M&A activity in the UK media and marketing services sectors – Q1 2023

2023 is off to a flying start, defying predictions!

Our annual round-up of 2022 reflected on what turned out to be a record year for M&A in the UK media and marketing services sectors, as confident dealmakers sought long-term opportunities, undeterred by a backdrop of economic and political uncertainty.

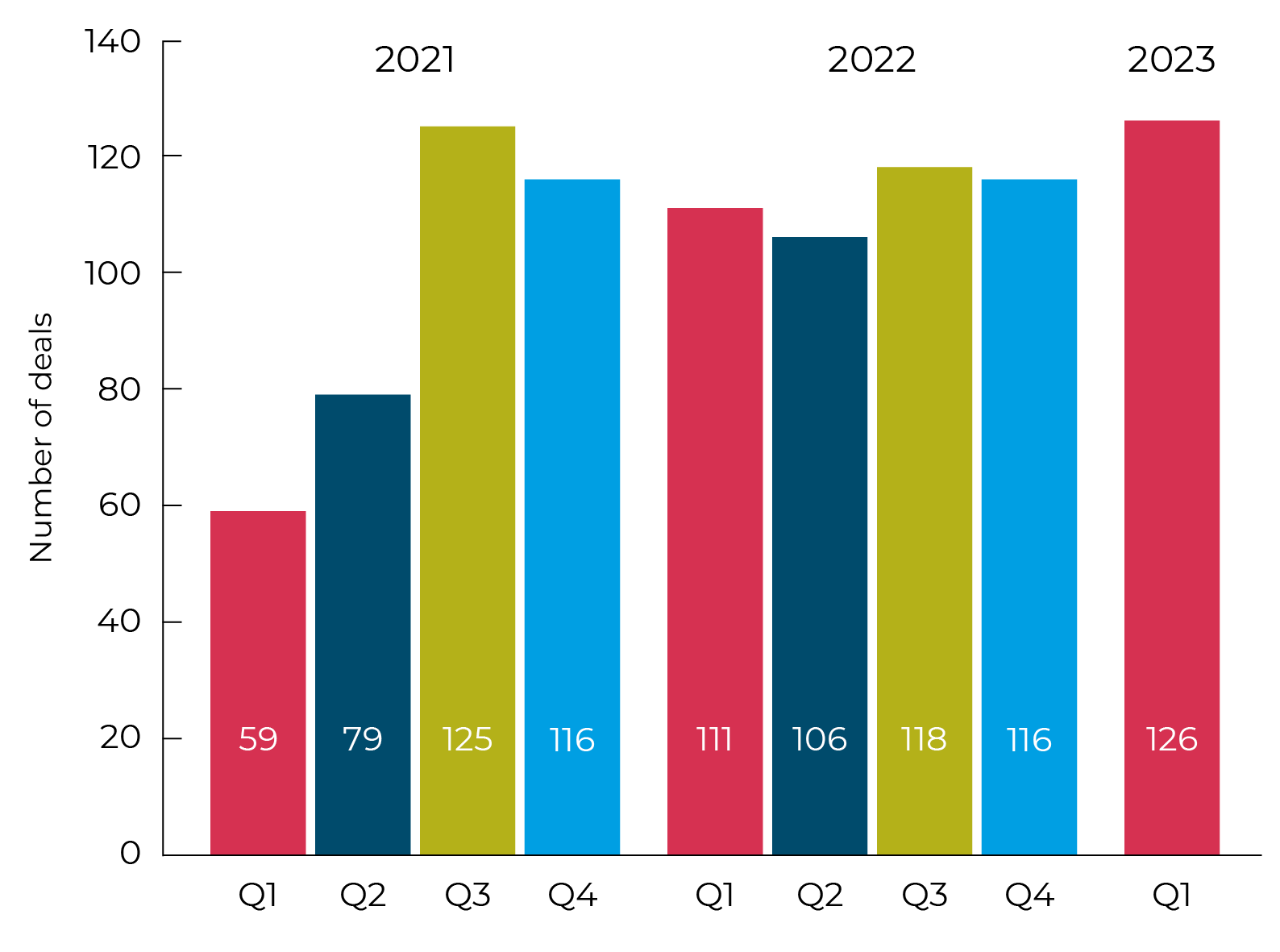

Moore Kingston Smith’s deal tracker recorded 126 UK media and marketing services deals in Q1 2023. This is a higher level of activity than we saw in any quarter in the last two years. It represents a 9% increase on the preceding quarter and is 14% higher than the equivalent period in 2022. Given 2022 was itself a record year for transactions, 2023 seems to be off to a flying start.

Quarterly deal volume in the media and marketing services sectors

Sector activity

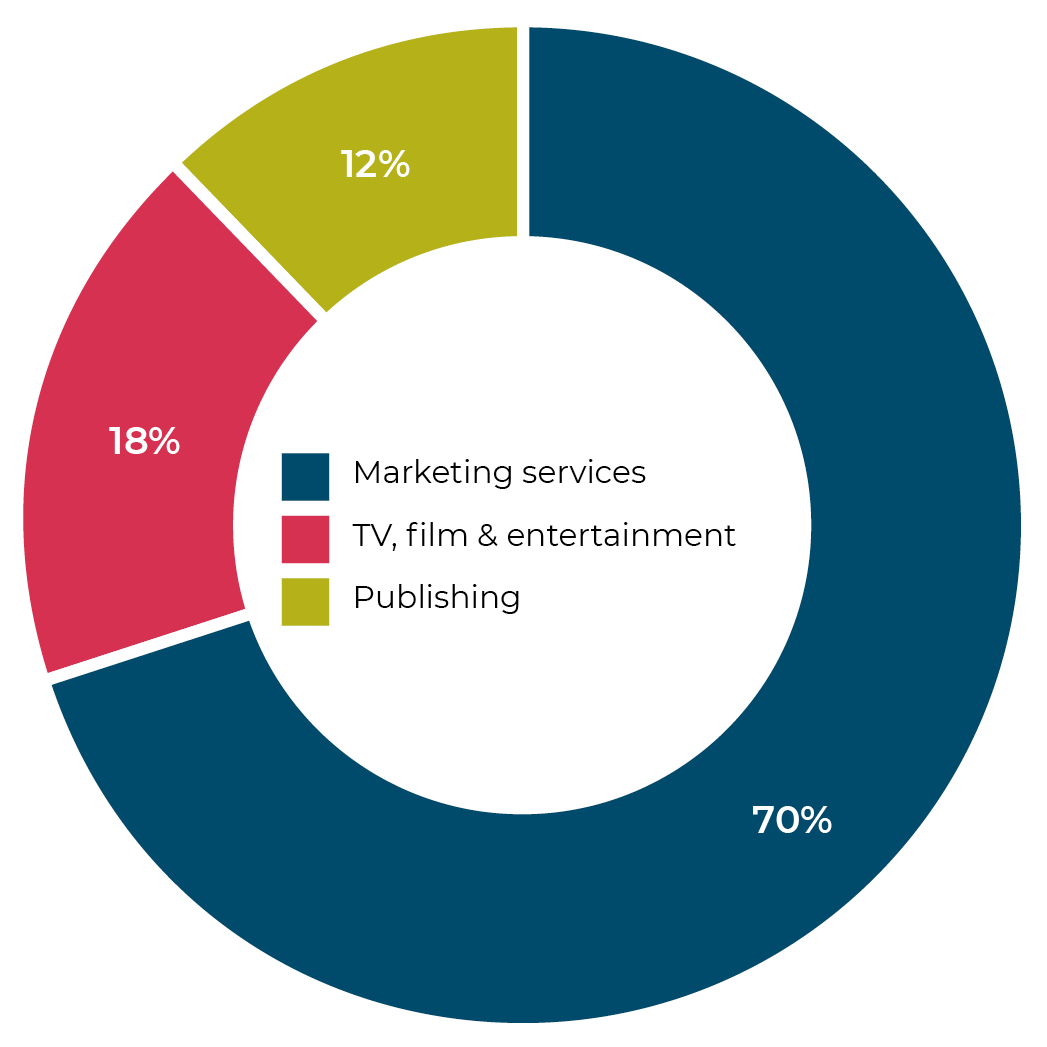

Media and marketing services covers a broad range of activities so, for the purposes of this report, we allocate transactions to three main categories: marketing services; publishing; and TV, film and entertainment (which includes gaming and music).

70% of our 126 Q1 deals fell within the marketing services sector, with a total of 88 transactions completed. TV, film and entertainment saw 23 deals announced, representing 18% of all transactions in Q1. Publishing doubled its share of the market with 15 transactions recorded in Q1, compared with seven in the prior quarter.

Q1 2023 deals by sector

Hot marketing services disciplines

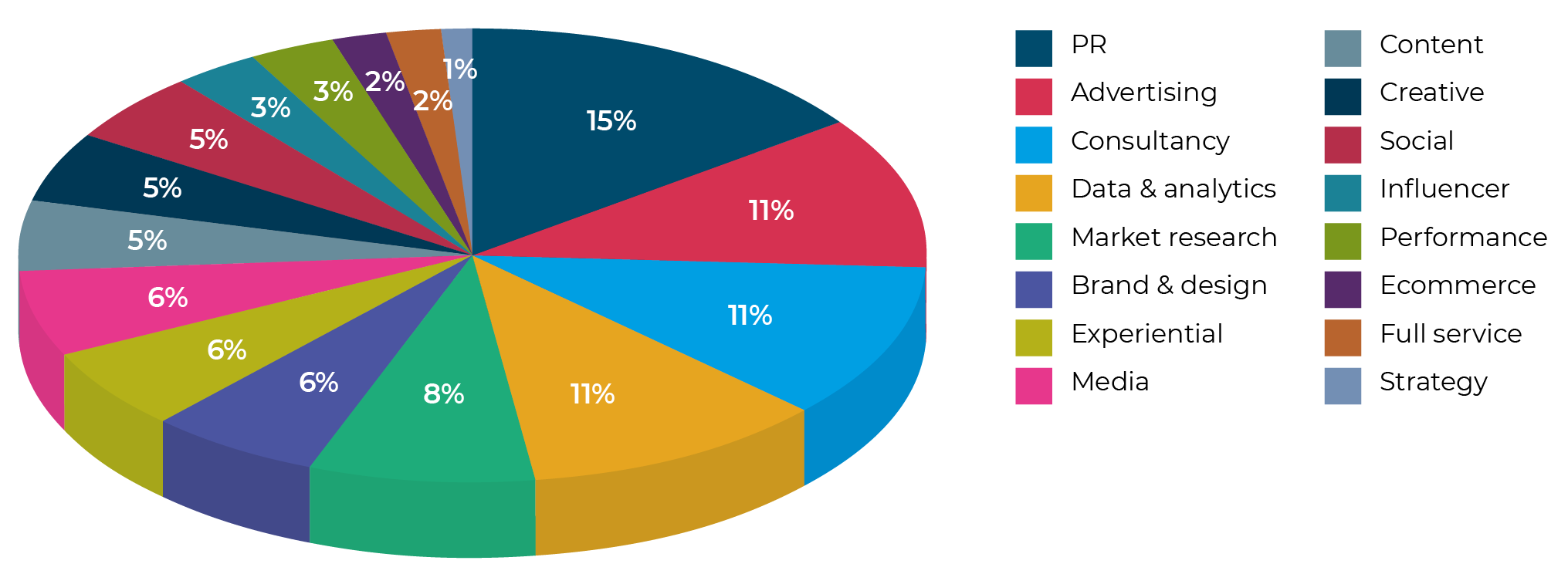

Our analysis of the 88 marketing services transactions completed last quarter enables us to determine whether the company acquired was a full-service agency or a specialist in one of the marketing services disciplines, such as PR or advertising.

In Q1 2023, PR specialists was the favourite category with acquirers, with advertising, consultancy, and data & analytics tying for joint-second place.

“In Q1 2023, PR specialists was the favourite

category with acquirers, with advertising,

consultancy, and data and analytics

tying for joint-second place.”

Q1 2023 deal activity in the marketing services sector

Focus on PR

Noteworthy cross-border deals in the PR sector in Q1 included the announcement in January that US group Teneo was acquiring the London-based financial and corporate PR firm, Tulchan, in a deal said to value Tulchan at more than £70 million. Teneo was itself acquired by private equity group CVC in a $700 million deal in 2019. The New York-headquartered company has been particularly acquisitive in the UK in recent years, purchasing several UK boutique PR groups, including Blue Rubicon and Stockwell, as well as Deloitte’s UK restructuring business.

Also in January, we learned that US sports marketing agency rEvolution had acquired London-based PR and communications agency, Sine Qua Non. Specialising in tech-forward PR, communications and sponsorship in sport, Sine Qua Non boasts NetApp, Hyundai, Tata Communications and Toyota amongst its client portfolio, which now joins rEvolution’s client roster of technology and automotive partners, including Capgemini, Lamborghini and McLaren Racing.

“We are finding PR companies particularly attractive to acquirers because of the access they have to senior executives within their client companies. These relationships may be leveraged to gain access to new opportunities and sell additional services.”

Dan Leaman, Corporate Finance Partner at

Moore Kingston Smith

In March, Moore Kingston Smith advised Martin Loat, founder of Propeller Group, on the sale of the business to its management team led by Kieran Kent and Jody Osman. Propeller Group is rated a top ten UK B2B PR agency by PR Week. The deal was backed by the investment management firm, Triple Point.

Spotlight on martech and adtech

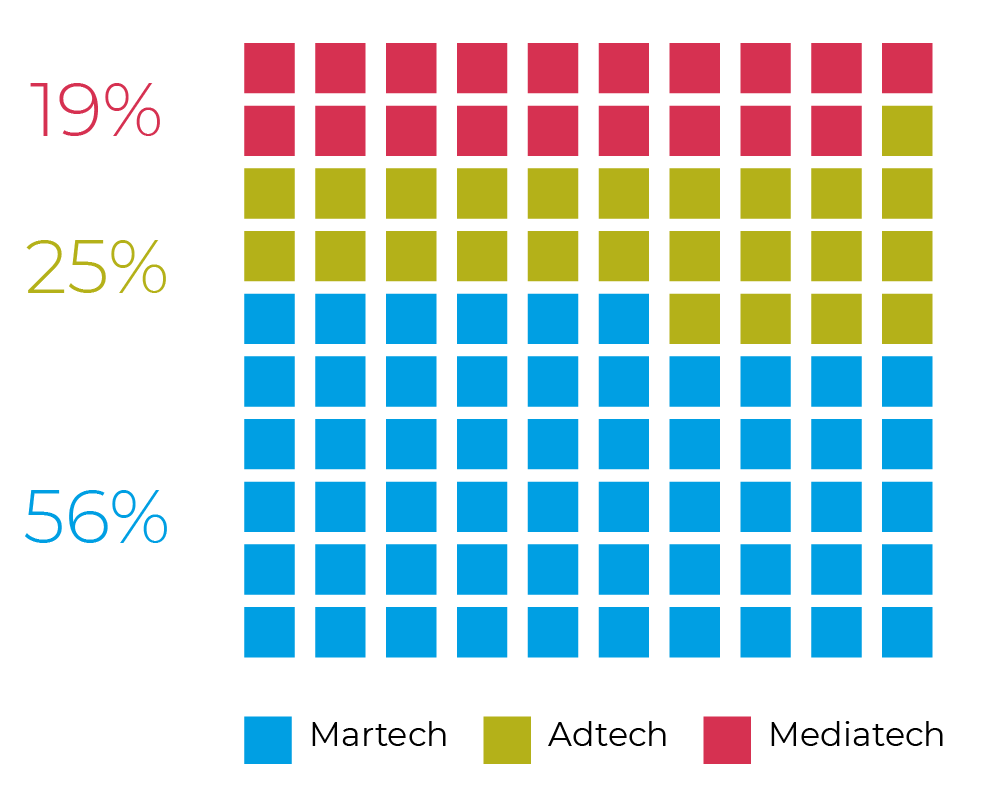

In the marketing services sector, while most deals involved the acquisition of traditional service-led agencies, 35% of the deals we recorded in Q1 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.

56% of these transactions in Q4 related to martech companies – companies developing and using technology to assist with a digital marketing strategy, including such elements as content and social, lead generation, customer acquisition and retention, and data and analytics.

Q1 2023 saw some of the major holding companies pursuing investments in the martech space. In January, Publicis announced that it was acquiring London-based Yieldify, which will join the global marcoms giant’s advertising and marketing technology division Epsilon. Yieldify helps clients personalise consumers’ website experience based on their profile and stage in the purchase journey.

Q1 2023 marketing services technology deals

In March, WPP announced the acquisition of Obviously, a technology-led social influencer marketing agency based in New York. Founded in 2014, Obviously’s technology platform is designed to increase campaign efficiency and enables the company to service large-scale complex campaigns for enterprise clients, including Google, Ford and Amazon. Obviously will join VMLY&R, WPP’s brand and customer experience agency.

Adtech also proved popular last quarter, accounting for a quarter of the marketing services technology deals we recorded. Adtech refers to specific solutions or tools used for digital advertising, such as programmatic advertising tools, data management platforms and ad exchanges.

“35% of the deals we recorded in Q1 were technology-led. These involved businesses that have developed and are selling innovative software and technology solutions to their clients.”

A notable adtech transaction last quarter was the announcement by Venatus, a leading provider of digital advertising solutions in the gaming industry, that it had acquired AdinPlay, an adtech business focused on monetising browser-based games. The acquisition is the first since Venatus took an investment from PE house LivingBridge in 2021, and is part of its strategic plan to scale in the burgeoning gametech space.

TV, film and entertainment

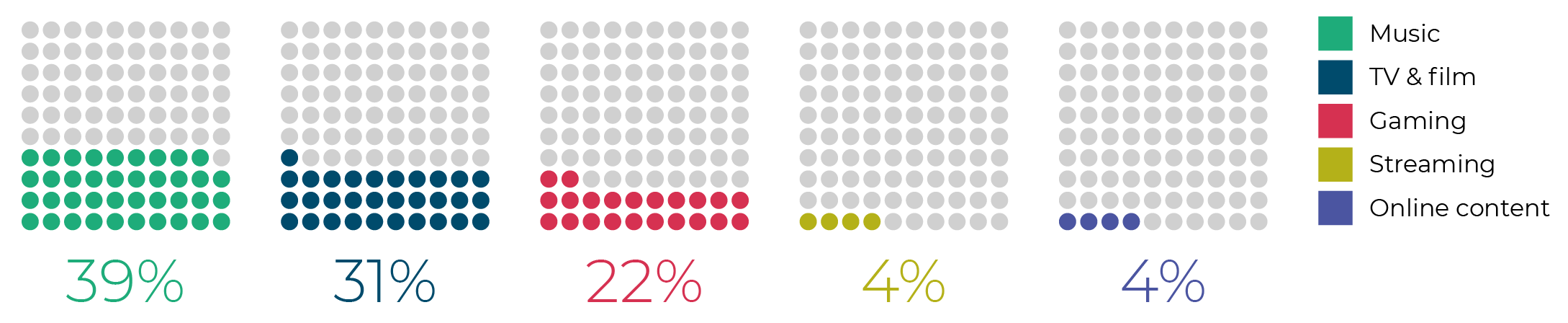

Within the TV, film and entertainment sector, music moved into the top spot in Q1 2023, accounting for 39% of the deals we recorded, a huge increase on the meagre 6% we logged in Q4 2022. TV and film, which was the most popular category in the final two quarters of last year, accounted for a respectable 31% of Q1 2023 deals.

Technology deals were the most prominent in Q1, accounting for 44% of the transactions we recorded in this space. Production services accounted for a further 39%, while pure content plays made up 17% of the deals recorded in Q1.

Notable music deals in Q1 included the acquisition of British independent classical record label Hyperion Records by Universal Music Group, which was announced in March. In January the US-based serial acquirer Downtown Music Holdings announced its latest UK target, with the purchase of London-headquartered music technology company Curve Royalty Systems.

In February, we saw the takeover of UK listed music technology company 7digital by Los Angeles-based B2B music licensing company Songtradr. An all-cash offer, worth £19.4 million in total, was made to 7digital’s shareholders, which equated to 0.695 pence per 7digital share, more than double its closing price on the day before the offer was announced. Unsurprisingly, such a significant bid premium found favour with 7digital’s shareholders – the offer was accepted and the shares delisted from AIM at the end of March.

Q1 2023 deal activity in the TV, film and entertainment sector

Publishing

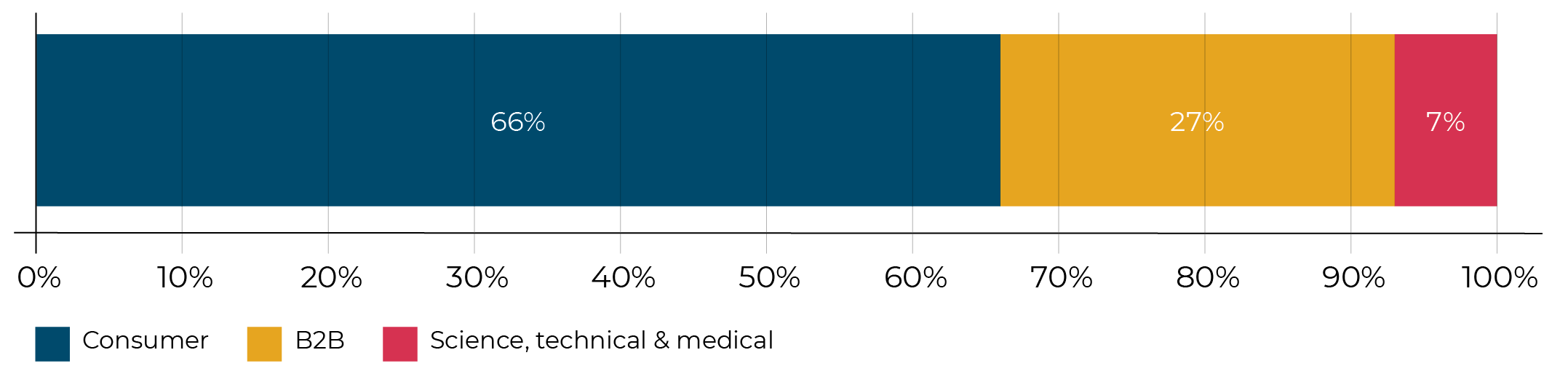

In what was a relatively busy quarter for the publishing sector overall, consumer publishing achieved the first spot, representing two-thirds of the deals we

recorded in Q1.

Within the consumer publishing space, lifestyle publisher The Chelsea Magazine Company was bought in March by Telegraph Media Group. Founded in 2007, The Chelsea Magazine Company owns a portfolio of specialist consumer brands including The English Home, The English Garden, Artists & Illustrators, Classic Boat and Britain.

Q1 2023 deal activity in the publishing sector

Marketing services networks round-up

Major holding companies

Only one of the major holding companies announced no new deals in Q1 – Omnicom.

The other major holding companies were very active, with WPP and Publicis leading the field with four new acquisitions apiece.

In January, WPP announced the purchase of Fēnom Digital, a New York-based digital transformation agency, which will join WPP’s Wunderman Thompson division. Then in March, it announced three further deals. First came the purchase of German healthcare specialist PR agency 3K Communication. This was followed by the acquisition of UK-headquartered, data-driven influencer marketing agency Goat, which PE house Inflexion invested in in March 2021. Moore Kingston Smith has previously identified influencer marketing as a hot sector for M&A and, according to Statista, global influencer marketing spend is set to hit $22.2 billion by 2025. Mark Read, CEO of WPP, said influencer marketing was “a key growth priority” for both the industry and the agency network. The acquisition will see Goat join GroupM and merge with its current influencer marketing offer INCA as part of the media performance organisation Nexus. Finally, there was the announcement of the purchase of Obviously, which we have already covered in this report.

Publicis completed three acquisitions in 2022 and has already exceeded that total in just the first three months of 2023. In January, it followed the acquisition of London-based Yieldify, which we have already covered in this report, with the announcement that it was acquiring a New York-based influencer networking and technology platform, Perlu, and a Bulgarian performance marketing agency, Advertise BG. Then at the end of March it announced the purchase of Buenos Aires-based Practia to expand the delivery of its Sapient digital business transformation capabilities to the Latin American market.

Having made no new acquisitions last year, only some small venture investments, Dentsu kicked off 2023 with the announcement of three deals in Q1. In February, it announced that it was expanding its customer transformation and technology capabilities in Spain through the acquisition of Omega CRM Consulting. Then in March, it disclosed that it had acquired US-based Shift7, a B2B experience and commerce agency. Both of these newly acquired companies will join Dentsu’s Merkle division.

Finally, in March, Dentsu also announced that it had entered into a definitive agreement with PE house Advent International to acquire digital marketing production powerhouse Tag Worldwide. The price was not disclosed but was widely reported to be in excess of £500 million. That transaction is subject to various antitrust approvals and closing conditions, so is not expected to close until later in 2023. If it does complete as planned, it is likely to be the largest deal for a UK-based advertising business in several years, and Dentsu’s biggest since it paid more than $1 billion for the US-based digital agency Merkle in 2016.

Our most prolific major network acquirer of 2022, Havas, announced just the one deal in Q1 2023: the acquisition of a majority stake in HRZN, a German creative agency for social media and content.

Interpublic also announced just a single transaction: the March acquisition of UK-based immersive technology studio, Diverse Interactive, which will become part of digital agency Flipside, within the Weber Shandwick Collective.

Challenger networks

In contrast to the renewed activity by the major holding companies, or perhaps because of that, the challenger networks had a relatively quiet start to the year, with no new deals announced by the likes of S4Capital, Selbey Anderson, Ebiquity, Sideshow or Definition Group.

The only real activity we saw was in the shape of three of the AIM-listed challengers, who announced a deal apiece in Q1.

Next Fifteen spent much of 2022 in the ultimately fruitless pursuit of M&C Saatchi, and we suggested in our Q4 report that it would be looking for alternative acquisition targets in 2023, following the collapse of that deal. Sure enough, in January, Next Fifteen announced that its data and insights group Savanta had acquired a US market research agency, Infosurv.

The Mission, the company behind Krow, Bray Leino, Story and Soul, continued its late 2022 acquisition spree by snapping up London-headquartered data science and digital analytics consultancy Mezzo Labs in February. Terms were not disclosed.

Also in February, Brave Bison announced that it was acquiring UK-based social media and influencer marketing agency Social Chain for an initial payment of £7.7 million, plus an additional contingent consideration of up to £9.5 million payable over the next three years. It announced a £4.75 million vendor share placing to raise funds for the acquisition. The deal attracted a significant amount of press attention because Social Chain was originally founded by TV’s Dragon’s Den star Steven Bartlett, who had claimed he grew the agency’s annual revenues to around $300 million before he left. Commentators were therefore confused as to why it was being sold for such a low price but Bartlett explained that the company being sold to Brave Bison represented just a small part of the group he had originally run.

Marketing services industry stock performance

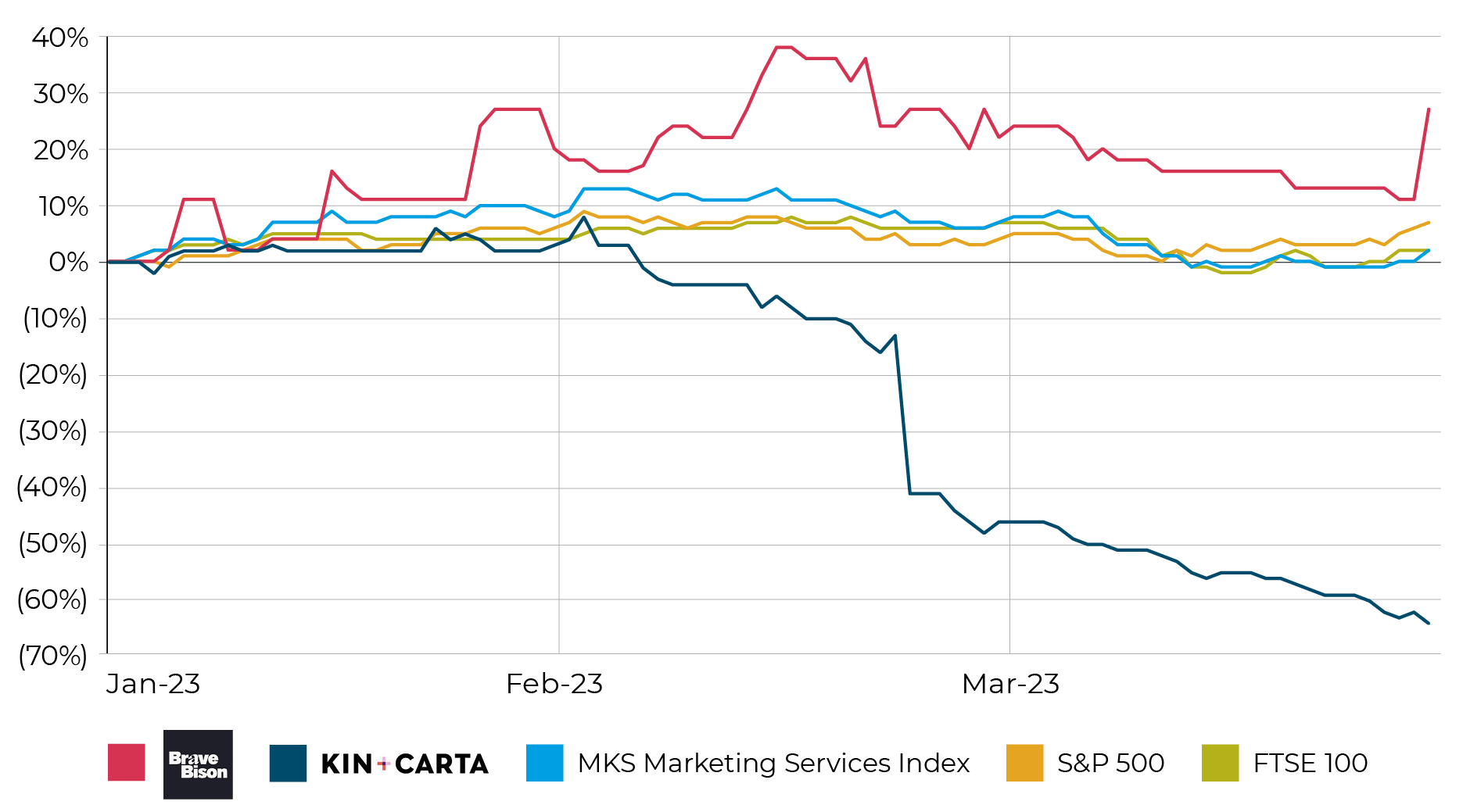

Moore Kingston Smith has plotted the share price performance of 14 listed marketing services groups, which together make up the Moore Kingston Smith Marketing Services Index, to see how they have fared in the last quarter compared with the FTSE 100 and S&P 500 indices. We have also highlighted the share price movements of Brave Bison and Kin + Carta, which represent the best and worst performance from our sample this quarter.

“The first quarter of 2023 saw global stock markets continue the recovery that we started to see at the end of 2022. The FTSE 100 was up by 2% in Q1, having increased by 8% in Q4 2022.”

The first quarter of 2023 saw global stock markets continue the recovery that we started to see at the end of 2022. The FTSE 100 was up by 2% in Q1, having increased by 8% in Q4 2022. The S&P 500 was up by 7% in Q1, having increased by 4% in Q4 2022. In Q1, the Moore Kingston Smith Marketing Services Index was up 2% across the period, having had an extremely positive 14% increase in Q4 2022. This continued improvement in the share prices of the global listed marketing service companies is likely to increase their appetite for acquisitions, since they will find it easier and cheaper to use their paper as currency.

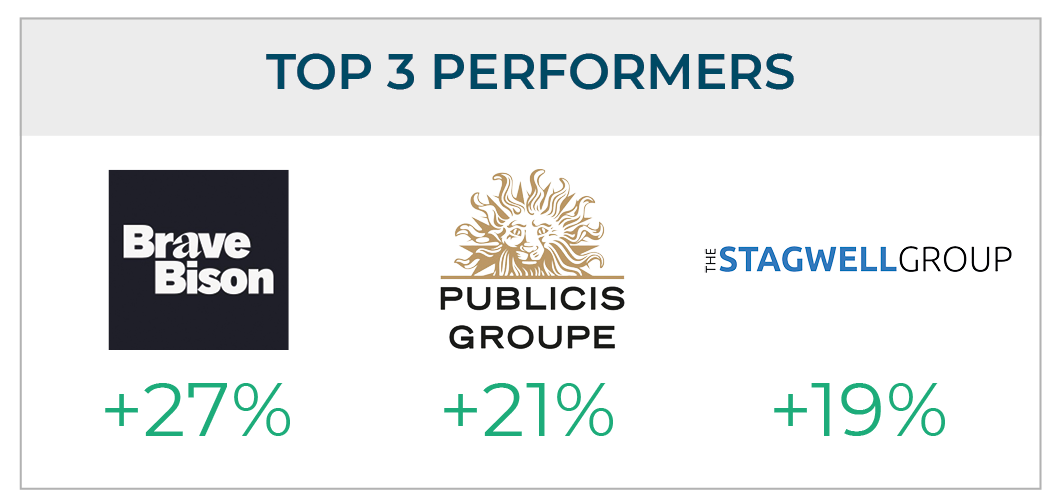

Of the 14 companies that make up the index, ten ended the quarter in positive or flat territory. The star performer this quarter was Brave Bison, whose share price increase of 27% was largely due to the announcement of the Social Chain acquisition in February – clearly, shareholders believe that this acquisition will bring enduring benefits to the company. Our other two top performers, Publicis and Stagwell, saw their share prices rise by 21% and 19% respectively on the back of the release of their latest financial results that surpassed market expectations.

Our worst performer in Q1 was Kin + Carta, which saw a 64% decline in its share price in the period. In fact, its shares fell by 32% in just one day at the end of February, after it issued a profit warning saying its net revenues had fallen by 6% in the first six months of the year to the end of January as clients scaled back their spending. Sales had slipped in the Americas and in Europe, it said, particularly in Britain.

Moore Kingston Smith marketing services index – Q1 2023

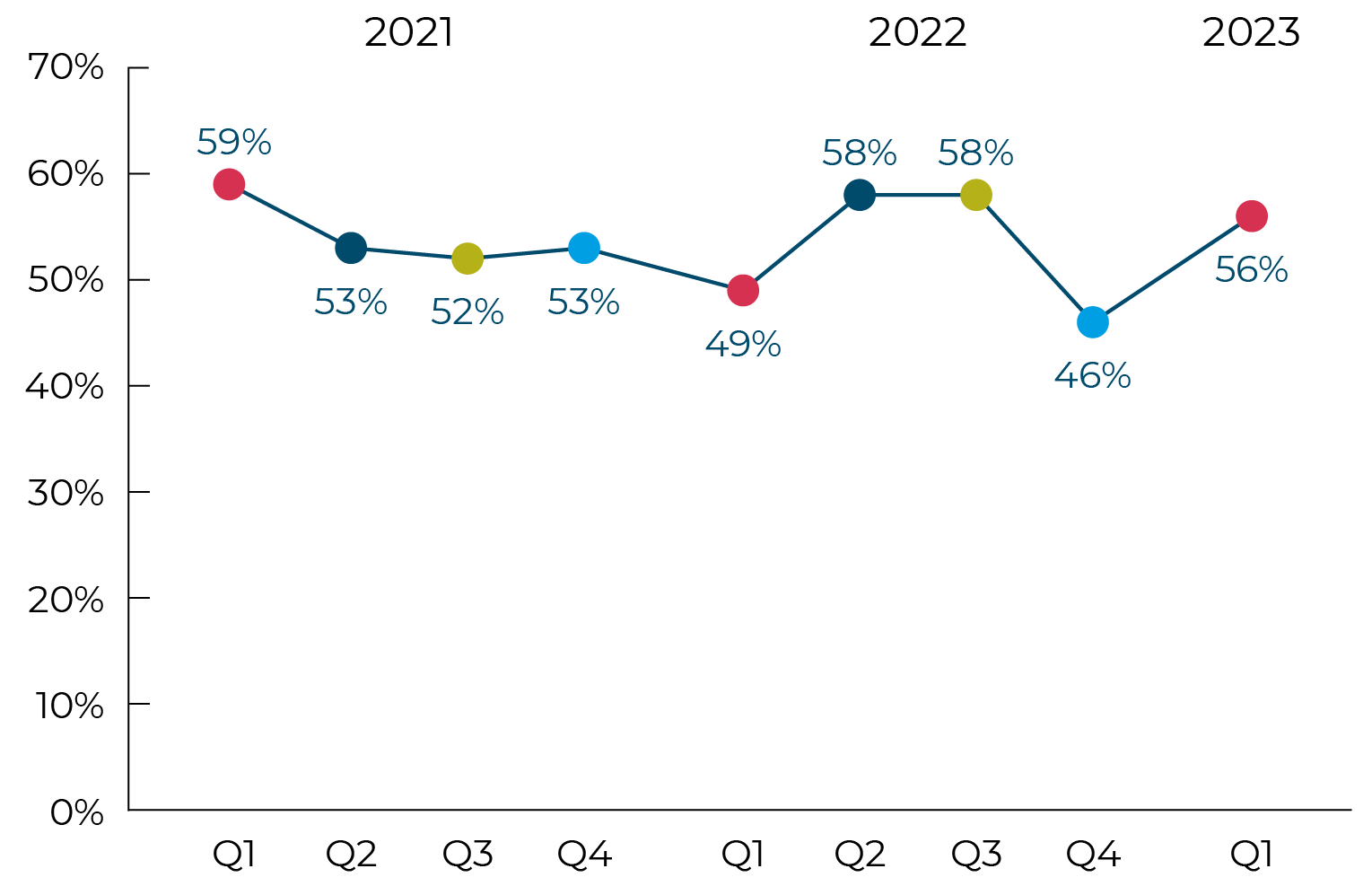

Private equity bounces back

Private equity-backed investments accounted for 56% of all deals completing in Q1 2023, which represents a significant return to form after the fall to 46% recorded in the previous quarter.

We speculated in our last report that the decline in Q4 2022 might reflect concerns about rising interest rates and the affordability of transactions.

decline in Q4 2022 might reflect concerns

about rising interest rates

and the affordability of transactions.”

On the other hand, it could just have been a blip. It may be too early to tell but the renewed activity we have seen in Q1 2023 hopefully reflects continuing enthusiasm by PE for the media and marketing services sectors and a belief that interest rates may soon be close to their peak. As well as making new investments in businesses, PE is driving M&A activity through seeking exits for investments made in the sector within the last few years. Typically, a PE house may expect to hold an investment for between three and five years before looking to realise a return, which may come in the form of a secondary transaction – a sale to another PE house – or in the form of a sale to a trade acquirer. A Q1 example of the latter was the sale of Inflexion-backed Goat to WPP, which we have already covered in this report.

In January, Waterland Private Equity announced that it had acquired a majority stake in Markettiers4DC, a London-headquartered network of tech-enabled, data-driven, broadcast-activated strategic communications agencies. In its press release, Waterland said that it was expecting to help Markettiers4DC to expand internationally through an active buy-and-build programme, much as it has supported its other platform investments in the sector, including Sideshow. Shortly before the announcement of the Waterland investment, Markettiers4DC reported that it had acquired commercial and community radio news provider Radio News Hub, suggesting that the Waterland-supported acquisition programme is well under way.

“UK media and marketing services businesses remain attractive to PE houses because of their potential for strong cash flow, high growth, scalability, intellectual property and consolidation opportunities, coupled with the accelerating digital transformation trends driving disruption to traditional business models.”

Paul Winterflood, Corporate Finance Partner at Moore Kingston Smith

Out-of-home (OOH) media agency Talon Outdoor has had a busy start to the year, having been backed by its new PE investor Equistone in a renewed expansion strategy. In March, it announced that it had acquired UK-headquartered OOH business Evolve and was also expanding its North American footprint with the acquisition of OOH agency, Novus Media Canada.

The B2B exhibitions business CloserStill Media, which has been backed by Providence Equity Partners since 2019, also announced two additions to its portfolio of events in Q1. In January, it revealed that it had acquired a majority stake in CommerceNext, a US ecommerce conference and community, and that it had also acquired OpenRoom Events, a global organiser of hosted buyer events in the healthcare and specialist retail sectors.

PE-backed deals as a percentage of all deals in the media and marketing services sectors

Outlook

2022 was a record year for UK M&A deals in the media and marketing services sectors. So far, 2023 appears to be following suit, despite the notes of caution that were being sounded coming into the year. Private equity interest in the sector, that we thought might be starting to soften at the end of last year, has come back with a vengeance this quarter. The major global holding companies have signalled their interest in returning to the fray, which has resulted in the continuing high level of deal activity. As a result of this increased interest from PE and the global holding companies, it may be that the challenger networks are finding it harder to win deals. However, this competition for assets means it seems to be a very good market for owners of high performing businesses to sell in.

Katharine Stone, Corporate Finance Director at

Moore Kingston Smith

Contact us

We are in contact with an ever-growing pool of motivated acquirers prepared to pay for well-managed, successful businesses. Now is an excellent time for shareholders in media and marketing services companies to start planning for an exit.

For more information, get in touch with the Moore Kingston Smith corporate finance team.

Methodology

In compiling our deal tracker we use Pitchbook, an international financial data provider that gives access to comprehensive data on the private and public markets. We analyse every deal with either a UK buyer or UK seller (or both) and where the target company is classified as marketing services, publishing or TV, film & entertainment, the transaction is entered into the deal tracker. We classify marketing services into sixteen sub-categories; TV, film and entertainment into seven sub-categories; and publishing into four sub-categories.

As well as the data extracted from Pitchbook we have used information from the following sources: theguardian.com, ft.com, revolutionworld.com, mrweb.com, wpp.com, venatus.com, gramophone.co.uk, musicbusinessworldwide.com, lse.co.uk, corporate.telegraph.co.uk, group.dentsu.com, publicisgroupe.com, havasgroup.com, adweek.com, next15.com, londonstockexchange.com, waterland.nu, talonooh.com, commercenext.com, exhibitionworld.co.uk, thetimes.co.uk, propellergroup.com, prolificnorth.co.uk, radiotoday.co.uk.