creative collective House 337, part of Next 15. The acquisition is House 337’s first strategic acquisition, following its formation in 2022 through a merger of creative agency Engine Creative with fashion and lifestyle specialist creative agency ODD Group.

Next 15 also announced the acquisition of shopper insights agency Explorer Research by its Savanta division; and two acquisitions by its Brandwidth agency – ecommerce specialist Williams Commerce along with its B2B ecommerce platform Cloudfy, and performance agency Rush Ventures.

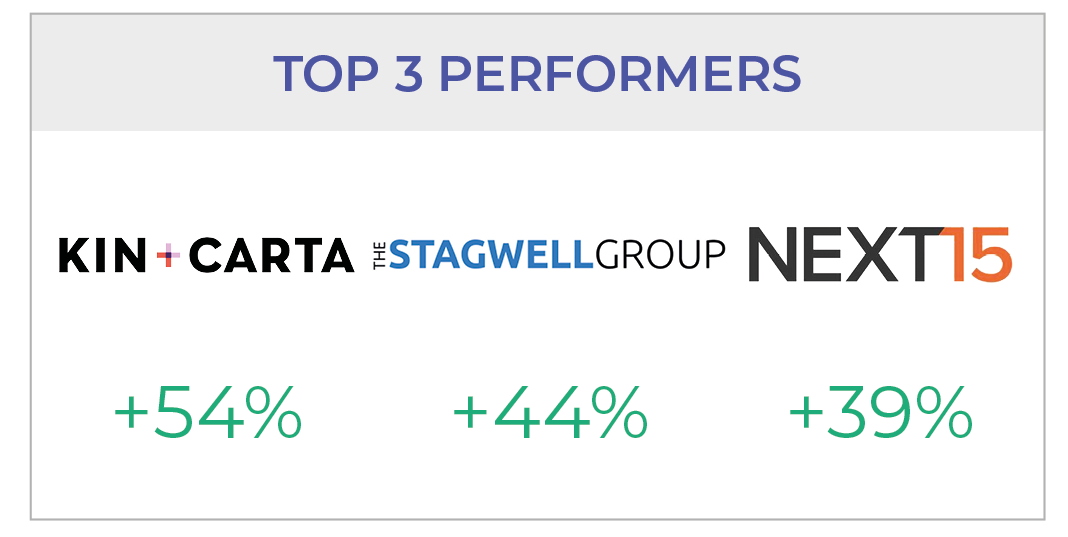

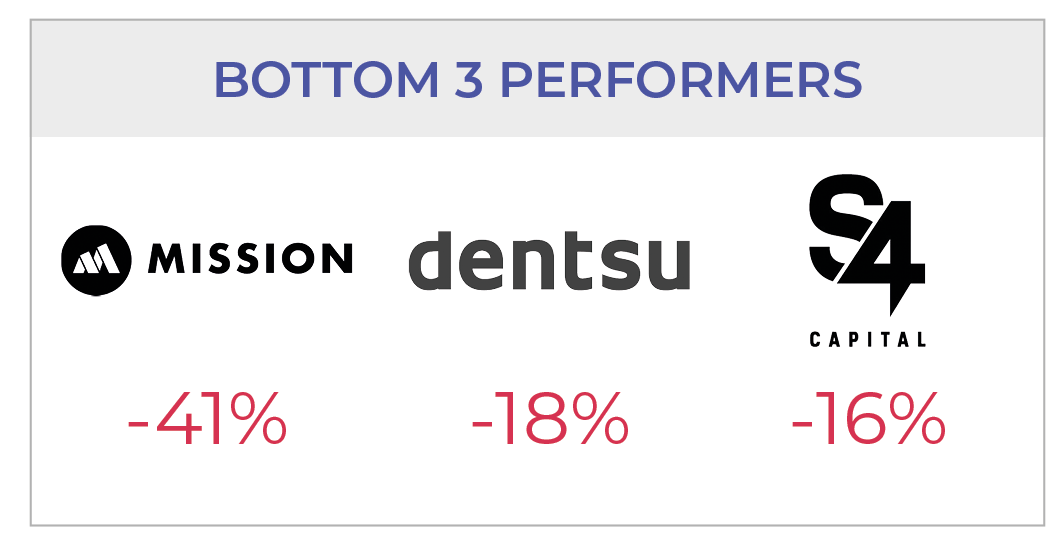

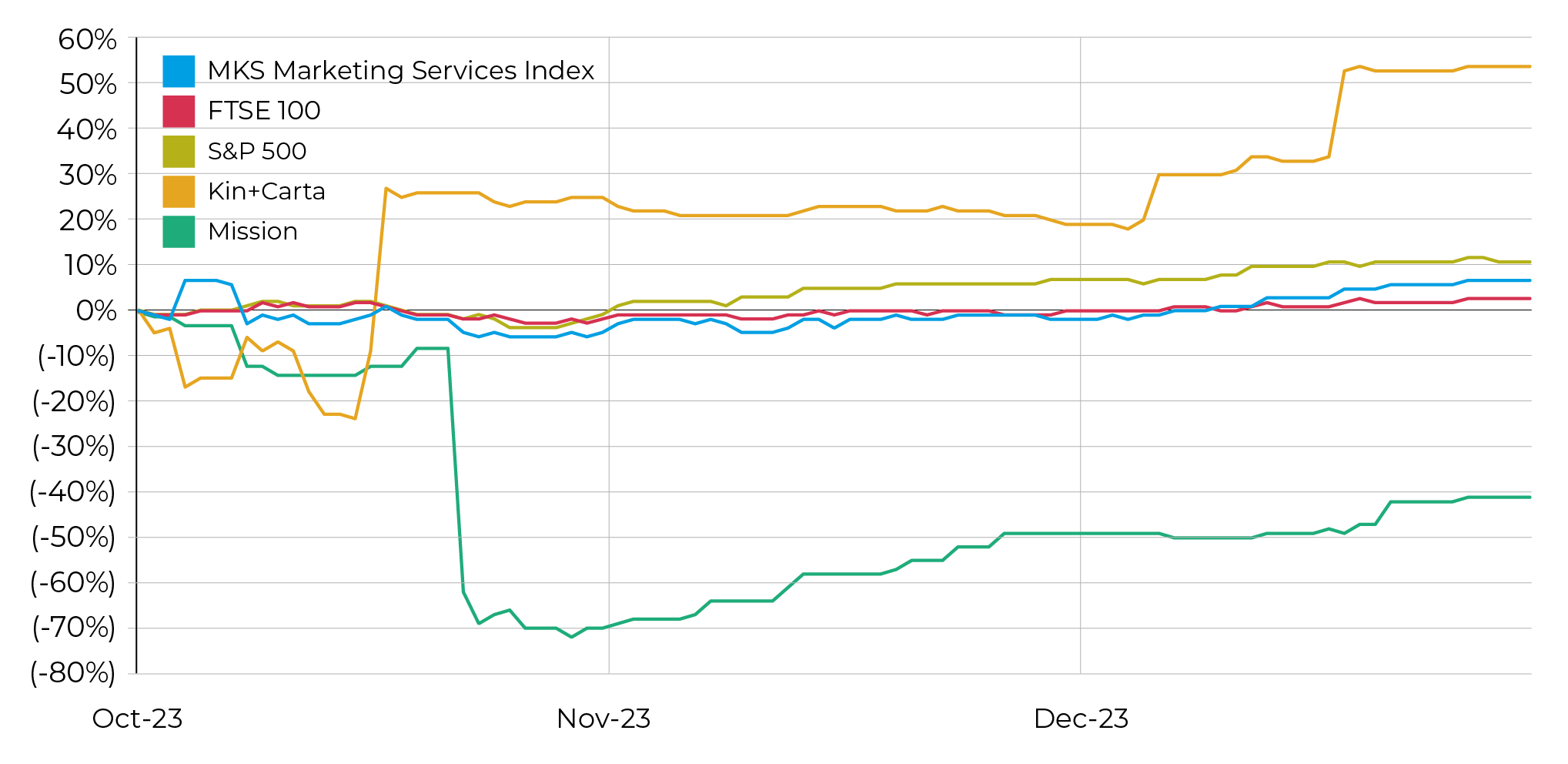

Marketing services industry stock performance

Global stock markets rallied in the final quarter. The S&P 500 was up by 11% in Q4. The FTSE 100 was also up, albeit only by 3%. The Moore Kingston Smith Marketing Services Index came in between the two indices, up 7% across the period. Of the 14 companies in the Moore Kingston Smith Marketing Services Index, half saw their share prices rise in Q4,

while half ended the quarter in flat or negative territory.

Our star performer from Q3, digital transformation consultancy Kin + Carta, topped our charts again in Q4, during which period it saw its share price increase by 54%, on top of the 32% it had already risen in Q3. Its share price surged in October, following a takeover bid launched by PE house Apax,

valuing the company at £203 million. That offer was then trumped by a December counter- bid worth £239 million from digital services firm Valtech, which is backed by PE house BC Partners, sending the share price still higher. It remains to be seen whether this bidding war

is over or whether new entrants may enter the contest for control of Kin + Carta.

Our worst performer in Q4 was Mission Group, which saw a 41% decline in its share price.

Its shares slumped in October, following the company issuing a profits warning, cancelling its dividend and advising it was in talks with its bankers about a possible covenant waiver.

Moore Kingston Smith Marketing Services Index Q4 2023

Private equity

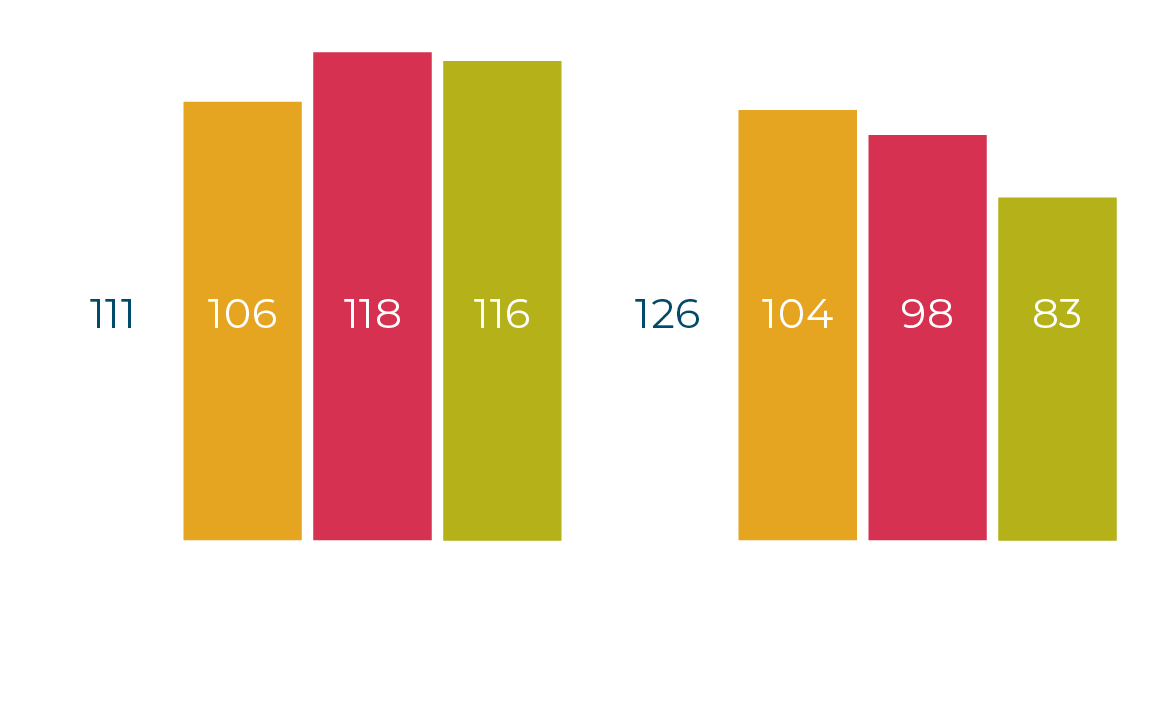

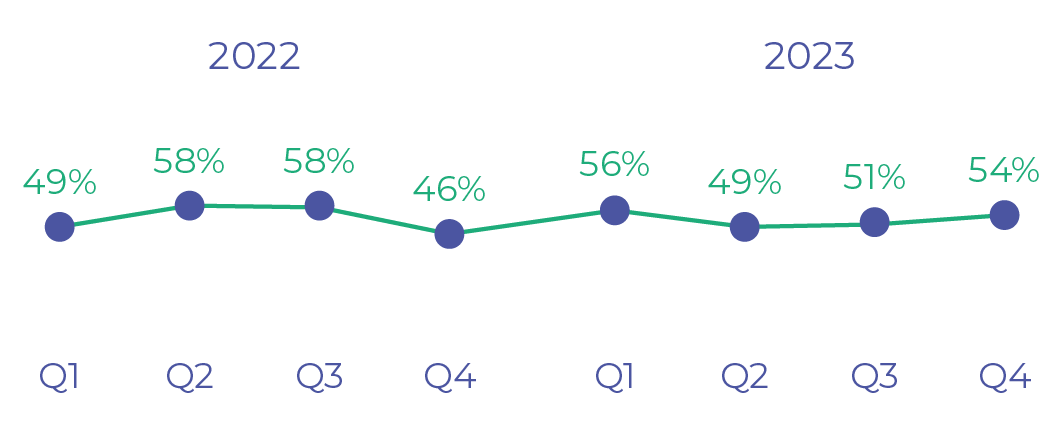

Of the 83 transactions we recorded in Q4, 54% involved private equity investment, either directly or via an existing portfolio company. This is an improvement on the levels we saw in the previous two quarters, albeit not quite up to the level we saw in Q1.

Looking at the year as a whole, we find that private-equity backed investments accounted for 53% of the 411 deals we recorded. This is exactly the same percentage as we reported in 2022 and is only marginally down on the 54% we noted in 2021. While overall M&A activity may be down from the heady heights of 2022, this data does suggest that private equity’s enthusiasm for the media and marketing services sectors remains undiminished.

We reflected last quarter on the resurgence of secondary transactions – where one PE house exits its investment by selling to another PE investor. A significant example of this in Q4 was UK PE house Inflexion’s sale of legal ranking and insights business Chambers and Partners to US investment house Abry Partners. Inflexion backed the MBO of Chambers in 2018, in a deal estimated to be worth between £35 and £50 million. Abry is reported to be paying more than £400 million for Chambers, representing an extremely handsome return on investment for Inflexion.

Notable UK mid-market deals

![]()

![]()

Morrow Sodali, a global shareholder engagement and governance advisory company, backed by US PE house TPG, acquired strategic communications consultancy Powerscourt. This continues the trend we have seen recently of US PE houses entering the UK market, particularly in secondary buy-outs.

![]()

Global insights business Delinian (formerly known as Euromoney) was acquired by private equity firm Epiris in November 2022. In November 2023, Delinian announced it had acquired Ascend Global Media, which runs the Women in Tech World Series of events.

Phoenix Equity Partners investee company Nineteen Group acquired global events and conferences business Oliver Kinross.

Percentage of PE-backed deals

“There is strong interest in the sector from private equity. With the expectation that interest rates have now peaked and may start to fall in 2024, I think we can expect to see leveraged PE-backed transactions return to the market, fuelling more M&A activity in the media and marketing services arenas.”

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith

TV, film and entertainment

Within the TV, film and entertainment sector, gaming transactions proved to be the most popular with acquirers in Q4, accounting for 41% of the deals we recorded ‒ a sizeable increase on the 33% we recorded in Q3.

Technology-led transactions and pure content plays were the most prominent in Q4, each accounting for 31% of the transactions we recorded in this space. We saw a decline in the number of production services deals, which had been to the fore in Q3.

The most significant gaming transaction in Q4 was the completion of Microsoft’s $68.7 billion deal to acquire Activision Blizzard, the publisher of Call of Duty and World of Warcraft. The acquisition required 20 months of battling with regulators in the UK and the US, but the deal closed in October following Microsoft winning its court battle with the UK’s Federal Trade Commission and restructuring the deal to appease the Competition and Markets Authority in the UK. The deal is Microsoft’s largest acquisition ever, far more than the $26 billion it paid to acquire LinkedIn in 2016. Microsoft now claims to be the world’s third-largest gaming company by revenue, behind Tencent and Sony.

Notable UK mid-market deals

![]()

Swedish gaming group Aonic acquired UK-based VR gaming studio nDreams for approximately $110 million. nDreams had been backed by PE house Mercia Asset Management which exited the company as part of the transaction.

![]()

Banijay UK acquired TV drama producer The Forge. The deal brings the number of scripted labels under the Banijay UK umbrella to nine, including Kudos and Tiger Aspect.

Sony Interactive Entertainment acquired iSIZE, a UK-based company which builds AI-powered solutions to deliver quality improvements for the media and entertainment industry

Q3 2023 deal activity in the TV, film and entertainment sector

Publishing

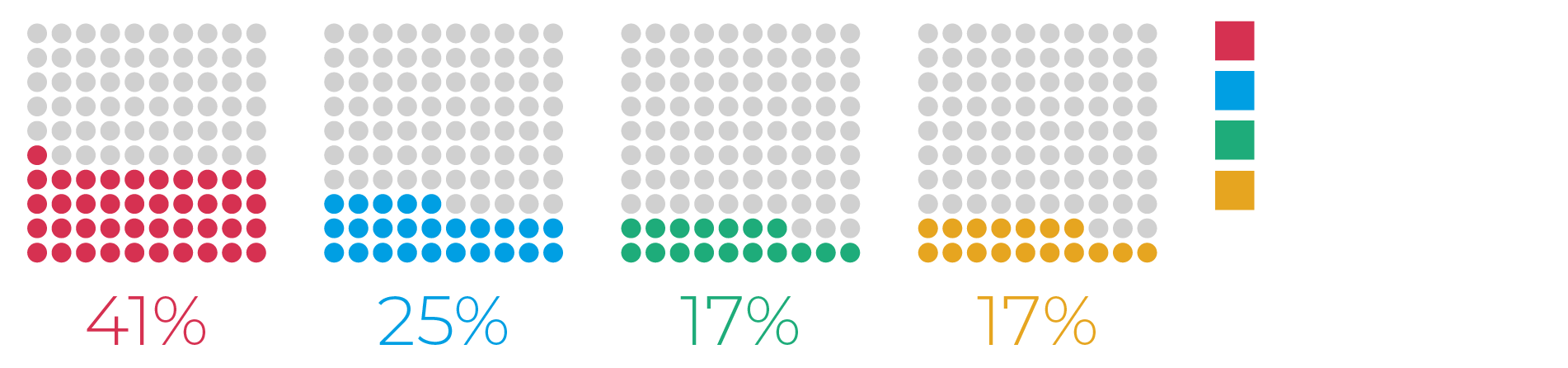

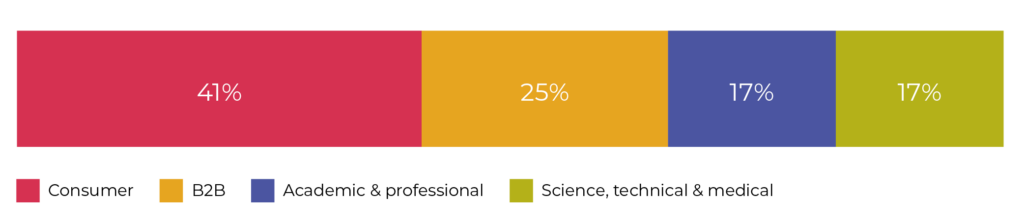

Consumer publishing was in the top spot in Q4, just as it was in every quarter last year. However, it dipped below 50% for the first time, representing 41% of the deals we recorded in Q4.

Within the B2B space, UK group Datateam Business Media was busy, snapping up two companies in Q4, Sign Update and Image Reports – two brands operating in the visual communications sector. These deals follow the Q3 acquisition by Datateam of Sign & Digital UK, a specialist signage and wide format trade show.

Notable UK mid-market deals

![]()

As mentioned earlier in this report, legal rankings business Chambers was acquired by US PE house Abry, in a deal reported to be worth more than £400 million.

Penguin Random House UK acquired Australia-based publisher Hardie Grant Publishing’s UK business, which comprises the imprints Hardie Grant UK and Quadrille.

Q4 2023 deal activity in the publishing sector

Outlook

Inflation rates in the UK have come down significantly from their 2023 highs, and there is an expectation that interest rates have now peaked and could start to reduce. 2024 will see a general election in the UK, the Olympics in Paris and a presidential election in the US – all of which should boost the marketing and advertising sectors. We therefore expect the coming months to be a positive environment for those companies and investors looking to do deals.

“We are still seeing strong appetite from well-funded acquirers in the market for cutting-edge capabilities and well-performing businesses, as the PE- backed groups continue to look to fuel their growth. The Media Outlook Survey predicts an increase in client spend in the second half of 2024, which should strengthen the M&A market.”

Paul Winterflood, Corporate Finance Partner