M&A in the UK media and marketing services sectors: Q3 2023

A tough economic environment reduces deal numbers but quality still sells

![]()

98

deals completed

![]()

-11%

Moore Kingston Smith

Marketing Services Index

![]()

51%

deals backed by PE

Our view of the market

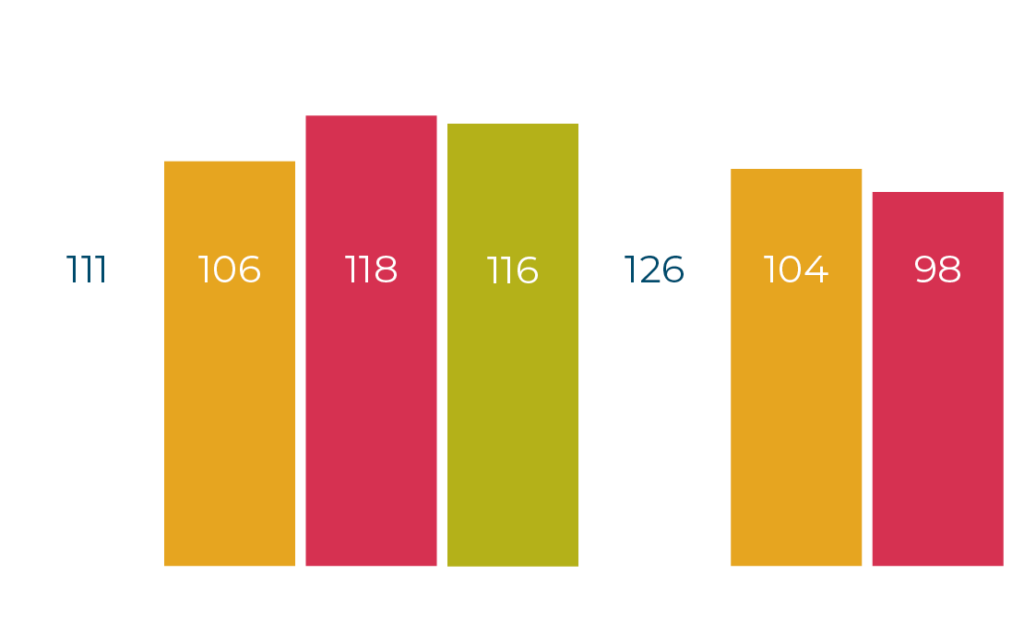

Last quarter, we reported on a dip in the number of UK media and marketing services deals. Unfortunately, Q3’s data reveals a further decline – 98 UK media and marketing services deals were recorded, a 6% decrease.

The percentage of transactions involving PE has risen this quarter but is still running below recent levels. This could be due to the fact that leveraged deals are harder to put together in a high interest rate environment. The major networks have been busier acquiring than the challenger networks, and most quoted holding companies have seen their share prices decline in Q3.

Paul Winterflood, Partner, Corporate Finance, comments: “The macroeconomic environment makes dealmaking difficult, with market turbulence, tougher new-business conditions and high levels of inflation resulting in fewer quality opportunities and stretched timetables. Acquirers still pursue high-quality businesses that are trading well.”

Quarterly deal volume

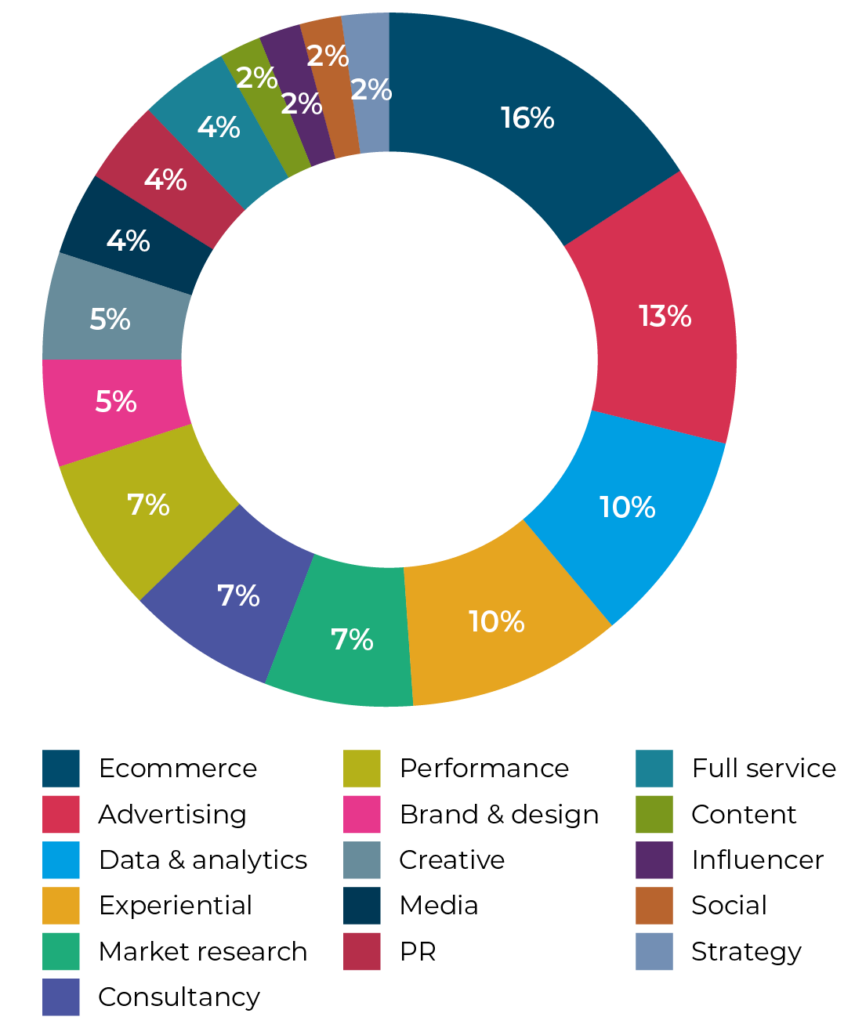

Trending: ecommerce

Ecommerce was the favourite marketing services category with acquirers. It made up 16% of all the marketing services deals we recorded, with advertising in second place with 13%. Ecommerce sales are increasing as a percentage of total sales and becoming an ever more important channel for retailers globally. WPP announced the launch of a strategic partnership with Shopify to bring the value of Shopify’s ecommerce platform to its enterprise clients.

Optimizon, a UK eBay and Amazon agency, made two acquisitions in Q3: Nozzle, a London-based ecommerce and advertising platform for Amazon; and Cambridge-headquartered FMCG ecommerce agency Marketplace AMP. In August, PE house WestBridge backed the management buy-out of London-based digital commerce agency, Tryzens.

Spotlight on: martech

Within marketing services, while most deals involved the acquisition of traditional service-led agencies, 22% of the deals we recorded in Q3 were technology-led. This is an improvement on the 16% we recorded in Q2. However, it remains below the level seen throughout last year, where technology-led transactions tended to represent around a third of all deals. As the M&A market contracts and acquirers become more cautious, they are prioritising traditional professional service-led agencies as targets.

77% of the technology-led transactions in Q3 related to martech companies (companies developing and using technology to assist with a digital marketing strategy), 15% mediatech and 8% adtech.

“The martech industry is predicted to double in value by 2027, so we expect to see continued investment in this area, as acquirers look to build out their capabilities in this space. Also, as interest rates start to come off recent highs, valuation gaps between would-be buyers and sellers may begin to narrow.”

George Hatswell, Associate Director at Moore Kingston Smith

Q3 2023 deal activity in the marketing services sector

Notable UK martech deals

Nasdaq-listed, US-based, global travel software provider Sabre Corporation acquired UK hospitality ecommerce provider Techsembly.

London-based Another Acquisition, a wholly owned subsidiary of London-based VC firm Trapping Holdings, acquired New Delhi-based AI-powered email solutions provider Nyxion.ai.

Major holding companies

Notable transactions

Three of the major marketing services networks – WPP, Publicis and Interpublic – made no new acquisitions in Q3. The remainder were extremely busy. Dentsu and Havas completed two transactions apiece, while Omnicom made six.

Havas bought a majority stake in the UK’s Uncommon Creative Studio and acquired Mumbai-based digital marketing agency PivotRoots.

Dentsu announced that it had completed the acquisition of Tag Group from Advent International. It also acquired RCKT, a German brand communications and creative agency.

Omnicom started Q3 with the acquisition of German creative agency Grabarz & Partner and London-based financial services media agency Ptarmigan Media. It followed that with the acquisition of two Brazilian commerce and retail media agencies, Outpromo and Global Shopper. It then finished Q3 with the acquisitions of public affairs firm PLUS Communications and FP1 Strategies, a political consultancy.

The challengers

In contrast to the majors, the challenger networks were rather subdued in Q3. No new deals were announced by S4Capital, Selbey Anderson, Ebiquity, The Mission, Brave Bison or Sideshow.

In July, Stagwell announced it had acquired Tinsel Experiential Design, a US-based marketing and design studio focused on immersive customer experiences.

In August, Next 15 acquired Oxford-based commercial consulting firm White Space Strategy to extend the commercial footprint of its Palladium division.

In September, Moore Kingston Smith’s corporate finance team advised Common Interest on its first acquisition, TwentyFirstCenturyBrand, an international brand consultancy operating out of San Francisco and London. Common Interest has offices in the UK and North America and the group is designed to combine the capabilities of creative agency specialists, tech-enabled marketing services and progressive entertainment companies. Common Interest is on the look-out for further acquisitions.

Brainlabs is also likely to be back on the acquisition trail, having secured significant new investment from US PE house Falfurrias Capital Partners.

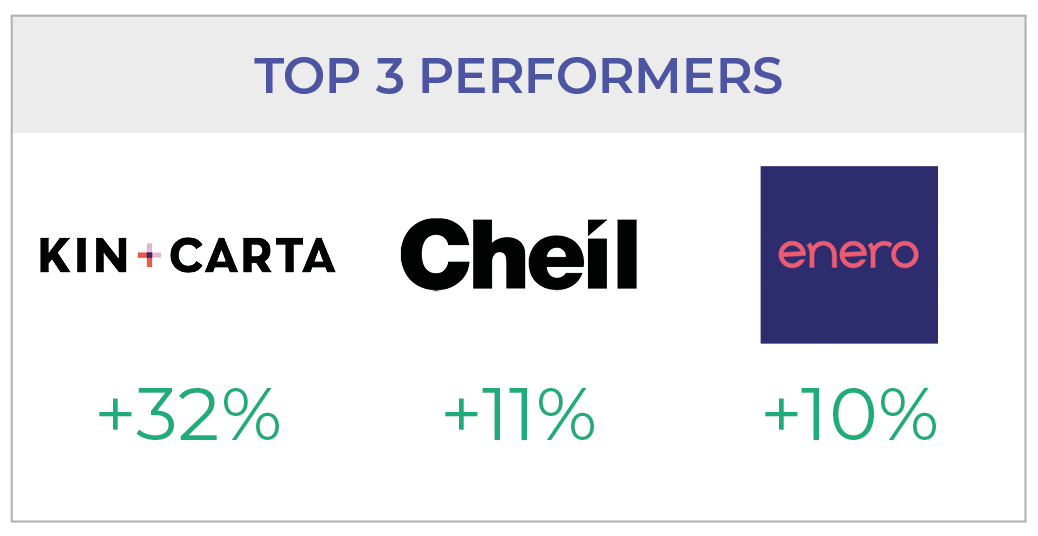

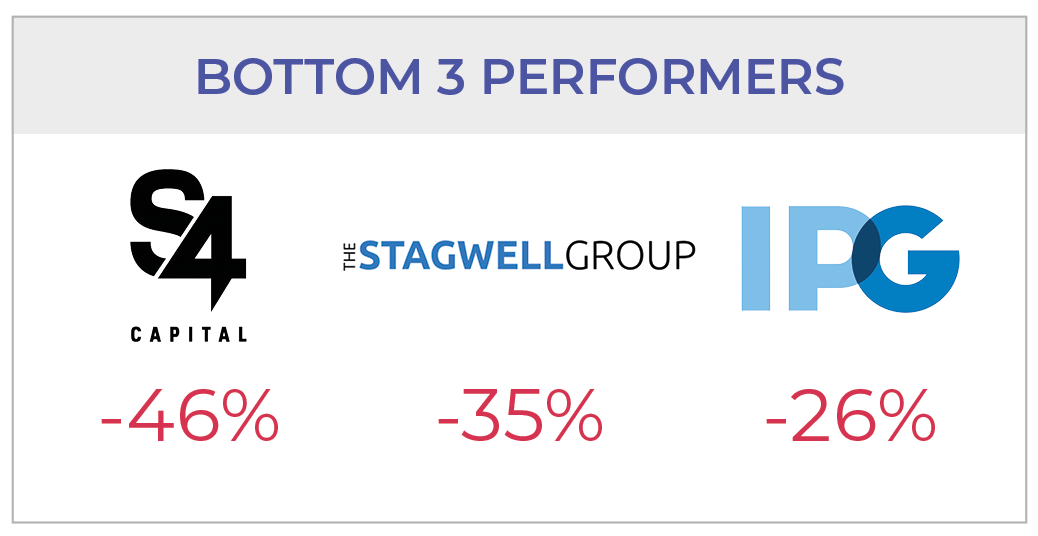

Marketing services industry stock performance

After a positive first six months of 2023, global stock markets fell back over the summer. The S&P 500 was down by 4% in Q3. The FTSE was up but only by 1%. The Moore Kingston Smith Marketing Services Index was down a disappointing 11% across the period. Of the 14 companies in the Moore Kingston Smith Marketing Services Index, just three ended the quarter in positive territory.

Media stocks significantly underperformed the domestic and global markets in Q2 and that underperformance continued into Q3. However, there were some companies that bucked the trend. Our star performer this quarter was Kin + Carta, which saw its share price increase by 32%. This followed a well-received trading update in mid-August, which said the company expected its 2023 profits to beat market forecasts.

For the second quarter in a row, our worst performer was S4 Capital, which saw a 46% decline in its share price in Q3, following a 23% fall in Q2. S4 Capital’s shares are now worth less than 10% of the level they were trading at in September 2021. Q3’s slump came after the company issued a profits warning (its second within two months) and spoke of a continuing fall in revenues.

Moore Kingston Smith Marketing Services Index Q3 2023

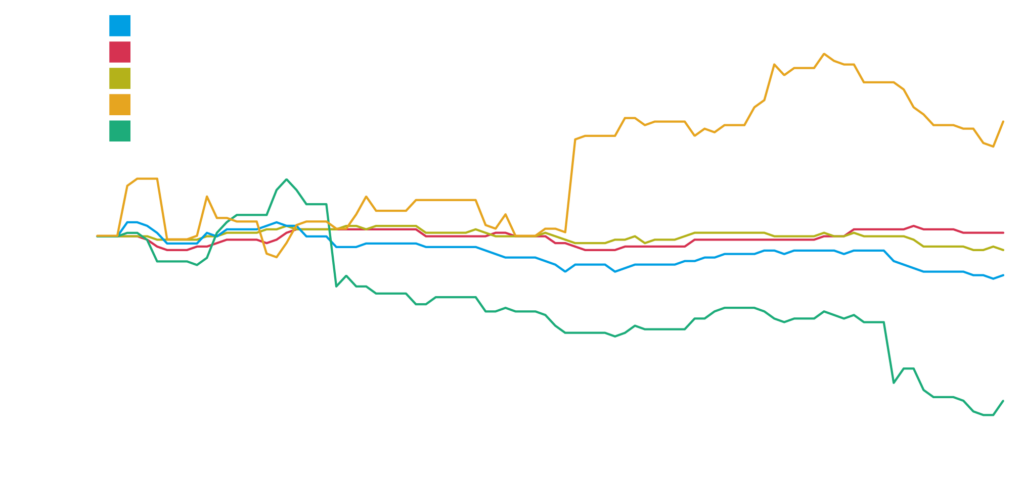

Private equity

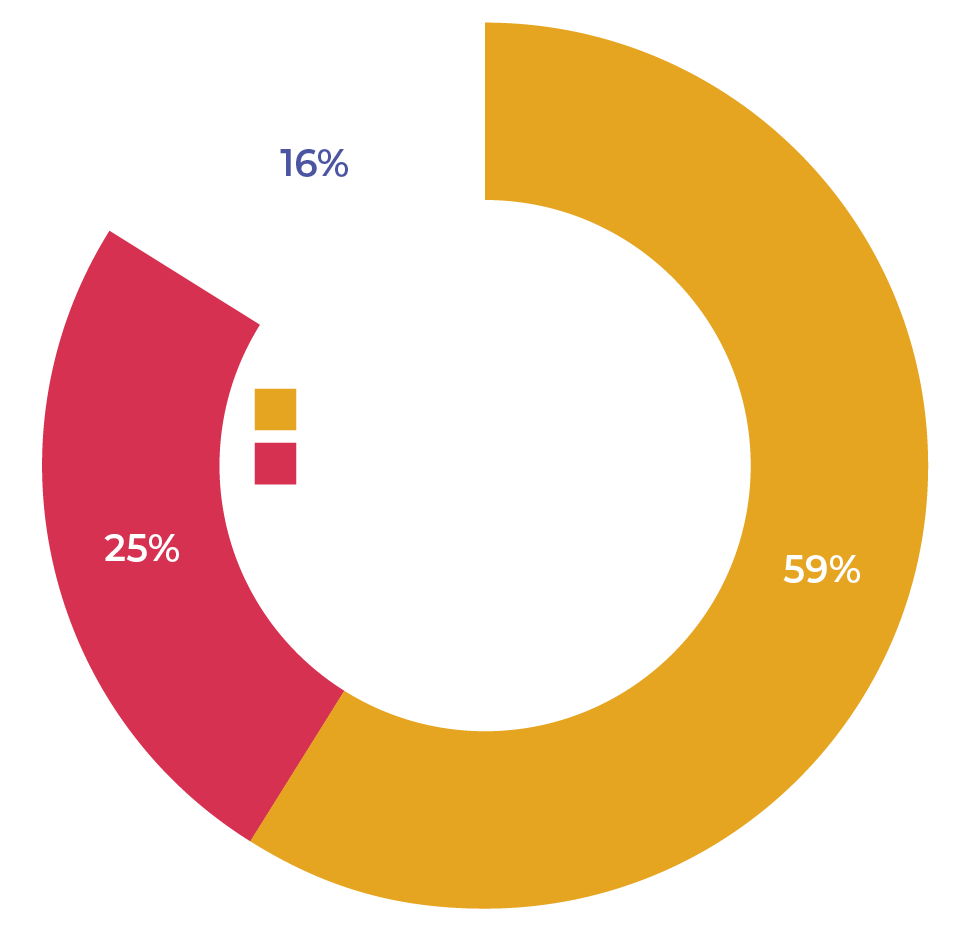

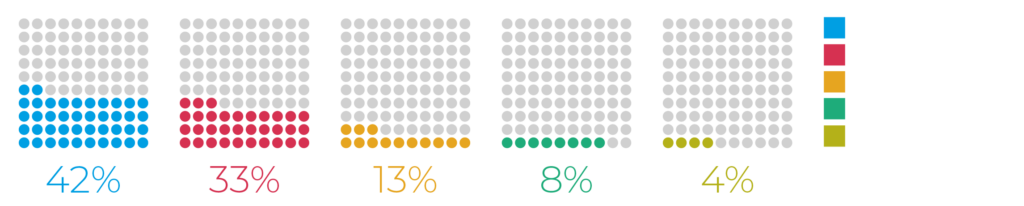

PE-backed investments accounted for 51% of all deals completing in Q3 2023. This is a slight improvement on the 49% we recorded in Q2 but remains below the recent historical average.

Underpinning just over half of the transactions we recorded, PE remains an enduring and significant driver of M&A activity in the UK’s media and marketing services sectors. However, PE transactions, particularly larger leveraged deals, are much harder to put together in a high interest rate environment, hence subdued activity.

As well as making new investments in businesses and backing its existing portfolio companies, PE is driving M&A activity through seeking exits for investments made in the sector within the last few years. Typically, a PE house holds an investment for some years before looking to realise a return, which may come in the form of a secondary transaction – a sale to another PE house or to a trade acquirer. A Q3 example of one PE house handing over the baton to another was the sale of digital marketing group Brainlabs. Brainlabs originally received investment in 2019 from UK PE house Livingbridge, which backed Brainlabs to make eight acquisitions. Livingbridge was rumoured to be seeking an exit more than a year ago, and that exit was finally secured in September with the introduction of a new majority investor, Falfurrias Capital Partners.

Notable UK mid-market deals

Markettiers4DC expanded its group by acquiring creative communications studio Sassy Create. The deal represents the first acquisition by Markettiers4DC since Waterland Private Equity invested in the group at the start of this year.

Providence Equity-owned exhibitions business CloserStill Media acquired UKi Media & Events, a company specialising in events in the transportation sector.

Livingbridge investee company Jensten Group acquired MORE Telemarketing,

a specialist insurance telemarketing business.

Percentage of PE-backed deals

“We are heartened to have seen a slight increase in PE activity this quarter, even though the macroeconomic environment remains difficult, particularly for larger leveraged deals. We remain confident that, once inflation starts to come down and interest rates stabilise, PE activity will return to more normal levels.”

Dan Leaman, Corporate Finance Partner at Moore Kingston Smith

TV, film and entertainment

Within the TV, film and entertainment sector, music fell from first place – that it had occupied in Q1 and Q2 – to fourth place in Q3. TV and film transactions proved to be the most popular with acquirers in Q3, accounting for 42% of the deals we recorded, a sizeable increase on the 27% that we recorded in Q2.

Production services deals were the most prominent in Q3, accounting for 46% of the transactions we recorded in this space. Technology-led transactions accounted for a further 38%, while pure content plays made up 16% of the deals recorded in Q3.

One TV and film deal that caught our eye in Q3 was the announcement that UK theatre mogul John Gore was acquiring iconic horror film producer Hammer Films. Founded in 1934, Hammer Films became synonymous with horror, producing such classics as Dracula, The Curse of Frankenstein and The Mummy, making stars of Christopher Lee and Peter Cushing in the process. Under Gore’s management, the plan is to invest significantly in Hammer Films to breathe new life into the studio, blending the nostalgic charm of Hammer with modern cinematic style and innovation, while preserving its heritage and library.

Notable UK mid-market deals

Paris-headquartered production studio Asacha acquired UK factual TV and specialist true crime production company Arrow International Media.

Live entertainment company Trafalgar Entertainment acquired a majority stake in one of the UK’s biggest pantomime providers, Imagine Theatre.

UK post-production facility Molinare acquired specialist digital imaging

technology company Notorious DIT.

Q3 2023 deal activity in the TV, film and entertainment sector

Publishing

In what was a relatively busy quarter for the publishing sector overall, consumer publishing retained the top spot, representing half the deals we recorded in Q3.

One transaction that received a great deal of attention was the surprise sale of London freesheet City AM to ecommerce business THG, best known for its protein and beauty brands. The purchase saved the troubled newspaper, which had been hit hard by the change in commuter habits post-pandemic, from having to go into administration.

Notable UK mid-market deals

Ex-Mirror Group CEO David Montgomery’s National World acquired Midland News Association, the UK’s largest independent regional news publisher.

Global publishing company Pan Macmillan acquired specialist finance, trading and investment book publisher Harriman House.

Q3 2023 deal activity in the publishing sector

Outlook

Despite the slowdown in deal-doing that we have witnessed over the last six months, we remain bullish about the media and marketing services sectors as a whole. With PE underpinning more than half of all deals this quarter, we believe that activity will return to more normal levels once macroeconomic factors start to stabilise and interest rates begin to fall.

Once business confidence starts to improve, and the new business environment brightens, this will reduce the trading volatility of listed acquirers, allowing better use of listed shares as deal capital. The completion of private equity secondaries by the likes of Brainlabs and MSQ who will continue to execute buy and build strategies is good for the market in the short term, and a signal that investors are engaged in the sector for the long term.