Growth Capital Update: Q4 – 2023

Reduced activity in 2023 but reasons for optimism in 2024

![]()

240

deals completed

![]()

+1%

number of deals

![]()

£1.104 billion

growth capital raised

Our view of the market

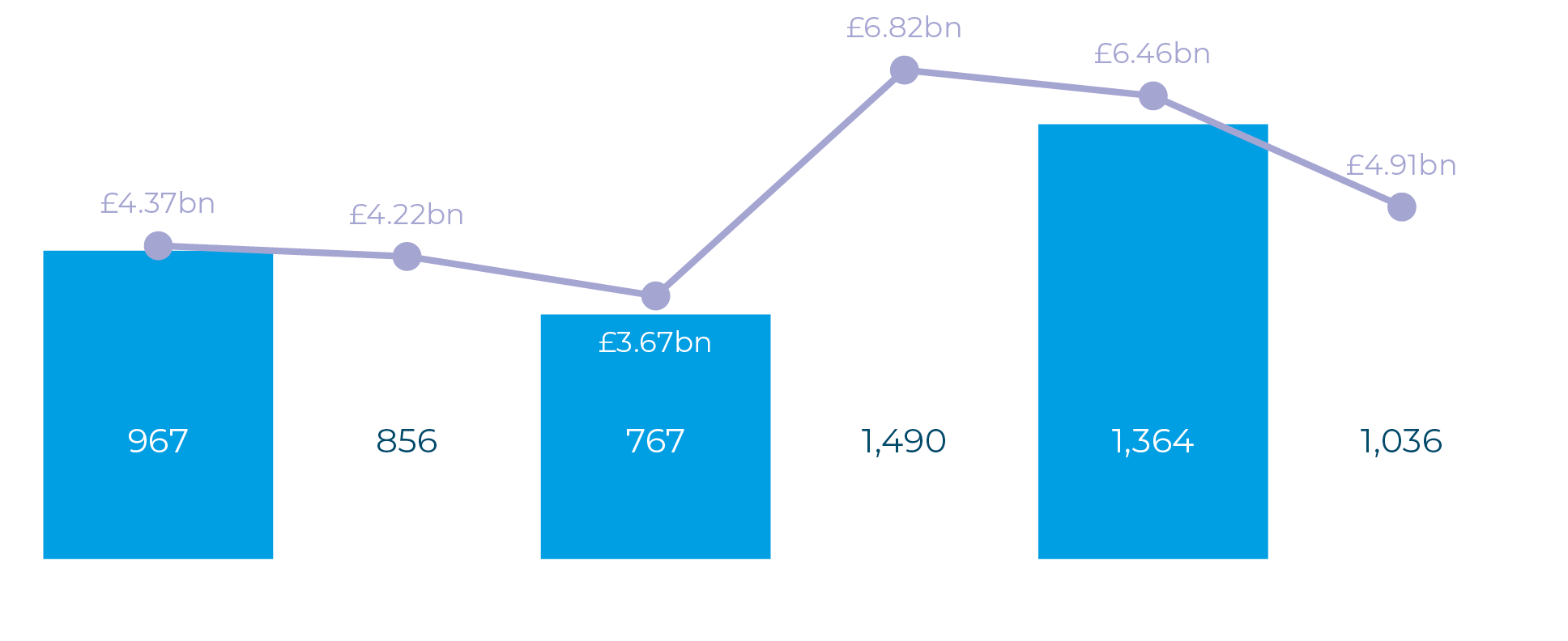

2023 was much quieter for the UK’s growth capital market than either of the two preceding years. Our research into UK private companies raising between £1 million and £20 million of growth equity capital each finds that, in 2023, 1,036 UK businesses raised a total of £4.91 billion. This is 24% down on 2022, both in terms of numbers of deals completed and amount of funds raised. However, 2023 compares favourably with previous years, with activity still above pre-pandemic levels.

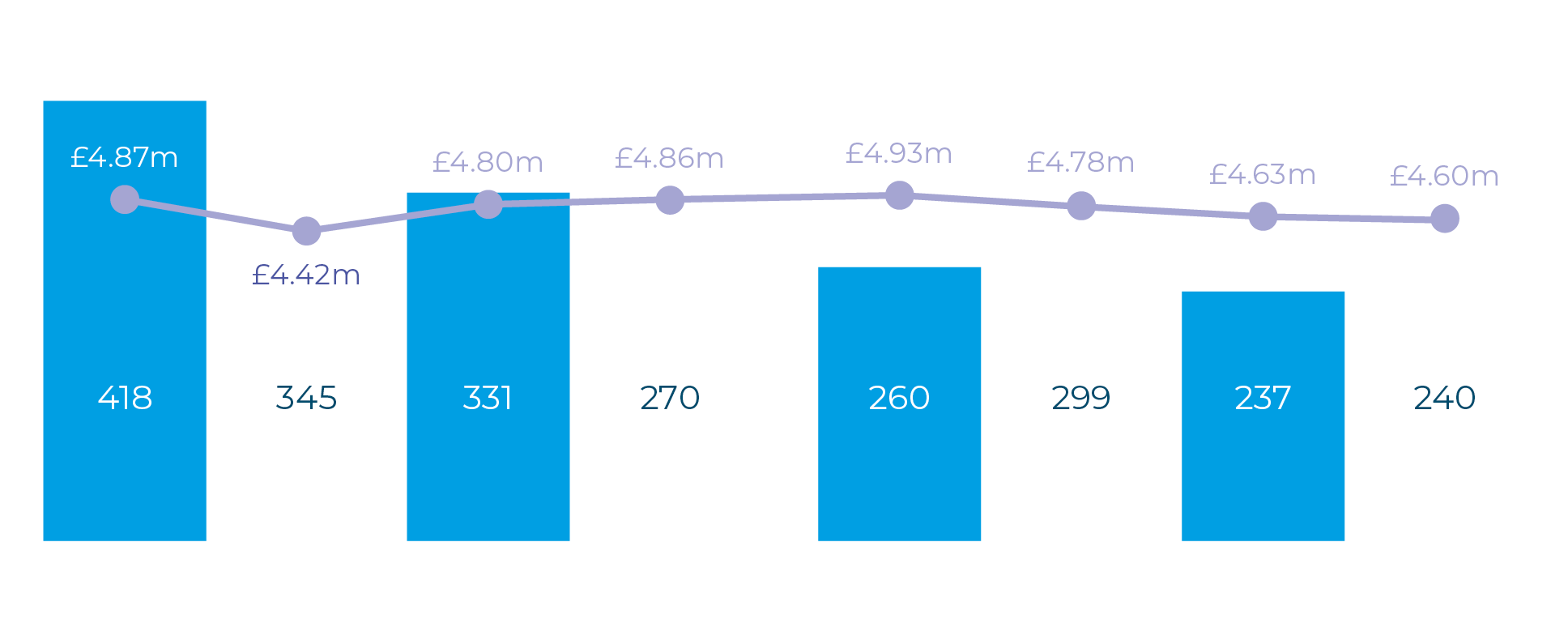

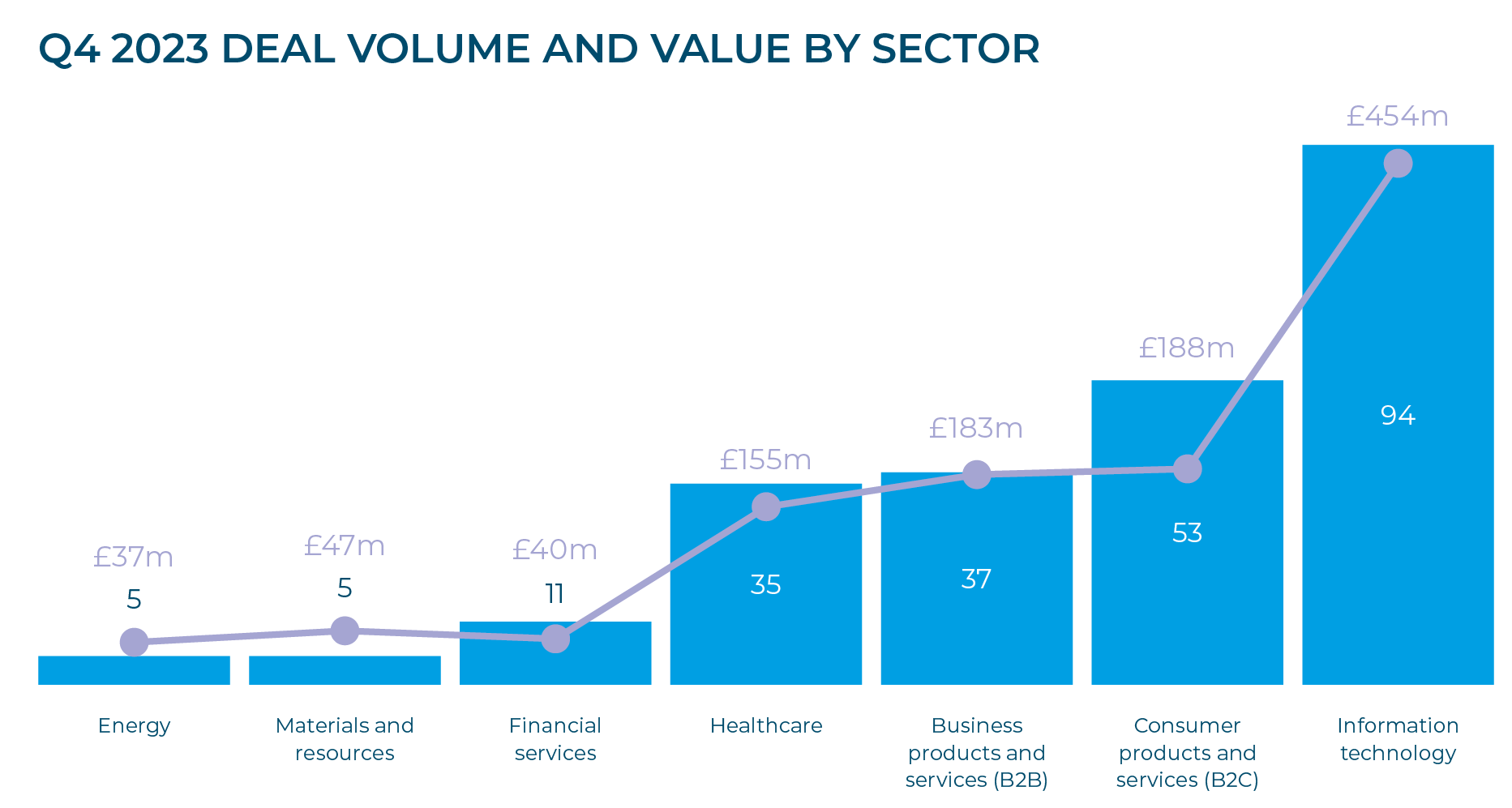

As far as Q4 2023 is concerned, activity was marginally up on Q3, with 240 UK businesses raising a total of £1.104 billion. The average deal size was £4.6 million.

2023 was a quieter year, largely because of high interest rates making transactions relatively less affordable. However, with markets now predicting interest rate cuts in 2024, we expect investment levels to increase throughout the coming months. The UK’s growth capital market is resilient, and there is no shortage of investors for exciting growth opportunities.

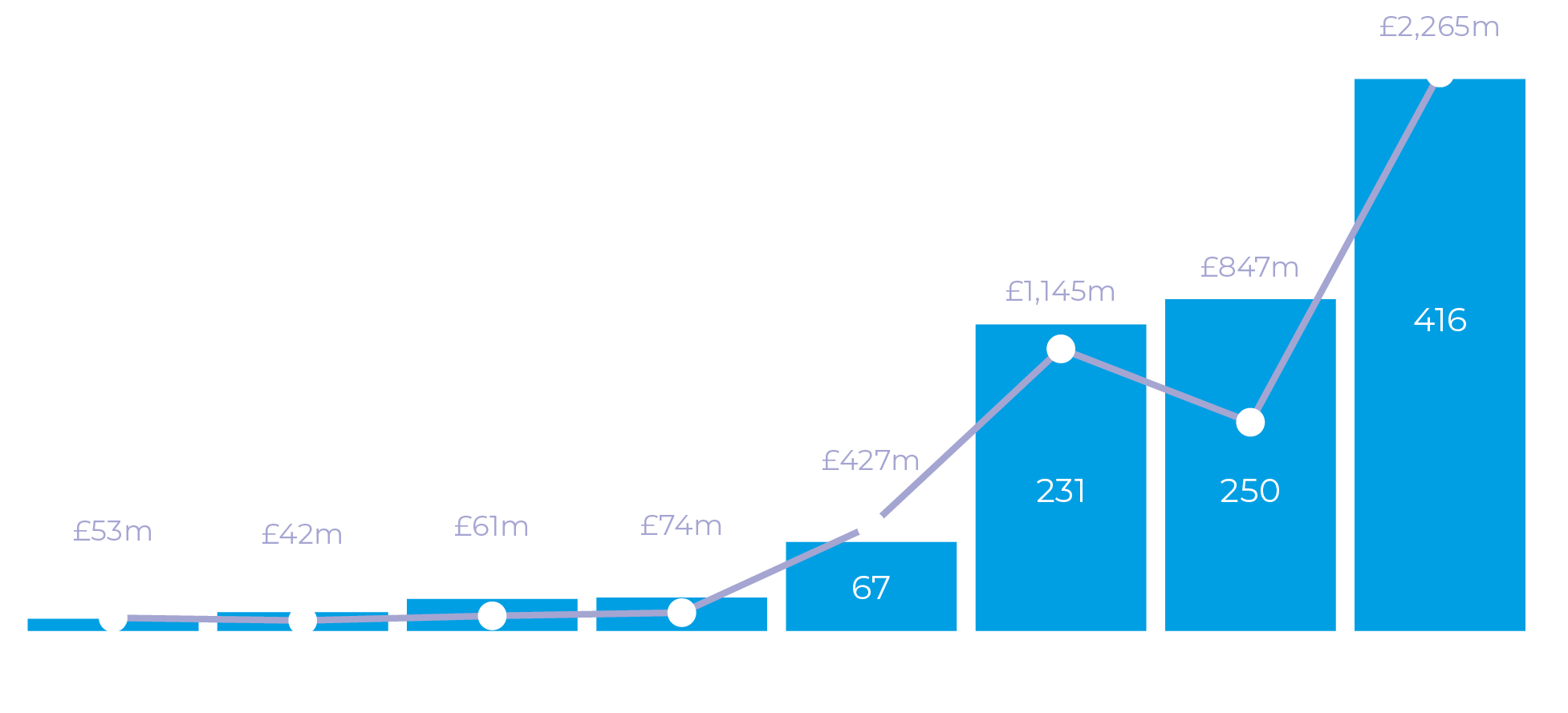

Regarding the types of deals that were most common in 2023, later-stage VC retained the top spot it had achieved in both 2022 and 2021. It increased its share of the market, accounting for 40% of all deals completed, and 46% of total funds invested last year. In 2022, it accounted for 34% of deals completed and 40% of funds invested. This demonstrates that companies with a proven track record were increasingly more attractive to investors in 2023 than early-stage businesses.

The UK’s growth capital market is resilient, and there is no shortage of investors for exciting growth opportunities.

Quarterly number of deals and average deal size

2023 deal volume and value by deal type

Technology sector

“Activity in 2023 may have been down on the two prior years but there were still plenty of deals being done, particularly in the technology space, where the UK is an international success story. More positive news about interest rates should provide a fillip to the rest of the UK growth capital market in 2024.”

John Cowie, Head of Growth Capital

Notable UK tech sector deals

Fintech business Embedded Finance (trading as Railsr) secured funding of £20 million from existing investors including D Squared Capital and Moneta Venture Capital.

Belfast-headquartered software supply chain management firm Cloudsmith raised £8.8 million in a Series A funding round led by MMC Ventures.

“This fresh infusion of capital comes as industry demand for secure and reliable software supply chain solutions is surging. Cyber security attacks of increasing severity have become more frequent and threaten reputational damage, data exfiltration and IP theft.”

Glenn Weinstein, CEO, Cloudsmith

Trending: B2C products and services

The B2C sector was the second most popular with UK investors in Q4 2023, having been in fourth place in the previous quarter. B2C deals accounted for 22% of all transactions by volume and 17% by value in Q4. While often perceived as more risky investment propositions than B2B, owing to the challenges of predicting consumer demand and the potential for high marketing costs, successful B2C companies often have broad customer bases and scalable models, making them attractive to investors seeking significant growth and market impact.

Notable B2B deals

London-based Yoto, which serves the children’s education and entertainment sectors, raised $17 million in a Series A fundraising led by Acton Capital.

London coffee house group WatchHouse secured a £7.9 million investment to support its launch in New York, from a mix of family offices, high net worth individuals and follow-on funding from existing VC backer Edition Capital, a specialist leisure industry investor.

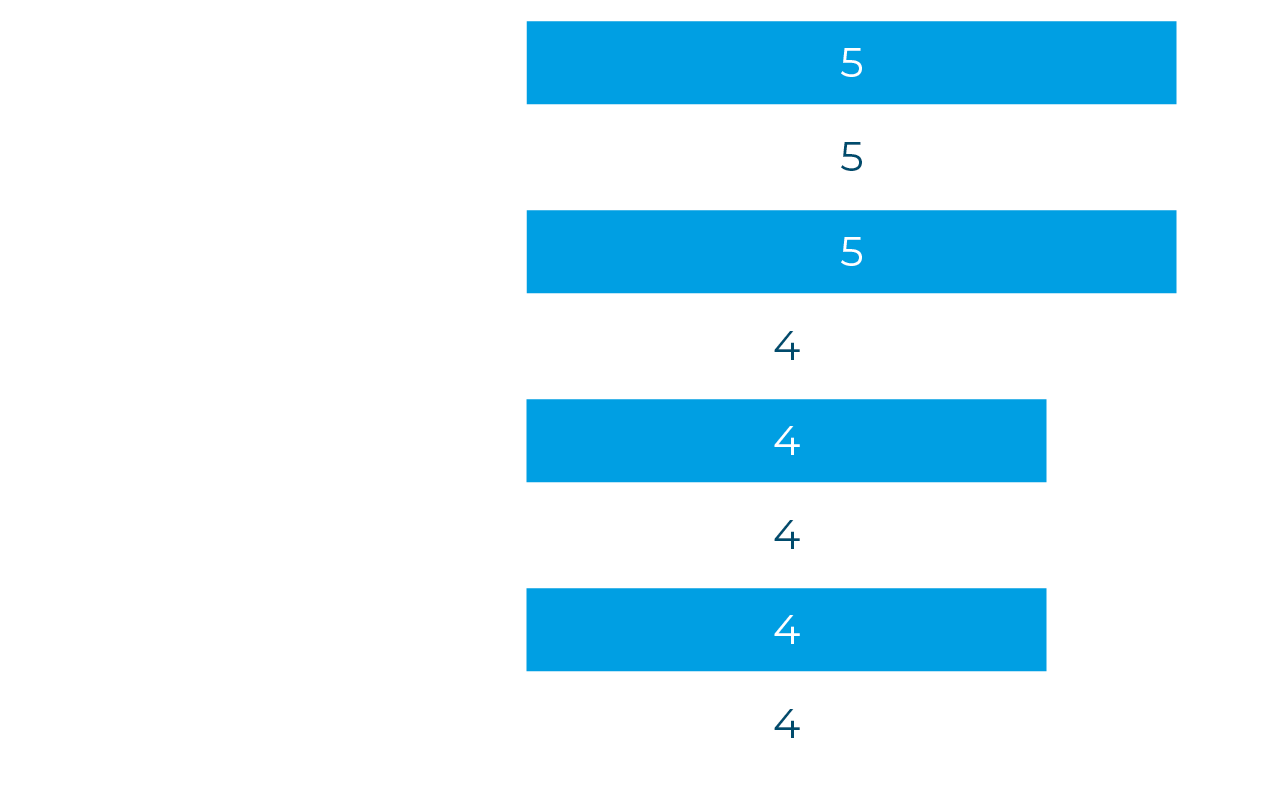

Active investors

We saw a tie for first place in our most active investor table in Q4 2023, with SyndicateRoom, Speedinvest and MMC Ventures all completing five transactions apiece.

MMC invested largely in technology businesses in Q4, including:

- leading the £8.8 million funding round for Cloudsmith.

- leading a $15 million Series A fundraising for Modo Energy, a London-based provider of an SaaS platform specialising in data analytics for renewable energy assets.

- co-leading, with fintech-focused 13books Capital, a $12 million Series A round for UK-based SME payments fintech Crezco.

- participating in a seed funding round, led by Sure Valley Ventures, which raised £2.2 million for London-based AI image recognition start-up Captur.

SyndicateRoom backed several B2C businesses, including women’s health and wellness solutions provider Unfabled, and moving and storage solutions start-up Stackt.

All of Speedinvest’s deals were in the technology space, and included a battery performance company, Breathe, and a provider of banking and payment services for cryptocurrency platforms, Fiat Republic.

Q4 2023 top investors

“Despite the slowdown last year, we saw several well-funded UK institutional investors active in the market. There is still plenty of growth capital funding available for well-positioned UK businesses, and we expect to see many more deals being done in 2024.”

Paul Winterflood, Corporate Finance Partner

Outlook

2023 represented something of a reset for the UK’s growth capital market, after the frenzied activity of 2021 and 2022. Global and local uncertainties over the economic outlook, inflation rates and the very real impact of high interest rates all weighed on the market, reigning in deal-doing. 2024 brings the prospect of lower inflation, a more stable economic environment and the expectation of reduced interest rates. All this implies that the market for growth capital transactions, in particular leveraged transactions, should start to ease. We expect to see an increase in growth capital deals completing in the coming months.

Contact us

If you’re an ambitious entrepreneurial business with revenues of at least £1 million and are looking to scale, get in touch for an initial discussion. We can work together to assess the best action and then assist with finding the right partner for you. Contact us to find out more about our raising finance and growth capital services. We also assist investors and are experts at providing advice throughout the acquisition or investment process. Our team can help identify and evaluate potential opportunities and run the financial and tax due diligence process, allowing you to make decisions quickly and confidently.